Cleanroom Robots in Healthcare Market Size, Share, & Industry Analysis Report

: By Type (Traditional Industrial Robots and Collaborative Robots), By Component, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5690

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

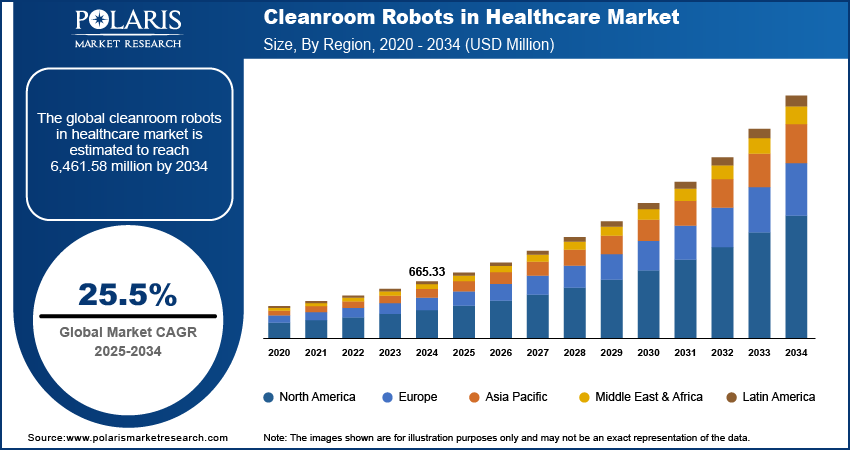

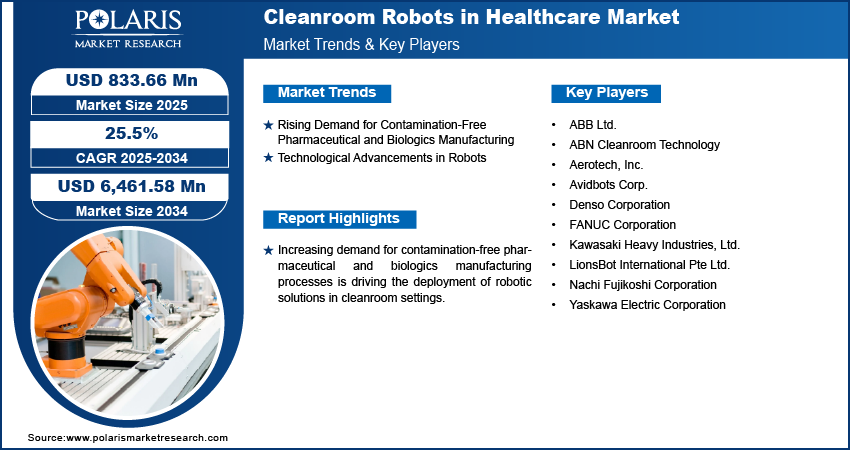

The global cleanroom robots in healthcare market size was valued at USD 665.33 million in 2024 and is expected to register a CAGR of 25.5% during 2025–2034. The cleanroom robots in healthcare market is expanding due to rising demand for contamination-free environments, advancements in robotic automation, and increased use in pharmaceutical manufacturing, biotechnology, and hospital sterile processing.

The cleanroom robots in healthcare are systems specifically engineered for operation within controlled cleanroom environments that meet stringent contamination and hygiene standards. These robots are utilized in pharmaceutical manufacturing, biotechnology labs, medical device production, and hospital settings to perform repetitive, precise, and contamination-sensitive tasks. Designed to comply with ISO cleanroom classifications, these robotic solutions reduce human intervention, enhance sterilization reliability, and minimize the risk of microbial contamination during critical healthcare processes such as drug compounding, aseptic packaging, and diagnostic services. The expanding prevalence of hospital-acquired infections (HAIs) and the associated need for strict infection control measures are encouraging healthcare facilities to adopt cleanroom-compatible robotic systems.

Growing shortage of skilled labor in critical sterile environments is increasing reliance on automated solutions to maintain operational continuity and product quality. Moreover, the rising adoption of modular cleanroom facilities and flexible robotic platforms in both the established and emerging healthcare industry is contributing to the overall growth.

Market Dynamics

Rising Demand for Contamination-Free Pharmaceutical and Biologics Manufacturing

Increasing demand for contamination-free pharmaceutical and biologics manufacturing processes is driving the deployment of robotic solutions in cleanroom settings. The pharmaceutical and biologics sectors require an exceptionally sterile environment to meet stringent quality and safety regulations, particularly for injectable and inhalable products. Even minimal contamination compromises product efficacy or poses serious health risks. Cleanroom robots, designed to operate under ISO-certified conditions, reduce human intervention, a primary source of contamination. These robots handle repetitive and critical tasks such as aseptic filling, sample transfer, and packaging in a highly controlled environment. The automation enhances process reliability and supports consistent production quality, aligning with GMP compliance. This shift is intensifying across high-throughput manufacturing setups, especially in biologics and personalized medicine development.

Technological Advancements in Robots

Technological advancements in sensor-based navigation, robotic arms, and AI integration are enabling higher precision and repeatability, thus fueling market penetration. Robots tailored for cleanroom applications are increasingly being integrated with advanced vision systems, haptic feedback, and real-time environmental monitoring. For instance, in September 2024, Pudu Robotics launched the PUDU MT1, an AI-powered robotic sweeper designed for large-scale environments such as home improvement stores and warehouses. Traditional cleaning methods are often labor-intensive and inefficient, but the PUDU MT1 utilizes advanced sensors, machine learning, and autonomous navigation to improve efficiency, reduce costs, and maintain high cleanliness standards. These features allow robots to adapt to dynamic conditions within the cleanroom, detect anomalies, and adjust movements without compromising sterility. AI algorithms further enhance operational intelligence by enabling predictive maintenance, workflow optimization, and autonomous decision-making. High-precision robotic arms offer micron-level accuracy, essential for sensitive applications such as micro-dosing or cell sorting. This convergence of robotics and AI boosts operational efficiency and expands the use cases of cleanroom robots across R&D, pharmaceutical filling lines, and sterile packaging, thereby accelerating the overall growth.

Segment Insights

Market Assessment by Type

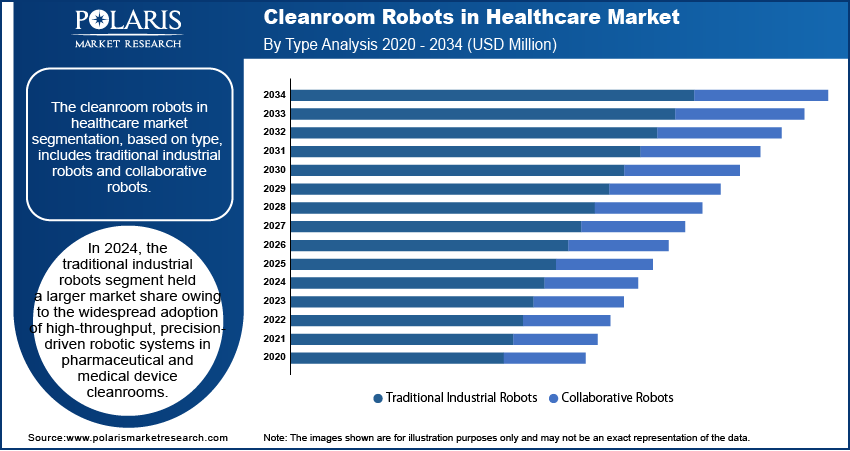

Market segmentation, based on type, includes traditional industrial robots and collaborative robots. In 2024, the traditional industrial robots segment held a larger share owing to the widespread adoption of high-throughput, precision-driven robotic systems in pharmaceutical, and medical device cleanrooms. Industrial robots are purpose-built for repetitive, high-speed, and contamination-sensitive environments, making them indispensable in large-scale manufacturing. The demand for consistent performance and strict adherence to cleanroom classifications such as ISO 5 and ISO 6 has reinforced the reliance on traditional industrial robots. These systems offer superior payload capacity, advanced motion control, and compatibility with HEPA filtration systems, making them ideal for various tasks such as aseptic filling, sterile packaging, and lab automation. Major pharmaceutical production facilities continue to expand automation to reduce operator-dependent contamination and maintain compliance with evolving GMP regulations.

Market Evaluation by End Use

Market segmentation, based on end use, includes hospitals & diagnostics, pharmaceuticals & medical devices, and others. The hospitals & diagnostics segment is expected to witness the highest CAGR during the forecast period due to increasing pressure to maintain contamination-free environments during diagnostic workflows and critical care interventions. Cleanroom robots are being deployed in laboratory diagnostics, pathology labs, and hospital-based sterile compounding units to eliminate manual handling errors and reduce exposure risks. Demand is surging for automated specimen handling, diagnostic test preparation, and medication packaging, particularly in high-volume hospitals and specialty diagnostic centers. The growing use of point-of-care diagnostic technologies, which demand high precision and sterility, further intensifies this trend. In addition, rising awareness around healthcare-associated infections (HAIs) and the push for advanced hospital automation are prompting strategic investments in cleanroom robotic solutions. Robots tailored for hospital settings increasingly come with compact footprints and collaborative features, allowing seamless integration into lab benches and isolation units without compromising cleanliness standards. This rapid adoption is transforming sterile diagnostics and procedural automation, thereby accelerating growth in the hospital and diagnostic sector.

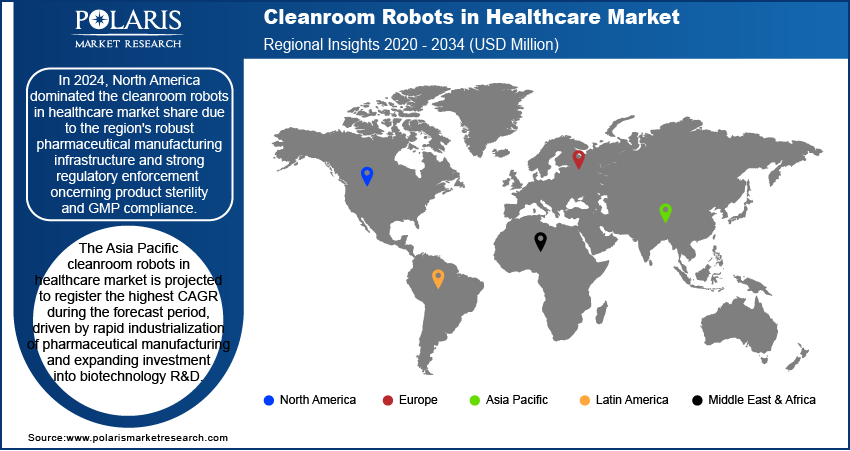

Regional Analysis

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America cleanroom robots in healthcare market held the largest share due to the region's robust pharmaceutical manufacturing infrastructure and strong regulatory enforcement concerning product sterility and GMP compliance. Major manufacturers across biologics, cell therapies, and sterile injectables have increased investments in robotic automation to reduce manual intervention and meet FDA-mandated quality requirements. For instance, in 2023, the US Food and Drug Administration emphasized increased inspections and enforcement of Good Manufacturing Practices (GMP) in pharmaceutical and biologics manufacturing, encouraging companies to adopt automation solutions such as cleanroom robotics to ensure compliance and sterility. The early adoption of Industry 4.0 practices across life sciences companies in the US supports integration of cleanroom robots into broader digital manufacturing systems. Furthermore, the presence of mature automation vendors and system integrators enables rapid deployment and customization of cleanroom robotics tailored to specific manufacturing or diagnostic workflows. Increased funding into high-precision, AI-enabled robots for advanced therapeutic applications and centralized labs further expands the scope of adoption. Moreover, healthcare institutions are accelerating automation initiatives to meet rising diagnostic demands and address labor shortages, strengthening the region’s dominance in the global cleanroom robotics landscape.

The Asia Pacific cleanroom robots in healthcare market is projected to register the highest CAGR during the forecast period, driven by rapid industrialization of pharmaceutical manufacturing and expanding investment into biotechnology R&D. Countries such as China, India, South Korea, and Japan are intensifying focus on automation to align with global GMP and PIC/S standards, especially in vaccine production, biosimilars, and sterile injectables. Regulatory bodies in the region are mandating stringent aseptic processing protocols, prompting manufacturers to integrate cleanroom robots that ensure minimal contamination risk and consistent batch quality. Local players are increasingly forming strategic partnerships with international automation firms, promoting technology transfer and cost-effective robotic implementation. Accelerated construction of high-capacity production facilities, particularly for APIs and biologics, further boosts demand for sterile, robotic-enabled environments. Additionally, growing demand for automated diagnostics in urban hospitals and pathology labs, combined with favorable government initiatives for smart healthcare infrastructure, is propelling regional acceleration.

Key Players & Competitive Analysis Report

The competitive landscape of the cleanroom robots in healthcare market is shaped by continuous innovation, strategic realignments, and increasing focus on specialized automation capabilities. Industry analysis indicates a surge in mergers and acquisitions aimed at enhancing robotic portfolios for sterile pharmaceutical and diagnostic applications. Key players are pursuing expansion strategies by leveraging joint ventures and strategic alliances with healthcare providers and automation technology firms to penetrate emerging markets and optimize deployment. Product launches featuring AI-integrated robotic arms, enhanced sensor suites, and mobile automation units underscore the emphasis on precision and contamination control.

Technology advancements are heavily concentrated on enabling real-time monitoring, compliance traceability, and cleanroom-compatible designs that support ISO-classified environments. Post-merger integration has focused on harmonizing control systems, software platforms, and global service networks to deliver scalable solutions tailored to aseptic operations. Cleanroom robots in healthcare are increasingly embedded within larger digital health ecosystems, enabling interoperability with laboratory information systems and smart diagnostics. Custom-engineered robotic modules for sterile compounding, specimen processing, and biomanufacturing are gaining traction, pushing competitors to differentiate through value-added features and vertical integration. The rising complexity of biologics manufacturing and automated lab diagnostics continues to redefine the competitive dynamics, with sustained investments driving innovation and long-term growth trajectories.

ABB operates as a technology company worldwide. The company operates through four segments: electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgears under the distribution solution subsegment. The Motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation cater to various energy and process industries and also offer measurement analytics, machine automation, and robotics.

ABN Cleanroom Technology is engaged in the design, construction, and commissioning of modular and pre-engineered cleanroom solutions for industries such as pharmaceuticals, life sciences, healthcare, automotive, and micro-electronics. The company specializes in delivering turnkey cleanroom projects that integrate Industry 4.0 connectivity, focusing on reducing total cost of ownership and maximizing energy efficiency through its patented VIX technology and ADAPTUS platform. Its product portfolio includes modular cleanrooms, ballroom and bespoke cleanroom configurations, and mobile solutions, all designed for flexibility, scalability, and rapid deployment. Services provided by ABN Cleanroom Technology encompass complete project planning, architectural and process engineering, procurement, construction management, commissioning, validation, and ongoing maintenance, as well as CGMP compliance and continuous monitoring. The company operates primarily in Europe, with headquarters in Munsterbilzen, Belgium, and additional offices in the Netherlands, serving clients across the continent and expanding into laboratory markets through its subsidiary, ABN Labs.

List of Key Companies in Cleanroom Robots in Healthcare Market

- ABB Ltd.

- ABN Cleanroom Technology

- Aerotech, Inc.

- Avidbots Corp.

- Denso Corporation

- FANUC Corporation

- Kawasaki Heavy Industries, Ltd.

- LionsBot International Pte Ltd.

- Nachi Fujikoshi Corporation

- Yaskawa Electric Corporation

Cleanroom Robots in Healthcare Industry Developments

In October 2024, Bigwave Robotics launched a Robot-as-a-Service (RaaS) model for healthcare, allowing hospitals to outsource nonclinical tasks such as delivery, guidance, and cleaning to service robots, all managed through a centralized system.

In October 2024, ABN Cleanroom Technology collaborated with POELS in advancing controlled environment solutions, highlighted by the HOSPIWALL circular wall system for healthcare. ABN’s acquisition of POELS NV strengthens its expertise in cleanroom wall and ceiling systems, enhancing its capabilities to meet rigorous industry standards.

Cleanroom Robots in Healthcare Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Traditional Industrial Robots

- Articulated Robots

- SCARA Robots

- Parallel Robots

- Cartesian Robots

- Collaborative Robots

By Component Outlook (Revenue, USD Million, 2020–2034)

- Robotic Arms

- End Effectors

- Drives

- Controllers

- Sensors

- Power Supply

- Motors

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals & Diagnostics

- Pharmaceuticals & Medical Devices

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cleanroom Robots in Healthcare Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 665.33 million |

|

Market Size Value in 2025 |

USD 833.66 million |

|

Revenue Forecast by 2034 |

USD 6,461.58 million |

|

CAGR |

25.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 665.33 million in 2024 and is projected to grow to USD 6,461.58 million by 2034.

The global market is projected to register a CAGR of 25.5% during the forecast period.

In 2024, the North America cleanroom robots in healthcare market held the largest share due to the region's robust pharmaceutical manufacturing infrastructure and strong regulatory enforcement concerning product sterility and GMP compliance.

A few of the key players in the market are ABB Ltd.; ABN Cleanroom Technology; Aerotech, Inc.; Avidbots Corp.; Denso Corporation; FANUC Corporation; Kawasaki Heavy Industries, Ltd.; LionsBot International Pte Ltd.; Nachi Fujikoshi Corporation; and Yaskawa Electric Corporation.

In 2024, the traditional industrial segment held a larger market share owing to the widespread adoption of high-throughput, precision-driven robotic systems in pharmaceutical and medical device cleanrooms.

The hospitals & diagnostics segment is expected to witness the highest CAGR during the forecast period due to increasing pressure to maintain contamination-free environments during diagnostic workflows and critical care interventions.