Captive Portal Market Size, Share, Trends, Industry Analysis Report

By Offering (Platforms, Services), By Deployment, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5878

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

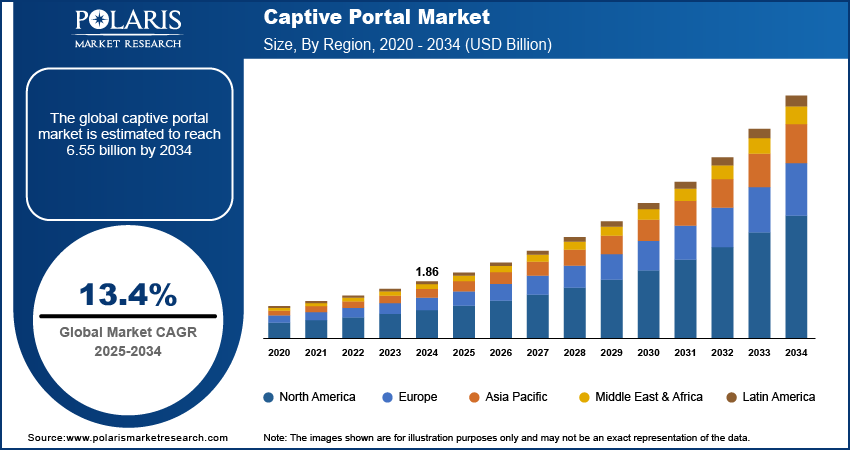

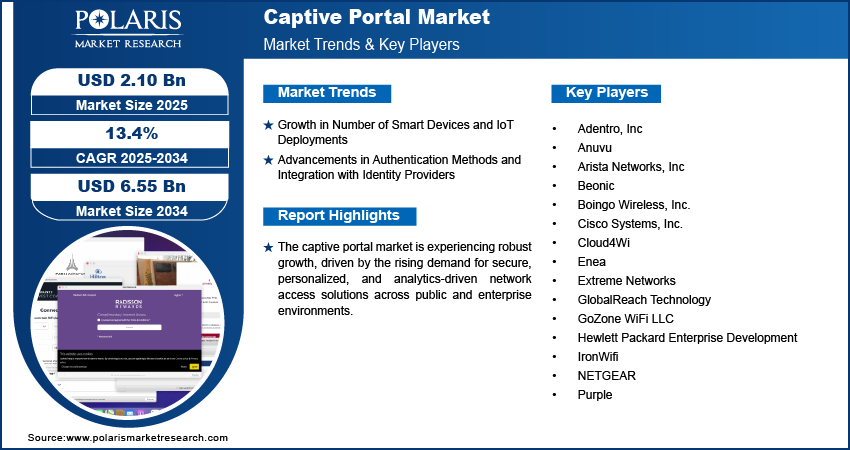

The global captive portal market size was valued at USD 1.86 billion in 2024, growing at a CAGR of 13.4% from 2025 to 2034. The growth is driven by the increasing demand for Wi-Fi monetization and marketing through captive portals, enabling businesses to generate revenue and collect valuable user data.

A captive portal is a web-based gateway that restricts user access to a network until authentication or agreement to terms is completed. The portal is commonly used to manage access in public and semi-public internet environments. The growing deployment of public Wi-Fi networks across airports, hotels, shopping malls, transportation hubs, and urban smart cities infrastructure is driving demand for captive portal solutions. These networks require secure, scalable access controls to ensure that only authenticated users can connect, which helps minimize misuse and enhance data centric security. Captive portals act as a first line of defense, allowing network operators to manage usage policies, collect user data for analytics, and ensure compliance with local regulations. The need for intelligent, user-friendly network onboarding platforms is expanding as public connectivity becomes more integral to customer experience and operational functionality.

The increasing adoption of cloud-based captive portal solutions is reshaping the landscape by offering improved scalability, flexibility, and cost efficiency. Organizations are preferring cloud-based solutions over traditional on-premise infrastructures as cloud solutions simplify deployment across multiple locations, allow centralized management, and reduce capital expenditure. These cloud-based portals integrate with a wide range of customer relationship management and marketing tools, making them valuable for security, also for customer engagement, and data insights. The ability to customize login experiences, monitor real-time user behavior, and update access policies remotely aligns with the evolving operational needs of businesses in the retail, hospitality, and education sectors. This shift towards cloud-hosted platforms is expected to sustain long-term momentum in the captive portal market.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growth in Number of Smart Devices and IoT Deployments

The rapid growth in the number of smart devices and IoT deployments is propelling the sector growth, as it increases the volume of devices requiring network access in public and enterprise environments. According to a report published by Ericsson in 2023, the number of cellular IoT connections reached 3.4 billion, showcasing the rapid adoption of IoT technologies worldwide. There is a critical need for secure and efficient onboarding of both human users and connected devices, with IoT ecosystems expanding across industries such as healthcare, retail, logistics, and manufacturing. Captive portals provide a controlled gateway that enables device identification, access restrictions, and usage tracking, ensuring network integrity and operational continuity. This increasing dependency on secure connectivity, especially in high-density and multi-device settings, is elevating the role of captive portals in managing dynamic, device-rich environments.

Advancements in Authentication Methods and Integration with Identity Providers

Advancements in authentication methods and deeper integration with identity providers are improving the effectiveness and appeal of captive portal solutions. Traditional username-password combinations are being eliminated or replaced with modern authentication mechanisms such as multi-factor authentication (MFA), single sign-on (SSO), and social media logins. Integration with identity and access management (IAM) systems enables more granular control over user credentials, session monitoring, and policy enforcement across distributed networks. For instance, in May 2023, Juniper Networks launched the Mist Access Assurance service, integrating AI-driven network access control (NAC) and policy management into its existing wired and wireless, SD-WAN, and cloud portfolios. These advancements enable captive portals to provide seamless, secure, and personalized access experiences that align with enterprise-level security frameworks. The growing focus on identity-based access control is positioning captive portals as strategic tools in wide cybersecurity and user management ecosystems.

Segmental Insights

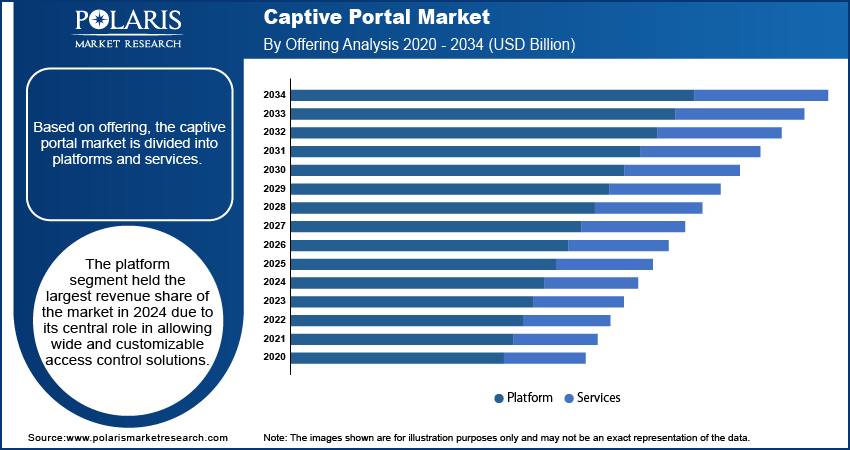

Offering Analysis

The segmentation, based on offering, includes platforms and services. The platform segment held a larger revenue share in 2024 due to its central role in allowing wide and customizable access control solutions. These platforms serve as the core interface for managing user authentication, session tracking, data analytics, and branding across multiple access points. Businesses increasingly prioritize platforms that offer seamless integration with existing IT infrastructure and third-party applications. Additionally, platforms provide greater flexibility to tailor user experiences, enforce compliance, and deliver targeted content, making them a preferred choice for enterprises seeking robust network access management capabilities. Their scalability and centralized control functions contribute greatly to their widespread adoption across high-traffic venues.

Deployment Analysis

The segmentation, based on deployment, includes cloud and on-premises. The on-premises segment is expected to witness fastest growth during the forecast period owing to rising concerns regarding data privacy, security, and regulatory compliance. Organizations with sensitive user data or strict internal IT policies often prefer localized infrastructure that offers full control over network access and stored information. On-premises deployments allow businesses to maintain autonomy over their captive portal solutions, reducing reliance on third-party cloud vendors. Additionally, industries such as government, healthcare, and finance favor on-premises systems for assuring operational continuity and managing risks associated with data breaches or connectivity issues.

Application Analysis

The segmentation, based on application, includes Wi-Fi management, content filtering, device management, and bandwidth management. The content filtering segment is expected to register the highest CAGR during the forecast period as organizations focus on controlling and monitoring internet usage across public networks. Captive portals integrated with content filtering mechanisms are becoming essential with increased cybersecurity threats and the need to maintain a safe browsing environment. These tools help restrict access to inappropriate or harmful content, enforce usage policies, and ensure optimal bandwidth utilization. It is used efficiently for business-critical functions. Educational institutions, hospitality providers, and co-working spaces are among key adopters, leveraging content filtering to enhance user experience while ensuring compliance with digital conduct standards.

End Use Analysis

The segmentation, based on end use, includes travel & transportation, hospitality & leisure, co-working spaces, shopping malls & retail outlets, entertainment, internet service providers (ISPs), and others. The retail segment growth is driven by the increasing adoption of Wi-Fi marketing strategies and personalized customer engagement. Retailers are leveraging captive portals to gather demographic and behavioral data through login interactions, which helps improve targeted promotions and customer loyalty programs. Additionally, offering secure and seamless Wi-Fi access encourages longer in-store dwell times, enabling greater customer satisfaction and sales opportunities. Therefore, as foot traffic in retail environments remains high, the ability to control network access while turning it into a marketing tool has positioned captive portals as a strategic investment for retailers.

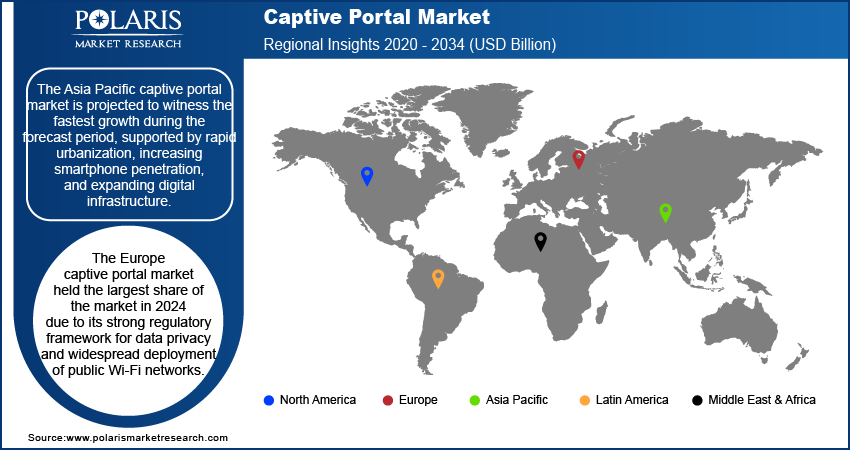

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America captive portal market is expected to witness substantial growth during the forecast period, due to the region’s advanced digital infrastructure and early adoption of public Wi-Fi systems. The growing demand for secure access solutions across large venues such as airports, stadiums, universities, and enterprise campuses is fueling the need for captive portals. Additionally, the strong presence of leading technology providers and widespread use of cloud-based IT architectures facilitate the integration of refined portal platforms. The region's focus on cybersecurity compliance and user data protection further drives the adoption of robust access management tools.

US Captive Portal Market Trends

The US market is driven by the widespread availability of high-density public Wi-Fi networks and a strong focus on cybersecurity and data privacy compliance. Enterprises and public service providers are leveraging captive portals to deliver secure, user-friendly access while aligning with regulatory standards. Furthermore, the integration of analytics and marketing functionalities into captive portal platforms supports customer engagement strategies across sectors such as retail, hospitality, and transportation.

Asia Pacific Captive Portal Market Overview

The Asia Pacific captive portal market is projected to witness the fastest growth during the forecast period, supported by rapid urbanization, increasing smartphone penetration, and expanding digital infrastructure. According to a February 2025 report from the Ministry of Communications, India's digital economy accounted for 11.74% of GDP in FY2022–2023. The growth was fueled by the rising penetration of AI, cloud services, and digital platforms, with the country hosting 55% of global capability centers. The surge in smart city initiatives and digital connectivity projects across commercial and public sectors is creating a strong demand for scalable and secure access control systems. Moreover, the growing number of internet users in densely populated regions prompt businesses and governments to deploy captive portals for enhanced network management and user engagement. The region’s ongoing investments in digital transformation and mobility services significantly contribute to this market expansion.

China Captive Portal Market Assessment

The market in China is expected to witness growth, fueled by rapid urbanization, growing public internet infrastructure, and digital transformation across commercial spaces. Businesses are adopting captive portals to manage access, support large user bases, and enhance service delivery as the number of internet users continues to surge. Additionally, the integration of mobile-first access experiences and localization features is increasing the appeal of captive portal solutions in densely populated urban environments.

Europe Captive Portal Market Insights

The market in Europe held the largest share in 2024 due to its strong regulatory framework for data privacy and widespread deployment of public Wi-Fi networks. The region has seen early adoption of captive portal technologies across retail, transportation, and hospitality sectors, driven by the need to comply with stringent GDPR guidelines. Businesses across Europe prioritize user identity verification, consent collection, and secure access, making captive portals an essential part of digital infrastructure. Additionally, the region’s focus on enhancing customer experience through personalized connectivity supports continuous demand for advanced portal platforms.

UK Captive Portal Market Analysis

The UK market growth is driven by the country's mature hospitality and retail sectors, which are increasingly focused on offering personalized digital experiences to users. Businesses are utilizing captive portals for secure network access and for data-driven insights to improve marketing efforts and customer retention. Additionally, compliance with data protection regulations such as the UK GDPR has increased the need for transparent, consent-based network access solutions.

Key Players and Competitive Analysis

The captive portal sector is evolving rapidly, driven by technological advancements in cloud-based authentication and AI-driven analytics. Small and medium-sized businesses increasingly adopt these solutions for secure guest access, while developed markets lead in innovation with Zero Trust integration. Strategic investments in Wi-Fi 6/7 and IoT compatibility are reshaping sustainable value chains, particularly in emerging markets where digital transformation is accelerating.

Major players focus on revenue growth through partnerships with telecom providers and smart city projects. Disruptions and trends include the rise of contactless authentication and hyper-personalized marketing portals. Future development strategies highlight interoperability with 5G networks and edge computing, addressing latent demand for seamless, secure connectivity across retail, healthcare, and transportation sectors. Regional footprints are expanding, with Asia Pacific showing high potential due to urbanization and smart infrastructure projects. Vendor strategies prioritize business transformation, integrating captive portals with broader digital ecosystems such as SD-WAN and NAC solutions. Growth projections remain strong as industries prioritize customer analytics and compliance, though economic and geopolitical shifts could impact supply chains for hardware components. The sector’s total addressable market is expanding beyond traditional hospitality to include smart offices and public venues, signaling expansion opportunities for agile providers.

A few key players are Adentro, Inc; Anuvu; Arista Networks, Inc; Beonic; Boingo Wireless, Inc.; Cisco Systems, Inc.; Cloud4Wi; Enea; Extreme Networks; GlobalReach Technology; GoZone WiFi LLC; Hewlett Packard Enterprise Development; IronWifi; NETGEAR; and Purple.

Key Players

- Adentro, Inc.

- Anuvu

- Arista Networks, Inc.

- Beonic

- Boingo Wireless, Inc.

- Cisco Systems, Inc.

- Cloud4Wi

- Enea

- Extreme Networks

- GlobalReach Technology

- GoZone WiFi LLC

- Hewlett Packard Enterprise Development

- IronWifi

- NETGEAR

- Purple

Industry Developments

November 2024: Cisco launched Wi-Fi 7 access points with unified subscription licensing, integrating AI-driven optimization and Cisco Spaces for smart workplaces. The solution offers location-aware adaptability and supports cloud, on-premises, and hybrid network management.

April 2024: HPE released Wi-Fi 7 access points offering 30% greater capacity than competitors, with enhanced security and location services for enterprise AI, IoT, and connectivity applications.

January 2024: Fortinet launched its first Wi-Fi 7 access point (FortiAP 441K) and FortiSwitch T1024, featuring 10GE/90W PoE support. The solution integrates with Fortinet's security services and AIOps for enterprise wireless networks.

Captive Portal Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Platforms

- Services

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Cloud

- On-Premises

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Wi-Fi Management

- Content Filtering

- Device Management

- Bandwidth Management

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Travel & Transportation

- Hospitality & Leisure

- Co-working Spaces

- Shopping Malls & Retail Outlets

- Entertainment

- Internet Service Providers (ISPS)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Captive Portal Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.86 billion |

|

Market Size in 2025 |

USD 2.10 billion |

|

Revenue Forecast by 2034 |

USD 6.55 billion |

|

CAGR |

13.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.86 billion in 2024 and is projected to grow to USD 6.55 billion by 2034.

The global market is projected to register a CAGR of 13.4% during the forecast period.

Europe dominated the market share in 2024.

A few of the key players in the market are Adentro, Inc; Anuvu; Arista Networks, Inc; Beonic; Boingo Wireless, Inc.; Cisco Systems, Inc.; Cloud4Wi; Enea; Extreme Networks; GlobalReach Technology; GoZone WiFi LLC; Hewlett Packard Enterprise Development; IronWifi; NETGEAR; and Purple.

The lead identification & candidate optimization segment dominated the market in 2024.

The on-premises segment is expected to witness the fastest growth during the forecast period.