Cargo Security Seals Market Share, Size, Trends, Industry Analysis Report

By Substrate (Plastic, Metal, and Glass); By Type (Bolt seals, Cable seals, Tamper-evident seals, Barcoded seals, Others); By End-User; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 118

- Format: PDF

- Report ID: PM3941

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

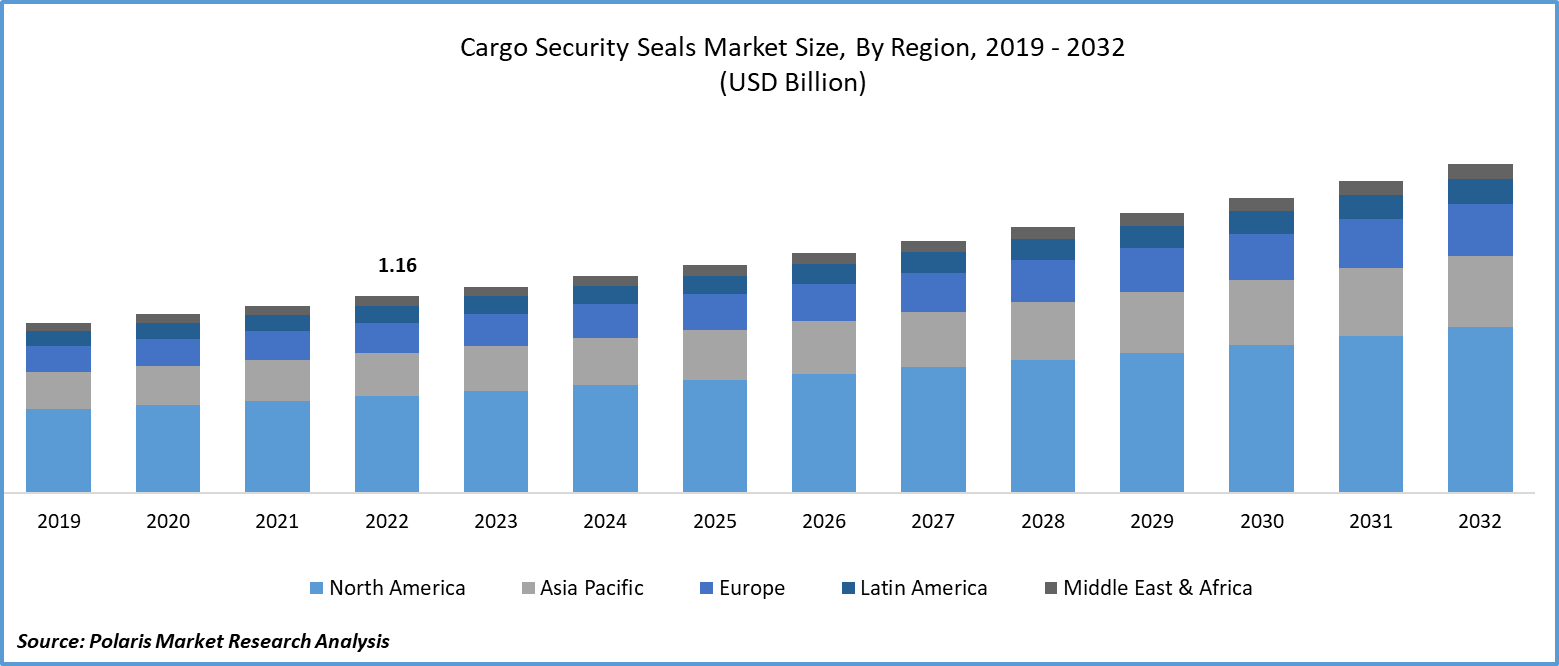

The global cargo security seals market was valued at USD 1.16 billion in 2022 and is expected to grow at a CAGR of 5.3% during the forecast period.

Cargo involves the transportation of goods from one place to another. Cargo security seals are used to avoid the theft of goods. A variety of containers are secured with cargo security seals. Cargo containers, totes, valves, coin bags, inner drum bags, storage bags, trailer doors, railcar doors, and any container with a hasp or loops are examples of typical usage. The growing theft of goods in various industries is driving the importance of the security seal market.

To Understand More About this Research: Request a Free Sample Report

- For instance, in February 2023, the latest theft report showed that beverage and food cargo theft had increased by approximately 50% since last year. Additionally, this theft category saw a 50% spike in January. The theft costs $214,0000 on average per load.

Moreover, rising cargo theft is enabling companies to take effective measures in goods transportation, driving demand for cargo security seals, as they work efficiently since the seal can only be broken once and guarantee that the container cannot be opened while being transported in any mode until it reaches its destination. The FBI estimates that cargo theft costs trucking businesses and merchants between $15 billion and $30 billion annually. This emphasizes the need for companies to incorporate effective tools, including cargo security seals, to protect goods from fraudsters.

However, the need for more awareness about cargo security seals and companies underestimating cargo is hampering demand for the product in the coming years. The prevalence of counterfeit products in the marketplace is making users undermine the effectiveness of cargo security seals at the marketplace, impeding the demand and growth of the market.

Growth Drivers

- The growing demand for cargo services due to online shopping

The popularity of e-commerce has transformed consumer purchasing habits and raised demand for freight services. In order to fulfill the demands of e-commerce clients, cargo services are essential for guaranteeing that goods are carried effectively and delivered on schedule. Cargo service companies are investing in infrastructure and technology to enhance their services in order to keep up with the rising demand for e-commerce deliveries. Businesses are starting to use drones and driverless vehicles to make deliveries more quickly and affordable. This ongoing trend of online shopping is driving the demand for cargo security seals as they ensure product safety from shipment to the end consumer, enhancing trust on e-commerce platforms.

Report Segmentation

The market is primarily segmented based on material, product type, end use and region.

|

By Material |

By Product Type |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

- Plastic segment is expected to witness the highest growth during the forecast period

The plastic segment is expected to grow at a higher rate during the study period, mainly attributable to its advantages, including cost-effectiveness, versatility, lightweight, and ease of use. Furthermore, growing advancements in seal technology are widening the use of plastic with effective seal methods like barcoding. This is setting high standards of security, as an individual cannot try to make cargo opening unnoticed, preventing unauthorized access to the cargo.

The metal segment witnessed a significant revenue share in 2022, mainly due to its ability to provide higher cargo security and durability. Unlike plastic, metal-based security seals are highly durable and resistant to climatic conditions, driving demand for cargo with sea-based transportation modes. These seals are widely used in the transportation of oil and gas in domestic and international trade due to their durability.

By Product Type Analysis

- Bolt seals segment witnessed the largest market share in 2022

The bolt seals segment accounted for the largest cargo security seals market share. A bolt seal is a powerful style of security seal used to seal shipments. Bolt seals are commonly serialized and have a single use. They also offer an additional degree of security due to their excellent breaking strength. Most bolt seals can be manually applied. Bolt seals require a tool like a bolt seal cutter to be removed or opened because of their high breaking strength, driving their use in various goods transportation.

The cable seals segment is projected to grow at the fastest rate over the next few years. Cable seals are frequently employed to tag equipment, trucks, high-value goods, or storage containers. When a user does not want to keep track of key access, they are a safe alternative to locks in secure closures that are not accessed regularly. One of the primary factors driving its use is its ease of use, as it does not require expertise to seal the containers and goods soon.

By End Use Analysis

- Container Seals segment held a significant market revenue share in 2022

The container seals segment witnessed a significant market share in revenue in 2022, which was highly fueled by rising cargo theft in the oil and gas industry. Oil and gas are stored in containers, and the usual transportation mode is by sea. Due to the rising prices of petroleum products, fraudsters are encouraged to steal cargo, driving the importance of cargo security seals for containers.

Growing international trade is further propelling the demand for cargo container seals, as they shield importers from the danger of having unauthorized or smuggled items planted in their boxes by thieves, which might land them in serious difficulty. These factors are all contributing to the rising demand for cargo security seals for containers in the coming years.

Regional Insights

- North America region witnessed the largest share of the global market in 2022

The North America region registered the largest market share in the global market in 2022 and is expected to continue its dominance over the study period. Countries in this region are witnessing higher cargo theft cases, primarily the United States. Shipment misdirection is one trick that has been particularly popular among fraudsters. Since November 2022, CargoNet has been keeping an eye on a substantial increase in that highly technical system across the country. Additionally, the number of complaints about fictitious pickups and fraud increased by 675% in the first 20 weeks of 2023 compared to the same period in 2022. This is driving awareness about the growing cargo thefts in the region and fueling demand for effective cargo security tools like seals by the distribution channels and warehouse operators in the coming years.

The Europe region is expected to be the fastest growing region with a higher growth rate during the forecast period due to the increasing trade volume at a higher level, driving the importance of the incorporation of security seals to safeguard cargo from fraudsters and driving demand for them by manufacturers and distribution channels in the region.

Key Market Players & Competitive Insights

The cargo security seals market is expected to see an increase in product launches, fueled by the growing number of companies in this market and the collaborations, mergers, and acquisitions in the marketplace. Rising demand for effective security seals is driving the companies to invest vast amounts in research and development activities to innovate new products catering to consumer demands.

Some of the major players operating in the global market include:

- Acme Seals

- American Casting.

- EnvoPak

- Euroseal

- Hoefon Security Products B.V.

- JW Products

- LegHorn

- Mega Fortis Group

- Precintia

- Shanghai JingFan Container Seal

- Transport Security

- Tyden Group

- Unisto

- W.W. Grainger

Recent Developments

- In September 2023, Intertape Polymer introduced a new SafeSeal-AI vision inspection system that offers an accurate, dependable, and repeatable inline seal & product inspection procedure.

Cargo Security Seals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1.22 billion |

|

Revenue forecast in 2032 |

USD 1.95 billion |

|

CAGR |

5.3% from 2022 – 2030 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material, By Product Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |