Chemical Tanker Market Share, Size, Trends, Industry Analysis Report

By Type (Organic Chemicals, Inorganic Chemicals, and Vegetable Oils & Fats); By Material; By Tanker Capacity; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3666

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

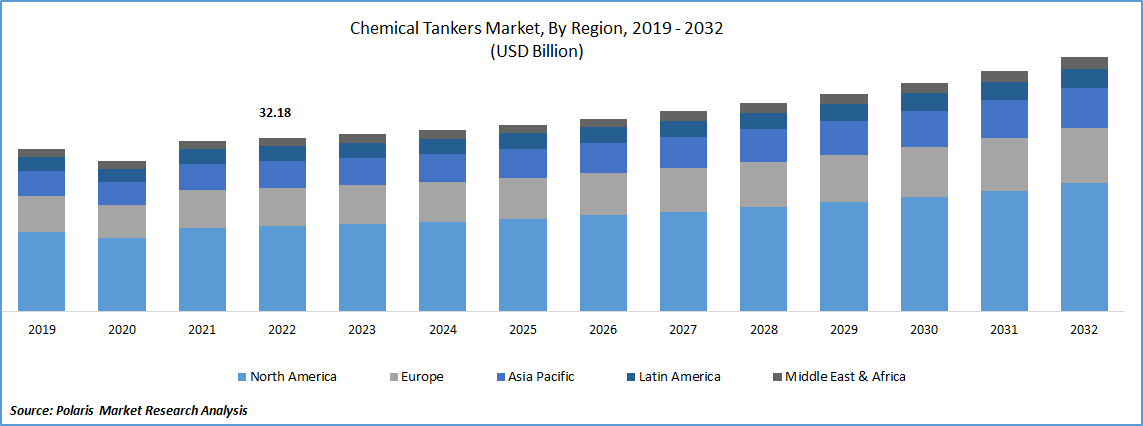

The global chemical tanker market was valued at USD 32.85 billion in 2023 and is expected to grow at a CAGR of 4.08% during the forecast period.

The increasing need for efficient and reliable transportation of chemical products from wide range of industries including pharmaceuticals, automotive, and petrochemicals along with the digital transformation of shipping industry that results in optimized operations, improved vessel performance, and enhanced supply chain visibility are driving the demand and growth of the market. Additionally, surging investments in port infrastructure and terminal facilities which can improve turnaround times, reduce congestion, and enhance cargo handling capabilities and introduction to several new tankers complying with safety and regulatory compliance, which in turn, have positively impacted the market.

For instance, in April 2023, Fairfield Chemical Tankers, announce the launch of its first LNG based stainless steel tanker called “Fairchem Pioneer”, which significantly helps in reducing CO2 emissions by 25 percent compared to the traditional fuels. The newly new LNG DF vessels also underlines the company’s commitment to deliver the environmentally approved tanker operations.

To Understand More About this Research: Request a Free Sample Report

However, the economic volatility and fluctuations in the demand for chemicals in the global market and compliance with several types of stringent safety, environmental, and regulatory requirements that often involves significant costs meeting these requirements due to equipment upgrades, crew training, and adherence, are major factors restraining the market growth.

Moreover, the growing emphasis on environmental sustainability and reducing greenhouse gas emissions in the maritime industry across the world encouraging the chemical tanker operators to adopt cleaner and more sustainable practices and transitioning to alternative fuels such as LNG or biofuels among major companies operating in the market, are likely to allow companies to gain a competitive edge in the market.

The outbreak of the COVID-19 pandemic has positively impacted the growth of the chemical tanker market. The rapid spread of deadly coronavirus across the world led to huge disruptions in global supply chains and negatively influenced the demand for chemicals, as a result of lockdown measures, reduced manufacturing activities, and restrictions on international trade activities. The pandemic has also caused shifts in global trade patterns, with some countries experiencing a decline in exports and imports, that affected the global market during the pandemic.

Industry Dynamics

Growth Drivers

Rising Demand for the Chemical Tankers Is Propelling the Market Growth

The increasing rate of industrialization, urbanization, and demand for various chemical products drive the need for transporting chemicals from manufacturing facilities to distribution centers and end-users. Apart from this, proliferation for Innovations in cargo handling systems, navigation equipment, and safety measures improving the efficiency, reliability, and safety of chemical tankers and attracting investments for modernizing the fleet are among the major factors driving the global market growth.

Furthermore, the rising prevalence for integrating software-based control systems and emerging trend of digitalization in the marine industry that led to incorporation of advanced technologies along with the growing need to modify products to meet specific application requirements among several businesses, has been fostering the demand and growth of the market over the years.

Report Segmentation

The market is primarily segmented based on type, material, tanker capacity, and region.

|

By Type |

By Material |

By Tanker Capacity |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Organic Chemicals Segment Accounted for the Largest Market Share in 2022

Organic chemicals segment of global share in 2022, which is mainly driven by their rising number of industrial applications and widespread use as key raw ingredients in the manufacturing or production of range of products including plastic, fiber, rubber, and insecticides. The growing need to comply with several safety and environmental regulations imposed by government authorities to maintain the safety while transportation, is also contributing positively towards the segment growth.

Additionally, the growing complexity and diversity of organic chemicals which have led to a shift towards specialized chemical tankers and prevalence of these tankers across various industries including pharmaceuticals, petrochemicals, and agriculture, as they are designed to handle specific types of chemicals, ensuring compatibility, segregation, and efficient loading/unloading operations, has been propelling the growth of the segment market over the years.

By Material Analysis

Stainless Steel Segment Held the Significant Market Share in 2022

The stainless-steel segment held the significant market share in terms of revenue in 2022, which is mainly driven by its wide range of beneficial properties or characteristics such as improved corrosion resistance, better chemical compatibility, and longevity & durability among others along with the ability to provide assurance to chemical manufacturers and shippers that their products are being transported in compliance with safety regulations set by government agencies across the globe.

For instance, in July 2021, Braemar ACM Shipbroking & Womar Tanker Pools, have entered into a strategic partnership mainly to launch the stainless-steel based chemical tankers between the capacity of 19,000 & 22,500 dwt.

The epoxy segment is projected to exhibit substantial growth rate over the next coming years, mainly due to its widespread use in industries including chemicals, paints & coatings, adhesives, construction, and automotive, as it offers excellent chemical resistance, adhesion, and mechanical properties that makes them suitable for transporting various kinds of liquid chemicals.

By Tanker Capacity Analysis

10,000 to 19,999 DWT Segment is Expected to Witness Highest Growth During Forecast Period

The 10,000 to 19,999 DWT segment is anticipated to gain highest growth rate over the study period, mainly accelerated to continuous expansion of chemical industry across the globe and significant rise in the demand for high chemical loading capacity tankers to supply and transport chemicals faster and easily to desired locations. Beside this, with the surge in globalization rate, there has been an exponential rise in international trade which includes the transportation of chemicals from one country to another, thereby, the surge in trade patterns and global distribution of chemical manufacturing facilities, is likely to have positive impact on the segment market.

Regional Insights

Asia Pacific Region Dominated the Global Market in 2022

The Asia Pacific region dominated the global market with considerable revenue share in 2022, and is anticipated to maintain its market dominance throughout the projected period. The regional market growth can be largely attributed to presence of well-established and large chemical industries in countries like China, Indonesia, South Korea, and Japan coupled with the growing investments on exploration activities to develop new product applications.

Moreover, ongoing infrastructure development projects in the APAC region including the construction of new ports, terminals, and petrochemical complexes, are creating growth opportunities for the market, as improved infrastructure enables efficient handling and transportation of chemicals, enhancing the overall logistics capabilities in the region.

The North America region is likely to be the fastest growing region with a healthy CAGR during the forecast period, on account of growing development and expansion of petrochemical industry and heavily rising investments in the construction of sea transportation infrastructure particularly in major developed countries across the region.

Key Market Players & Competitive Insights

The chemical tanker market is fragmented in nature. Major players in the market are constantly launching novel products to stay ahead of the competition. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- MOL Chemical Tankers

- Wilmar International

- MISC Berhad

- Lino Kaiun Kaisha

- Nordic Tankers

- Berlin Laju Tanker

- Seatrans Chemical Tankers

- Odfjell

- Tokyo Marine Asia

- JO Tankers

- Stolt-Nielsen

- Team Tankers

- Bahri

- Sinochem

- Hansa Tankers

- Market Actives

- Aurora Tankers Management

- TSM Group.

Recent Developments

- In April 2023, E&S Tankers, announced the launch of its newly developed dual-fuel stainless steel parcel chemical tanker, along with the options for an additional four vessels. The new vessels are mainly designed to be optimized in the terms of equipment and hull design that results in improved or enhanced energy efficiency.

- In September 2021, Aurora Tankers, introduced new 50,000 DWT IMO II MR Chemical Tanker. The construction of company’s new tankers is being developed, conceptualized, and supervised by the IMC Shipping new-building consultancy. They are also equipped with the high-tech real-time performance monitoring systems and allow the vessels to deliver more efficient energy consumption.

Chemical Tanker Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 33.67 billion |

|

Revenue forecast in 2032 |

USD 47.07 billion |

|

CAGR |

4.08% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Material, By Tanker Capacity, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

MOL Chemical Tankers, Wilmar International, MISC Berhad, Lino Kaiun Kaisha, Nordic Tankers, Berlin Laju Tanker, Seatrans Chemical Tankers, Odfjell, Tokyo Marine Asia Pte. Ltd., JO Tankers, Stolt-Nielsen Ltd., Team Tankers, Bahri, Sinochem, Hansa Tankers, Global Pump Marketing Inc., Market Actives LLC, Aurora Tankers Management Pte. Ltd., and TSM Group. |

FAQ's

key companies in chemical tanker market are MOL Chemical Tankers, Wilmar International, MISC Berhad, Lino Kaiun Kaisha, Nordic Tankers, Berlin Laju Tanker, Seatrans Chemical Tankers.

The global chemical tanker market is expected to grow at a CAGR of 4.08% during the forecast period.

The chemical tanker market report covering key segments are type, material, tanker capacity, and region.

key driving factors in chemical tanker market are rising prevalence for integrating software-based control systems.

The global chemical tanker market size is expected to reach USD 47.07 billion by 2032.