Cleanroom Films and Bags Market Share, Size, Trends, Industry Analysis Report

By Product (Bags, Pouches, Tape, Boxes, Films & Wraps), By Material, By End-use, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM3968

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

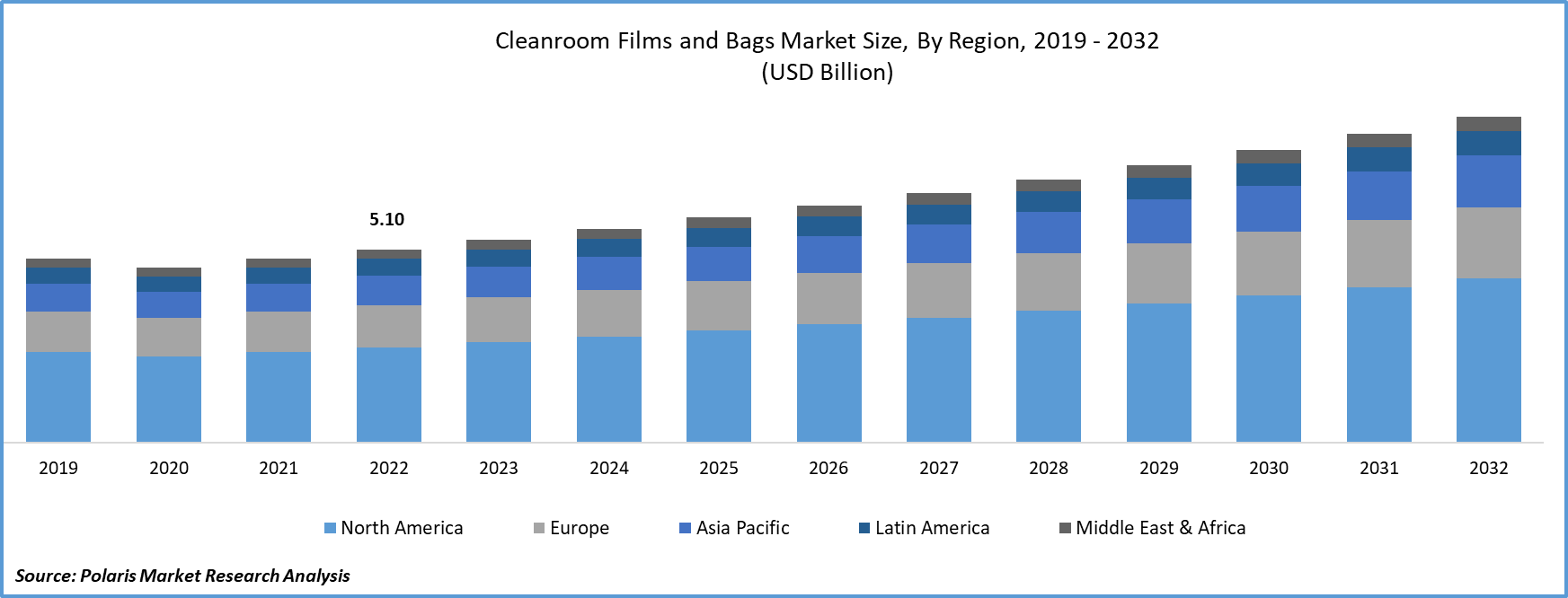

The global cleanroom films and bags market was valued at USD 5.10 billion in 2022 and is expected to grow at a CAGR of 5.4% during the forecast period.

The increasing focus on maintaining contamination-free conditions in various industries, particularly in sectors like pharmaceuticals and food & beverage, is driving the demand for cleanroom films and bags. Cleanroom environments are critical in these industries to ensure the production of safe, high-quality, and uncontaminated products. Cleanroom films and bags play a vital role in preserving the integrity of products by providing a protective barrier against dust, microbes, and other contaminants. In pharmaceutical manufacturing, where even a minor contamination can compromise the effectiveness and safety of medicines, cleanroom films and bags are used to store and transport pharmaceutical products under sterile conditions.

To Understand More About this Research: Request a Free Sample Report

Similarly, in the food & beverage industry, especially in sectors like food packaging and processing, maintaining hygiene and preventing contamination is paramount. Cleanroom films and bags are utilized to package perishable goods, ensuring they remain free from pollutants and microbes throughout the supply chain. This is particularly crucial in industries dealing with sensitive products, such as medical devices and electronic components, where the slightest contamination can result in product failure or health risks.

Modified Atmosphere Packaging (MAP) is a method that preserves the freshness of the food by regulating the mix of gases such as oxygen, CO2, & nitrogen within the packaging. By carefully controlling these gas proportions, MAP slows down the natural decay of food products, extending their shelf life considerably. The technology creates a controlled atmosphere that inhibits the growth of spoilage organisms and pathogens, maintaining the food's quality, texture, and nutritional value for a longer duration. This process is particularly vital in the food industry, ensuring that products remain fresh and safe for consumers.

The utilization of these advanced packaging technologies is crucial. These specialized packaging materials ensure a contaminant-free environment during the packaging process, guaranteeing the integrity and safety of the products. As a result, the combination of these technologies with cleanroom films and bags enables industries to deliver high-quality, long-lasting, and safe products to consumers, meeting the demands of modern markets.

In 2022, the U.S. Department of Commerce reported a milestone in the e-commerce sector, with retail sales reaching USD 1.03 trillion. As the e-commerce landscape continuously transforms, packaging needs are likely to change as well. Cleanroom films and bags manufacturers can stay ahead by proactively innovating, creating packaging solutions aligned with evolving trends and customer preferences in online retail.

For Specific Research Requirements: Request for Customized Report

The burgeoning e-commerce market presents a chance for these manufacturers to stand out by tailoring their offerings to meet the specific requirements of online retailers. By focusing on innovation, collaboration with online businesses, and developing protective and eco-friendly packaging solutions, companies can gain a competitive edge and enhance the overall shopping experience for consumers.

Industry Dynamics

Growth Drivers

- Expanding e-commerce industry

The fast-paced expansion of the e-commerce industry opens doors for manufacturers of cleanroom films and bags to meet the unique requirements of online retail enterprises. Businesses that innovate packaging solutions to safeguard products during shipping, minimize damage, and enhance unboxing experiences stand to gain a competitive edge in the e-commerce sector. Companies leverage e-commerce packaging not only for protection but also as a canvas to showcase branding elements and add personalized details that resonate with their customers.

Moreover, electronics industry, particularly the semiconductor and microelectronics sector, relies on cleanroom products to protect sensitive components from contamination. The growth of consumer electronics and the development of advanced technologies are driving the demand for cleanroom films and bags.

Report Segmentation

The market is primarily segmented based on product, material, end use, and region.

|

By Product |

By Material |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Films and bags segment accounted for the largest share in 2022

Films & bags segment held the largest share. This growth is primarily due to demand for cleanroom films & wraps is a result of their expanded use in vital sectors like pharmaceuticals, electronics, & healthcare. These industries prioritize maintaining sterility and managing airborne particles, making cleanroom bags essential. Regulations from organizations like the International Organization for Standardization (ISO) & the Food and Drug Administration (FDA) are propelling their adoption. FDA standards guarantee their safety and appropriateness for critical applications in healthcare and pharmaceutical sectors.

Pouches segment will grow at substantial pace. The demand for cleanroom pouches is soaring due to their diverse applications across different industries. For instance, electrostatic discharge pouches (ESD) play a crucial role in safeguarding sensitive electronic components from static electricity-induced damage.

By Material Analysis

- Plastic segment held the largest share over the forecast period

Plastic segment held the largest revenue share. This is attributed to the heightened use of plastic cleanroom films and bags in controlled settings like cleanrooms, where preserving a sterile and contamination-free atmosphere is paramount. The selection of plastics for producing these items is contingent on their characteristics, suitability for the cleanroom surroundings. Cleanroom wipes, crafted from specialized paper materials, are utilized for cleaning surfaces and equipment within cleanrooms. These wipes are engineered to minimize particle generation and are treated to align with cleanroom standards.

By End Use Analysis

- Pharmaceutical segment held the largest share over the forecast period

Pharmaceutical segment held the largest revenue share. These specialized materials are instrumental in packaging medications and medical devices, safeguarding them from contamination and ensuring their efficacy and safety. Additionally, cleanroom bags are essential for storing and transporting sensitive biological materials, tissues, samples, and cultures, demanding an environment entirely free from contaminants. This heightened demand within the pharmaceutical industry continues to propel the need for cleanroom films and bags.

Electronics segment will grow at substantial pace. Cleanroom films and bags play a crucial role in the electronics manufacturing sector, ensuring contamination control, protection, and precision are maintained at the highest standards. The growing demand for electronics products and substantial investments in the electronics industry are anticipated to drive the need for the product in the foreseeable future.

Regional Insights

- The demand in North America garnered the largest share in 2022

North America dominated the global cleanroom films and bags market. This growth is primarily due to the heightened production of branded drugs. This has led to a surge in demand for larger quantities of cleanroom packaging, essential for safeguarding drugs from external environmental factors.

Germany, with its prominent pharmaceutical and food processing sectors, is anticipated to have a significant demand for cleanroom films and bags. The country's food and beverage industries are making substantial investments in packaging to enhance product quality and attract consumers. The growing need for food packaging to extend product shelf life and ensure hygiene is expected to positively influence the industry's growth in the country.

Asia Pacific will grow at rapid pace. Growth is driven by demand for efficient packaging solutions that provide product protection, quality, tamper evidence, patient comfort, and security features. The emerging focus on social security and healthcare systems in the region is creating opportunities for pharmaceutical packaging providers. Additionally, the rising use of refillable syringes and parenteral vials for innovative injectable therapies will propel the region forward.

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- Tekni-Plex, Inc.

- AeroPackaging, Inc.

- Fruth Custom Packaging

- Pristine Clean Bags

- Nelipak Corporation

- PPC Cleanroom Films and Bags LLC

- Degage Corp.

- Plitek

- Production Automation Corporation

- VWR International, LLC.

- Origin Pharma Packaging

- Cleanroom World

- Arquimea

- SteriPackGroup

Recent Developments

- In June 2023, OLIVER has unveiled a new manufacturing facility specifically designed for cleanroom packaging, serving the medical and healthcare sectors.

- In March 2023, CFB Cleanroom Film and Bags has expanded its cleanroom packaging offerings in the market by introducing the Tyvek sterilizable packaging, targeting the healthcare sector.

- In February 2023, TekniPlex, presented samples from a variety of cyclic olefin copolymer (COC) diagnostics films. The differentiation factor lies in their clean-room production, particularly valuable in the healthcare sector.

Cleanroom Films and Bags Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5.36 billion |

|

Revenue forecast in 2032 |

USD 8.60 billion |

|

CAGR |

5.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Material, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |