Cell Line Development Market Size, Share, Trends, & Industry Analysis Report

By Product & Service, By Source, By Type of Cell Lines, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6117

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

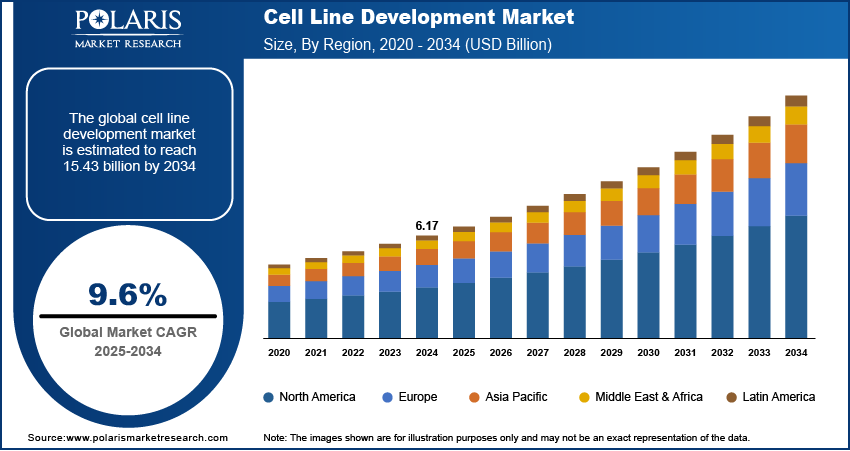

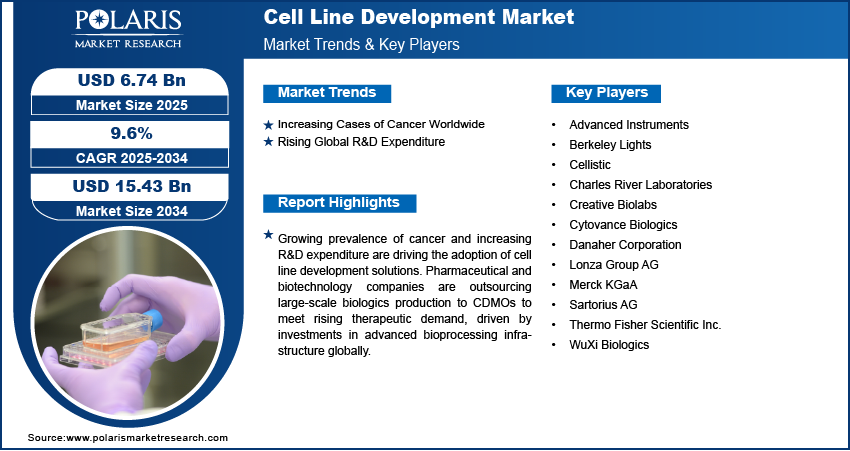

The global cell line development market size was valued at USD 6.17 billion in 2024, growing at a CAGR of 9.6% during 2025–2034. The cell line development market is driven by rising demand for biopharmaceuticals, advancements in gene editing technologies, increased R&D investments, and growing prevalence of chronic diseases. Regulatory support and innovations in single-use technologies further propel market expansion and efficiency.

Key Insights

- The reagents and media segment dominated the market share in 2024.

- The non-mammalian cell line segment is projected to grow at a rapid pace in the coming years, driven by increasing adoption in vaccine production and recombinant protein research.

- The North America cell line development market dominated the global market share in 2024.

- The US cell line development market is growing due to rising burden of cancer incidence and strong biopharmaceutical pipelines.

- The market in Asia Pacific is projected to grow at the highest CAGR from 2025-2034, propelled by rapid biotechnology advancements and expansion of biotechnology sector.

- Countries such as China and Japan are playing a key role in regional growth, due to expanding biomanufacturing capabilities and strategic partnerships with global pharmaceutical companies.

Industry Dynamics

- Increasing global cancer burden is driving demand for cell line development by accelerating the need for stable and high-yield cell lines to support biologics and monoclonal antibody production.

- The rising global R&D expenditures is fueling market growth by boosting advanced screening technologies and innovative cell engineering methods for faster biologics development.

- The integration of AI-driven cell line development is creating significant opportunities for biopharma companies to enhance biologics and monoclonal antibody production efficiency.

- The high cost and time-intensive development process limit adoption by smaller biotech firms that impacts the market growth.

Market Statistics

- 2024 Market Size: USD 6.17 billion

- 2034 Projected Market Size: USD 15.43 billion

- CAGR (2025-2034): 9.6%

- North America: Largest market in 2024

Cell line development refers to the process of generating stable cell lines for the production of biologics, therapeutic proteins, and vaccines. These cell lines are essential in drug discovery, toxicity testing, and recombinant protein manufacturing that supports research and commercial biopharmaceutical production. The process includes cell isolation, genetic modification, cloning, and screening to establish high-yield and stable production cell lines. The development platforms are equipped with automated screening systems, advanced culture media, and high-throughput technologies to ensure efficiency and reproducibility. Cell line development services are utilized by biopharmaceutical companies, contract research organizations, and research institutes, where reliable and scalable cell lines are essential for clinical and commercial biomanufacturing.

The global rise in chronic illnesses is driving demand for cell line development due to increasing need for biologics and cell-based therapies to manage complex diseases. Growing prevalence of cancer, autoimmune disorders, and cardiovascular conditions is pushing pharmaceutical and biotechnology companies to develop high-yield and stable cell lines for therapeutic protein and monoclonal antibody production. According to the US Department of Health and Human Services, around 129 million people in the US suffer with at least one major chronic disease. Simultaneously, the Eurostat 2023 data states that approximately 50.6% of Finland’s population and 43.2% of Germany’s population are living with chronic illness. This trend is boosting investment in cell line engineering to support large-scale manufacturing and accelerate the delivery of advanced biologics to patients.

To Understand More About this Research: Request a Free Sample Report

The rising demand for monoclonal antibodies (mAbs) and biologics is driving the cell line development market by increasing the need for high-yield and stable cell lines to support large-scale therapeutic production. Expanding pipelines for targeted therapies and immunotherapies are pushing pharmaceutical and biotechnology companies to invest in advanced cell line engineering to meet growing clinical and commercial requirements. This is boosting demand for optimized cell line development solutions to accelerate drug development and ensure consistent biologics supply.

Drivers & Opportunities

Increasing Cases of Cancer Worldwide: The surge in global cancer cases is driving demand in the cell line development market due to the growing need for high-yield and stable cell lines to support monoclonal and bispecific antibody production in oncology treatments. According to the World Health Organization (WHO), around 20 million new cancer cases and 9.7 million cancer deaths were reported in 2022, with cancer incidence projected to exceed 35 million new cases by 2050, marking a 77% increase from 2022. The expanding oncology drug pipeline is pushing pharmaceutical and biotechnology companies to invest in advanced cell line engineering for faster development and large-scale manufacturing of therapeutic biologics. This trend is boosting the adoption of innovative cell line development solutions that is driving consistent market growth.

Rising Global R&D Expenditure: Rising global R&D spending is driving the cell line development market by accelerating biologics research and increasing the need for optimized cell lines in drug discovery services and therapeutic manufacturing. According to World Intellectual Property Organization (WIPO), global R&D expenditure rose from 2.39% of GDP in 2020 to 2.75% in 2023, reflecting growing investment in clinical trials and advanced biologics development. The pharmaceutical and biotech companies are developing high-yield, stable cell lines to enhance production efficiency, which is boosting large-scale manufacturing capabilities and driving steady growth in the cell line development market.

Segmental Insights

Product & Service Analysis

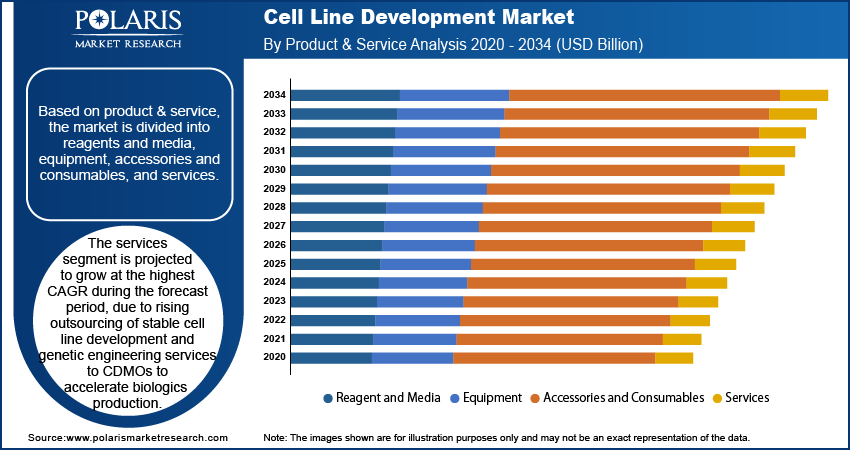

Based on product and service, the segmentation includes reagents and media, equipment, accessories and consumables, and services. The reagents and media segment held the dominant market share in 2024, driven by its indispensable role in cell culture optimization and large-scale bioproduction. The adoption of growth factors, serum-free formulations, and chemically defined media is improving cell viability and enhancing productivity in recombinant protein and monoclonal antibody production. Moreover, continuous advancements in media optimization, tailored to specific cell lines such as CHO and HEK293, are further enhancing this segment’s leadership in commercial-scale applications.

The services segment is projected to grow at the fastest CAGR through 2034, fueled by the increasing outsourcing of cell line development to contract development and manufacturing organizations (CDMOs). Pharmaceutical and biotechnology companies are leveraging specialized services, including stable cell line generation, genetic engineering, and clone screening, to accelerate biologics development timelines. For instance, in May 2025, AGC Biologics partnered with Novelty Nobility to support cell line development and Phase I clinical preparations for a novel bispecific antibody drug candidate, reflecting the growing demand for expertise-driven CDMO collaborations.

Source Analysis

In terms of source, the segmentation includes mammalian and non-mammalian cell lines. The mammalian cell line segment dominated the market in 2024 due to its compatibility with post-translational modifications, making it ideal for the production of therapeutic proteins, monoclonal antibodies, and vaccines. The segment benefits from continous innovations in gene editing, high-throughput screening, and perfusion culture systems, which enhance yield and reduce production costs.

The non-mammalian cell line segment is anticipated to grow steadily through 2034, driven by increasing use in vaccine production and basic research. Insect cell lines, such as Sf9 and Sf21, are growing in prominence in viral vector manufacturing, while amphibian cell lines are utilized in toxicology and developmental biology studies. The cost-effectiveness and ability to express complex proteins in specific research applications continue to support demand in academic and diagnostic settings.

Type of Cell Lines Analysis

Based on type of cell lines, the segmentation includes recombinant cell lines, hybridomas, continuous cell lines, and primary cell lines. The recombinant cell lines segment held the largest market share in 2024, attributed to their crucial role in producing therapeutic proteins, monoclonal antibodies, and biosimilars. Advancements in genetic engineering are improving clone stability and expression levels, making recombinant cell lines the preferred choice for biopharmaceutical manufacturing. For instance, in March 2024, Agathos Biologics launched a recombinant adeno-associated virus (rAAV) production service utilizing its novel, proprietary AE1-BHK cell line, demonstrating the growing adoption of advanced recombinant platforms.

The hybridomas segment is expected to expand at a notable pace through 2034, driven by its established use in monoclonal antibody generation for research and therapeutic applications. The hybridomas remain relevant in preclinical and diagnostic antibody production due to its cost-effectiveness and ability to produce high-affinity antibodies.

Application Analysis

Based on application, the segmentation includes bioproduction, drug discovery, toxicity testing, tissue engineering, and others. The bioproduction segment dominated the market in 2024, owing to the increasing demand for biologics, biosimilars, and advanced vaccines. Stable and high-yield cell lines are essential for large-scale manufacturing, with CHO and HEK293 cells serving as the primary production platforms. Continuous bioprocessing, coupled with advanced screening technologies, is further enhancing productivity and reducing development timelines for new biologics.

The tissue engineering segment is projected to grow at the fastest rate through 2034, fueled by the increasing adoption of engineered cell lines for regenerative medicine and 3D tissue modeling. Advances in stem cell-derived lines and gene-edited primary cells are enabling the development of complex tissue constructs for transplantation and disease modeling. Moreover, growing investments in regenerative therapies and organ-on-a-chip technologies are further accelerating the use of specialized cell lines in tissue engineering applications.

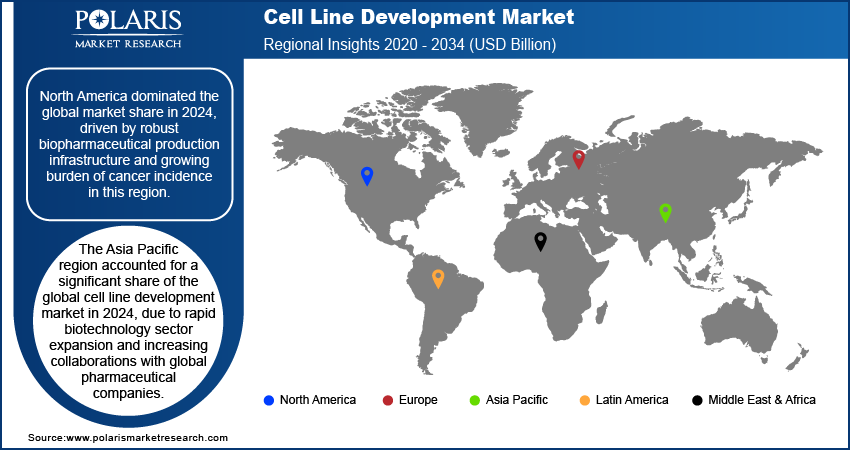

Regional Analysis

North America cell line development industry dominated the global market share in 2024. This growth is driven by strong biopharmaceutical production capabilities and early adoption of advanced biologics. Additionally, the growing cases of cancer and infectious diseases are increasing demand for monoclonal antibodies and recombinant proteins, which rely heavily on optimized cell line development for large-scale manufacturing.

The US Cell Line Development Market Insight

The US dominated the regional market, due to expanding demand for monoclonal antibodies and other biologics used in oncology treatments. Pharmaceutical and biotechnology companies are focusing on developing high-yield and stable cell lines to accelerate antibody production and meet rising therapeutic needs. According to the American Cancer Society, 2,041,910 new cancer cases are reported in 2025, while cancer-related deaths are reaching 618,120 in the US. This growing cancer burden is pushing investments in advanced cell line engineering to support large-scale biologics manufacturing and ensure reliable supply for cancer therapies.

Asia Pacific Cell Line Development Market

Asia Pacific cell line development industry is projected to grow significantly by 2034. This is driven by the rapid expansion of the regional biotechnology sector and rising collaborations with global pharmaceutical companies. Countries such as China and Japan are witnessing increasing biologics development activities, stimulating biotech firms to partner with specialized service providers to access advanced cell line engineering platforms and accelerate clinical and commercial biologics production.

India Cell Line Development Market Insight

Rapid expansion of the biotechnology sector is driving the cell line development market due to increasing demand for recombinant proteins, monoclonal antibodies, and advanced cell-based therapies. Biotech companies are investing in high-throughput screening and stable cell line engineering to accelerate drug discovery and therapeutic development. According to Department of Biotechnology- Biotechnology Industry Research Assistance Council (DPT-BIRAC) of India, the country’ biotechnology industry was valued at USD 44 billion in 2017 and is projected to reach USD 300 billion by 2030, reflecting a CAGR exceeding 15.8%. This growth is creating strong demand for optimized and scalable cell line development solutions across research and commercial production.

Europe Cell Line Development Market Overview

Increasing R&D expenditure in Europe is driving the market due to rising investment in biologics research, vaccine production, and advanced therapy development. Pharmaceutical and biotechnology companies are focusing on creating high-yield and stable cell lines to accelerate drug discovery and large-scale manufacturing, boosting collaboration with specialized service providers. According to European Federation of Pharmaceutical Industries and Associations (EFPIA), research and development (R&D) spending rose significantly, climbing from USD 20.4 million in 2020 to USD 54.1 million in 2023. This rising investment is driving cell line engineering capabilities and boosting demand for optimized cell lines across research and commercial applications.

Key Players & Competitive Analysis Report

The cell line development market is highly competitive, with key players such as Lonza Group AG, WuXi Biologics, Thermo Fisher Scientific Inc., Sartorius AG, Charles River Laboratories, Merck KGaA, and Cytovance Biologics. These companies compete on cell line stability, high-yield expression systems, and regulatory-compliant development platforms to cater to the growing demand for monoclonal antibodies, vaccines, and recombinant proteins. The competitive dynamics are further influenced by strategic partnerships, acquisitions, and launches aimed at expanding technology portfolios and enhancing positions in biologics and biosimilars production.

Key companies in the industry include Lonza Group AG, WuXi Biologics, Thermo Fisher Scientific Inc., Sartorius AG, Charles River Laboratories, Merck KGaA, Cytovance Biologics, Cellistic, Berkeley Lights, Advanced Instruments, Danaher Corporation, and Creative Biolabs.

Key Players

- Advanced Instruments

- Berkeley Lights

- Cellistic

- Charles River Laboratories

- Creative Biolabs

- Cytovance Biologics

- Danaher Corporation

- Lonza Group AG

- Merck KGaA

- Sartorius AG

- Thermo Fisher Scientific Inc.

- WuXi Biologics

Industry Developments

February 2025: Cellistic launched the Allo Chassis platform, an off-the-shelf, immune-cloaked iPSC cell line derived from CD34+ and CD4+ T-cell primary cells, representing a significant advancement in cell line development. The platform is designed to help therapeutic developers reduce timelines and costs for cell therapy, offering ready-to-use, cGMP-compliant cell lines that are easily customizable for various applications.

October 2024: WuXi Biologics launched WuXia RidGS, a new high-yield, non-antibiotic cell line development platform based on glutamine synthetase (GS)-knockout CHO cells. This platform uses zinc finger nucleases (ZFN) technology to precisely knock out the endogenous GS gene in CHO cells, enabling the development of cell lines without antibiotics.

January 2023: Berkeley Lights launched Beacon Select, a new optofluidic system designed for cell line development (CLD). It features advanced optofluidic and NanoPen chamber technology, optimized to address the research and budget requirements of small- to mid-sized biopharma companies and CDMOs/CROs.

Cell Line Development Market Segmentation

By Product & Service Outlook (Revenue, USD Billion, 2020–2034)

- Reagent and Media

- Equipment

- Automated Systems

- Centrifuges

- Bioreactors

- Storage Equipment

- Others

- Accessories and Consumables

- Services

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Mammalian Cell Line

- Non-Mammalian Cell Line

- Insects

- Amphibians

By Type of Cell Lines (Revenue, USD Billion, 2020–2034)

- Recombinant Cell Lines

- Hybridomas

- Continuous Cell Lines

- Primary Cell Lines

By Application (Revenue, USD Billion, 2020–2034)

- Bioproduction

- Drug Discovery

- Toxicity Testing

- Tissue Engineering

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cell Line Development Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.17 Billion |

|

Market Size in 2025 |

USD 6.74 Billion |

|

Revenue Forecast by 2034 |

USD 15.43 Billion |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Cell Line Development Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.17 billion in 2024 and is projected to grow to USD 15.43 billion by 2034.

The global market is projected to register a CAGR of 9.6% during the forecast period.

• North America dominated the market share in 2024 due to by strong biopharmaceutical manufacturing capabilities and early adoption of advanced cell line engineering technologies.

A few of the key players in the market are Lonza Group AG, WuXi Biologics, Thermo Fisher Scientific Inc., Sartorius AG, Charles River Laboratories, Merck KGaA, Cytovance Biologics, Cellistic, Berkeley Lights, Advanced Instruments, Danaher Corporation, and Creative Biolabs.

The reagents and media segment dominated the market share in 2024, due to its crucial role in optimizing cell culture conditions and enhancing productivity in large-scale biologics manufacturing.

The hybridomas segment is expected to witness the fastest growth during the forecast period, due to its established use in generating high-affinity monoclonal antibodies for therapeutic and diagnostic applications.