Cellular Modem Market Share, Size, Trends, Industry Analysis Report

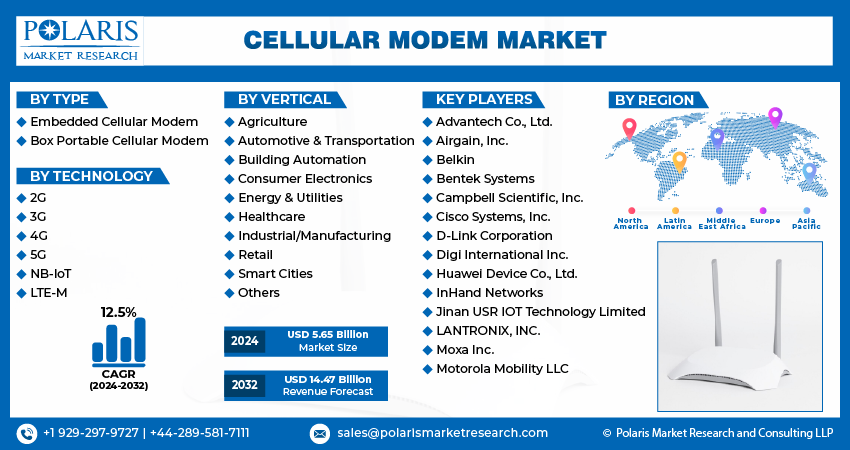

By Type (Embedded Cellular Modem, Box Portable Cellular Modem); By Technology; By Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM4478

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

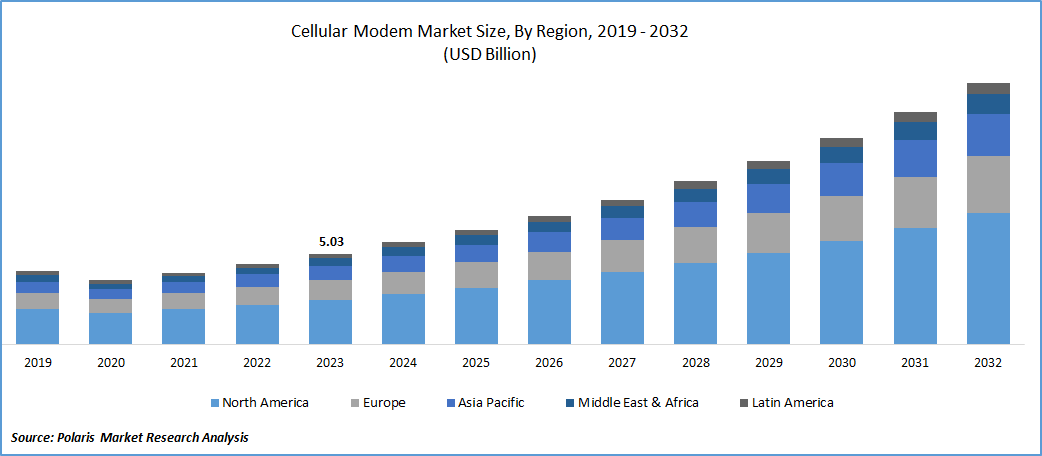

The global cellular modem market was valued at USD 5.03 billion in 2023 and is expected to grow at a CAGR of 12.5% during the forecast period.

The worldwide adoption of cellular devices, primarily smartphones, with their increased availability and ease of operation, is driving new growth opportunities for the cellular modem market. They are crucial to ensuring the connectivity of devices with cellular networks. The ongoing advancements in the network to cater to changing consumer needs are fueling innovations in the cellular modem. The recent evolution of 5G is encouraging companies to produce cellular modems that are capable of ensuring connectivity for 5G and even 4G where the 5G network is not deployed.

To Understand More About this Research:Request a Free Sample Report

For instance, in February 2023, Qualcomm unveiled its 5G advanced-ready RF-system, Snapdragon X75 modem. It is compatible with the Snapdragon satellite and 5G networks and offers enhanced network coverage, power efficiency, and mobility.

Moreover, the emergence of Industry 4.0 necessitates the need for improved connectivity in the market along with the increasing adoption of the internet of things in various end-use industries, including agriculture, banking, healthcare, and retail. This trend, in a way, is expected to facilitate the need for cellular modems

However, the higher resistance to adopting new technologies attributable to the higher initial investments and lower replacement of advanced networks in rural and remote areas is significantly impeding the demand for cellular modems.

Growth Drivers

The Ongoing Need for Connectivity Among the Various Industries

The increased accessibility of smart devices and the internet opened the doors for several purposes. One of the recent advances in the adoption of IoT in healthcare is telemedicine, which is one of the outcomes of the COVID-19 pandemic. This transformed the healthcare industry by providing doctor consultation and treatment with the development of online interphase. The increased connectivity is essential for these tasks, increasing the need for cellular modems. Not only has healthcare revolutionized with the internet, but everything from agriculture to shopping also requires connectivity. This penetration of online services is gaining traction among the population, contributing to the increased demand for cellular devices. This rapid adoption of internet services is expected to boost the demand for cellular modems in the foreseeable future.

The emergence of machine learning and artificial intelligence is expected to support the growth of the cellular modem market. The increasing adoption of electric vehicles, along with the ongoing trend towards autonomous vehicles and smart homes, is boosting the demand for internet connectivity. As more industries utilised internet connectivity, there will be a significant need for cellular modems during the forecast period.

Report Segmentation

The market is primarily segmented based on type, technology, vertical, and region.

|

By Type |

By Technology |

By Vertical |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Box Portable Cellular Modem Segment is Expected to Witness the Highest Growth During the Forecast Period

The box portable segment is projected to grow at a CAGR during the projected period, mainly driven by its ability to provide internet connectivity without the need for installation or wiring. It offers flexibility in mobility and can share connectivity with multiple devices, like computers. The growing need for higher-speed internet among consumers for the various utilities is expected to stimulate the adoption of box portable cellular modems. The rising need for the internet for numerous activities, including remote work, e-commerce evolution, and online education, are the major factors driving this segmental growth.

The embedded cellular modem segment led the industry market with a substantial revenue share in 2022, largely attributable to the rising demand for consumer electronics and the significant need for internet connectivity.

By Technology Analysis

5g Segment Accounted for the Largest Market Share in 2023

The 5G segment accounted for the largest market share and is likely to retain its market position throughout the forecast period. The 5G network has additional features from the earlier versions, such as reduced latency, increased capacity, and higher bandwidth. It enables users to download videos and audio at higher speeds and with higher power efficiency, as it uses less power by switching to lower networks when the cellular radios are not in use.

The 4G segment is expected to witness significant growth in the coming years on account of its cost-effectiveness, stability, and reliability. As the 5G transition takes some time for sure, as it needs to adopt infrastructure development, 4G offers affordability with its significant speed, driving adoption from people who do not require additional speed.

By Vertical Analysis

Energy & Utilities Segment Held the Significant Market Revenue Share in 2023

The energy and utilities segment held a significant market share, due to the continuous rise in demand for smart homes as they ensure proper communication between smart home devices and central control systems. They also enable users to access real-time data, remote monitoring, and asset tracking and management. Furthermore, the recent shift in the adoption of smart meters is facilitating the need for cellular modems as they allow remote communication and data collection.

The consumer electronics segment is expected to register significant growth after energy and utilities during the forecast period, owing to the increasing number of consumer interests in mobile broadband services.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North American region dominated the market. The growth of the segment market can be largely influenced by the increased adoption rate of advanced technologies due to the well-established infrastructure in the region. According to the article published in Telecom TV, North America reached a higher 5G penetration rate of 40 percent with a 25.5% growth rate in the first half of 2023 and is expected to reach 669 million 5G connections by 2028. Furthermore, FCC is starting the authorization of 5G modem modules based on the Qualcomm X62/X65 for use in routers in North America, which are expected to become available in 2023.

The Asia Pacific with healthy pace, owing to the growing internet users in developing countries, primarily in India. According to the Telecom Regulatory Authority of India, the total number of internet subscribers was 881.25 million at the end of March and 865.90 million in December 2022. This ongoing online revolution is likely to support the growth of cellular modems, as they enable them to get connected to the network.

Key Market Players & Competitive Insights

The cellular modem market is fairly consolidated with the few major players in the market, followed by increasing strategic mergers, acquisitions, and collaborations. The growing product upgrades and launches of cellular modems with advanced features are widening the market. For instance, mobile hand-sets powered by the Qualcomm’s Snapdragon X35 will be launched by the 2nd half of 2024.

Some of the major players operating in the global market include:

- Advantech Co., Ltd.

- Airgain, Inc.

- Belkin

- Bentek Systems

- Campbell Scientific, Inc.

- Cisco Systems, Inc.

- D-Link Corporation

- Digi International Inc.

- Huawei Device Co., Ltd.

- InHand Networks

- Jinan USR IOT Technology Limited

- LANTRONIX, INC.

- Moxa Inc.

- Motorola Mobility LLC

Recent Developments

- In August 2023, Renesas, a supplier of advanced semiconductor solutions, acquired cellular IT specialist Sequans Communications

- In November 2022, MediaTek and Skyworks entered into a collaboration to offer modem-to-antenna 5G-grade automotive solutions.

- In May 2022, Qualcomm and Viettel collaborated to develop a next-generation 5G radio unit with massive MIMO capabilities along with a distributional unit.

Cellular Modem Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.65 billion |

|

Revenue forecast in 2032 |

USD 14.47 billion |

|

CAGR |

12.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Technology, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Cellular Modem Market Size Worth $ 14.47 Billion By 2032.

The top market players in Cellular Modem Market include Advantech, Airgain, Inc., Belkin, Bentek Systems, Campbell Scientific.

North America is contribute notably towards the Cellular Modem Market.

The global cellular modem market is expected to grow at a CAGR of 12.5% during the forecast period.

Cellular Modem Market report covering key segments are type, technology, vertical and region.