Cleanroom Technology Market Size, Share, Trends, Industry Analysis Report

: By Product (Consumables and Equipment), By Type, By End Use, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM2078

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

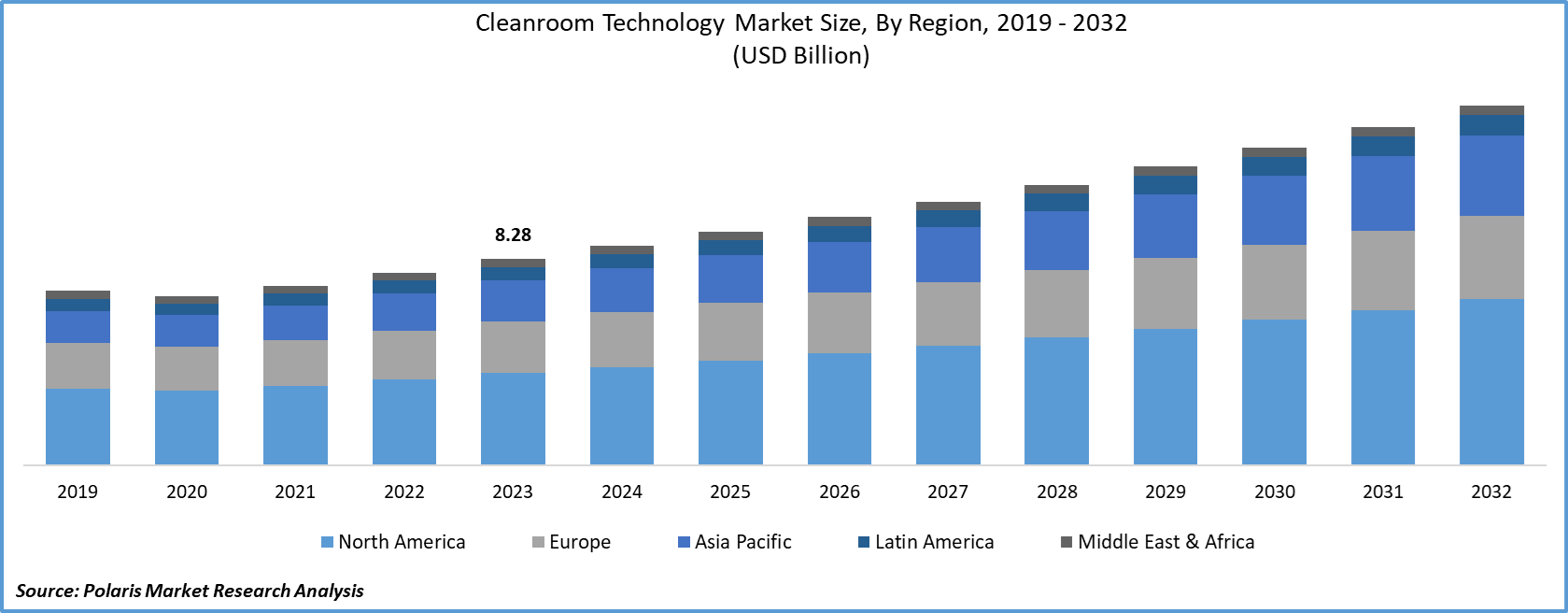

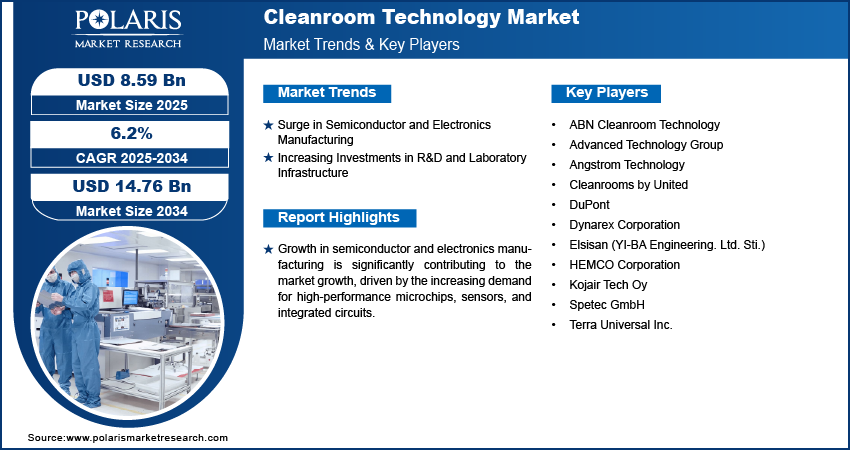

The global cleanroom technology market size was valued at USD 8.10 billion in 2024, growing at a CAGR of 6.2% during 2025–2034. The market growth is primarily fueled by the rising demand for biologics and personalized medicine, as well as technological advancements in cleanroom design.

Key Insights

- The consumables segment accounted for the largest market share in 2024. The segment’s leading market share is primarily attributed to the recurring and high-volume usage of consumables like wipes and gloves across cleanroom-dependent sectors.

- The biotechnology industry segment is projected to register the highest CAGR during the projection period. The expanding pipeline of cell and gene therapies and mRNA-based therapeutics contributes to the segment’s robust growth.

- North America accounted for the largest market share in 2024. The presence of an advanced healthcare infrastructure and stringent regulatory oversight contributes to the region’s leading market share.

- Asia Pacific is anticipated to witness the highest CAGR during the projection period. Rapid industrialization and growing investments in healthcare infrastructure drive market growth in the region.

Industry Dynamics

- The increased demand for high-performance sensors, microchips, and integrated circuits has led to increased adoption of cleanroom technology to meet strict ISO classifications.

- Growing investments in R&D and laboratory infrastructure, especially in emerging economies, are fueling the adoption of cleanroom technologies across various sectors such as material science and pharmaceuticals.

- The rising demand for portable and customizable cleanroom technologies is projected to provide several market opportunities in the coming years.

- High initial and ongoing costs may present challenges to market expansion.

Market Statistics

Market Size in 2024: USD 8.10 billion

2034 Market Projected Size: USD 14.76 billion

CAGR (2025-2034): 6.2%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The cleanroom technology market encompasses the design, development, and maintenance of controlled environments with low levels of pollutants such as dust, airborne microbes, aerosol particles, and chemical vapors. These cleanrooms are critical for processes requiring stringent contamination control, particularly in industries such as pharmaceuticals, biotechnology, semiconductor manufacturing, and medical devices. The market includes cleanroom equipment, consumables, and construction services used to maintain precise environmental parameters such as temperature, humidity, pressure, and particulate levels. Stringent regulatory compliance in pharmaceutical and biotechnology manufacturing, including GMP and FDA requirements, necessitates the use of cleanroom environments.

Rising demand for biologics and personalized medicine has accelerated the adoption of advanced contamination control systems in life sciences, thereby fueling cleanroom technology market growth. Additionally, technological advancements in cleanroom design, including modular cleanrooms and energy-efficient HVAC systems, are enhancing scalability and cost-efficiency, which is further contributing to the market growth.

Market Dynamics

Surge in Semiconductor and Electronics Manufacturing

Growth in semiconductor and electronics manufacturing is significantly contributing to the cleanroom technology market expansion, driven by the increasing demand for high-performance microchips, sensors, and integrated circuits. For instance, as reported by the Semiconductor Industry Association, global semiconductor sales reached USD 627.6 billion in 2024, marking a robust increase of 19.1% over the USD 526.8 billion recorded in 2023. The precision required in nanomaterials and microelectronics assembly necessitates ultra-clean environments that minimize particulate contamination and electrostatic interference. Cleanrooms in this sector must meet strict ISO classifications to ensure process stability and yield optimization. The evolution of technologies such as advanced packaging, EUV lithography, and MEMS fabrication further elevates the requirements for contamination control. This demand has prompted semiconductor fabs and electronics manufacturers to invest heavily in modular and customizable cleanroom solutions. As miniaturization and chip complexity advance, the need for cleanrooms with enhanced airflow control and environmental monitoring is accelerating market expansion.

Increasing Investments in R&D and Laboratory Infrastructure

Increasing investments in R&D and laboratory infrastructure, particularly in emerging economies, boost the demand for cleanroom technologies across multiple sectors, including pharmaceuticals, life sciences, and material science. In June 2023, the US Department of Commerce’s National Institute of Standards and Technology (NIST) announced a USD 50 million investment under the CHIPS and Science Act to expand semiconductor research infrastructure. Moreover, national initiatives to promote innovation and local drug development have led to substantial funding for state-of-the-art laboratories and pilot manufacturing facilities. These facilities require strict environmental control to ensure the integrity of experimental data and compliance with global quality standards. Universities, research parks, and CRO services are adopting scalable, modular cleanroom systems to support a wide range of research applications. This trend is further reinforced by the growing focus on pandemic preparedness, vaccine development, and next-generation biologics research, all of which rely on contamination-free environments. As a result, capital flows into cleanroom infrastructure are directly contributing to market growth on a global scale.

Segment Insights

Market Assessment by Product

The global market segmentation, based on product, includes consumables and equipment. In 2024, the consumables segment accounted for a larger market share due to the recurring and high-volume usage of gloves, garments, wipes, disinfectants, and face masks across cleanroom-dependent sectors. These items are critical in maintaining particulate-free environments and ensuring regulatory compliance during every operational cycle. The demand surge is especially pronounced in sterile pharmaceutical production and aseptic processing, where single-use, contamination-sensitive protocols dominate. Additionally, increasing focus on GMP validation and quality assurance protocols is reinforcing reliance on standardized consumables, thereby supporting consistent market growth across both developed and emerging manufacturing hubs.

The equipment segment is projected to witness a higher CAGR during the forecast period due to the rising deployment of modular cleanrooms, laminar airflow systems, HVAC units, and air showers tailored for scalable manufacturing environments. Increasing technological integration, such as automated environmental monitoring, IoT-enabled airflow systems, and HEPA filtration, enhances operational efficiency while meeting evolving regulatory standards. High-value sectors such as semiconductor fabrication, gene therapy labs, and vaccine manufacturing facilities are adopting advanced cleanroom equipment to reduce contamination risk and downtime. These capital-intensive upgrades are driving long-term investments, further propelling the equipment segment growth.

Market Evaluation by End Use

The global market segmentation, based on end use, includes pharmaceutical industry, medical device industry, biotechnology industry, hospitals and diagnostic centers, and others. In 2024, the pharmaceutical industry segment accounted for the largest share due to its stringent contamination control requirements for sterile drug production, parenteral formulations, and quality-controlled R&D environments. Heightened regulatory scrutiny from agencies such as the FDA and EMA necessitates validated cleanroom conditions aligned with GMP, fueling extensive use of both consumables and engineered systems. Accelerated production of generics, biosimilars, and novel biologics is increasing the density of cleanroom infrastructure within pharma manufacturing workflows, substantially contributing to the demand for cleanroom technologies.

The biotechnology industry segment is expected to register the highest CAGR during the forecast period, driven by the expanding pipeline of cell and gene therapies, tissue engineering solutions, and mRNA-based therapeutics. These biologics require highly controlled and sterile environments throughout their development and scale-up processes. Innovation in bioprocessing, coupled with an increasing number of clinical trials and personalized medicine platforms, is generating the need for adaptable, modular cleanroom systems. Research institutions and bio manufacturers are making significant investments in contamination prevention and process integrity, accelerating cleanroom technology market growth in the biotech sector.

Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest market share due to the region’s advanced healthcare infrastructure, stringent regulatory oversight, and high concentration of pharmaceutical and biotechnology manufacturers. The presence of well-established players in drug development, biologics production, and medical device manufacturing has led to consistent demand for state-of-the-art contamination control environments. Regulatory frameworks enforced by agencies such as the FDA and USP emphasize strict adherence to aseptic processing and GMP standards, driving widespread cleanroom adoption. Furthermore, sustained investments in life sciences R&D and early adoption of advanced cleanroom equipment and consumables significantly contribute to the North America cleanroom technology market development.

The Asia Pacific market is projected to experience the highest CAGR during the forecast period due to rapid industrialization, increasing pharmaceutical and semiconductor production, and rising investments in healthcare infrastructure. Government-backed initiatives promoting domestic drug manufacturing and clinical trials particularly in China, India, and Southeast Asia are accelerating cleanroom installations across both public and private sectors. In July 2023, the Indian Ministry of Chemicals and Fertilizers launched the Pharma Vision 2047 initiative, aiming to boost domestic drug production. The plan includes setting up over 500 new pharmaceutical units, many requiring ISO-certified cleanrooms. The surge in demand for cost-effective biosimilar, generics, and advanced electronics is also fueling cleanroom integration. Local manufacturers are expanding cleanroom capacity to comply with global quality standards, directly driving the Asia Pacific cleanroom technology market expansion. Additionally, growing foreign direct investments and rising number of contract manufacturing organizations (CMOs) are further amplifying regional momentum.

Key Players and Competitive Analysis

The competitive landscape of the market is shaped by aggressive market expansion strategies, continuous technology advancements, and a growing focus on product innovation. Industry analysis indicates a surge in strategic alliances and joint ventures as companies aim to strengthen their global footprint and access emerging markets with high demand for contamination-controlled environments. Mergers and acquisitions are also prevalent, enabling firms to consolidate their product portfolios and enhance their technological capabilities, particularly in HVAC systems, modular cleanroom construction, and high-efficiency filtration systems.

Post-merger integration is increasingly centered on streamlining operational efficiency and maximizing synergies across manufacturing and R&D facilities. Recent product launches emphasize energy efficiency, real-time environmental monitoring, and modular scalability key differentiators in a competitive landscape. The market is also witnessing strong competition in consumables, where value-added features such as anti-static properties and enhanced durability are driving procurement decisions. Investments in automation, IoT integration, and smart cleanroom solutions reflect the industry’s transition toward digital transformation. Players are leveraging regional manufacturing hubs and local partnerships to reduce cost and enhance supply chain agility.

ABN Cleanroom Technology is engaged in the design, construction, and commissioning of modular and pre-engineered cleanroom solutions for industries such as pharmaceuticals, life sciences, healthcare, automotive, and micro-electronics. The company specializes in delivering turnkey cleanroom projects that integrate Industry 4.0 connectivity, focusing on reducing total cost of ownership and maximizing energy efficiency through its patented VIX technology and ADAPTUS platform. Its product portfolio includes modular cleanrooms, ballroom and bespoke cleanroom configurations, and mobile solutions, all designed for flexibility, scalability, and rapid deployment. Services provided by ABN Cleanroom Technology encompass complete project planning, architectural and process engineering, procurement, construction management, commissioning, validation, and ongoing maintenance, as well as CGMP compliance and continuous monitoring. The company operates primarily in Europe, with headquarters in Munsterbilzen, Belgium, and additional offices in the Netherlands, serving clients across the continent and expanding into laboratory markets through its subsidiary, ABN Labs.

Advanced Technology Group (ATG) is engaged in providing cleanroom construction services for a wide range of operations, from small-scale manufacturing to large semiconductor plants and pharmaceutical facilities. The company specializes in the construction of cleanrooms that meet precise standards, including Class 1–10,000 cleanrooms and cGMP-compliant spaces, serving industries such as microelectronics, semiconductor, biotechnology, healthcare, and telecommunications. ATG’s product portfolio includes proprietary cleanroom construction techniques, interstitial support grids, cleanroom ceiling and wall systems, gasketed and gel grid systems, walkable panels, architectural envelopes, automated material handling systems, and raised access floors. Services offered include design-assist, value engineering, BIM and VDC support, and comprehensive project management, ensuring collaboration and quality throughout all phases of development and construction. ATG operates primarily in the Us, and delivers cost-effective, high-quality cleanroom projects tailored to client requirements.

List of Key Companies in Cleanroom Technology Market

- ABN Cleanroom Technology

- Advanced Technology Group

- Angstrom Technology

- Cleanrooms by United

- DuPont

- Dynarex Corporation

- Elsisan (YI-BA Engineering. Ltd. Sti.)

- HEMCO Corporation

- Kojair Tech Oy

- Spetec GmbH

- Terra Universal Inc.

Cleanroom Technology Industry Developments

In April 2024, AES Clean Technology launched its CleanLock Module, a groundbreaking solution designed to enhance cleanliness and operational efficiency in controlled environments. This innovative module implements advanced technologies and methodologies that elevate cleanroom standards, ensuring superior contamination control and streamlined processes essential for high-stakes industries.

In October 2023, Angstrom Technology launched its new Life Sciences Division, aiming to enhance its technical service offerings. This strategic expansion is to deliver a superior range of options and maintain the highest standards of quality in the field.

Cleanroom Technology Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Consumables

- Gloves

- Wipes

- Disinfectants

- Apparels

- Cleaning Products

- Equipment

- Heating Ventilation and Air Conditioning System (HVAC)

- Cleanroom Air Filters

- Air Shower and Diffuser

- Laminar Airflow Unit

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Softwall Cleanroom

- Hardwall Cleanroom

- Rigidwall Cleanroom

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Pharmaceutical Industry

- Medical Device Industry

- Biotechnology Industry

- Hospitals and Diagnostic Centers

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cleanroom Technology Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.10 billion |

|

Market Size Value in 2025 |

USD 8.59 billion |

|

Revenue Forecast in 2034 |

USD 14.76 billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.10 billion in 2024 and is projected to grow to USD 14.76 billion by 2034.

The global market is projected to register a CAGR of 6.2% during the forecast period.

In 2024, North America held the largest market share due to the region’s advanced healthcare infrastructure, stringent regulatory oversight, and high concentration of pharmaceutical and biotechnology manufacturers.

A few of the key players in the market are ABN Cleanroom Technology, Advanced Technology Group, Angstrom Technology, Cleanrooms by United, DuPont, Dynarex Corporation, Elsisan (YI-BA Engineering. Ltd. Sti.), HEMCO Corporation, Kojair Tech Oy, Spetec GmbH, and Terra Universal Inc.

In 2024, the consumables segment accounted for a larger market share due to the recurring and high-volume usage of gloves, garments, wipes, disinfectants, and face masks across cleanroom-dependent sectors.

In 2024, the pharmaceutical industry segment accounted for the largest share due to its stringent contamination control requirements for sterile drug production, parenteral formulations, and quality-controlled R&D environments.