Circulating Tumor Cells Market Size, Share, Trends, Industry Analysis Report: By Technology (CTC Detection & Enrichment Methods, CTC Direct Detection Methods, and CTC Analysis), Products, Specimen, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM1814

- Base Year: 2024

- Historical Data: 2020-2023

Circulating Tumor Cells Market Overview

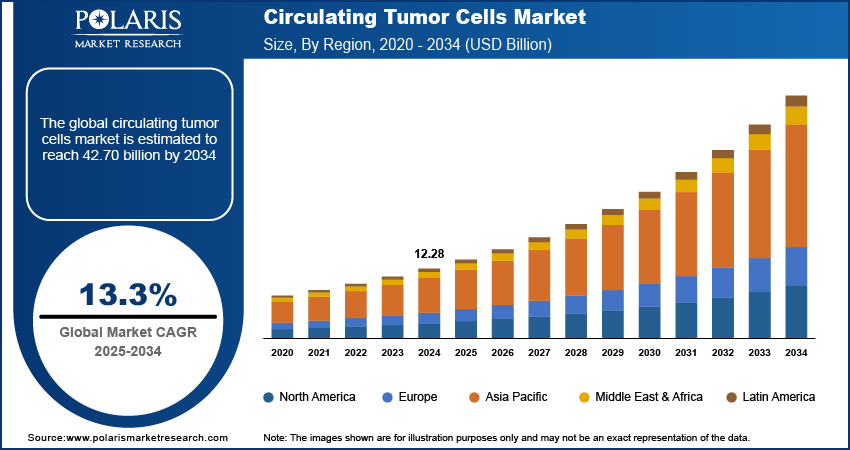

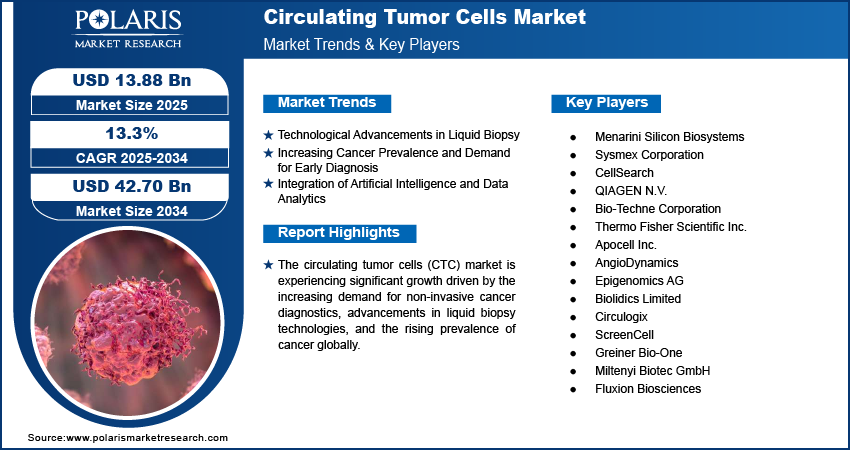

The circulating tumor cells market size was valued at USD 12.28 billion in 2024. The market is projected to grow from USD 13.88 billion in 2025 to USD 42.70 billion by 2034, exhibiting a CAGR of 13.3% during 2025–2034.

The circulating tumor cells (CTC) market focuses on the detection, analysis, and treatment of tumor cells that circulate in the bloodstream, offering potential for early cancer diagnosis, monitoring, and personalized treatment. The growth of this market is driven by advancements in non-invasive diagnostic technologies, increasing cancer prevalence, and the demand for more accurate and less invasive diagnostic methods. Key trends include the growing adoption of personalized medicine, and the integration of artificial intelligence and machine learning in data analysis for improved patient outcomes. Additionally, the rising focus on precision oncology is expected to further fuel CTC market expansion.

To Understand More About this Research: Request a Free Sample Report

Circulating Tumor Cells Market Dynamics

Technological Advancements in Liquid Biopsy

One of the primary drivers of the circulating tumor cells market is the continuous innovation in liquid biopsy technologies. Liquid biopsy, which involves analyzing CTCs in blood samples, offers a non-invasive alternative to traditional biopsy procedures. This method allows for real-time monitoring of tumor progression and detection of genetic mutations, which is essential for personalized cancer treatment. According to a study published in Nature Reviews Cancer in 2024, liquid biopsy has demonstrated the potential to detect CTCs with high sensitivity and specificity, improving early cancer detection and monitoring of therapeutic efficacy. The increased focus on precision medicine and minimally invasive diagnostic methods is propelling the growth of liquid biopsy applications in oncology.

Increasing Cancer Prevalence and Demand for Early Diagnosis

The rising global incidence of cancer is a significant CTC market driver. As cancer rates continue to increase, particularly among aging populations, there is a growing need for early and accurate diagnostic methods to improve survival rates. The World Health Organization (WHO) reports that cancer is responsible for nearly 10 million deaths worldwide in 2020, with an estimated 1 in 5 people developing cancer during their lifetime. This growing cancer burden has spurred the demand for effective diagnostic tools, such as CTCs, that enable earlier detection and treatment. The ability of CTCs to detect cancer in its early stages, even before symptoms appear, makes this technology highly valuable for timely interventions.

Integration of Artificial Intelligence and Data Analytics

The integration of artificial intelligence (AI) and machine learning (ML) into the analysis of CTCs is accelerating circulating tumor cells market growth. AI algorithms can process vast amounts of data collected from CTC samples to identify patterns and predict treatment responses more accurately than traditional methods. AI-based platforms can also streamline the interpretation of liquid biopsy results, providing clinicians with actionable insights faster. According to an article in NCBI on Cancer Research published in 2021, AI-driven technologies are showing promising results in the detection and characterization of CTCs, enhancing the precision and speed of diagnosis. The adoption of AI in oncology is expected to continue expanding, as it offers significant improvements in the efficiency of cancer detection and personalized treatment planning.

Circulating Tumor Cells (CTC) Market Segment Insights

Circulating Tumor Cells Market Assessment by Technology

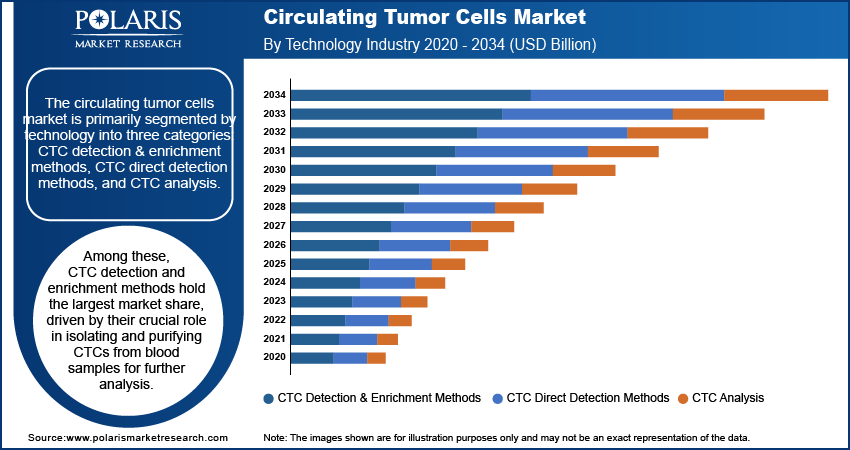

The circulating tumor cells market is primarily segmented by technology into three categories: CTC detection & enrichment methods, CTC direct detection methods, and CTC analysis. Among these, CTC detection & enrichment methods hold the largest market share, driven by their crucial role in isolating and purifying CTCs from blood samples for further analysis. Technologies such as immunomagnetic separation, microfluidics, and density gradient centrifugation are widely adopted for their efficiency and sensitivity in isolating viable CTCs. The growth of this segment is fueled by the increasing demand for early cancer detection and non-invasive diagnostics, as well as the continuous advancements in technology to enhance isolation techniques.

The CTC analysis segment is also registering the fastest growth, largely due to the integration of advanced technologies such as artificial intelligence and machine learning in data analysis. These technologies are revolutionizing the analysis of CTCs, enabling precise molecular profiling and a better understanding of tumor dynamics. With the increasing trend towards personalized medicine, the ability to analyze CTCs and identify genetic mutations or resistance markers is becoming more critical in developing tailored treatment plans. This trend is expected to drive the CTC analysis segment, especially as the use of AI and data-driven insights becomes more prevalent in clinical oncology.

Circulating Tumor Cells Market Evaluation by Products

The circulating tumor cells market segmentation, based on products, includes kits & reagents, blood collection tubes, and devices or systems. The kits & reagents segment holds the largest market share, as they are integral to the detection and enrichment of CTCs in blood samples. These products are essential for both clinical and research applications, allowing laboratories and healthcare providers to perform tests with high accuracy and reliability. The widespread adoption of liquid biopsy techniques in oncology is driving the demand for these products, particularly as they enable non-invasive cancer detection and treatment monitoring. The kits and reagents segment benefits from ongoing advancements in technology that improve test sensitivity and ease of use.

The devices or systems segment is also experiencing the fastest growth, driven by the increasing adoption of automated and highly efficient systems for CTC isolation, detection, and analysis. These systems, such as microfluidic devices and immunomagnetic separation tools, provide faster results and improve the precision of CTC diagnostics. As healthcare providers continue to seek more efficient and automated solutions for cancer diagnosis and monitoring, the demand for sophisticated devices and systems is expected to rise significantly. This growth is also supported by the increasing trend toward personalized and targeted cancer therapies, which rely on advanced CTC technologies for better clinical decision-making.

Circulating Tumor Cells Market Assessment by Specimen

The CTC market is segmented by specimen type into blood, bone marrow, and other body fluids. The blood specimen segment holds the largest circulating tumor cells market share, as it is the most commonly used sample type for CTC detection. Blood-based CTC testing is widely recognized for its non-invasive nature, making it the preferred choice for early cancer detection, monitoring, and treatment evaluation. The high volume of blood samples collected for diagnostic purposes and the well-established methodologies for blood-based CTC analysis are key factors contributing to the dominance of this segment. Additionally, the continuous advancements in liquid biopsy technologies that focus on blood samples have further cemented the blood specimen segment’s leading position in the market.

The bone marrow specimen segment is also experiencing the fastest growth, largely due to the increasing demand for more specific and localized tumor analysis. Bone marrow, being a primary site for hematologic cancers, such as leukemia and lymphoma, provides valuable insights into the presence of CTCs in these types of cancers. As advancements in biopsy techniques enable more effective CTC isolation from bone marrow, this specimen type is gaining traction in research and clinical settings. Additionally, the rising focus on precision oncology and the need for more detailed cancer profiling is expected to further drive the growth of the bone marrow segment, especially in the context of targeted therapies and treatment response monitoring.

Circulating Tumor Cells Market Evaluation by End Use

The circulating tumor cells market is segmented by end use into research & academic institutes, hospitals & clinics, and diagnostic centers. The hospitals and clinics segment holds the largest market share, primarily due to the increasing adoption of CTC-based diagnostic technologies in clinical settings for cancer diagnosis, monitoring, and treatment planning. These healthcare institutions play a critical role in patient care and the integration of CTC technologies in clinical practice, where their use in personalized medicine is rapidly expanding. Hospitals and clinics benefit from continuous advancements in diagnostic methods, which allow for more accurate detection and monitoring of cancer in real-time, thereby boosting their adoption of CTC-based technologies.

The diagnostic centers segment is also registering the fastest growth, as these centers specialize in offering non-invasive, specialized diagnostic tests such as CTC detection. With the rising demand for liquid biopsy tests, diagnostic centers are increasingly focusing on CTC-based assays for cancer detection and monitoring. The growing preference for outpatient diagnostic services, combined with the need for quicker and more reliable diagnostic results, is driving the growth of this segment. Furthermore, advancements in technology and the expansion of CTC testing options in the diagnostic sector are expected to continue fueling the growth of diagnostic centers as they integrate more sophisticated CTC detection systems.

CTC Market Regional Insights

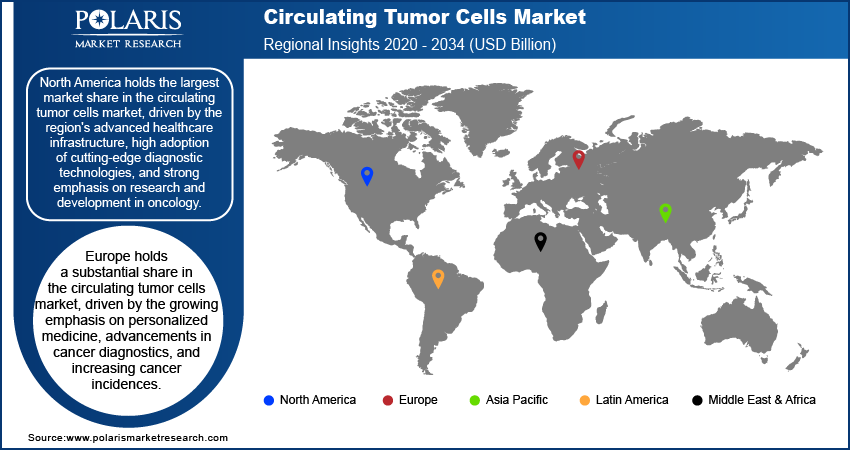

By region, the study provides circulating tumor cells market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by the region's advanced healthcare infrastructure, high adoption of advanced diagnostic technologies, and strong emphasis on research and development in oncology. The presence of key market players and ongoing investments in CTC-based diagnostic technologies further bolster the region’s dominance. Additionally, the increasing prevalence of cancer, coupled with rising demand for non-invasive diagnostic methods and personalized medicine, is contributing to North America's market leadership. Europe also represents a significant market, but North America's early adoption of liquid biopsy technologies and established healthcare systems place it at the forefront in terms of market share and growth potential.

Europe holds a substantial CTC market share, driven by the growing emphasis on personalized medicine, advancements in cancer diagnostics, and increasing cancer incidences. The region benefits from a well-established healthcare infrastructure and high research investment in oncology, particularly in countries such as Germany, the UK, and France. With a strong focus on non-invasive diagnostic solutions, European countries are increasingly adopting liquid biopsy technologies, including CTC detection, to improve early cancer detection and treatment monitoring. Moreover, regulatory support and collaborations between academic institutions, healthcare providers, and private companies contribute to the market growth in this region. The ongoing adoption of precision oncology further fuels the demand for CTC-based diagnostics in Europe.

Asia Pacific is expected to register the fastest growth in the circulating tumor cells market due to rapid advancements in healthcare infrastructure, rising cancer prevalence, and increasing awareness about early cancer detection. Countries such as Japan, China, and India are major contributors to this growth. Japan and China, in particular, are witnessing significant investments in oncology research and the development of non-invasive diagnostic technologies. The growing healthcare expenditure in these countries, along with the increasing adoption of liquid biopsy methods, is driving the demand for CTC technologies. In India, the rise in cancer cases and improvements in diagnostic facilities are likely to further fuel the market. The region’s vast population, coupled with the expanding healthcare access and rising demand for efficient diagnostic tools, positions Asia Pacific as a key growth area of the market.

Circulating Tumor Cells Market – Key Players and Competitive Insights

Key players in the circulating tumor cells market include Menarini Silicon Biosystems, Sysmex Corporation, CellSearch, QIAGEN N.V., Bio-Techne Corporation, Thermo Fisher Scientific Inc., Apocell Inc., AngioDynamics, Epigenomics AG, Biolidics Limited, Circulogix, ScreenCell, Greiner Bio-One, Miltenyi Biotec GmbH, and Fluxion Biosciences. These companies are actively involved in the development, production, and commercialization of CTC detection technologies and devices, providing various solutions ranging from cell enrichment kits to automated systems and molecular analysis platforms. They continue to contribute to the market growth through their innovative approaches to liquid biopsy technologies, non-invasive cancer diagnostics, and personalized oncology solutions.

The competitive landscape of the CTC industry is shaped by a mix of established players and newer entrants that focus on technology innovation and enhancing diagnostic capabilities. Companies such as Menarini Silicon Biosystems and Thermo Fisher Scientific offer a wide range of liquid biopsy solutions, including CTC detection kits and integrated systems that streamline the process of isolating and analyzing CTCs. Other companies, such as Bio-Techne and Miltenyi Biotec, focus on developing sophisticated laboratory tools and systems for high-throughput testing, expanding the scope of research applications. Additionally, companies such as Circulogix and AngioDynamics are focusing on creating specialized devices and platforms for improved CTC collection and analysis, positioning themselves to meet the growing demand for more efficient and accurate diagnostic tools.

The CTC market is becoming increasingly competitive as players strive to differentiate themselves through technological innovation, strategic partnerships, and geographic expansion. Companies such as QIAGEN N.V. and Bio-Techne have formed collaborations with academic and healthcare institutions to advance their CTC testing technologies and expand their market reach. Moreover, advancements in AI and machine learning are pushing companies to develop smarter diagnostic platforms that offer faster and more precise CTC analysis. The increasing preference for non-invasive cancer diagnostics and the rising focus on personalized medicine will likely drive further investments in R&D and foster continued competition among these key market players. As the market matures, companies will continue to innovate and refine their offerings to cater to the evolving needs of clinicians and researchers.

Menarini Silicon Biosystems is a prominent player in the circulating tumor cells market. It is known for its innovative technology for detecting and analyzing of CTCs. The company focuses on providing solutions for non-invasive cancer diagnostics, offering products such as cell enrichment kits and automated systems. Menarini's products are widely used in clinical research and cancer monitoring, enabling medical professionals to identify and track tumor cells in blood samples.

Thermo Fisher Scientific Inc. is another CTC market key player, specializing in the development of scientific instruments, reagents, and laboratory equipment for various diagnostic and research applications. The company's CTC-related products include systems and kits for the isolation and analysis of tumor cells from blood samples, with a focus on advancing liquid biopsy technologies for cancer diagnosis.

List of Key Companies in Circulating Tumor Cells Market

- Menarini Silicon Biosystems

- Sysmex Corporation

- CellSearch

- QIAGEN N.V.

- Bio-Techne Corporation

- Thermo Fisher Scientific Inc.

- Apocell Inc.

- AngioDynamics

- Epigenomics AG

- Biolidics Limited

- Circulogix

- ScreenCell

- Greiner Bio-One

- Miltenyi Biotec GmbH

- Fluxion Biosciences

Circulating Tumor Cells Market Developments

- January 2025: Thermo Fisher Scientific announced the expansion of its oncology portfolio with the introduction of a new platform that integrates artificial intelligence to enhance the analysis of CTCs. This platform provides faster and more precise insights for clinical applications.

- September 2024: Menarini Silicon Biosystems launched an advanced version of its CTC detection platform, which incorporates more efficient isolation techniques to improve the sensitivity and accuracy of CTC testing.

Circulating Tumor Cells Market Segmentation

By Technology Outlook (Revenue-USD Billion, 2020–2034)

- CTC Detection & Enrichment Methods

- CTC Direct Detection Methods

- CTC Analysis

By Products Outlook (Revenue-USD Billion, 2020–2034)

- Kits & Reagents

- Blood Collection Tubes

- Devices or Systems

By Specimen Outlook (Revenue-USD Billion, 2020–2034)

- Blood

- Bone Marrow

- Other Body Fluids

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Research & Academic Institutes

- Hospital & Clinics

- Diagnostic Centers

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Circulating Tumor Cells Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.28 billion |

|

Market Size Value in 2025 |

USD 13.88 billion |

|

Revenue Forecast by 2034 |

USD 42.70 billion |

|

CAGR |

13.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The circulating tumor cells market has been segmented into detailed segments of technology, products, specimen, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth strategy for the circulating tumor cells (CTC) market focuses on expanding product offerings, enhancing technological capabilities, and increasing market reach. Companies are investing in research and development to improve the sensitivity and accuracy of CTC detection methods, with a growing emphasis on integrating artificial intelligence and machine learning for better data analysis. Strategic partnerships with healthcare providers, research institutions, and biotechnology companies are also crucial for expanding product applications and increasing market penetration. Additionally, key players are focusing on geographical expansion, particularly in emerging markets, to capitalize on the rising demand for non-invasive cancer diagnostic solutions.

FAQ's

The circulating tumor cells market size was valued at USD 12.28 billion in 2024 and is projected to grow to USD 42.70 billion by 2034

The market is projected to register a CAGR of 13.3% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the circulating tumor cells market include Menarini Silicon Biosystems, Sysmex Corporation, CellSearch, QIAGEN N.V., Bio-Techne Corporation, Thermo Fisher Scientific Inc., Apocell Inc., AngioDynamics, Epigenomics AG, Biolidics Limited, Circulogix, ScreenCell, Greiner Bio-One, Miltenyi Biotec GmbH, and Fluxion Biosciences.

The CTC detection & enrichment methods segment accounted for the larger share of the market in 2024.

The kits & reagents segment accounted for the larger share of the market in 2024.

Circulating Tumor Cells (CTCs) are cancer cells that have detached from a primary or metastatic tumor and enter the bloodstream. These cells can travel throughout the body and potentially cause the spread of cancer to other organs. CTCs are considered a key biomarker for cancer diagnosis, monitoring, and treatment response. Their detection is important because they offer a non-invasive method to assess cancer progression and evaluate the effectiveness of treatments, such as chemotherapy or targeted therapy, through liquid biopsy. Analyzing CTCs can help in early cancer detection, tracking of metastasis, and the development of personalized treatment strategies.

A few key trends in the market are described below: Advancement in Liquid Biopsy Technologies: Continuous improvements in non-invasive testing methods, such as liquid biopsy, are driving the demand for CTC-based diagnostics. Integration of Artificial Intelligence and Machine Learning: AI and ML are being incorporated into CTC analysis platforms for enhanced accuracy and faster results in cancer detection. Personalized Medicine: Increasing focus on personalized treatment plans, where CTCs play a critical role in monitoring treatment responses and identifying genetic mutations. Rising Adoption of Precision Oncology: A growing emphasis on targeted therapies and precision oncology, which relies on CTC detection for tumor profiling.

For a new company entering the CTC market, focusing on innovative and efficient detection technologies could provide a competitive edge. Investing in the integration of artificial intelligence and machine learning into CTC analysis for faster and more accurate results would be crucial. Additionally, offering cost-effective solutions for early cancer detection and monitoring, especially in emerging markets, could help capture a broader customer base. Collaborating with healthcare providers and research institutions for the validation and adoption of new technologies could also accelerate market penetration. Lastly, maintaining a focus on personalized medicine and targeted therapies could align the company with the growing demand for precision oncology solutions.

The report must be purchased by companies manufacturing, distributing, or purchasing circulating tumor cells related products and solutions, as well as by other consulting firms.