Cholecystectomy Devices Market Share, Size, Trends, Industry Analysis Report

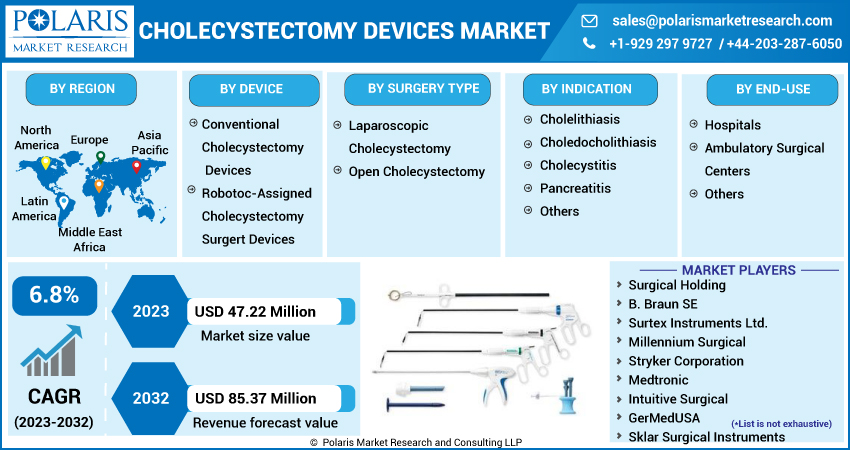

By Device (Conventional Cholecystectomy Devices and Robotic-Assigned Cholecystectomy Surgery Devices); By Surgery Type; By Indication; By End-Use; By Region; Segment Forecast, 2023- 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3453

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

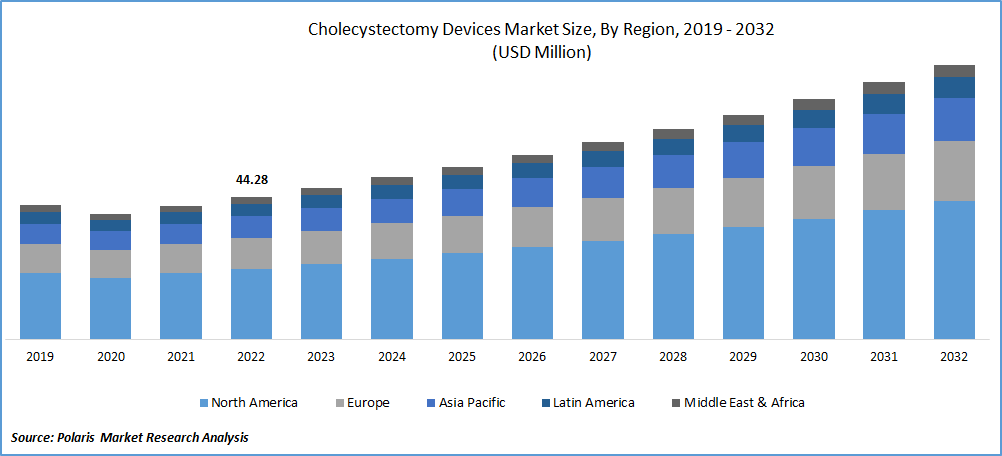

The global cholecystectomy devices market was valued at USD 44.28 million in 2022 and is expected to grow at a CAGR of 6.8% during the forecast period. The rapid increase in the geriatric population, growing preference for elective laparoscopic surgeries, increased awareness among people regarding early disease diagnosis, and high prevalence for gallstone disease, coupled with the high technological advancements and integration of new features in these devices, are key factors propelling the growth of the global market. In addition, the emerging trend towards the modernization of the healthcare industry through the incorporation of developed and innovative devices and systems in hospitals and other surgery centers and rising healthcare spending in major producing countries is also likely to contribute significantly to the market growth.

To Understand More About this Research: Request a Free Sample Report

For instance, in September 2021, Olympus Corporation announced the launch of the POWERSEAL family of advanced bipolar surgical energy devices that will strengthen the company’s surgical portfolio. It provides surgeons with the sealing, dissection, & grasping capabilities in open surgery while reducing the required force by the surgeon.

Moreover, single-incision laparoscopic cholecystectomy (SILC) is a new technique gaining traction and popularity around the world, that uses a single incision in the belly button to perform the complete procedure, as this approach offers a wide range of benefits in terms of reduced scarring and faster recovery times. SILC devices typically include specialized ports and instruments designed to fit through a single small incision, which in turn, positively influences the market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the cholecystectomy devices market. During the pandemic, many elective surgeries, including cholecystectomies, were postponed or canceled as hospitals across the globe were mainly focused on treating COVID-19 patients and conserving resources, which led to a decrease in demand for cholecystectomy devices. However, the resumption of elective surgeries and the increasing popularity of minimally invasive procedures post-pandemic are expected to drive demand in the long term.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rapid development of new cholecystectomy devices, such as laparoscopic instruments, advanced imaging techniques, and robotic-assisted surgery systems, has improved the safety and efficacy of the procedure, as these advancements have also led to shorter hospital stays, reduced recovery times, and lower overall costs are the primary factors boosting the growth of the global market at a significant pace. Furthermore, the extensive rise in the healthcare industry, especially in emerging markets like India, Brazil, China, and South Africa, because of the rising public and private initiatives that major market stakeholders are undertaking, low regulatory barriers for trade, increasing patient population, surging healthcare expenditure, and strengthening distribution networks across these countries, are some other factors fueling the growth of the market.

Report Segmentation

The market is primarily segmented based on device, surgery type, indication, end-use, and region.

|

By Device |

By Surgery Type |

By Indication |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Conventional cholecystectomy segment accounted for the largest market share in 2022

The conventional cholecystectomy segment accounted for the largest market share in 2022. The rapid increase in the demand and prevalence for various devices, including laparoscopes, trocars, closure devices, energy systems, irrigation devices, and insufflation devices, along with the surging adoption of hand access instruments like electrodes, scissors, grasper, and dissectors, are among the major factors propelling the segment market growth at a rapid pace.

The robotic-assigned cholecystectomy surgery devices segment is anticipated to exhibit a significant growth rate over the coming years due to its ability to manipulate tissue considerably compared to several laparoscopic tools. Along with this, there is less possibility of bleeding, bile leakage, and unintentional harm to several surrounding issues during the surgery.

Laparoscopic cholecystectomy segment held the significant market revenue share in 2022

Laparoscopic cholecystectomy held the majority of market revenue share in 2022, mainly driven by its growing popularity across the globe due to its wide range of advantageous features, such as shorter hospital stays, lower patient morbidity, and less blood loss. In addition, it further offers rapid quick recovery, faster and more successful outcomes, less or no incision, and a low risk of infection.

The open cholecystectomy segment is projected to account for a substantial growth rate over the coming years, which can be highly accelerated by recent advancements in technology and its growing usage for removing the gallbladder. It can be done in places where laparoscopic surgery does not work.

Choledocholithiasis segment is expected to witness highest growth in projected period

The choledocholithiasis segment is projected to grow at the highest CAGR during the anticipated period, which is mainly driven by the continuous rise in the incidences of choledocholithiasis globally primarily due to changes in lifestyle and dietary habits, as well as the rising aging population along with rapid development of advanced technologies and devices, such as laparoscopic cholecystectomy devices, that has led to improved patient outcomes and reduced recovery times. The elderly population is more susceptible to gallstones and bile duct stones, which require several procedures and treatments through choledocholithiasis, thereby propelling the demand and growth of the market.

Hospitals segment led the market with largest market revenue share in 2022

The hospital's segment led the industry market with the largest share in 2022, which is highly accelerated by the growing number of surgical treatments that are being performed in the hospitals due to the availability of the best technology due to the rise in the number of patients suffering from gallstone disorders globally. Moreover, its simplicity in managing several medical crises that might develop during surgical procedures and the widespread availability of hospital treatment options will further stimulate the segment market growth in the coming years.

The ambulatory surgical center's segment is likely to grow steadily over the study period due to increasing interest and penetration for outpatient surgery, the rising adoption of various improved minimally invasive treatments, and the high affordability of ASC-based procedures.

North America region dominated the global market in 2022

North America region dominated the global market with considerable market share in 2022. The increasing preference for laparoscopy over several other traditional surgeries by surgeons due to its quicker recovery and better successful outcomes, along with the growing healthcare spending and presence of well-established healthcare infrastructure mainly in developed countries like the US and Canada.

The Asia Pacific region is anticipated to be the fastest-growing region, with a healthy CAGR over the anticipated period. The regional market can be highly attributable to an increase in the number of well-equipped and technologically-advanced hospitals and a large volume of cholecystectomy surgical procedures across the region. Additionally, the improving reimbursement scenarios, rising medical tourism, and several government initiatives towards enhancing healthcare services will further bode well for the market growth.

Competitive Insight

Some of the major players operating in the global market include Surgical Holding, B. Braun, Surtex Instruments, Millennium Surgical, Stryker Corporation, Medtronic, Intuitive Surgical, GerMedUSA, Sklar Surgical Instruments, Olympus, Mindray Medical, Smith & Nephew, AMNOTEC International, Strauss Surgical, EndoMed Systems, & CONMED Corporation.

Recent Developments

- In May 2022, CMR Surgical introduced a new “Versius Surgical Robotic System” that will be used to perform several cases across cholecystectomy, hysterectomy, and prostatectomy. These robotic-assisted surgical platforms like Versius provide surgeons with dexterity and precision to enable surgeons to perform very complex surgeries easily.

- In April 2021, Erbe Elektromedizin announced the acquisition of Maxer Endoscopy, which is highly engaged in manufacturing numerous endoscopic systems and a wide range of instruments for laparoscopy and ENT surgery. With the acquisition, the company has taken a crucial step towards becoming a leading solutions provider for surgeries and procedures.

Cholecystectomy Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 47.22 million |

|

Revenue forecast in 2032 |

USD 85.37 million |

|

CAGR |

6.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Device, By Surgery Type, By Indication, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Surgical Holding, B. Braun SE, Surtex Instruments Ltd., Millennium Surgical, Stryker Corporation, Medtronic, Intuitive Surgical, GerMedUSA, Sklar Surgical Instruments, Olympus, Mindray Medical International Ltd., Smith & Nephew PLC, AMNOTEC International Medical, Strauss Surgical, EndoMed Systems GmbH, Becton, Dickson and Company, and CONMED Corporation. |

FAQ's

The global cholecystectomy devices market size is expected to reach USD 85.37 million by 2032.

Top market players in the Cholecystectomy Devices Market are Surgical Holding, B. Braun, Surtex Instruments, Millennium Surgical, Stryker Corporation, Medtronic.

North America contribute notably towards the global Cholecystectomy Devices Market.

The global cholecystectomy devices market expected to grow at a CAGR of 6.8% during the forecast period.

The Cholecystectomy Devices Market report covering key are device, surgery type, indication, end-use, and region.