Cloud Native Application Market Share, Size, Trends, Industry Analysis Report

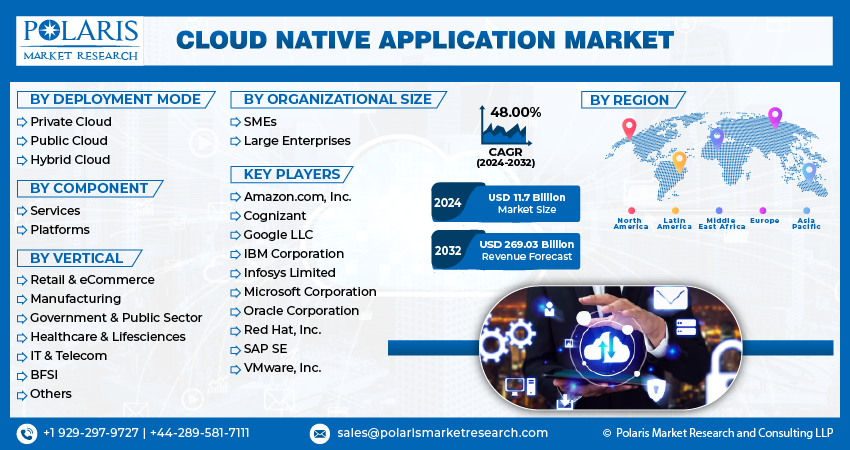

By Deployment mode (Private Cloud, Public Cloud, Hybrid Cloud); By Component; By Vertical; By Organizational Size; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3957

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

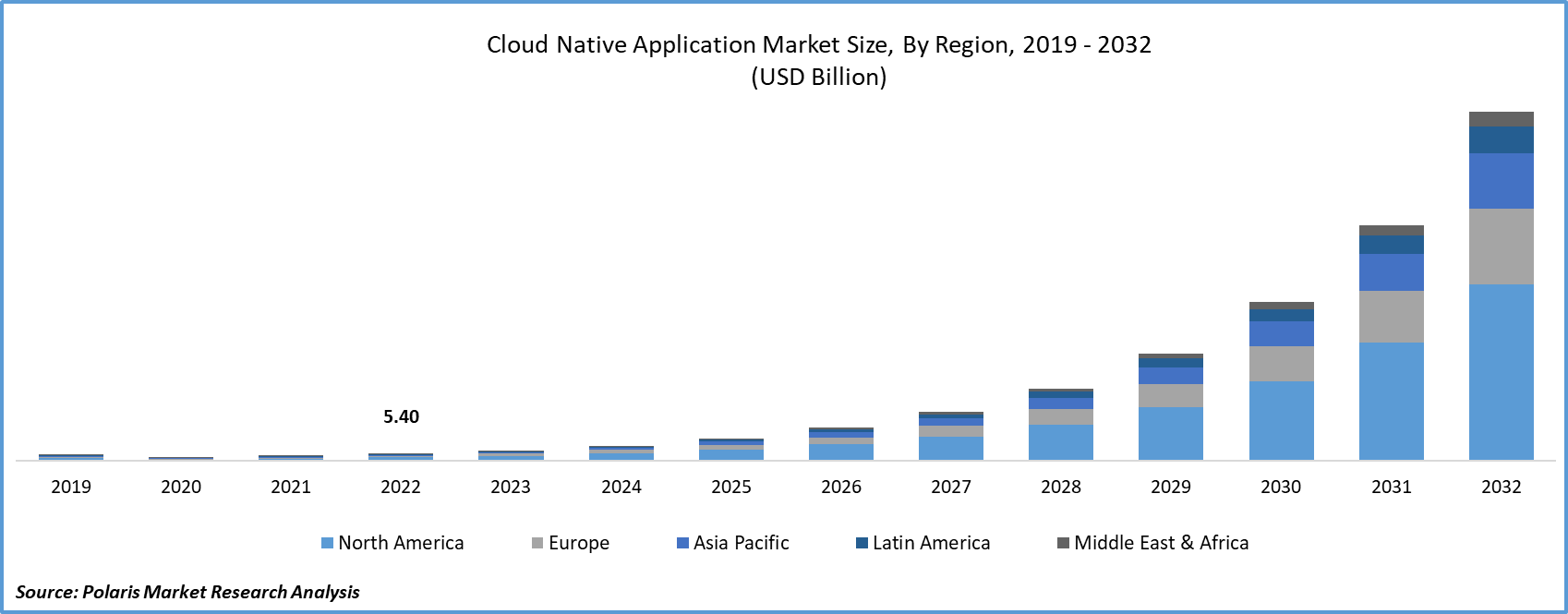

The global cloud native application market size and share was valued at USD 7.95 billion in 2023 and is expected to grow at a CAGR of 48.00% during the forecast period.

The concept of "cloud-native" refers to the development and management of applications that leverage the distributed computing resources provided by the cloud delivery model. Cloud-native applications are purpose-built to take full advantage of the cloud's scalability, reliability, and adaptability. This approach streamlines the process of bringing innovative ideas to the market, thanks to the inherent features of cloud-native applications. Users require responsive performance, uninterrupted operation, cloud-native methods for application management, and access to cutting-edge features. This underscores the fundamental role of the cloud in driving strategic transformations that enhance the speed of business operations.

The cloud-native application architecture unites software components used by development teams to develop and deploy scalable cloud-native applications. The main technological blocks of a cloud-native application architecture are immutable infrastructure, microservices, declarative APIs, service meshes, and containers. Microservices are small, independent software components that act as complete cloud-native software, with API being the method used by computers to exchange information. The service mesh in cloud native applications acts as a software layer that supports communication between various microservices.

Cloud native solutions offered by cloud native application market key players can help businesses gain a competitive advantage in several ways. They can improve efficiency by enabling developers to use automated tools and cloud services to develop scalable applications rapidly. Also, they can reduce costs by eliminating the need for companies to make huge investments in the development and maintenance of costly physical infrastructure. Furthermore, cloud-native technology allows firms to build highly available applications. The growing cloud-native development worldwide is projected to spur the demand for cloud native applications over the forecast period.

To Understand More About this Research: Request a Free Sample Report

Many large enterprises are actively constructing highly scalable cloud-native platforms. In today's business landscape, most companies are seamlessly integrating cutting-edge innovations such as machine learning, artificial intelligence, and big data analytics into their daily operations.

The adoption of cloud-native applications has become imperative for enterprises seeking to design and operate applications across public, private, and hybrid clouds at scale. This is in response to the increasing demand for cloud computing and the surging volume of cloud-related traffic. Consequently, businesses must adapt their approaches to application design, development, and utilization to thrive in rapidly evolving, software-centric markets. The process of building, deploying, and enhancing applications using well-established cloud computing techniques and technologies is commonly referred to as "cloud-native application development." These applications are purpose-built for cloud computing architectures.

Cloud-native applications frequently leverage open-source and standards-based technology for enhanced interoperability and workload portability. This approach helps mitigate vendor lock-in, and fosters increased application portability. Furthermore, cloud-native applications offer a range of benefits, including the ability to construct and manage applications, facilitating separate deployment independently. Their resilient architecture ensures they can withstand infrastructure outages and remain online. All of these advantages stem from the interoperability and workload portability inherent in cloud-native applications.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Cloud Native Application Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Industry Dynamics

Growth Drivers

- Cloud-native development across the Globe will Facilitate Market Growth

The cloud-native model empowers enterprises to introduce new features for immediate customer usage swiftly. According to an IBM survey, 73% of development executives, IT leaders, and developers have reported that this model has led to faster development and deployment. The cloud-native approach, with its emphasis on efficiency and flexibility, directly catalyzes and accelerates business expansion. On a global scale, enterprises can readily scale their resources to meet user demands and reach a broader audience. Leveraging this cloud platform enables companies to remain highly responsive and relevant with their application updates. This continuous integration and continuous deployment (CI/CD) approach, coupled with self-service options, has gained favor among customers, making them more inclined to purchase and utilize the app while sharing their experiences, as seen in recent trends.

Report Segmentation

The market is primarily segmented based on component, deployment mode, vertical organizational size, and region.

|

By Deployment mode |

By Component |

By Vertical |

By Organizational Size |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

- The Platforms segment held the largest revenue share in 2022

A cloud-native platform is developed, optimized, and operated only in the cloud. Since the platform is designed in the cloud, cloud-based tools are rapid and flexible. This technology offers dependable performance, seamless interconnectivity, and improved business continuity. Cloud-native applications are entirely developed in the cloud and give developers new and innovative deployment methods to quickly evolve the businesses' overall architecture.

By Deployment Mode Analysis

- The Hybrid Cloud segment accounted for the highest market share during the forecast period

In 2022, the hybrid cloud sector held a modest share of revenue. The increasing demand for scalable and cost-effective computing solutions is fueling the growth in revenue for this segment. Market players are turning to the hybrid cloud model to address complex business challenges that were previously difficult to tackle with traditional IT infrastructure. Moreover, the hybrid cloud is fostering collaboration between IT and businesses by enhancing agility and efficiency, delivering IT resources swiftly and cost-effectively. It empowers enterprises to adapt their applications and infrastructure as needed, ensuring high-speed performance and robust availability for users. Additionally, the hybrid cloud offers economies of scale while safeguarding sensitive business data.

The availability of secure, scalable, and cost-effective resources is opening up new operational opportunities for organizations, further boosting the demand for hybrid cloud. Leading market players, such as IBM and others, are strategically investing in platform-centric solutions, hybrid cloud, and Artificial Intelligence (AI) strategies. Additionally, businesses are dedicating resources to employee upskilling, new offerings, technical talent, and other areas, all of which contribute significantly to the revenue growth of this segment in various regions.

By Vertical Analysis

- The IT & Telecom segment accounted for the highest cloud native application market share during the forecast period

In 2022, the IT & telecom sector secured a moderate share of revenue. A key driver of revenue growth in this industry is the increasing integration of fifth-generation (5G) technology in the telecom sector. With 5G, the newly standardized Third-Generation Partnership Project (3GPP) 5G Core functions are built on cloud-native and container-based foundations. This has spurred the adoption of cloud-native technologies by many operators and vendors, drawn to the numerous advantages they offer.

The widespread adoption of cloud-native technologies has had a profound impact on various facets of the industry, influencing application design and development, technology infrastructure, processes, management, and orchestration, among others. Market players are quick to follow suit, particularly for telecom applications built on microservices, containers, and state-optimized design. The increased demand for cloud-native platforms is contributing to quicker software upgrades and releases, among other factors.

Additionally, companies are automating their cloud data center resources, leveraging embedded features in the Network Functions Virtualization Infrastructure (NFVI) layer, and adapting their software architecture. Furthermore, other factors propelling revenue growth in this sector include cost savings, rapid deployment, enhanced consumer engagement, and the rising trend of DevOps 2.0. DevOps 2.0 introduces adaptive feature delivery and broadens its scope to non-technical teams, employing cross-functional methodologies that align software iteration with marketing and sales campaigns. Moreover, it elevates security as a fundamental component throughout the development process, with the philosophy that security is everyone's responsibility. By treating security as code, security professionals are equipped with tools that streamline their contributions with minimal friction.

Regional Insights

- North America dominated the largest market in 2022

In 2022, the North American market claimed the most substantial share of revenue. The accelerated adoption of cutting-edge technologies like Artificial Intelligence (AI), Internet of Things (IoT), Machine Learning (ML), and others across various industries has emerged as a principal driver of revenue growth in this region. AI and ML empower market enterprises to deploy and manage cloud platforms effectively. Furthermore, the evolving market landscape has spurred end-use companies to embrace cloud platforms, thereby bolstering revenue growth swiftly.

Companies operating within this region are also diligently concentrating on reducing operational and downtime expenses, enhancing platform flexibility, and improving efficiency. These efforts represent another pivotal factor propelling revenue growth. Notably, the Canadian market secured the largest revenue share thanks to its ample reservoir of skilled professionals. Additionally, businesses in this region are making substantial investments in upskilling their workforce, a trend that is accelerating adoption and significantly contributing to revenue growth in the country.

Asia Pacific market secured the second-largest share of revenue. A driving force behind the revenue growth in this region is the escalating demand for advanced cloud solutions within medium and large-scale industries. Furthermore, the increasing awareness of the manifold benefits offered by cloud-native platforms plays a pivotal role in augmenting market revenue. Distinguishing itself from monolithic architecture in cloud-native applications, all the solutions in this region embrace open-source systems and tools, including serverless systems that operate on a pay-per-use model, substantially reducing costs. Notably, the Japanese market claimed the largest share of revenue, primarily due to substantial investments made to enhance product services. Moreover, the rising consumer awareness about the diverse advantages associated with cloud-native platforms, such as improved productivity, flexible infrastructure, rapid scalability, and reduced operational costs, is a significant contributor to the escalating market revenue in this country.

Numerous regional economies are actively investing in enhancing their ultrasound and other medical imaging capabilities, fostering opportunities for technological and device innovations that align with these advancements. Moreover, heightened research and development investments from manufacturers, coupled with ongoing government initiatives, are playing a substantial role in driving growth within the regional market.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Amazon.com, Inc.

- Cognizant

- Google LLC

- IBM Corporation

- Infosys Limited

- Microsoft Corporation

- Oracle Corporation

- Red Hat, Inc.

- SAP SE

- VMware, Inc.

Recent Developments

- In February 2023, Infosys collaborated with ng-voice GmbH, a provider of fully containerized and cloud-native IMS solutions for the telecom sector. This partnership involved joint efforts to deliver outstanding managed services and cloud-native software solutions, with a focus on fostering innovation and delivering customized customer experiences to ng-voice clients.

- In July 2022, Huawei Cloud unveiled its Cloud Native Core Banking Solution, providing a long-term cloud-native platform for transitioning from mainframes, fueling digital banks, and establishing new core systems for traditional banks. Notable system attributes include high availability, extensive concurrency, and agile application development. An example of its high availability is the disaster recovery (DR) with a Recovery Point Objective (RPO) of 0 and a Recovery Time Objective (RTO) of just 2 minutes. Additionally, the GaussDB meets stringent financial regulatory requirements, boasting an intra-city Availability Zone RTO of less than 10 seconds.

- In December 2021, IBM inaugurated the IBM Z and Cloud Modernization Center, serving as a digital gateway to a diverse array of resources, training, tools, and ecosystem partners. This center empowers IBM Z clients to expedite the modernization of their data, applications, and processes within an open hybrid cloud framework. Through this center, clients gain insights on preserving their existing IT infrastructure while directing their focus toward crafting and executing a hybrid cloud readiness strategy for their core IBM Z-dependent applications and data.

Cloud Native Application Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.7 billion |

|

Revenue Forecast in 2032 |

USD 269.03 billion |

|

CAGR |

48.00% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Deployment mode, By Vertical, By Organizational size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of Cloud Native Application Market in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.