Carbon Capture, Utilization and Storage Market Share, Size, Trends, Industry Analysis Report

By Technology (Chemical Looping, Solvents & Sorbent, and Membranes); By Service; By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4549

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

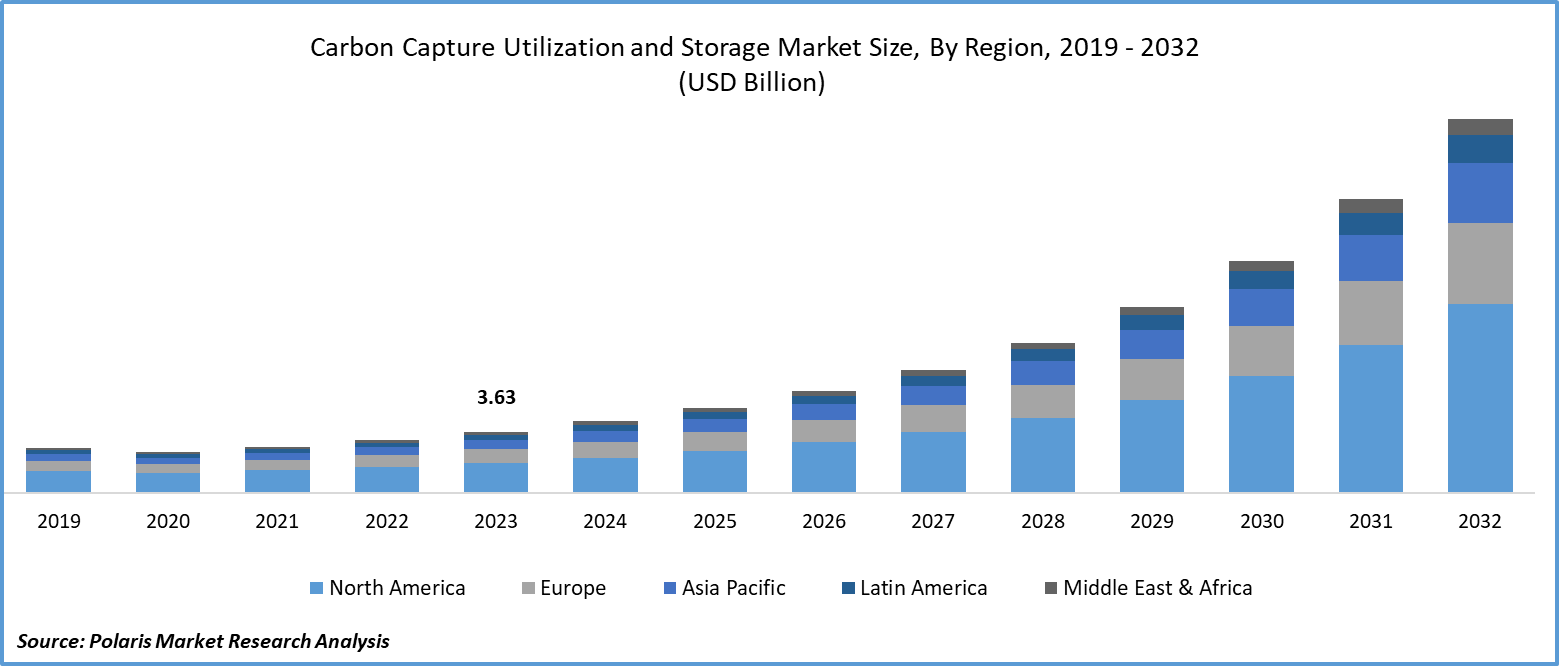

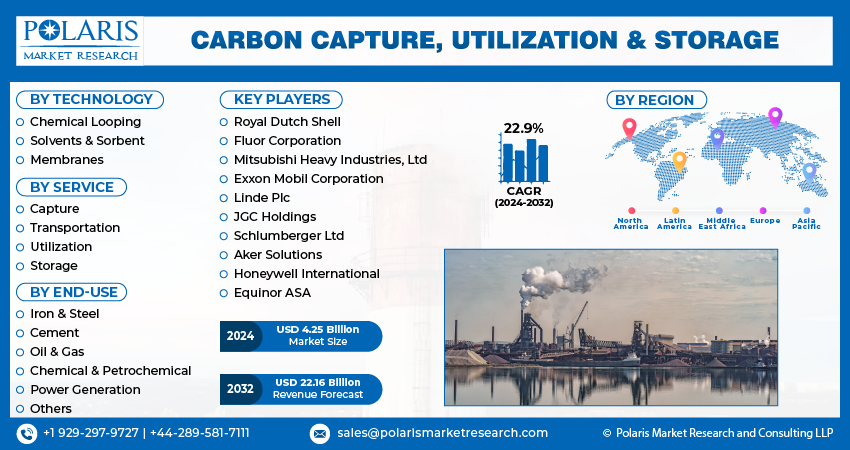

The global carbon capture, utilization, and storage market size & share was valued at USD 3.63 billion in 2023. The market is anticipated to grow from USD 4.25 billion in 2024 to USD 22.16 billion by 2032, exhibiting a CAGR of 22.9% during the forecast period.

Industry Trends

In carbon capture, utilization, and storage, CO2 is extracted, usually from large point sources such as industrial sites or power stations that use biomass or fossil fuels as fuel. The gathered CO2 is compressed and sent, either by truck, train, or pipeline, if it is not needed right away, for use in a number of applications. Additionally, it might be pumped into deep geological formations such as depleted oil and gas deposits or saltwater aquifers. The increased interest in lowering carbon dioxide (CO2) emissions is one of the key factors driving the revenue growth of the carbon capture, utilization, and storage technologies market demand.

- For instance, in July 2023, Fluor Corporation disclosed its MOU with Carbix, the first in carbon dioxide (CO2) mineral storage for exploring carbon capture and storage (CSS) solutions comprehensively.

Global initiatives and project announcements are anticipated to surge, propelling the market's revenue growth for the market forecast period. Initiatives for carbon capture, usage, and storage that are currently underway or in the works in different places have created market opportunities for global market players. China and Australia are two of the early adopters of carbon capture, utilization, and storage in the region. Together with Australia and China, the Middle East is concentrating on adopting carbon capture, utilization, and storage. Governments in the MENA area have been greatly encouraged to take action on climate change by the Conference of the Parties of the UNFCCC, also known as COP27 or the United Nations Climate Change Conference, which was scheduled for 2022, and other events.

To Understand More About this Research: Request a Free Sample Report

In power plants and natural gas processing facilities, where COVID-19 has had very little effect, carbon capture, utilization, and storage have been mostly utilized. But because of the lockdown that was imposed in many different countries, it has affected commercial sectors, like chemical and cement plants, and others. These industries are not very important to the carbon capture, utilization, and storage market, but they also quickly adjusted to the changes and resumed operations after a few months of lockdown. On the other hand, the lockdown delayed the planned initiatives, which had a relatively minor impact on the carbon capture, utilization, and storage market's expansion.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the global carbon capture, utilization, and storage market based on SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Key Takeaways

- North America dominated the market and contributed to more than 49.3% of the share in 2023

- By technology category, chemical looping has the largest revenue share during the projected period

- By service category, Capture segment accounted for the largest market share in 2023

What are the market drivers driving the demand for carbon capture, utilization, and storage market?

Rising concern about reducing CO2 emission is projected to boost product demand.

The main cause of carbon emissions into the atmosphere is the reliance of the population on fossil fuels for energy. Technology for carbon capture, utilization, and storage is used to remove CO2 from different sources and move it to locations for storage or use. Technology for capturing, utilizing, and storing carbon dioxide can lower the amount of greenhouse gases released into the environment by industrial sources. Positive influences on the implementation of carbon capture, use, and storage have come from the world's growing concern over climate change. For instance, the US government issued an executive order requiring the production of power that is 100% carbon-free by 2030.

Which factor is restraining the demand for Carbon Capture, Utilization, and Storage?

High cost associated with the installation and maintenance of carbon capture, utilization, and storage plant

Large capital expenditures are needed for the carbon capture, utilization, and storage equipment, which is also more expensive to run and maintain. This has caused the sectors to feel hesitant about making investments in technology. Because most plants are not built with the implementation of such capture technologies, the implementation also negatively affects the plants' process efficiency. The whole value chain, from the point of carbon capture at the source to the transportation, storage, and end-use application areas, is involved in the cost of carbon capture, utilization, and storage. The income generated by this needs to be increased to recoup the initial investments. For instance, the original capital expenditure and subsequent operation and maintenance expenses are increased by the deployment of an air separator unit for oxy-fuel technology and a CO2 scrubber for post-combustion. Significant financial resources are also needed for the initial investigation, site evaluation, and site preparation in the carbon storage sites.

Report Segmentation

The market is primarily segmented based on technology, service, end-use, and region.

|

By Technology |

By Service |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Technology Insights

Based on technology analysis, the market is segmented on the basis of chemical looping, solvents & sorbents, and membranes. The chemical looping segment holds the largest Carbon Capture, Utilization, and Storage market revenue share in 2023. The Chemical Looping Combustion (CLC) concept depends on the transmission of oxygen from the combustion air to the fuel via an oxygen carrier, such as a metal oxide, in order to reduce direct fuel-air contact. The absence of N2 dilution in the CO2 offers a significant advantage over traditional burning. Unlike other CO2 separation systems that have been shown, this method does not require external capture equipment and does not dramatically increase energy usage during the collection phase. Consequently, it is anticipated that the technique will be less costly than the CO2 separation technologies in use today, which is fueling the segment's revenue growth.

The solvent & sorbent segment is anticipated to hold a substantial share of the market throughout the forecast period. Chemical mixtures that have been specially prepared are known as solvents, and they are used to remove carbon dioxide from industrial gasses. They have been in use for a long time and are now the foundation of the most advanced and tried-and-true carbon capture techniques available, which are fueling the segment's sales growth. In most solvents, carbon dioxide is eliminated by chemical absorption. They frequently contain an amine that will react with CO2 preferentially.

By Service Insights

Based on service analysis, the market has been segmented on the basis of capture, transportation, utilization, and storage. The capture segment accounted for the largest market share in 2023 and is likely to retain its position throughout the market forecast period. Currently, more than 90 full-chain Carbon Capture, Utilization, and Storage projects and more than 150 initiatives focused only on CO2 capture are being developed. The majority of capture-specific projects aim to store CO2 in one of the 40 hubs that are currently being built. Under some conditions, full-chain projects may choose to enhance their CO2 storage infrastructure in order to create a storage hub, which is anticipated to propel the segment's revenue growth. Two such initiatives that consider this are the Italian Ravenna hub and the Canadian Polaris Carbon Capture, Utilization, and Storage hub.

The transportation segment is expected to grow at the fastest growth rate over the next coming years in the carbon capture, utilization and storage market development due to Pipelines that transport CO2 gathered from several sources can facilitate the widespread application of Carbon Capture, Utilization and Storage operations. Although it currently only transports 1.6 Mt CO2/year from two sources, the 240 km Alberta Carbon Trunk Line in Canada has a capacity of 14.6 Mt CO2/year. The pipeline was constructed with a significant quantity of spare capacity and will go into operation in 2020. Multi-user CO2 pipeline networks are being constructed all over the world. For instance, the U.S. Midwest Carbon Express, an offshore pipeline connecting Belgium and Norway, and the Delta Corridor, which connects parts of Germany and the Netherlands.

Regional Insights

North America

The North America region dominated the market with a significant revenue share. American businesses and institutional organizations invented the technology for carbon collection, utilization, and storage. The laws and policies of the nation are also designed to incentivize the industrial market players to adopt new technologies by offering tax breaks and technological help. The region is leading the global market for this technology's adoption by multiple folds caused due to the numerous oil and gas projects that have integrated or retrofitted carbon capture, utilization, and storage technology. The businesses have a wealth of experience with carbon collection, utilization, and storage technologies in their specific areas. As a result, the market has been developed overall for experiencing a huge boom in the carbon capture, utilization, and storage market opportunity by the market players.

Asia Pacific

The Asia Pacific region is anticipated to have the quickest revenue CAGR throughout the projected period. Increased funding and the efforts of numerous businesses to create cutting-edge and creative carbon capture, utilization, and storage solutions are anticipated to propel revenue growth in the market development area. For instance, Sinopec Corp. of China stated on August 29, 2022, that it had opened the nation's largest carbon capture, utilization, and storage facility in east China and that it planned to build two more plants by 2025 that would be comparable in size.

In China, some market players are creating pilot carbon capture, utilization, and storage projects as part of the nation's goal to reach peak carbon emissions by 2030. At Sinopec's Qilu refinery in eastern Shandong province, carbon dioxide is manufactured in order to produce hydrogen. This carbon dioxide is collected as part of the recently started carbon capture, utilization and storage project, which involves injecting it into 73 oil wells close to the Shengli oilfield.

Competitive Landscape

The carbon capture, utilization, and storage market growth is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Royal Dutch Shell

- Fluor Corporation

- Mitsubishi Heavy Industries, Ltd

- Exxon Mobil Corporation

- Linde Plc

- JGC Holdings

- Schlumberger Ltd

- Aker Solutions

- Honeywell International

- Equinor ASA

Recent Developments

- In June 2023, Mitsui & Co. Ltd, Petronas, and TotalEnergies SE agreed to work together on a carbon capture and storage (CSS) project in Malaysia by signing a development agreement.

Report Coverage

The carbon capture, utilization, and storage market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, service, end-use, and their futuristic growth opportunities.

Carbon Capture, Utilization and Storage Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.25 billion |

|

Revenue Forecast in 2032 |

USD 22.16 billion |

|

CAGR |

22.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Technology, By Service, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of carbon capture, utilization and storage in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Bicycle Chain Lubricant Market Size, Share 2024 Research Report

Bio Pharma Logistics Market Size, Share 2024 Research Report

Biobased Polyvinyl Chloride Market Size, Share 2024 Research Report

FAQ's

The Carbon Capture, Utilization and Storage Market report covering key segments are technology, service, end-use, and region.

Carbon Capture, Utilization and Storage Market Size Worth $22.16 Billion By 2032

Carbon capture, utilization and storage market exhibiting the CAGR of 22.9% during the forecast period.

North America is leading the global market

key driving factors in Carbon Capture, Utilization and Storage Market are Rising concern about reducing the CO2 emission