Carrier Aggregation Solutions Market Share, Size, Trends, Industry Analysis Report

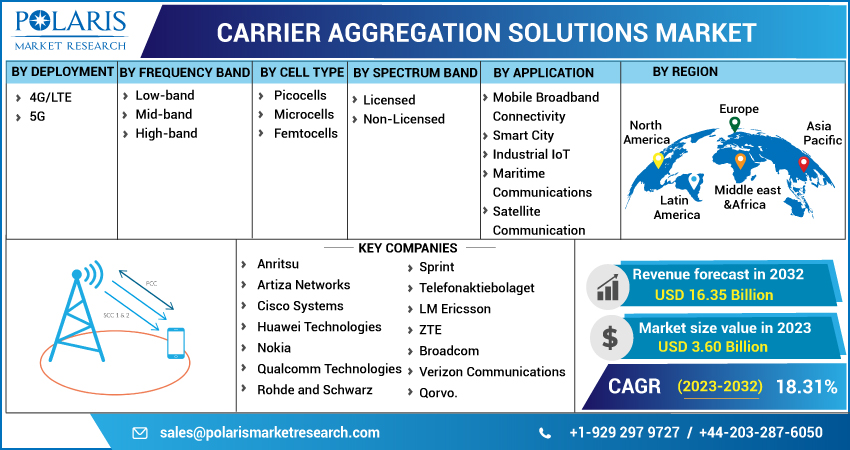

By Deployment (4G/LTE, 5G); By Frequency Band; By Cell Type; By Spectrum Band; By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Jun-2023

- Pages: 118

- Format: PDF

- Report ID: PM3337

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

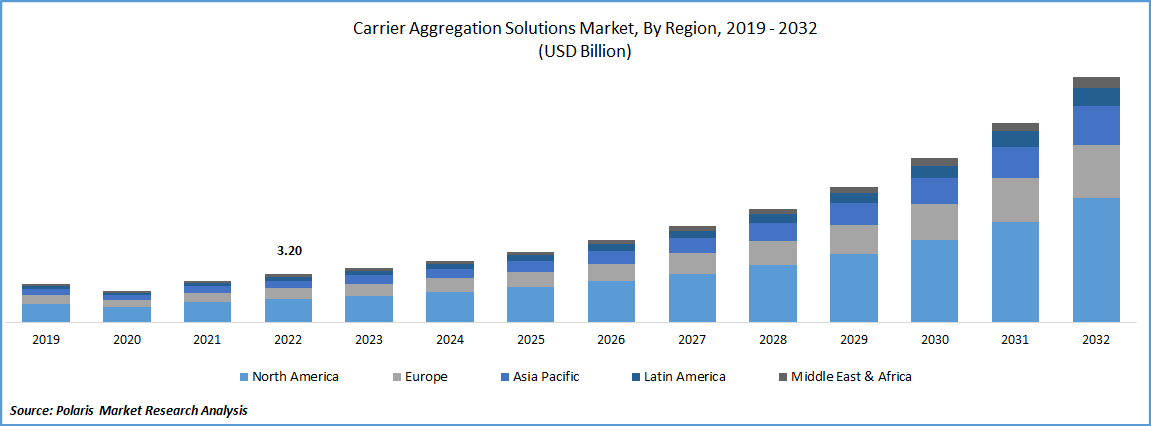

The global carrier aggregation solutions market was valued at USD 3.20 billion in 2022 and is expected to grow at a CAGR of 18.31% during the forecast period. The rise in mobile internet subscribers is a key factor driving the growth of the market. As more people around the world gain access to mobile internet services, there is an increasing demand for faster data transfer speeds and better network performance.

To Understand More About this Research: Request a Free Sample Report

Carrier Aggregation solutions can help meet this demand by combining multiple carrier signals into a single logical channel, which can increase the amount of data that can be transmitted at one time and improve network efficiency. According to the study The Mobile Economy 2022, the GSMA predicts that by the end of 2025, there will be 5,000 million mobile Internet subscribers, or 60% of the global population. This will create a wide range of opportunities for the demand and growth of the carrier aggregation solutions market in coming years.

For Specific Research Requirements, Request For Customized Report

Industry Dynamics

Growth Drivers

With the proliferation of smartphones and other mobile devices, there is a growing demand for high-speed data transfer. Carrier Aggregation solutions help meet this demand by increasing the amount of data that can be transmitted at one time, resulting in faster data transfer speeds. Carrier Aggregation solutions are widely used in 4G LTE and 5G networks, which are being adopted by a growing number of consumers and businesses around the world. As the adoption of these networks continues to grow, the demand for Carrier Aggregation solutions is expected to increase as well.

Market is constantly evolving, with new technologies and innovations being developed to improve the performance and efficiency of mobile networks. As these technologies continue to improve, the demand for these solutions is expected to grow as well. Photonic integrated circuits (PIC) have been made possible by the convergence of complementary metal-oxide semiconductor (CMOS), three-dimensional (ED), and fiber-optic communication technologies due to the demand for high-speed data transmission and the rise in data traffic in cloud computing. PICs can be used in conjunction with Carrier Aggregation solutions to improve the performance and efficiency of mobile networks, as well as in the development of 5G networks.

Report Segmentation

The market is primarily segmented based on deployment, frequency band, cell type, spectrum band, application and region.

|

By Deployment |

By Frequency Band |

By Cell Type |

By Spectrum Band |

By Application |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

4G/LTE segment is expected to witness fastest growth during forecast period

4G/LTE segment is projected to grow faster throughout the forecast period. Carrier aggregation is a technology that enables mobile network operators to combine multiple frequency bands into a single logical channel, which increases the bandwidth available to users and improves network performance. In addition, carrier aggregation is also driving the growth of the market for advanced radio frequency (RF) components and solutions. As operators deploy carrier aggregation technology, they require more sophisticated RF components, such as high-performance antennas, filters, and amplifiers, to support the increased bandwidth and data rates of their networks. This creates new opportunities for vendors of RF components and solutions to develop and market advanced products that meet the needs of mobile network operators.

Microcells segment accounted for the largest market share in 2022

Microcells segment registered with the largest market share in the year 2022. Microcells are driving the growth of the market for advanced network infrastructure and equipment. As mobile network operators deploy microcells, they require more sophisticated network infrastructure and equipment, such as high-performance antennas, transceivers, and baseband processing units, to support the increased bandwidth and data rates of their networks. This creates new opportunities for vendors of network infrastructure and equipment to develop and market advanced products that meet the needs of mobile network operators.

Licensed spectrum segment is expected to hold the significant revenue share in 2022

Licensed spectrum segment is projected to witness higher revenue share in the study period. Licensed spectrum is driving the growth of the market by enabling operators to deploy more advanced network technologies. For example, licensed spectrum is essential for the deployment of 5G networks, which require higher frequency bands to support the increased bandwidth and data rates of these networks. Carrier aggregation technology can be used to combine multiple licensed spectrum bands to create a contiguous spectrum block that is suitable for 5G deployments, which opens new opportunities for mobile network operators to offer advanced 5G services to their customers.

Mobile Broadband Connectivity segment is garnered with the largest revenue share in 2022

Mobile Broadband Connectivity segment is registered with the largest revenue share throughout the forecast period. Carrier aggregation technology is driving the growth of the mobile broadband connectivity segment by enabling operators to provide more reliable and consistent network performance. Carrier aggregation technology can be used to create a more robust and resilient network that is less susceptible to network congestion and signal interference, which can result in more reliable and consistent network performance for users. This will propel the growth and demand for the market in the coming future.

APAC is expected to witness higher growth rate in the study period

APAC is projected to have a higher growth rate in the coming years. One of the main reasons is the increasing adoption of advanced mobile devices and mobile broadband connectivity in the region. The growing demand for high-speed internet access and the increasing use of mobile devices for online activities such as video streaming, social media, and e-commerce is driving the need for faster and more reliable mobile networks. For instance, India's overall mobile data consumption is anticipated to more than double by 2024. India is expected to get more than 70 million 5G devices in 2022, demonstrating the technology's strong market traction. Carrier aggregation technology can help mobile network operators to address this demand by combining multiple frequency bands to increase the available bandwidth and improve network performance.

North America is expected to have larger revenue share in the study period

North America is home to some of the largest mobile network operators in the world, including Verizon Wireless, AT&T, and T-Mobile, which are actively investing in carrier aggregation technology to improve their network performance and provide faster and more reliable mobile broadband connectivity to their customers. In addition, the region is home to major technology vendors, such as Qualcomm and Intel, which are developing and supplying carrier aggregation solutions to mobile network operators. Verizon wireless recorded 182,177 mobile subscribers and $133,613 million in sales, with average revenue growth of 4.2%. This will further create a wide range of opportunities for the growth of the market by creating new innovations in the industry.

Competitive Insight

Some of the major players operating in the global carrier aggregation solutions market include Anritsu, Artiza Networks, Cisco Systems, Huawei Technologies, Nokia, Qualcomm Technologies, Rohde and Schwarz, Sprint, Telefonaktiebolaget LM Ericsson, ZTE, Broadcom, Verizon Communications & Qorvo.

Recent Developments

- In March 2023, Anritsu, offers cutting-edge test and measurement solutions for communications, & Artiza Networks, the foremost expert in testing radio access networks (RAN) and core networks (CN) for 3G, 4G, and 5G, are collaborating to develop an Open RAN test solution.

- In March 2023, Ooredoo Group and Huawei entered a partnership agreement to use the Huawei Mobile Fintech platform to offer Fintech services in the Ooredoo-served markets.

Carrier Aggregation Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.60 billion |

|

Revenue forecast in 2032 |

USD 16.35 billion |

|

CAGR |

18.31% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Deployment, By Frequency Band, By Cell Type, By Spectrum Band, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Anritsu, Artiza Networks, Cisco Systems, Huawei Technologies, Nokia, Qualcomm Technologies, Rohde and Schwarz, Sprint, Telefonaktiebolaget LM Ericsson, ZTE, Broadcom, Verizon Communications & Qorvo. |

FAQ's

The carrier aggregation solutions market report covering key segments are deployment, frequency band, cell type, spectrum band, application and region.

Carrier Aggregation Solutions Market Size Worth $16.35 billion By 2032.

The global carrier aggregation solutions market expected to grow at a CAGR of 18.31% during the forecast period.

North America is leading the global market.

key driving factors in carrier aggregation solutions market are rise in mobile internet subscribers.