Cable Tool Drilling Market Share, Size, Trends, Industry Analysis Report

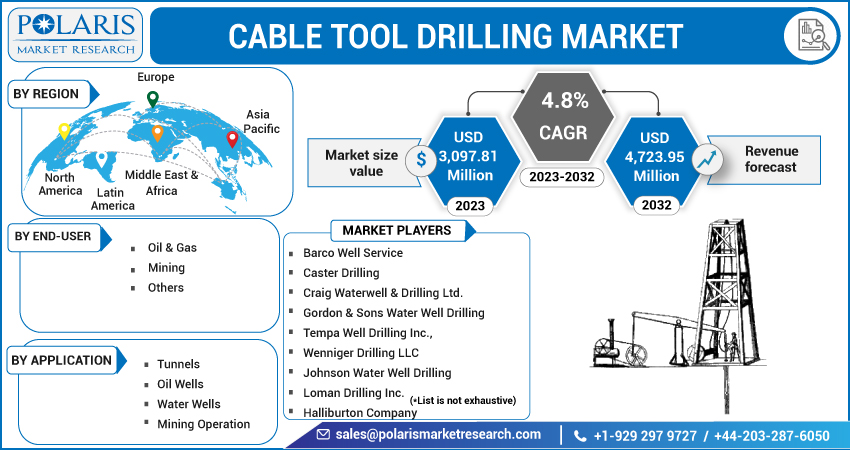

By Application (Tunnels, Oil Wells, Water Wells, and Mining Operation); By End-User; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 118

- Format: PDF

- Report ID: PM3450

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

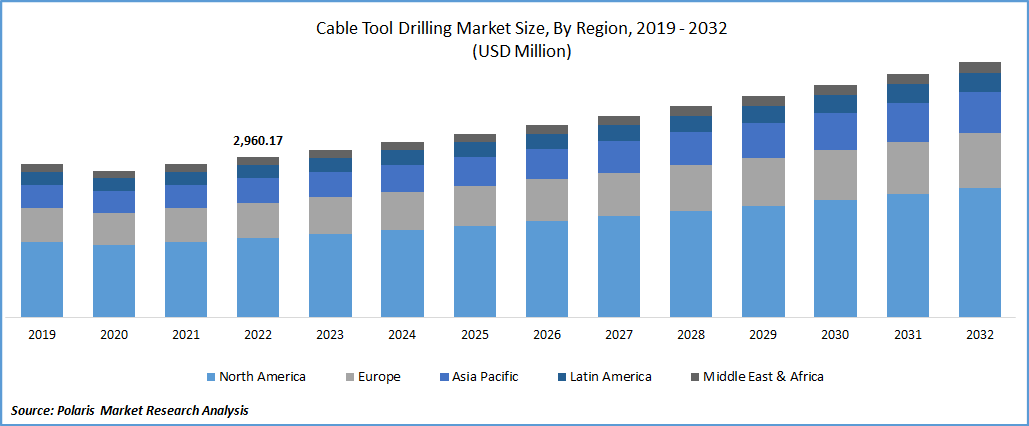

The global cable tool drilling market was valued at USD 2,960.17 million in 2022 and is expected to grow at a CAGR of 4.8% during the forecast period. The growing utilization of these machines or equipment for effective drilling in soft rock formations and unconsolidated materials, especially when shallow depth wells of more than 100 feet are needed, and the rise in the number of exploration projects and mining operations all over the world are the primary factors boosting the market growth at a rapid pace. In addition, several new technologies are being developed to make drilling faster, more efficient, safer, and cost-effective, along with improvements in the operating capabilities of this equipment and tools, which are also likely to impact the market growth positively. For instance, in March 2021, Enteq announced the launch of its new SABER tool with a game-changing approach to directional drilling, an alternative to the traditional rotary steerable system for directional drilling. The newly developed tools use internally directed pressure to steer from the drill bit face effectively.

To Understand More About this Research: Request a Free Sample Report

Moreover, automation is being widely introduced in cable tool drilling rigs, making the process faster and more accurate, as the automated system can easily handle several aspects of drilling, including drilling depth, bit pressure, and drilling speed, coupled with the increasing adoption of environmentally sustainable practices such as using biodegradable drilling fluids and reducing waste generated during drilling, is gaining traction worldwide.

However, the high cost associated with the maintenance and installation of this equipment makes it challenging for small companies, and environmental concerns, particularly about air and water pollution, are the key factors hampering the market growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the cable tool drilling market. The rapid emergence of deadly coronavirus across the globe has forced countries to take necessary actions like lockdowns and other restrictions on trade activities and lack of skilled labor or workforce, due to which mining and drilling activities were on hold, which declined the adoption and sales of these tools.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rapidly growing advancements in cable tool drilling technology have resulted in the development of more efficient and reliable equipment that allow mining operators to easily operate in several challenging conditions, such as deep wells and high-pressure environments, coupled with the exponential growth in mining and construction activities like foundation drilling and well drilling, are among the primary factors fueling the global cable tool drilling market growth. Furthermore, many governments around the world are promoting exploration and production activities to reduce dependence on imported oil and gas in their respective nations, and several public and private sector companies are significantly investing in the development of infrastructure such as roads, bridges, and buildings, are further estimated to drive the demand and growth of the market over the coming years.

Report Segmentation

The market is primarily segmented based on application, end-user, and region.

|

By Application |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Mining operation segment accounted for the largest market share in 2022

The mining operation segment accounted for the largest market share in 2022 and will likely retain its market position throughout the forecast period. As a large number of mining companies across the globe are continuously looking for new mineral deposits, there is a growing demand for cable tool drilling equipment to explore and develop these sites and is often used in the early stages of mining operations to determine the composition of the earth and identify potential mineral deposits, that are the major factors driving the segment market growth.

In addition, the rising demand for minerals, particularly rare earth metals used in high-tech applications, is resulting in a higher need for mining operations to extract these minerals from the ground, as it is a low-intact drilling method as compared to other techniques available in the market like hydraulic fracturing, which in turn, propelling the growth of the segment market.

The water wells segment is expected to grow significantly during the anticipated period, largely attributed to the rising demand for clean and safe water due to the surge in global population and rate of industrialization in emerging economies like India, China, and Indonesia. Additionally, many governments worldwide have imposed regulations to ensure that water wells are drilled safely and by the established standards, which positively affects market growth.

Oil & gas segment held the significant market revenue share in 2022

The oil & gas segment held the maximum market revenue share in 2022 with a healthy growth rate because of a continuous rise in the number of oil & natural gas exploration projects and growing investments towards developing more improved and developed exploration solutions by key market companies. This drilling method is particularly effective in drilling through hard rock formations, which is quite challenging for several other drilling methods, making it a suitable method for shallow oil and gas wells in hard rock formations. These are some other factors fueling the market growth at a rapid pace.

The mining segment is projected to exhibit the fastest growth rate over the next coming years, which is mainly driven by increasing demand for various types of minerals such as copper, iron ore, gold, and silver, along with the significant rise in global population and economy, that fuels the product demand from the mining industry. Advances in drilling technologies, including cable tool drilling, have made it possible to extract minerals from deeper underground deposits and in more challenging geological conditions, increasing the efficiency and productivity of mining operations and making them more profitable.

North America region dominated the global market in 2022

North American region dominated the global market with the largest revenue share in 2022 and is expected to maintain its dominance throughout the forecast period. The growth of the segment market can be highly attributed to the presence of various developed economies with substantial oil and gas resources and a large number of robust drilling shale gas reserves across the region. Moreover, significant growth in mining technology and equipment and rapid adoption of advanced drilling techniques with lower environmental impact and cost-friendly mainly in developed nations like the US and Canada, are also propelling the market growth.

The Asia Pacific region is anticipated to be the fastest-growing region with a considerable growth rate over the projected period, largely attributable to increased demand for groundwater and rapid industrialization in emerging economies such as India, China, and Indonesia. To meet the growing consumer demand and encourage the development of a secure, sufficient, and clean energy sector, countries are heavily investing in their infrastructure projects, which has led to higher adoption of these tools and equipment in the region.

Competitive Insight

Some of the major players operating in the global market include Barco Well Service, Caster Drilling, Tempa Well Drilling, Wenniger Drilling, Johnson Water Well Drilling, Loman Drilling, Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International, NOV Inc., XCMG, and Toro Company.

Recent Developments

- In October 2022, Aramco announced the launch of a new joint venture between Saudi Arabia and NOV to manufacture the drilling rigs and other related equipment. This project is among the largest NOV investments for rig manufacturing outside the United States; the facility is built in Ras AI-Khair on a total area of nearly 500,00 square meters. The new local rig industry will help reduce the dependence on imported products and offer more job opportunities in the nation.

- In January 2021, United Drilling Tools announced the commencement of operations at their newly set up manufacturing plant in Gujrat near the Mundra Port, which spreads into a total area of around 35 acres. The new manufacturing unit will be producing products such as casing pipe with connector assembly segments that further help the company widen its existing portfolio.

Cable Tool Drilling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3,097.81 million |

|

Revenue forecast in 2032 |

USD 4,723.95 million |

|

CAGR |

4.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Barco Well Service, Caster Drilling, Craig Waterwell & Drilling Ltd., Gordon & Sons Water Well Drilling, Tempa Well Drilling Inc., Wenniger Drilling LLC, Johnson Water Well Drilling, Loman Drilling Inc., Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International Plc, NOV Inc., XCMG, and The Toro Company. |

FAQ's

key companies in cable tool drilling market are Barco Well Service, Caster Drilling, Tempa Well Drilling, Wenniger Drilling, Johnson Water Well Drilling, Loman Drilling, Halliburton Company.

The global cable tool drilling market is expected to grow at a CAGR of 4.8% during the forecast period.

The cable tool drilling market report covering key segments are application, end-user, and region.

key driving factors in cable tool drilling market are rise in the number of exploration projects and mining operations.

The global cable tool drilling market size is expected to reach USD 4,723.95 million by 2032.