Case Packing Machine Market Share, Size, Trends, Industry Analysis Report

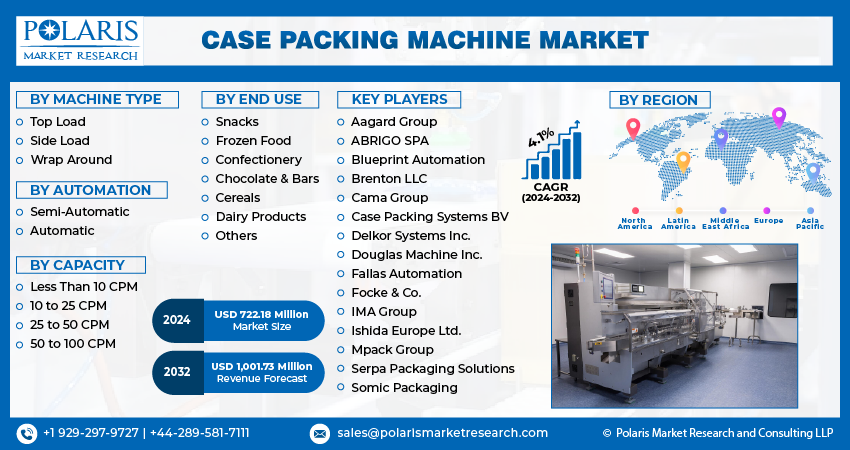

By Machine Type (Top Load, Side Load, and Wrap Around); By Automation; By Capacity; By End Use; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM4116

- Base Year: 2023

- Historical Data: 2019-2021

Report Outlook

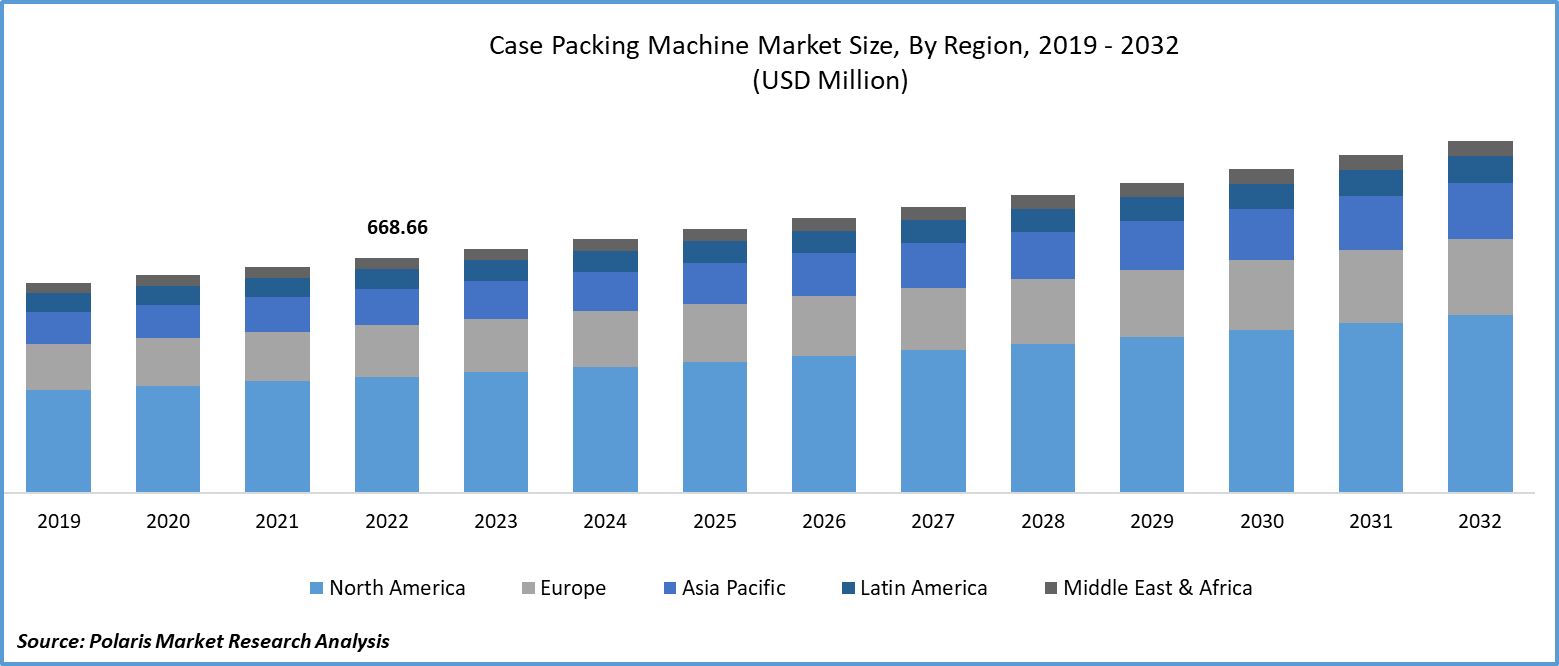

The global case packing machine market was valued at USD 694.74 million in 2023 and is expected to grow at a CAGR of 4.2% during the forecast period.

Increasing proliferation among several businesses globally towards automating and streamlining their production processes in order to boost productivity and reduce their operating costs and the surging popularity of case packaging systems due to their ability to streamline packaging processes, optimize entire production, and reduce the need for human intervention, are among the primary factors influencing the growth of the market. Apart from this, the growing focus on sustainable and eco-friendly packaging solutions all over the world leads to innovations in case packing systems and the development of new solutions with enhanced capabilities, which, in turn, generate huge growth opportunities for the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in August 2023, JBT’s Proseal introduced a new CP4 case packing machine, which is the latest in their CP range. The new CP4 will offer producers an unparalleled level of flexibility, profitability, & efficiency in their packaging processes.

In the last few years, robotic case packing systems have become increasingly popular across industries due to their ability to efficiently handle a wide range of products and packaging configurations, as they are equipped with high-level vision systems and advanced grippers to pick, place, and pack products into cases with high precision even at greater speed.

However, the high upfront capital investment required to purchase and install case packing systems at manufacturing facilities and several other factors like high maintenance and downtime, integration complexity, limited flexibility, and shortage of skilled labor, are major factors hindering the global market growth.

Industry Dynamics

Growth Drivers

Increasing Production Demand from Industries and Adoption of Automation

There is an increasing need and proliferation for increased production outputs across various product applications, such as snacks, cereals, dairy products, and chocolates, among others, to meet the growing requirements of the global population. Thus, with the constant increase in demand for such production to cater to the needs of people worldwide, the demand for efficient and faster packing solutions for products is crucial, and the case packing machine market is likely to increase substantially over the years.

For instance, as per a report published by the United Nations, the world’s population reached 8 billion people in mid-November 2022. The global population has surged by over 2.1 billion people in the last 25 years, and it is also expected that the world’s population will reach about 10 billion by 2050.

Report Segmentation

The market is primarily segmented based on machine type, automation, capacity, end use, and region.

|

By Machine Type |

By Automation |

By Capacity |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Machine Type Analysis

Top Load Segment Accounted for the Largest Market Share in 2022

The top load segment accounted for the largest market share. Growth is primarily due to numerous advantageous characteristics, including automation & efficiency, cost savings, convenient personalization, and customization, along with the increasing proliferation among companies towards packaging solutions that could be integrated smoothly with their existing producing and manufacturing lines.

The side wrap load segment is expected to grow at the highest growth rate over the next coming years on account of its ability to allow manufacturers of food products to increase their packaging production while providing more secure and precise packaging. Apart from this, these systems are well-known due to their ability to handle a wide range of products and pack them quickly and accurately, which is significantly crucial for manufacturers seeking to improve their production processes.

By Automation Analysis

Automatic Segment is Expected to Hold Substantial Market Share over Forecast Period

The automatic segment is expected to hold a substantial market share in terms of revenue throughout the study period, which is mainly attributable to their specific design and capabilities that are built to handle a bigger number of products and items at a much faster rate compared to semi-automatic systems.

As ongoing technological advancements such as improved robotics, vision systems, and artificial intelligence across the globe continue to enhance the capabilities and efficiency of automatic case-packing systems and make them even more appealing to several businesses, the segment market growth is likely to gain huge traction.

By Capacity Analysis

25 to 50 CM is Expected to Witness Highest Growth Rate Throughout Projected Period

The 25 to 50 cm is expected to grow at the highest growth rate during the projected period, mainly attributable to its widespread utilization in small and medium-sized products and the presence of stringent regulations and standards regarding the packaging and labeling of products in various industries that necessitates the use of packing with limited capacity. Also, the continuous expansion of the e-commerce industry all over the world will positively influence the market for the 25 to 50 cm segment, as they are widely used in the packaging of products sold online.

By End Use Analysis

Snacks Segment Held the Majority Market Revenue Share in 2022

The snacks segment held the majority market revenue share in 2022, which is majorly driven by a constant surge in demand for snack products such as chips, nuts, pretzels, and many other convenience snacks around the world and focus on leading companies operating in the market towards improving their operational efficiency and reduce costs. Additionally, companies are constantly introducing new product flavors, sizes, and packaging formats that help them cater to wider customer preferences, which in turn boost segment market growth drastically.

Regional Insights

North America Region Dominated the Global Market in 2022

The North America region dominated the global market. The regional market growth is mainly attributable to many industries across the region and the drastic growth of e-commerce and online shopping trends that have substantially increased demand for efficient and effective packaging solutions. Besides this, the surging need for sustainable packaging materials and practices has been driving the adoption of case packing systems that could easily accommodate eco-friendly packaging solutions.

Asia Pacific will grow rapidly, owing to significant demand for ready-to-eat meals and changing consumer consumption patterns and habits that lead to greater influence towards packaged food products. With a rapidly growing population across several Asia Pacific countries and an emerging rate of urbanization, the demand for packaged food products, consumer goods, and beverages is increasing at a significant pace, which is likely to generate huge opportunities for the market.

For instance, according to our findings, the total population of India has almost tripled in the last six decades, with 36.1 crore people in 1951 to approx. 130 crores in 2021. India gains approx. One million inhabitants every month will result in making it the world’s most populous country by surpassing China.

Key Market Players & Competitive Insights

The case packing machine market is highly competitive in nature with the presence of various large global market players, who are extensively focusing on several business development and expansion strategies including partnerships, collaborations, acquisitions & mergers, and new product launches, in order to expand their geographical presence and reach wider customer base.

Some of the major players operating in the global market include:

- Aagard Group

- ABRIGO SPA

- Blueprint Automation

- Brenton LLC

- Cama Group

- Case Packing Systems BV

- Delkor Systems Inc.

- Douglas Machine Inc.

- Fallas Automation

- Focke & Co.

- IMA Group

- Ishida Europe Ltd.

- Mpack Group

- Serpa Packaging Solutions

- Somic Packaging

Recent Developments

- In September 2022, Ranpak, a leading US-based packaging company, announced the launch of its new automated packaging solution, which will boost the company’s packaging output, reduce its overall operating costs, and enhance sustainability. It will further reduce temporary labor and help companies save about 25% of the dimensional volume to be shipped.

- In July 2023, EndFlex Packaging Machinery unveiled its new automated packaging systems, which robotically pick and place bottles into formed cartoons and close them. It is specially designed to fill up to 50 cartons every minute and helps meet application requirements, which include flexibility in packaging.

Case Packing Machine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 722.18 million |

|

Revenue forecast in 2032 |

USD 1,001.73 million |

|

CAGR |

4.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Machine Type, By Automation, By Capacity, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |