C4ISR Market Size, Share, Trends, Industry Analysis Report

By Type (New Installation, Retrofit), By Component, By Application, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5901

- Base Year: 2024

- Historical Data: 2020-2023

Overview

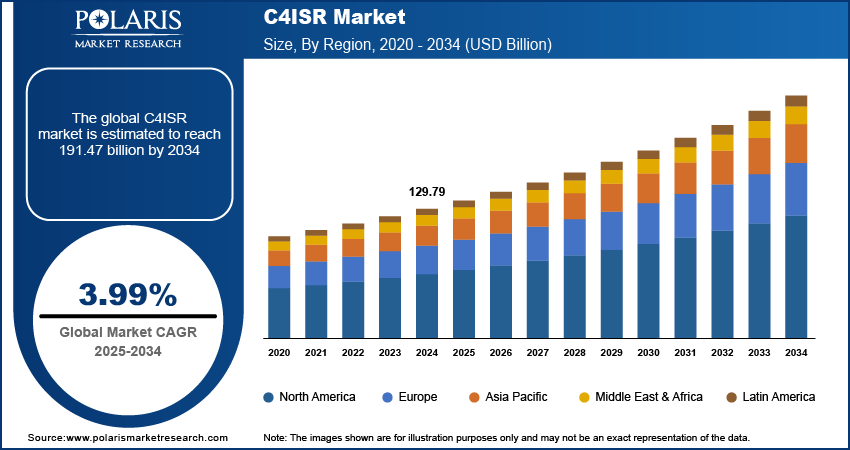

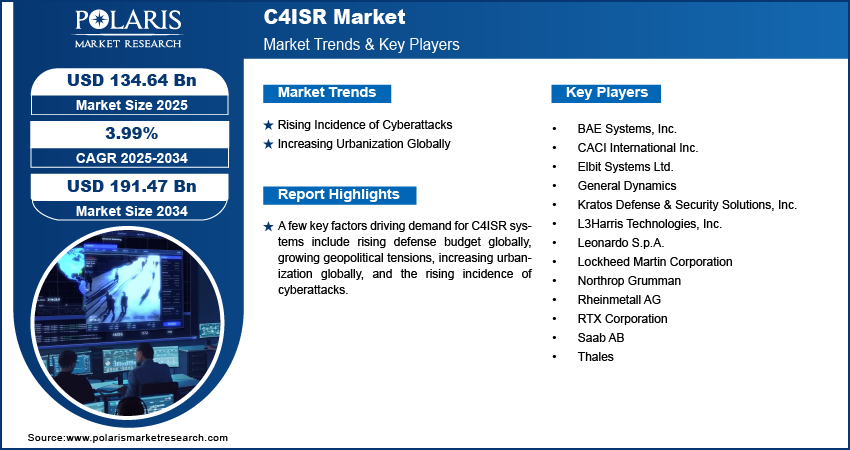

The global C4ISR market size was valued at USD 129.79 billion in 2024, growing at a CAGR of 3.99% from 2025 to 2034. Key factors driving demand for C4ISR systems include rising defense budgets globally, growing geopolitical tension, increasing urbanization, and rising incidence of cyberattacks.

C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) forms the backbone of modern military operations, enhancing situational awareness, decision-making, and operational effectiveness on the battlefield. Militaries use C4ISR systems for air defense by integrating radar, identification, and weapons systems to engage threats rapidly. Naval forces employ C4ISR to coordinate fleet operations and manage sensor data.

The rising defense budget globally is driving the market growth. According to the Stockholm International Peace Research Institute report, global military expenditure increased to $2718 billion in 2024. This increase in military spending enables armed forces to invest in advanced C4ISR technologies, such as real-time data sharing, AI-driven analytics, and integrated communication networks, thereby enhancing situational awareness and decision-making. Therefore, the rising defense budget globally is propelling the market expansion.

To Understand More About this Research: Request a Free Sample Report

The growing geopolitical tensions across the world propel the adoption of C4ISR systems. Military forces require real-time situational awareness, secure communication, and rapid decision-making tools to respond to evolving geopolitical tension across land, sea, air, and cyberspace. To meet this rising demand, governments and military organizations worldwide are investing heavily in C4ISR technologies that enable precise intelligence gathering, surveillance, and reconnaissance to monitor adversary movements and prevent potential incursions.

Industry Dynamics

Increasing Urbanization Globally

Growing urbanization is creating complex security challenges that are driving demand for C4ISR technologies. The World Bank, in its report, stated that the urban population is expected to more than double by 2050. Law enforcement and defense agencies require advanced surveillance, communication, and intelligence systems to monitor urban environments effectively. Governments are deploying integrated C4ISR solutions to enhance situational awareness, manage civil unrest, counter urban terrorism, and respond swiftly to emergencies. Urbanization also requires secure and interoperable communication networks, which further aligns with the capabilities of C4ISR systems. Hence, as urbanization expands, the demand for C4ISR systems increases.

Rising Incidence of Cyberattacks

Military and defense organizations are recognizing the urgent need for advanced technologies to protect their critical infrastructure and sensitive information from cyberattacks. Cyberattacks often target communication networks and data systems, making robust and secure C4ISR solutions essential for maintaining operational integrity and continuity. The increasing complexity of cyber threats is pushing governments and defense agencies to invest heavily in upgrading their C4ISR capabilities. Therefore, the demand for C4ISR technologies is increasing with the rising incidence of cyberattacks.

Segmental Insights

Type Analysis

Based on type, the segmentation includes new installation and retrofit. The new installation segment accounted for a major market share in 2024 due to growing demand for modernized defense infrastructure and advanced battlefield management systems. Governments across North America, Europe, and Asia Pacific increased their defense budgets to enhance situational awareness, decision-making speed, and interoperability among different military units. These initiatives fueled the deployment of advanced command, control, communications, computers, intelligence, surveillance, and reconnaissance capabilities in new platforms such as unmanned systems, next-generation combat vehicles, and integrated naval vessels. Countries such as the U.S., China, and India aggressively invested in new installation programs to support digitized warfare and real-time intelligence operations, driving the segment's dominance.

Component Analysis

In terms of component, the segmentation includes hardware, software, and services. The hardware segment dominated the market share in 2024 due to increasing procurement of advanced communication systems, sensors, radars, and surveillance equipment. Defense agencies prioritized the deployment of hardware components to support high-speed data transmission, real-time intelligence gathering, and secure communication across multiple platforms. The widespread induction of drones, satellites, and electronic warfare systems further boosted demand for specialized hardware components. Countries such as the U.S., China, and Russia expanded investments in high-performance computing units, ruggedized command consoles, and next-generation battlefield communication gear, strengthening the segment's leading position.

The software segment is projected to grow at a robust pace in the coming years, owing to the increasing threats from cyberattacks and the need for seamless interoperability among various platforms. Furthermore, the shift toward cloud-based architectures and digital twin technologies in defense operations is estimated to accelerate software adoption across global military forces.

Application Analysis

In terms of application, the segmentation includes command & control; communications; computers; intelligence, surveillance, and reconnaissance (ISR); and electronic warfare. The intelligence, surveillance, and reconnaissance (ISR) segment held the largest market share in 2024, due to rising demand for real-time situational awareness and precision targeting capabilities. Defense forces worldwide prioritized ISR capabilities to enhance decision-making, detect threats early, and monitor adversary movements across land, air, sea, and space domains. The proliferation of unmanned aerial vehicles (UAVs), high-resolution satellite imaging, and advanced sensor technologies significantly contributed to the segment’s expansion. Countries such as the U.S., Israel, and China heavily invested in ISR platforms to support border security, counterterrorism, and maritime surveillance missions, strengthening the segment's dominance.

The command & control segment is projected to grow at a rapid pace in the coming years, owing to the growing need for synchronized battlefield operations, coupled with advancements in AI-enabled command & control systems and real-time data fusion tools. Furthermore, rising geopolitical tensions and the emphasis on faster operational response times are prompting defense agencies to modernize their command architectures, making this critical to future military readiness and operational superiority.

Vertical Analysis

In terms of vertical, the segmentation includes defense & military, government, and commercial. The defense & military segment held the largest market share in 2024 due to increasing focus on modernizing armed forces and enhancing national security capabilities. Global military powers such as the U.S., China, Russia, and India increased investments in advanced battlefield technologies to support strategic dominance across land, air, sea, and cyber domains. The need for real-time threat detection, secure communications, and rapid decision-making tools prompted defense agencies to adopt integrated command, surveillance, and communication systems at scale. Additionally, the increasing prevalence of asymmetric warfare and cross-border tensions has further encouraged nations to strengthen their military infrastructure through the large-scale procurement of advanced solutions, thereby contributing to the segment's dominance.

Regional Analysis

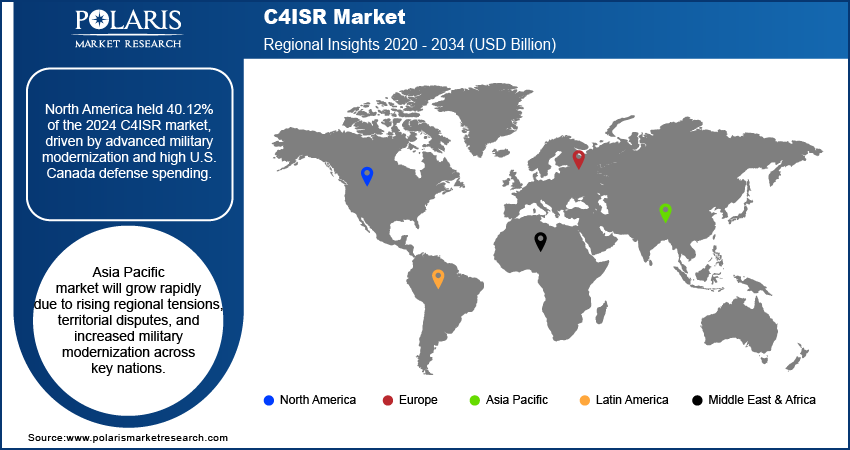

The North America C4ISR market accounted for 40.12% global share in 2024, owing to the region's advanced military modernization programs and high defense spending, particularly in the U.S. and Canada. The increasing focus on multi-domain operations, cybersecurity, and the integration of AI and machine learning into defense systems fueled investments in C4ISR. Additionally, geopolitical tensions, such as those with Russia and China, as well as the enhanced space and missile defense capabilities, have pushed North American militaries to adopt next-generation C4ISR technologies for superior situational awareness and decision-making.

U.S. C4ISR Market Insight

The U.S. held a 94.52% revenue share in North America in 2024 due to the rising emphasis of Department of Defense (DoD) on Joint All-Domain Command and Control (JADC2). The U.S. military invested heavily in network-centric warfare, unmanned systems, and satellite communications in 2024 to maintain battlefield dominance. The growing threats from China, Russia, and Iraq, as well as the need for real-time data fusion across air, land, sea, space, and cyber domains, have propelled C4ISR procurement. Additionally, initiatives such as the Air Force’s Advanced Battle Management System (ABMS) and the Navy’s Project Overmatch have boosted demand for integrated C4ISR solutions in the U.S.

Asia Pacific C4ISR Market Trends

The market in Asia Pacific is expected to grow at a robust pace in the coming years, owing to the rising regional tensions, territorial disputes between South China Sea and India-China border, and military modernization efforts. Countries such as China, Japan, South Korea, and Australia are investing heavily in ISR (Intelligence, Surveillance, Reconnaissance), electronic warfare, and secure communications to counter emerging threats. China’s aggressive military expansion and the U.S.’s Indo-Pacific strategy are prompting Asia Pacific countries to enhance their C4ISR capabilities for maritime awareness, anti-access/area denial (A2/AD) strategies, and cyber warfare.

India C4ISR Market Overview

The C4ISR industry in India is driven by the rising border tensions with China and Pakistan, along with the need for networked warfare systems. The Indian Armed Forces are prioritizing indigenous C4ISR development under the Atmanirbhar Bharat initiative while also acquiring advanced systems from the U.S., Israel, and France. The modernization of Army Battlefield Management Systems (BMS), Integrated Air Command and Control Systems (IACCS), and naval ISR platforms is also driving the market in the region. Additionally, India’s focus on space-based surveillance and AI-driven analytics is boosting C4ISR investments to enhance situational awareness and decision-making speed.

Europe C4ISR Market Analysis

The market in Europe is projected to hold a substantial market share in 2024 due to rising geopolitical instability, particularly from Russia’s aggression in Ukraine, and the need for NATO interoperability. European nations are increasing defense budgets to strengthen electronic warfare, cyber defense, and multi-domain C4ISR integration. The European Defence Fund (EDF) and initiatives such as PESCO (Permanent Structured Cooperation) are driving collaborative C4ISR projects. Countries such as the UK, France, and Germany are investing in next-gen ISR drones, secure military SATCOM, and AI-enabled command systems to counter hybrid warfare threats. Additionally, the modernization of military equipment and the need for resilient communications are shaping Europe’s C4ISR procurement strategies.

Key Players and Competitive Analysis

The global C4ISR market is highly competitive, with the presence of key players such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, BAE Systems, and Thales Group driving innovation and technological advancements. These companies dominate the market through extensive R&D investments, strategic partnerships, and robust product portfolios that cater to the defense, aerospace, and intelligence sectors. Lockheed Martin leads with advanced integrated systems, such as Aegis and Space Fence, while Northrop Grumman focuses on next-generation solutions, including the Joint All-Domain Command and Control (JADC2) framework. Raytheon Technologies excels in cybersecurity and electronic warfare, offering platforms such as the Global Precision Strike System. BAE Systems and Thales Group strengthen their positions with modular, interoperable solutions, including the APEX system and CONTACT software-defined radios.

Governments worldwide are increasing their defense budgets, further fueling demand for C4ISR capabilities, particularly in regions such as North America, Europe, and Asia Pacific. The market is also witnessing a surge in artificial intelligence, machine learning, deep learning, and cloud-based C4ISR solutions, prompting firms to innovate rapidly.

A few major companies operating in the C4ISR industry include BAE Systems, Inc.; CACI International Inc.; Elbit Systems Ltd.; General Dynamics; Kratos Defense & Security Solutions, Inc.; L3Harris Technologies, Inc.; Leonardo S.p.A.; Lockheed Martin Corporation; Northrop Grumman; Rheinmetall AG; RTX Corporation; Saab AB; and Thales.

Key Players

- BAE Systems, Inc.

- CACI International Inc.

- Elbit Systems Ltd.

- General Dynamics

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman

- Rheinmetall AG

- RTX Corporation

- Saab AB

- Thales

Industry Developments

June 2025: Kontron announced the launch of the VX3406, a 3U VPX Ethernet board for harsh environments in defense and aerospace applications.

April 2025: India announced to launch 52 dedicated satellites for gathering intelligence and surveillance.

C4ISR Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- New Installation

- Retrofit

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Command & Control

- Communications

- Computers

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Electronic Warfare

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Defense & Military

- Government

- Commercial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

C4ISR Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 129.79 Billion |

|

Market Size in 2025 |

USD 134.64 Billion |

|

Revenue Forecast by 2034 |

USD 191.47 Billion |

|

CAGR |

3.99% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 129.79 billion in 2024 and is projected to grow to USD 191.47 billion by 2034.

The global market is projected to register a CAGR of 3.99% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are BAE Systems, Inc.; CACI International Inc.; Elbit Systems Ltd.; General Dynamics; Kratos Defense & Security Solutions, Inc.; L3Harris Technologies, Inc.; Leonardo S.p.A.; Lockheed Martin Corporation; Northrop Grumman; Rheinmetall AG; RTX Corporation; Saab AB; and Thales.

The new installation segment dominated the market share in 2024.

The command & control segment is expected to witness the fastest growth during the forecast period.