Carob Powder Market Share, Size, Trends, Industry Analysis Report

By Product Type (Organic Carob Powder and Natural Carob Powder); By Sales Channel; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 112

- Format: PDF

- Report ID: PM3451

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

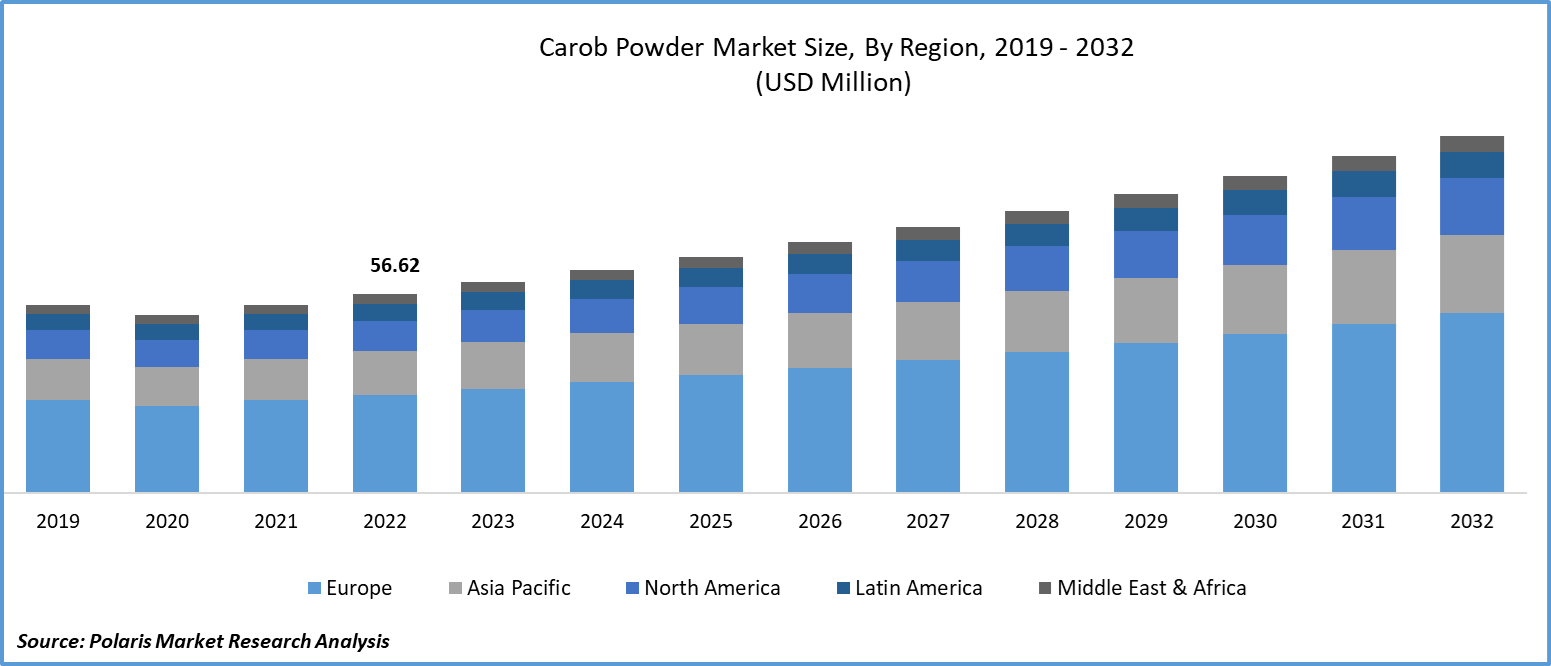

The global Carob Powder market was valued at USD 56.62 million in 2022 and is expected to grow at a CAGR of 6.0% during the forecast period. The market’s growth is attributed to the increasing demand for natural and healthy ingredients. Consumers are becoming more health-conscious and are looking for natural and healthy alternatives to traditional food ingredients. The growing demand for organic food products is expected to propel the market. Carob powder is a natural ingredient and can be produced using organic farming methods. This has led to increased production of organic carob powder, which is in high demand in the organic food market.

To Understand More About this Research: Request a Free Sample Report

Carob powder is a popular ingredient used in various food and beverage applications. Carob powder is a healthy alternative to cocoa powder, as it is naturally sweet and contains no caffeine. Carob powder is a natural sweetener with no caffeine, making it a popular choice for health-conscious consumers. Carob powder is used in various food applications, including baked goods, confectionery, and beverages.

Food products also use it as a natural sweetener and flavoring agent. The increasing demand for vegan and plant-based food products is driving Carob powder market growth. Carob powder is a vegan ingredient and can be used as a replacement for dairy products in various food applications. This has led to the development of new plant-based food products that use carob powder as a key ingredient.

Industry Dynamics

Growth Drivers

Increasing demand for natural and plant-based ingredients is anticipated to boost market growth. Consumers are increasingly becoming health-conscious and are seeking natural and plant-based ingredients for their food and beverages. Carob powder is a natural and healthy alternative to cocoa powder containing caffeine and theobromine. Carob powder is also free from allergens, such as gluten and dairy, making it a popular choice among people with food allergies. For instance, in 2021, Clif Bar & Company launched a new line of energy bars with carob powder as a key ingredient.

Growing awareness about the health benefits of carob powder is expected to drive market growth. Carob powder is a rich source of fiber, antioxidants, and several vitamins and minerals, including calcium and potassium. It has been associated with several health benefits, such as improved digestion, reduced cholesterol levels, and better bone health. As consumers become more health conscious, they turn to carob powder as a healthier alternative to cocoa powder. For example, in 2021, Naked Nutrition launched a new line of plant-based protein powders with carob powder as a key ingredient.

Rising demand for vegan and plant-based products is anticipated to create lucrative growth in the market. The global trend towards plant-based diets has led to a surge in demand for vegan and plant-based products. Carob powder is a vegan and plant-based alternative to cocoa powder containing dairy products. As a result, carob powder has become a popular ingredient in vegan and plant-based food products. For instance, in 2020, Nestle launched a plant-based version of its KitKat chocolate bar, which uses carob powder as a key ingredient.

The growing popularity of Mediterranean and Middle Eastern cuisine is expected to spur market growth. Carob powder is a common ingredient in Mediterranean and Middle Eastern cuisine, where it is used in various dishes, including desserts and beverages. As the popularity of these cuisines grows, the demand for carob powder also grows. For example, in 2021, Nada Moo launched a new line of vegan ice creams inspired by Mediterranean and Middle Eastern flavors, which feature carob powder as a key ingredient.

Report Segmentation

The Carob Powder market is segmented based on product type, sales channel, and region.

|

By Product Type |

By Sales Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The natural carob powder segment is expected to witness the fastest growth in the forecast period

Natural powder accounts for the largest share owing to its health benefits and increasing product availability, popularity, and wide penetration. This powder is also used as raw material in artificial chocolates. Natural carob powder is more affordable than organic carob powder, the major factor driving the segment. Organic carob powder segment accounts for the rapid growth with the highest CAGR. The increasing popularity of organic products is boosting the demand for organic carob powder owing to the health benefits, changing lifestyles, food consumption patterns, and less chemical usage.

The B2B segment accounted for the largest market share in 2022

The B2B segment accounts for the largest market share owing to the increasing application of carob powder in the confectionery industry. The bakery industry has witnessed significant growth as the participants invest in developing healthy & premium artisanal products. This resulted in carob powders being a functional ingredient in manufacturing baked goods.

Globally, consumers prefer a healthy lifestyle by shifting their preference toward plant-based food, drinks, & physical exercise. The rising awareness among consumers regarding obesity, cardiovascular diseases, weight management, and healthy life is anticipated to augment the market. The rising demand for vegan foods & health supplements has made major key players focus on launching vegan and sugar-free food products, thus increasing the segment’s growth. It includes unsaturated fat and no cholesterol, making it a favorite choice among consumers.

Europe garnered the largest revenue share in 2022

Europe is the largest market for carob powder, holding a high revenue share in the global market. The region's growing demand for natural and healthy food products drives the market. Europe has the largest consumers of bakery products and chocolates in the world. Consumers’ rising interest in healthier alternatives to chocolate is augmenting the market growth in the region. The increasing shift of consumers to plant-based products has led to an increase in the vegan population. The market is expected to grow at the highest CAGR during the forecast period. Spain, France, Italy, and Germany are the major markets for carob powder in Europe.

North America is expected to grow at a considerable CAGR during the forecast period. The growth in the region is attributed to the increasing demand for natural and organic food products. For instance, Now Foods produces and sells natural products, including carob powder. They have been expanding their distribution channels and increasing their online presence to reach more customers.

Asia-Pacific registered a robust growth rate over the study period, owing to the region's increasing demand for plant-based food products. The availability of products at hypermarkets and supermarkets will boost the demand in the projected period. China, India, and Japan are the major markets. For instance, Australian Carob Co. is an Australian company that produces and exports carob products, including carob powder, to the Asia Pacific region. They have been investing in research and development to create new carob-based products and expand their product line. Furthermore, Soil Association Certification Limited is a UK-based company that provides organic certification for food products, including carob powder.

Competitive Insight

Some of the major players operating in the global market include Creta Carob; Terra Soul Superfood; Biofair; Australian Carbo Co.; Barry Farm Foods; Frontier Co-op; Now Foods; Clif Bar; Nestle.

Recent Developments

In October 2021, Barry Callebaut, one of the leading suppliers of chocolate and cocoa products, announced the launch of a new range of carob-based chocolate products. The range includes chocolate bars, drops, and chunks made with carob powder and is aimed at meeting the growing demand for vegan and plant-based chocolate products.

In September 2021, Creta Carob, a leading producer of carob products, announced the expansion of its production capacity with the addition of a new carob processing plant that has increased the production of carob powder and other carob products.

Carob Powder Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 59.95 million |

|

Revenue forecast in 2032 |

USD 101.54 million |

|

CAGR |

6.0% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Sales Channel, By Region |

|

Regional scope |

North America, Latin America, Europe, Middle East & Africa, Asia Pacific |

|

Key companies |

Creta Carob; Terra Soul Superfood; Biofair; The Australian Carbo Co.; Barry Farm foods; Frontier Co-op; Now Foods; Clif Bar; Nestle. |

FAQ's

The Carob Powder Market report covering key are product type, sales channel, and region.

Carob Powder Market Size Worth 101.54 Million By 2032.

The global Carob Powder market expected to grow at a CAGR of 6.0% during the forecast period.

Europe is leading the global market.

key driving factors in Carob Powder Market Consumer preference for healthier bakery products.