Cast Elastomer Market Share, Size, Trends, Industry Analysis Report

By Technology (Hot Cast Elastomer, Cold Cast Elastomer); By Application; By Industry Vertical; By Region; Segment Forecast, 2023- 2032

- Published Date:Dec-2023

- Pages: 118

- Format: PDF

- Report ID: PM4086

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

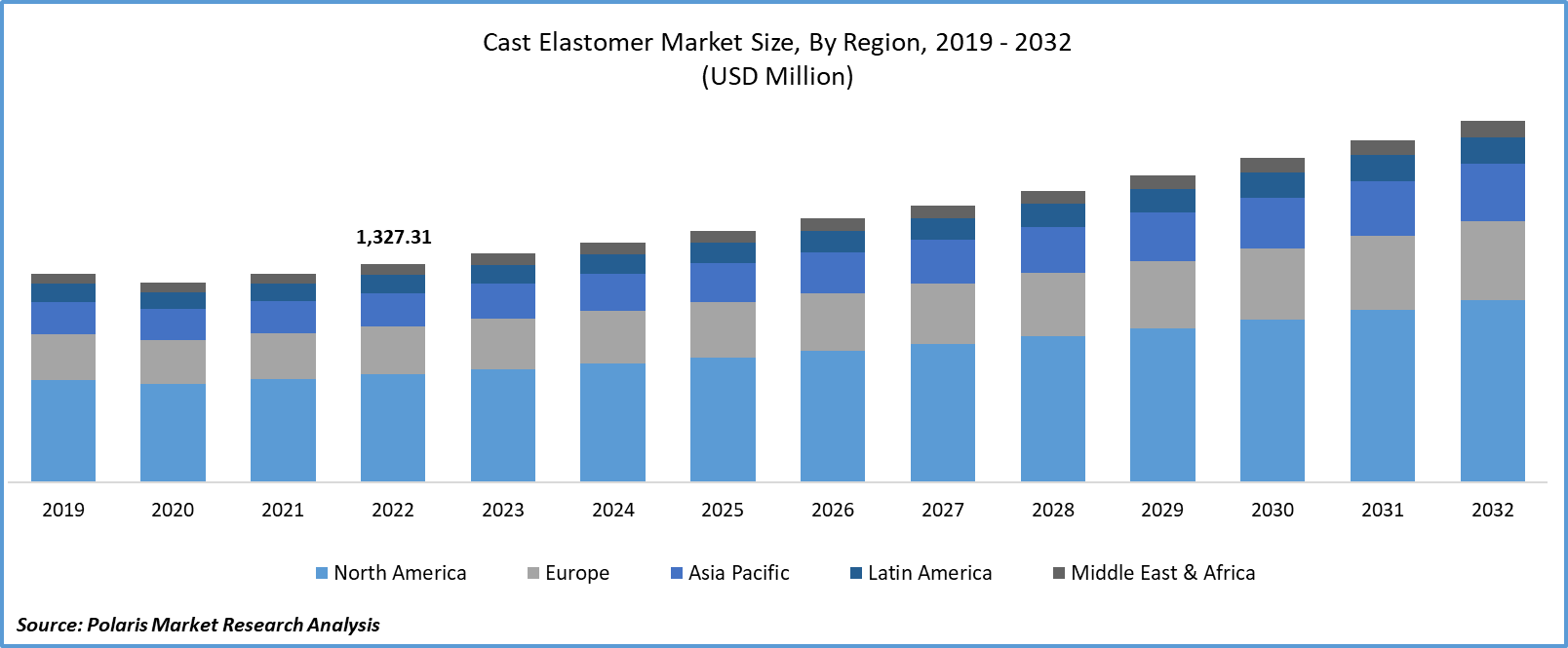

The global cast elastomer market was valued at USD 1,327.31 million in 2022 and is expected to grow at a CAGR of 5.2% during the forecast period.

When a polymer exhibits elastic properties, like rubber, it is referred to as an elastomer. Cast elastomers made of polyurethane come in many different forms. They can be solid, rigid, pliable, tough, resilient, long-lasting, and viscoelastic. Cast polyurethanes are reliable and cost-effective elastomers that combine rubber's resilience and flexibility with some of the performance benefits of high-tech plastics, metals, and ceramics. Furthermore, the growing mining industry, attributable to the increasing exploration activities in various countries to meet the ongoing demand for power, is creating demand for cast elastomers due to their wear resistance and durability. The ongoing research activities focus on developing suitable elastomers to promote their use in various applications.

Elastomers are rubber-like polymers that recline considerably more than other kinds of substances and restore shape when the power is detached, homogenous to a spring. When mangled by outward forces, elastomers combat course such as viscous liquid withstanding movement much like a damper or a dashpot.

The inventiveness of polyurethane cast elastomers offers the capacity to achieve a perfect positioning of physical attributes needed for a particular application. The cast elastomer market sales are soaring as this ductility of characters permits urethane cast elastomers to be customized for usage in a handful of taxing industries and markets. Cast polyurethanes are economical and reliable elastomers that integrate some of the presentation benefits of high-tech plastics, metals, and ceramics with the flexibility of rubber.

To Understand More About this Research: Request a Free Sample Report

- For instance, in February 2023, a study published in Science Direct under the Construction and Building Materials part focused on examining the polyurethane elastomer performance development law in various building settings to encourage its acceptance and use.

Moreover, they are renowned for their outstanding oil and grease resistance, resilience, impact strength, abrasion resistance, and load-bearing capability. Polyurethanes are frequently used in applications that require resistance to aging, compression, torsional stresses, load-bearing, impacting, cutting, and ripping.

However, the higher initial costs associated with cast elastomers are restraining new manufacturing companies in this field, leading to a lower supply of cast elastomers and causing price instability in the marketplace.

Growth Drivers

- Rising awareness about the benefits associated with cast elastomers is driving its application in various disciplines

Cast polyurethane components can be found everywhere. They are widely used in the oil and gas industry, material handling, agricultural machinery, and all facets of mining. Even in recreation, cast polyurethane is the material of choice to produce scuba fins, golf ball covers, bowling balls, roller skate wheels, and more. These elastomers are employed specifically in the mining sector, where they are used as pipe linings, conveyor scrapers, & flotation process components. Wheels, tires, and rollers have several uses outside of the mining business. Increasing applications of cast elastomer in a wide range of products is expanding its outreach to the industrials in the coming years.

For Specific Research Requirements: Request for Customized Report

Report Segmentation

The market is primarily segmented based on technology, application, industry vertical and region.

|

By Technology |

By Application |

By Industry Vertical |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

- Hot Cast Elastomer segment is expected to witness the highest growth during the forecast period

The hot cast elastomer segment is projected to grow at a CAGR during the projected period, mainly driven by its chemical and hydrolysis resistance. In the most demanding situations where the best performance is required, hot cast urethane prepolymers are used. These polyurethane elastomers are often processed using heated tools and components, followed by a hot post-cure to improve their characteristics. It is used in the oil and gas industry, belting, mining, industrial tyres and wheels, agriculture, and more. The rise in its use in these sectors is further boosting the expansion of the hot cast elastomer market.

The cold cast elastomer segment led the industry market with a substantial revenue share in 2022, largely imputable to its cut-and-tear resistance and ease of production. A wide range of applications, from the flexible polyurethane resin or foam to harden plastics, use cold-cast polyurethane elastomers and foams. These systems are easy and quick to make because they are designed to be applied at room temperature. The most common applications for these elastomeric polyurethanes include filtration systems, architectural form liners, & concrete molds. The lower production cost of cold-cast elastomers compared to hot-cast elastomers is further fueling the production process in the marketplace.

By Application Analysis

- Pipe linings segment accounted for the largest market share in 2022

The pipe linings segment accounted for the largest market share. One of the most popular uses for hot-cure polyurethane elastomers made up of TDI (toluene diisocyanate) and MDI (methylene diphenyl diisocyanate) is lining pipes and fittings. For the working surfaces of pipelines in a variety of industries, including mining, construction, chemical, agriculture, and mechanical engineering, reliable and durable coatings are achievable using castable polyurethane elastomers of varied hardness. The rising demand for pipe linings is creating new growth opportunities for the market in the coming years.

The conveyor scrapers segment is expected to grow at the fastest rate over the next few years on account of the increasing abrasion and wear, as it is mostly used to remove bulk materials from conveyor belts. Cast elastomers are durable, wear-resistant, and flexible, making them suitable for use in conveyor scrapers. The growing demand for conveyor scrapers is propelling the need for cast elastomers, fueling global market expansion throughout the study period.

By Industry Vertical Analysis

- Oil and Gas segment held the significant market revenue share in 2022

The oil and gas segment held a significant market share in revenue share in 2022, which is highly accelerated due to the rising importance of pipeline safety. Depending on its weak spots, every pipeline attached to an offshore platform is liable to fail. Cast elastomers are used to build strong solutions for pipe protection with the help of carefully placed bend stiffeners and bend restrictors. Furthermore, pipelines carrying oil and gas must be regularly cleaned and inspected to maintain proper operation. Cleaning devices and equipment require sturdy materials due to the rigorous circumstances in the sector, driving the need for cast elastomers in the coming years.

Regional Insights

- Asia Pacific region accounted for the largest share in the global market in 2022

The Asia Pacific region witnessed the largest market share in the global market in 2022 and is projected to continue its dominance over the study period. Countries in this region, primarily India and China, are witnessing a rapid increase in economic activity. The growing automotive industry is creating new growth opportunities for various materials and chemicals, including cast elastomers.

According to data released by the China Association of Automobile Manufacturers (CAAM), China's automobile industry has accelerated its global expansion this year, with exports rising by more than 81% year over year to 1.76 Mn vehicles in the first 5 months of FY 2023. Cast elastomers are used in the making of suspension bushings and mounts in vehicles. It is used in tyre manufacturing, engine maintenance, seals and gaskets, shock absorbers, and more, driving its need in the coming years in the region.

The Europe region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing research and development activities in the aerospace sector. The growing demand for healthcare and medical devices is creating a need for cast elastomers due to their biocompatibility. Rising renewable energy resource use, including solar and wind power panels, is driving the need for components of wind turbines and hydropower, which is, in turn, driving demand for cast elastomers in the region.

Key Market Players & Competitive Insights

The cast elastomer market is expected to witness higher competition owing to the rising expansion of product portfolios by key market players to capture a larger consumer base driven by growing demand for cast elastomers in industrial applications. Furthermore, partnerships, collaborations, mergers, and acquisitions in this field are propelling the expansion of the global market.

Some of the major players operating in the global market include:

- Accella Polyurethane Systems

- BASF

- Coim Group

- Covestro

- Era Polymers

- Everchem Specialty Chemicals

- Huntsman Corporation

- Synthesia International

- Taiwan Pu Corporation

- Tosoh Corporation

- VCM Polyurethane

- Wanhua Chemical Group

Recent Developments

- In September 2023, Huntsman created a liquid thermo-plastic polyurethane (LTPU) that enables quick production of high-performing midsoles and is in line with the circularity goals of companies making athletic and athleisure footwear.

Cast Elastomer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,388.90 million |

|

Revenue forecast in 2032 |

USD 2,195.13 million |

|

CAGR |

5.2% from 2022 – 2030 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Technology, By Application, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |