Clinical Oncology Next Generation Sequencing Market Size, Share, Trends, Industry Analysis Report

By Technology (Whole Genome Sequencing, Whole Exome Sequencing), By Workflow, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5960

- Base Year: 2024

- Historical Data: 2020-2023

Overview

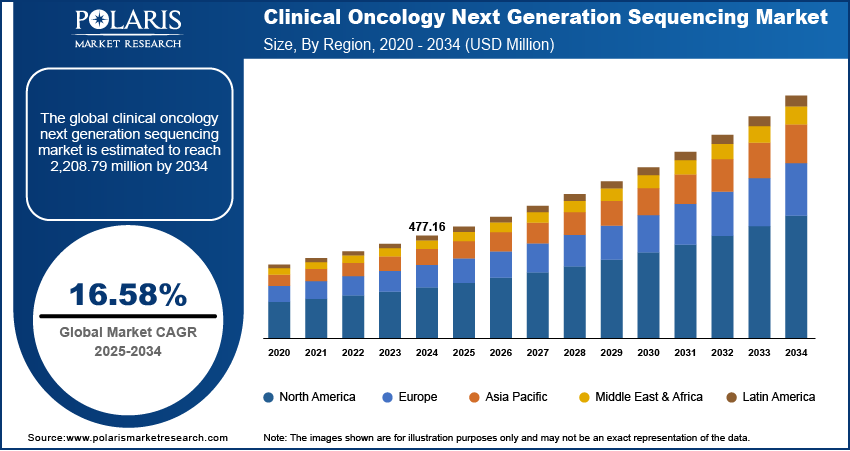

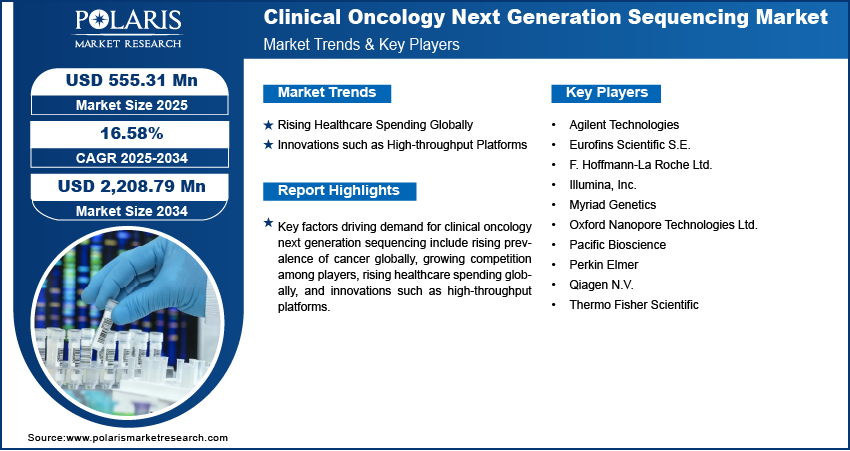

The global clinical oncology next generation sequencing (NGS) market size was valued at USD 477.16 million in 2024, growing at a CAGR of 16.58% from 2025 to 2034. Key factors driving demand for clinical oncology next generation sequencing include rising prevalence of cancer globally, growing competition among players, rising healthcare spending globally, and innovations such as high-throughput platforms.

Key Insight

- The targeted sequencing & resequencing segment accounted for 64.93% of market revenue share in 2024.

- The sequencing segment held 57.03% of market revenue share in 2024.

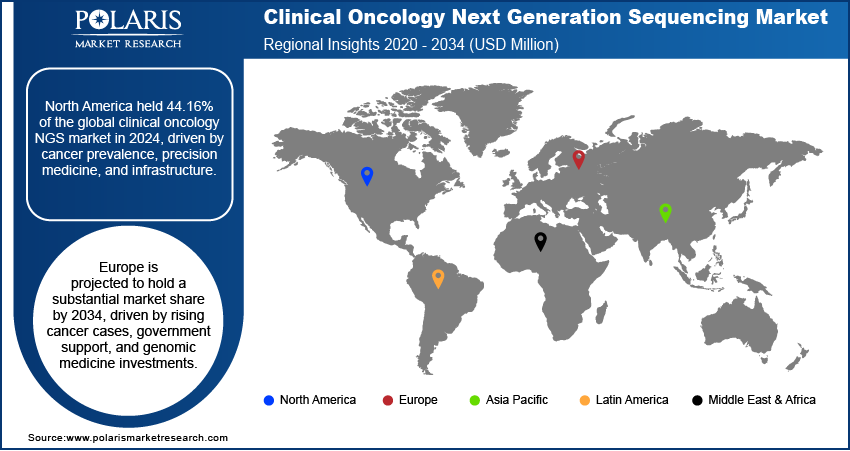

- North America accounted for 44.16% share of the global clinical oncology next generation sequencing market in 2024.

- The U.S. held 67.79% of revenue share in North America clinical oncology next generation sequencing landscape in 2024.

- The clinical oncology next generation sequencing landscape in Asia Pacific is expected to witness the highest CAGR during the forecast period.

- Countries such as China, Japan, and South Korea are leading with government-backed precision medicine programs.

Clinical oncology next-generation sequencing (NGS) is a transformative technology that enables the comprehensive analysis of cancer genomes by sequencing thousands of DNA molecules in parallel, providing both qualitative and quantitative data at high speed and throughput. A few main clinical applications of NGS in oncology include tumor profiling to identify actionable mutations, liquid biopsy for minimally invasive detection and real-time monitoring of tumor dynamics, companion diagnostics to match patients with targeted therapies, and minimal residual disease monitoring to track treatment response and disease recurrence.

The rising prevalence of cancer globally is driving the market growth. World Health Organization, in its report, stated that over 35 million new cancer cases are predicted by 2050, a 77% increase from the estimated 20 million cases in 2022. This rising incidence of cancer is creating pressure on clinicians to require advanced genomic profiling to identify targetable mutations and guide therapy decisions, which is encouraging the adoption of next-generation sequencing. The growing cancer burden is also fueling research into novel cancer biomarkers and drug development, further expanding the use of next-generation sequencing in clinical oncology.

To Understand More About this Research: Request a Free Sample Report

The clinical oncology NGS market demand is driven by the growing competition among players. Competitors in the market are investing in advanced NGS technologies to enhance precision medicine capabilities, enabling faster, more comprehensive genomic profiling of oncology. Major players in the market are also adopting next-generation sequencing technology to stay ahead by offering personalized treatment options that improve patient outcomes. Additionally, competition is fueling the development of targeted therapies and companion diagnostics for oncology, further increasing reliance on NGS for biomarker discovery and therapy selection.

Industry Dynamics

- Rising healthcare spending globally is propelling the market growth by expanding affordability, innovation, and clinical utility of next-generation sequencing.

- Innovations such as high-throughput platforms are also driving the adoption of next-generation technology, encouraging oncologists to utilize it for precision diagnostics, biomarker discovery, and therapy selection.

- Strategic collaborations are expected to create lucrative opportunities in the industry during the forecast period.

- The complexity of data analysis and interpretation hinder the demand for next generation sequencing technology in clinical oncology.

Rising Healthcare Spending Globally:

Increasing healthcare budgets are enabling healthcare facilities, such as hospitals and clinics, to adopt advanced technologies for oncology diagnostics, making NGS more accessible to a broader patient population. The American Medical Association, in its article, stated that health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion. Additionally, higher spending supports research and development, accelerating the discovery of new biomarkers and targeted therapies that rely on next-generation sequencing. The growing healthcare expenditures further fuel the adoption of NGS in oncology by expanding affordability, innovation, and clinical utility.

Innovations such as High-throughput Platforms:

Advanced platforms enable labs to process multiple tumor samples simultaneously, reducing turnaround times and making large-scale cancer genomic profiling feasible for routine clinical use. The ability of these platforms to sequence more genes at lower costs is encouraging oncologists to adopt NGS for precision diagnostics, biomarker discovery, and therapy selection. Additionally, high-throughput technologies enhance the detection of rare mutations and complex genomic alterations, improving treatment personalization and patient outcomes. Therefore, as high-throughput platforms streamline workflows and enhance data quality, hospitals and research institutions increasingly integrate NGS into standard oncology practice, driving broader adoption across healthcare systems.

Segmental Insights

Technology Analysis

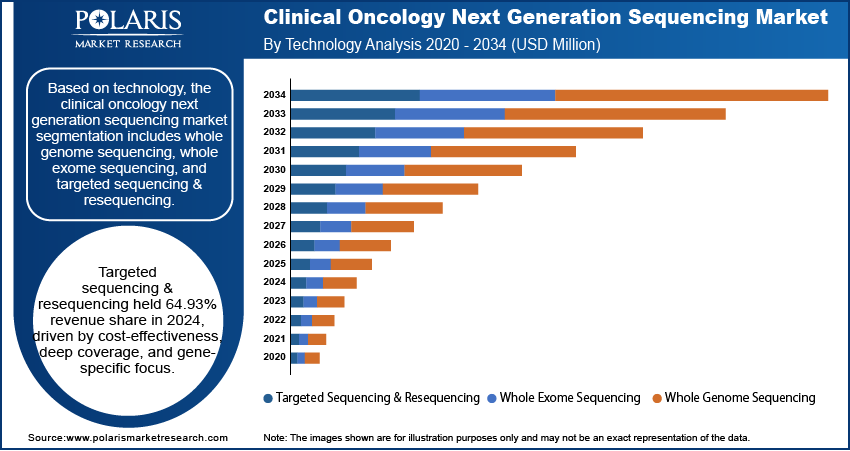

Based on technology, the segmentation includes whole genome sequencing, whole exome sequencing, and targeted sequencing & resequencing. The targeted sequencing & resequencing segment accounted for 64.93% of revenue market share in 2024 due to its cost-effectiveness, high depth of coverage, and ability to focus on specific genes or genomic regions. Targeted sequencing enables faster turnaround times and reduces data complexity compared to broader sequencing methods, making it ideal for routine clinical use and companion diagnostics. The widespread availability of cancer-specific gene panels and the increasing integration of precision medicine into oncology workflows further contributed to the dominance of targeted sequencing. Pharmaceutical companies also leveraged this technology to stratify patients in clinical trials, boosting its adoption.

Workflow Analysis

In terms of workflow, the segmentation includes pre-sequencing, sequencing, and data analysis. The sequencing segment held a 57.03% revenue share in 2024, due to a surge in demand for high-throughput, accurate, and cost-efficient platforms capable of analyzing cancer genomes with increased precision. Clinical laboratories and oncology centers adopted advanced sequencing instruments to enable faster turnaround times and scalable workflows for both research and diagnostic applications. The proliferation of cancer and the increasing use of liquid biopsy-based testing further drove demand for sequencing technologies. Companies also expanded their sequencing platform portfolios and optimized throughput to support rising clinical volumes, strengthening the segment’s leadership position.

Application Analysis

In terms of application, the segmentation includes screening, companion diagnostics, and other. The companion diagnostics segment led the market in 2024 by capturing 71.83% revenue share. This dominance is attributed to the rising number of FDA-approved cancer drugs with associated genetic biomarkers. This segment also gained momentum due to the growing adoption of personalized medicine in oncology, where treatment decisions depend on the identification of specific genetic mutations such as EGFR, ALK, BRAF, and KRAS. Collaborations between diagnostic developers and biopharmaceutical firms further accelerated the deployment of next-generation sequencing for companion diagnostics across clinical settings.

End Use Analysis

In terms of end use, the segmentation includes hospitals, clinics, and laboratories. The clinics segment is projected to register a CAGR of 19.21% in the coming years, owing to the shift toward decentralized testing and point-of-care diagnostics. Advances in portable and automated sequencing systems are reducing reliance on centralized labs, making NGS feasible even in smaller clinical settings. The growing emphasis on early cancer detection and preventive genomics is also positioning clinics as key adopters, especially those offering hereditary cancer risk assessments and liquid biopsy-based monitoring.

Regional Analysis

The North America clinical oncology next generation sequencing market accounted for a 44.16% share of the global market in 2024. This dominance is attributed to the high prevalence of cancer, advanced healthcare infrastructure, and strong adoption of precision medicine. Government initiatives, such as the Cancer Moonshot Program in the U.S., along with significant investments in genomic research, accelerated NGS integration, contributing to market dominance. Additionally, the presence of major NGS providers such as Illumina, Thermo Fisher, and collaborations between academic institutions and biotech firms propelled growth of the regional market. Insurance coverage for NGS-based testing and rising demand for personalized cancer therapies also contributed to industry expansion in the region.

U.S. Clinical Oncology Next Generation Sequencing Market Insight

The U.S. held 67.79% of revenue share in North America clinical oncology next generation sequencing landscape in 2024 due to a robust healthcare system, high cancer incidence rates, and early adoption of genomic technologies. The growing emphasis on companion diagnostics and liquid biopsies for early cancer detection, along with strong R&D investments from pharmaceutical companies, further drove market growth. Additionally, patient advocacy groups and precision oncology initiatives propelled the adoption of next-generation sequencing technology in clinical oncology.

Europe Clinical Oncology Next Generation Sequencing Market Trends

The market in Europe is projected to hold a substantial share in 2034, owing to increasing cancer cases, supportive government policies, and rising investments in genomic medicine. The European Union’s Horizon Europe program and national genomic initiatives are promoting large-scale sequencing projects, leading to industry growth. Standardization of NGS testing through ESMO (European Society for Medical Oncology) guidelines and the growing use of multigene panels for therapy selection are also contributing to the adoption of NGS in clinical oncology.

Germany Clinical Oncology Next Generation Sequencing Market Overview

Germany is a key region in Europe’s clinical oncology NGS landscape, driven by its strong research ecosystem, high healthcare expenditure, and well-established diagnostic infrastructure. The country’s National Decade Against Cancer initiative prioritizes precision oncology, promoting the adoption of next-generation sequencing. Major cancer centers and universities in the country are collaborating with biotech firms to advance NGS applications. Additionally, Germany’s favorable reimbursement landscape for molecular diagnostics and increasing use of tumor profiling for targeted therapies support market growth.

Asia Pacific Clinical Oncology Next Generation Sequencing Market Analysis

The market in Asia Pacific is expected to register the highest CAGR during the forecast period, owing to the rising cancer burden, improving healthcare access, and increasing investments in genomics. Countries such as China, Japan, and South Korea are leading with government-backed precision medicine programs. The expansion of liquid biopsy use, cost-effective NGS solutions, and partnerships with global NGS providers are driving the industry growth in the region.

Key Players and Competitive Analysis

The field of clinical oncology next-generation sequencing (NGS) is highly competitive, driven by the increasing demand for precision medicine and personalized cancer diagnostics. Key players such as Illumina, Inc. and Thermo Fisher Scientific dominate the industry with their high-throughput sequencing platforms. These companies dominate due to their extensive reagent portfolios, robust bioinformatics pipelines, and strong partnerships with academic and clinical institutions. F. Hoffmann-La Roche Ltd. also holds a significant position, leveraging its acquisition of Foundation Medicine to offer comprehensive genomic profiling (CGP) tests, such as FoundationOne CDx, which is FDA-approved for multiple cancer biomarkers. The industry is further shaped by increasing FDA approvals for NGS-based companion diagnostics, reimbursement challenges, and the growing use of liquid biopsies for non-invasive cancer monitoring. Companies are further investing in AI-driven data analysis and multi-omics integration to maintain a competitive edge.

A few major companies operating in the clinical oncology next generation sequencing industry include Agilent Technologies; Eurofins Scientific S.E.; F. Hoffmann-La Roche Ltd.; Illumina, Inc.; Myriad Genetics; Oxford Nanopore Technologies Ltd.; Pacific Bioscience; Perkin Elmer; Qiagen N.V.; and Thermo Fisher Scientific.

Key Players

- Agilent Technologies

- Eurofins Scientific S.E.

- F. Hoffmann-La Roche Ltd.

- Illumina, Inc.

- Myriad Genetics

- Oxford Nanopore Technologies Ltd.

- Pacific Bioscience

- Perkin Elmer

- Qiagen N.V.

- Thermo Fisher Scientific

Industry Developments

February 2025: Roche unveiled its sequencing by expansion (SBX) technology for decoding complex diseases such as cancer, immune disorders, and neurodegenerative conditions.

August 2024: Illumina Inc., a global company in DNA sequencing and array-based technologies, announced its oncology menu for NovaSeq X Series customers, which will enable labs to confidently expand oncology testing research of tissue and liquid biopsy samples.

Clinical Oncology Next Generation Sequencing Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

By Workflow Outlook (Revenue, USD Million, 2020–2034)

- Pre-Sequencing

- Sequencing

- Data Analysis

By Application Outlook (Revenue, USD Million, 2020–2034)

- Screening

- Sporadic Cancer

- Inherited Cancer

- Companion Diagnostics

- Other

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Clinics

- Laboratories

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Clinical Oncology Next Generation Sequencing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 477.16 Million |

|

Market Size in 2025 |

USD 555.31 Million |

|

Revenue Forecast by 2034 |

USD 2,208.79 Million |

|

CAGR |

16.58% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 477.16 million in 2024 and is projected to grow to USD 2,208.79 million by 2034.

The global market is projected to register a CAGR of 16.58% during the forecast period.

North America dominated the market in 2024, holding 44.16% share.

A few of the key players in the market are Agilent Technologies; Eurofins Scientific S.E.; F. Hoffmann-La Roche Ltd.; Illumina, Inc.; Myriad Genetics; Oxford Nanopore Technologies Ltd.; Pacific Bioscience; Perkin Elmer; Qiagen N.V.; and Thermo Fisher Scientific.

The targeted sequencing & resequencing segment dominated the market in 2024.

The clinics segment is expected to witness the fastest growth during the forecast period.