Chromium Market Share, Size, Trends, Industry Analysis Report

By Material (Ferrochromium, Chromium Chemicals, Chromium Metals, Others), By Application, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4096

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

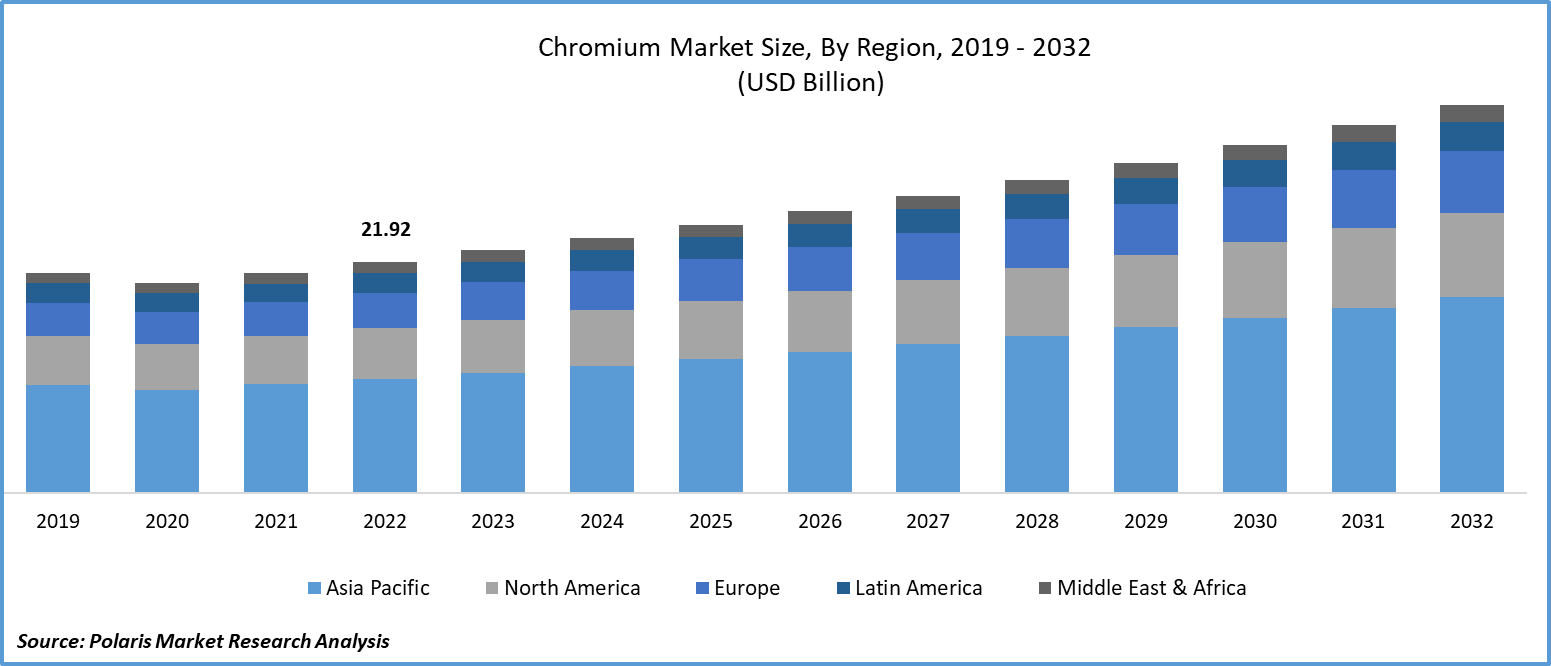

The global chromium market was valued at USD 23.02 billion in 2023 and is expected to grow at a CAGR of 5.40% during the forecast period.

The rising demand for stainless steel across various industries like automotive, aerospace, defense, marine, construction, and electronics is expected to drive market growth. Asia Pacific, particularly China, plays a significant role due to its large-scale production of stainless steel and specialty steel products. Chromium, a crucial element in stainless steel, constitutes about 18.0% of its composition, enhancing hardness and corrosion resistance. This increased need for stainless steel is a major factor fueling the global market.

To Understand More About this Research: Request a Free Sample Report

The market is poised for substantial growth in the coming years due to increased production of stainless steel-based ancillary products. Chromium plays a vital role in the formulation & manufacturing of stainless-steel grades for commercial applications. It is primarily used as an additive in steel production to achieve two crucial objectives: hardening the steel and enhancing its resistance to corrosion. It enhances the hardness of the steel, making it durable and resistant to wear and tear. This characteristic is especially valuable in industries where strong and long-lasting materials are essential, such as automotive, aerospace, and construction. Also, Chromium forms a thin, protective layer on the surface of stainless steel, preventing direct contact with corrosive elements like moisture and oxygen. This layer, often referred to as chromium oxide, acts as a barrier, shielding the steel from corrosion and ensuring its longevity even in challenging environments.

The market faces challenges due to its carcinogenic properties and price volatility. Chromium basically exists in nature in two forms: hexavalent (Cr VI) & trivalent (Cr III). Cr III is less toxic than Cr VI, both in acute and chronic exposure scenarios. Prolonged exposure to Cr VI can have serious effects on the human respiratory system, causing issues like shortness of breath, coughing, & wheezing. Additionally, it can lead to neurological and gastrointestinal problems.

Industry Dynamics

Growth Drivers

Increasing Use in Electrical and Electronic Applications

The increasing use of chromium in electrical and electronic applications has become a significant driver for the chromium market. Chromium's unique properties, such as corrosion resistance and excellent conductivity, make it a crucial component in the production of electrical devices and electronic gadgets. The demand for smartphones, laptops, and other electronic devices has surged, contributing to the growing need for chromium in various alloys and coatings.

Moreover, the expansion of electric vehicles (EVs) further amplifies the demand for chromium, as it is utilized in the manufacturing of batteries and other electronic components crucial to EV technology. As the world transitions towards a more electrified and digital future, the role of chromium in enhancing the performance and longevity of electronic devices positions it as a key player in the global market. This trend is expected to continue driving growth in the chromium market, creating opportunities for manufacturers and suppliers alike to meet the evolving demands of the electronics industry.

Report Segmentation

The market is primarily segmented based on material, application, and region.

|

By Material |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

The Ferrochromium Segment Accounted for the Largest Market Share in 2022

The ferrochromium segment held the largest revenue share. Ferrochromium is a crucial alloy made mainly of iron (Fe) and chromium (Cr). It finds widespread use in the production of stainless steel due to its ability to confer essential properties like corrosion resistance, hardness, and strength at high temperatures. The process of making ferrochromium involves smelting chromite ore, a mineral-rich in chromium, alongside other elements like iron, silicon, and carbon. Ferrochromium is created through this smelting process, becoming a vital component in the production of stainless steel.

Several factors influence the demand for ferrochromium. One of the key factors is industrial growth, as various industries require stainless steel for their operations. Additionally, the rise in construction activities, where stainless steel is extensively used, contributes to the demand. Furthermore, the global increase in stainless steel production directly impacts the need for ferrochromium, making it a crucial material in the modern industrial landscape.

Chromium chemicals are expected to grow at a rapid pace. The primary driving force behind the demand for chromium chemicals is the production of stainless steel. Chromium plays a vital role in the manufacturing of stainless steel, offering crucial attributes such as corrosion resistance, strength, and durability to the steel. Chromium chemicals have diverse applications in various chemical processes and industries. One significant application is in the production of stainless steel. Chromium is integrated into the steel composition, providing it with the ability to resist corrosion. Stainless steel, fortified with chromium, maintains its integrity and structural strength over time, making it highly valuable in these applications.

Apart from stainless steel production, chromium chemicals find utility in other sectors. They are used in the creation of pigments, providing vibrant colors in products like paints, plastics, and textiles. Additionally, these chemicals are employed in the formulation of dyes, giving color to various materials. Moreover, chromium chemicals serve as catalysts in chemical reactions, facilitating the conversion of substances into different forms. They are also integral in surface treatment processes, enhancing the quality and longevity of materials such as metal components used in automotive and construction industries.

By Application Analysis

The Metallurgy Segment Held the Largest Share in 2022

The metallurgy segment held the largest share. Chromium, essential for its exceptional mechanical strength, high oxidative resistance, hardness, and corrosion resistance, was utilized in metallurgical applications in various forms, such as ferroalloys, metals, & stainless-steel scrap. Chromium's significance in the production of high-strength steel is paramount. Its unique properties make it indispensable, and it has no viable substitute in the manufacturing of stainless steel and other superalloys. Interestingly, scrap derived from stainless steel can be employed as an alternative to ferrochromium in certain metallurgical applications, indicating the adaptability and sustainability of chromium usage in the metallurgy sector.

The chemicals segment will grow rapidly. A prominent chromium-containing product in the chemical industry is sodium dichromate, extensively utilized for the surface treatment of diverse metals and as a feed material for producing other chrome chemicals. These chemicals encompass compounds like chrome oxide, chromic acid, & potassium dichromate.

Regional Insights

Asia Pacific Dominated the Global Market in 2022

Asia Pacific emerged as the largest region in 2022. This high demand is particularly notable in developing nations like China and India, where rapid industrial expansion is fueling the global stainless steel market's growth. Europe region will grow rapidly over the projected period. The growing use of chromium in applications like decorative plating within the automotive finishing and plating industry is a significant driving force in the region. Chromium-plated automotive components are in demand due to their ability to enhance corrosion and wear resistance, along with improving the overall appearance of vehicles. These valuable properties are poised to fuel the region’s expansion.

Key Market Players & Competitive Insights

The global market is characterized by intense competition, with numerous key players contributing to a fragmented vendor landscape. The level of rivalry among these players fluctuates based on factors such as product demand, technological innovation, adherence to regulations, and the efficiency of their distribution networks.

Some of the major players operating in the global market include:

- Al Tamman Indsil FerroChrome L.L.C

- Assmang Proprietary Limited

- CVK Group

- Glencore

- Gulf Mining Group LLC

- Hernic Ferrochrome (Pty) Ltd.

- MVC Holdings LLC

- Odisha Mining Corporation Ltd.

- Samancor Chrome

Recent Developments

- In June 2023, The Indian government imposed restrictions on the export of chromium ores and concentrates, essential materials used in diverse industries like stainless steel production. According to the new regulations, exporters are mandated to acquire a license from the Directorate General of Foreign Trade (DGFT) for shipping chromium products.

- In May 2023, African Chrome Fields revealed plans for the launch of its groundbreaking aluminothermic smelting factory in Zimbabwe. This plant uses exclusive cutting-edge technology, eliminating the requirement for external power in the process of converting chrome ore into ferrochrome.

Chromium Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 24.2 billion |

|

Revenue Forecast in 2032 |

USD 36.77 billion |

|

CAGR |

5.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |