Bio Pharma Logistics Market Share, Size, Trends, Industry Analysis Report

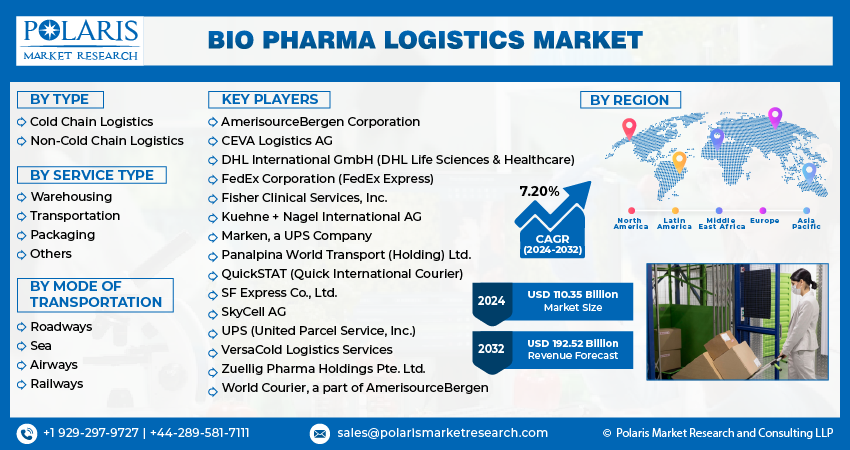

By Type (Cold Chain Logistics, Non-Cold Chain Logistics); By Service Type; By Mode of Transportation; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4001

- Base Year: 2023

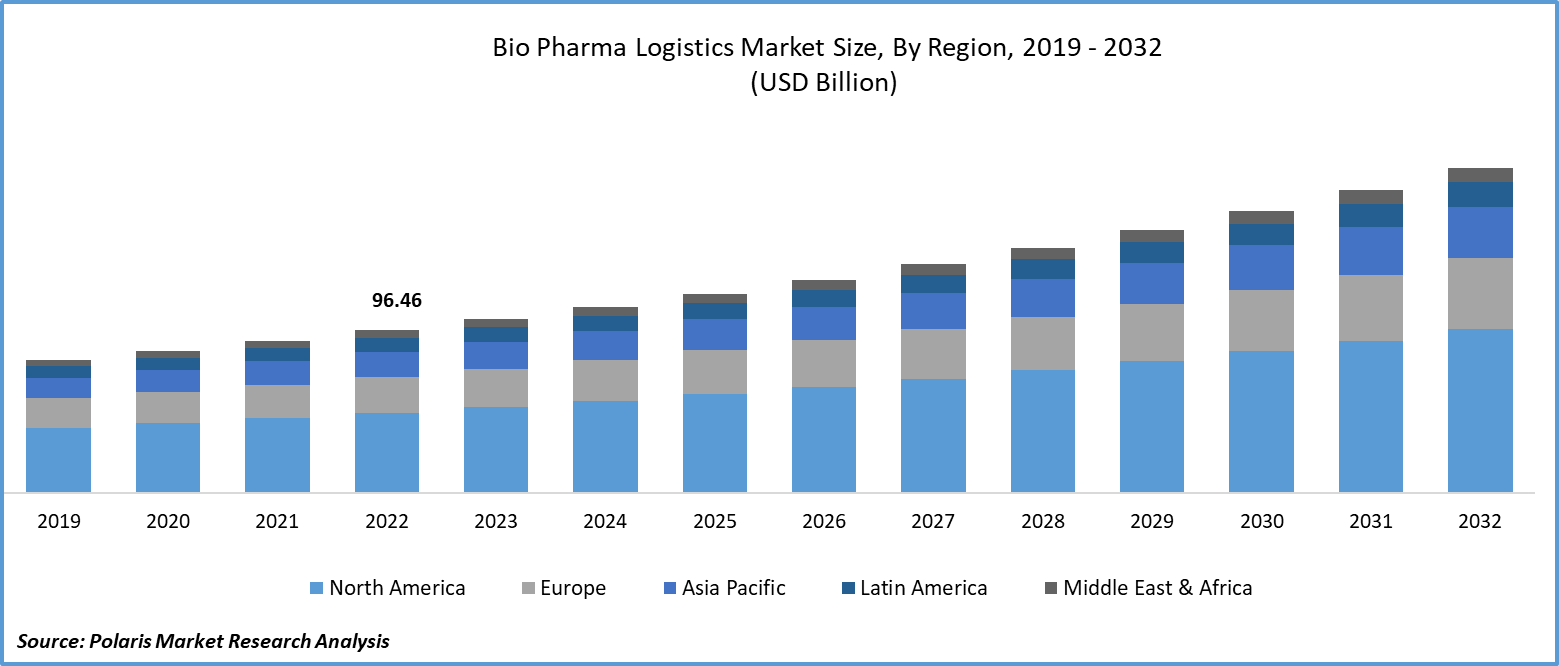

- Historical Data: 2019-2022

Report Outlook

The global bio pharma logistics market was valued at USD 103.15 billion in 2023 and is expected to grow at a CAGR of 7.20% during the forecast period.

The bio-pharma logistics sector has become an indispensable cornerstone of the worldwide pharmaceutical industry. It facilitates the seamless and secure transit of biopharmaceutical products from production hubs to end-users, ensuring the unblemished integrity and safety of temperature-sensitive medications, vaccines, and other biologics.

Biopharma logistics is an intricate and ever-advancing system of handling, locating, and reserving drugs and pharmaceuticals. It is an important part of any pharmaceutical firm as it sanctions that drugs realize the precise people in the precise places at the precise time. It must preserve conformity with all pertinent administrative needs for secure and safe conveyance of pharmaceuticals. As such, firms must fund in resources and IT framework to keep to stringent industry regulations to ensure that their supply chain persists to operate effortlessly.

Biopharma logistics can assist pharmaceutical firms in deciphering their functionalities and decrease expenses by offering end-to-end solutions. The bio pharma logistics market size is expanding from the conveyance of raw materials to the dispensation of finalized commodities; biopharma logistics solutions provide an entire entourage of services deliberated to optimize efficacy and preciseness while diminishing costs and waste.

To Understand More About this Research: Request a Free Sample Report

With pharmaceutical production and distribution becoming increasingly globalized, the demand for a reliable and efficient logistics network has become of utmost importance. This is particularly vital for the biopharmaceutical sector, where products are often manufactured in highly specialized facilities and distributed on a worldwide scale.

Moreover, the emergence of personalized medicine and cell therapies represents a significant growth opportunity for the bio pharma logistics market. These products often require specialized handling and transportation, creating a demand for advanced logistics solutions.

Further, the pharmaceutical industry is increasingly focusing on emerging markets, where access to healthcare is expanding. This presents an opportunity for logistics providers to establish a strong presence in these regions and offer specialized services.

For instance, in August 2023, Zuellig Pharma, headquartered in Singapore, unveiled its collaboration with GSK to enhance vaccine distribution in Asia. This strategic partnership aims to establish a distribution hub that will significantly improve the accessibility, reach, and cost-effectiveness of vaccines. The hub, located in Singapore, will serve as a pivotal link connecting 13 markets across the Asia-Pacific region.

However, regulatory challenges, compliance costs, and complex supply chains are the factors hampering the market growth. Meeting the stringent regulatory requirements in different regions can be a complex and costly process. Companies often need to invest heavily in compliance measures, which can impact profitability.

The complexity of the pharmaceutical supply chain, with multiple stakeholders involved, poses challenges in ensuring end-to-end visibility and control. This complexity increases the risk of product mishandling or temperature excursions.

The research report offers a quantitative and qualitative analysis of the Bio Pharma Logistics Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The market report provides a thorough analysis of the bio pharma logistics market, covering all the major aspects stakeholders need to know. It sheds light on the key developments and trends that are anticipated to drive the bio pharma logistics industry demand over the forecast period. Besides, it maps the qualitative impact of various key factors on market segments and geographies. Furthermore, it examines the key steps taken by industry participants to strengthen their presence in the industry.

Growth Drivers

Increased Advancements in Technology

The progress in cold chain technology has revolutionized the transportation and storage of biopharmaceuticals. Innovations such as specialized packaging solutions, real-time monitoring systems, and temperature-controlled containers have significantly reduced the risk of product degradation during transit.

The increasing number of biopharmaceutical products in development, including vaccines, monoclonal antibodies, and gene therapies, is a significant driver in the bio pharma logistics market. These products often require precise temperature controls and specialized handling protocols.

Additionally, compliance with regulations and ensuring quality are other factors contributing to the market's growth. The strict regulatory landscape, including guidelines such as Good Distribution Practice (GDP), requires pharmaceutical companies to maintain their product's integrity and quality throughout the entire supply chain. As a result, there has been a surge in demand for specialized logistics services.

Report Segmentation

The market is primarily segmented based on type, service type, mode of transportation, and region.

|

By Type |

By Service Type |

By Mode of Transportation |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Cold Chain Logistics Segment is Expected to Witness the Highest Growth During the Forecast Period

The cold chain logistics segment is expected to grow at a steady rate during the projected period. This growth is due to the increasing demand for temperature-sensitive biopharmaceuticals such as vaccines and gene therapies, which require specialized handling and transportation protocols. As a result, there is a growing demand for advanced cold chain solutions.

In addition, stringent regulatory requirements and quality standards imposed by authorities like Good Distribution Practice (GDP) have increased the need for precise temperature control throughout the supply chain. The continuous evolution of cold chain technology, including real-time monitoring systems and advanced temperature-controlled containers, has significantly reinforced the segment's progress. With the global biopharmaceutical sector surging ahead, particularly in emerging markets, the cold chain logistics segment is in a strong position for sustained growth. Its pivotal role in safeguarding the effectiveness and safety of these vital life-saving products remains integral.

By Service Type Analysis

Warehousing Segment Accounted for the Largest Market Share in 2022

The warehousing segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. The growing biopharmaceutical industry has driven the need for dedicated and compliant storage facilities. These facilities must meet strict regulatory requirements for temperature control, security, and quality assurance. Additionally, the increasing complexity of pharmaceutical supply chains has necessitated the expansion of warehousing capacity to ensure efficient and timely deliveries.

Advanced technology and automation in warehousing have improved inventory management, reduced errors, and enhanced the overall efficiency of pharmaceutical storage. This growth is particularly evident in regions with a rising demand for pharmaceuticals, such as emerging markets where access to healthcare is expanding.

Furthermore, the global distribution of pharmaceuticals has increased the demand for strategically located warehouses to facilitate international shipping. As biopharmaceutical companies seek to optimize their supply chains and respond to evolving healthcare challenges, the warehousing segment is expected to continue its growth trajectory in the bio pharma logistics market.

By Mode of Transportation Analysis

Airways Segment Held a Significant Market Revenue Share in 2022

The airways segment in the bio pharma logistics market has experienced significant growth driven by critical factors. The time-sensitive nature of pharmaceuticals, especially biopharmaceuticals and vaccines, demands rapid and reliable transportation. Airways provide the fastest mode of transit, which is crucial for meeting global healthcare needs. Technological advancements, including temperature-controlled cargo holds and real-time tracking systems, have bolstered the airways segment's capabilities.

Moreover, partnerships between airlines and logistics providers have resulted in specialized services tailored to the unique requirements of pharmaceutical transportation. As the demand for biopharmaceuticals continues to rise, the airways segment is poised to play a pivotal role in ensuring their timely and secure delivery worldwide.

Regional Insights

North America Region Dominated the Global Market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. This is due to a surge in biopharmaceutical research and development, along with a steady rise in FDA-approved products, has spurred demand for specialized logistics services. Stringent regulatory requirements have further emphasized the need for compliant transportation and storage solutions. Additionally, technological advancements in cold chain management and real-time tracking systems have bolstered the region's capabilities in handling temperature-sensitive pharmaceuticals. With a mature healthcare infrastructure and a strong presence of pharmaceutical companies, North America is positioned for sustained growth in the bio pharma logistics market.

Asia-Pacific bio pharma logistics market has experienced exponential growth in recent years. The region's expanding healthcare sector, coupled with a surge in pharmaceutical production, has heightened the demand for specialized logistics services. The rise in biopharmaceutical research and development, including vaccines and advanced therapies, has necessitated stringent temperature-controlled transportation. Additionally, regulatory compliance and quality assurance measures have propelled the need for advanced logistics solutions. With the increasing globalization of pharmaceutical manufacturing, Asia's strategic location offers a pivotal gateway for distribution across the globe. As the healthcare landscape continues to evolve, Asia is poised to play a central role in the bio pharma logistics market's ongoing growth.

Key Market Players & Competitive Insights

The bio pharma logistics market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AmerisourceBergen Corporation

- CEVA Logistics AG

- DHL International GmbH (DHL Life Sciences & Healthcare)

- FedEx Corporation (FedEx Express)

- Fisher Clinical Services, Inc.

- Kuehne + Nagel International AG

- Marken, a UPS Company

- Panalpina World Transport (Holding) Ltd.

- QuickSTAT (Quick International Courier)

- SF Express Co., Ltd.

- SkyCell AG

- UPS (United Parcel Service, Inc.)

- VersaCold Logistics Services

- World Courier, a part of AmerisourceBergen

- Zuellig Pharma Holdings Pte. Ltd.

Recent Developments

- In June 2023, Oliva Therapeutics, a healthcare firm specializing in product commercialization, sales, marketing, distribution, and promotion, unveiled its extensive, enduring collaboration with Rio Biopharmaceuticals. This partnership granted Oliva Therapeutics exclusive supply and distribution rights for a diverse portfolio of products in the North American region.

Bio Pharma Logistics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 110.35 billion |

|

Revenue Forecast in 2032 |

USD 192.52 billion |

|

CAGR |

7.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Service Type, By Mode of Transportation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 Bio Pharma Logistics Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Artificial Flowers Market Size, Share 2024 Research Report

Graphic Film Market Size, Share 2024 Research Report

Automotive Sensor Fusion Market Size, Share 2024 Research Report

Opioid Induced Constipation Market Size, Share 2024 Research Report