Coagulation Reagent Market Size, Share, Trends, & Industry Analysis Report

By Test Type (APTT, D-Dimer, Fibrinogen, Prothrombin, Others), By Technology, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5797

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

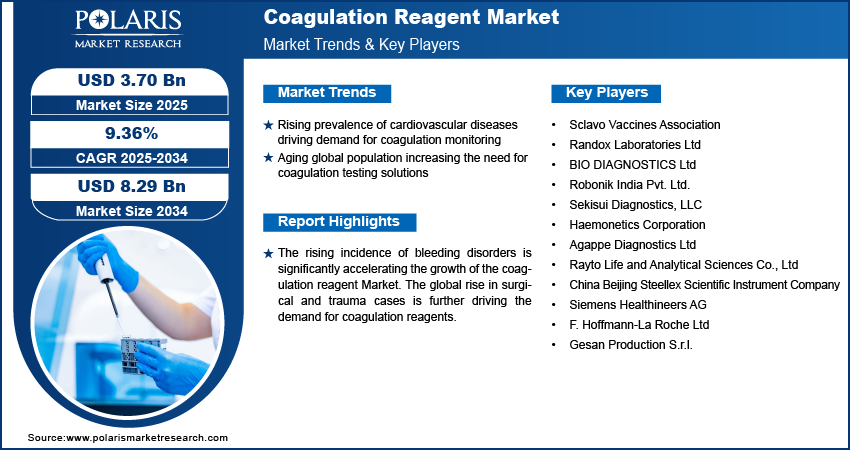

The global coagulation reagent market size was valued at USD 3.39 billion in 2024, growing at a CAGR of 9.36% during 2025–2034. The rising prevalence of cardiovascular diseases globally is driving the demand for coagulation monitoring, thereby boosting the adoption of coagulation reagents. Moreover, the aging global population is increasing the need for coagulation testing solutions, which in turn further expanding the demand for coagulation reagents.

Coagulation reagents are specialized chemical substances used in laboratory and clinical settings to evaluate, monitor, and diagnose blood clotting disorders. These reagents are fundamental to hemostasis testing, enabling the analysis of clot formation, strength, and breakdown. They are integral to coagulation analyzers and point-of-care diagnostic systems, supporting tests such as prothrombin time (PT), activated partial thromboplastin time (aPTT), D-dimer, fibrinogen assays, and thrombin time. By facilitating the detection of clotting factor deficiencies, tracking anticoagulant therapy, and identifying thrombotic conditions, coagulation reagents contribute significantly to patient safety and clinical decision-making during diagnosis and treatment.

.webp)

These reagents are critical in intensive care units, surgical centers, and hematology departments that require constant assessment of coagulation status in patients undergoing major surgeries, managing liver disease, or receiving anticoagulants. Innovations in automated diagnostics and portable point-of-care devices are accelerating the adoption of coagulation reagents by improving testing efficiency, reducing turnaround times, and supporting early and informed medical intervention.

The rising incidence of bleeding disorders is significantly accelerating the growth of the coagulation reagent Market. The growing number of individuals diagnosed with hemophilia, thrombophilia, and von Willebrand disease (VWD) is increasing the need for precise and reliable diagnostic tools. Coagulation reagents support clinical laboratories in detecting clotting abnormalities, assessing disease severity, and monitoring therapeutic efficacy. As per the World Bleeding Disorders Registry (WBDR) report by the World Federation of Hemophilia (WFH) as of the February 2023 survey, a total of 999 individuals had been enrolled from 45 Hemophilia Treatment Centers spanning 22 countries. This growth highlights the increasing demand for reagents that support diagnosis and ongoing care. Thus, coagulation reagents are becoming important components of personalized treatment strategies as public health systems and specialized clinics increasingly expand their focus on hematologic conditions.

Additionally, the global rise in surgical and trauma cases is further driving the demand for coagulation reagents. Coagulation reagents play a crucial role in preoperative screening, intraoperative monitoring, and postoperative recovery by helping clinicians evaluate clotting function and adjust anticoagulant or procoagulant therapies accordingly. Coagulation reagents are increasingly utilized in hospital operating rooms, emergency units, and trauma centers due to the growing volume of surgical procedures and emergency interventions worldwide.

Industry Dynamics

Rising Prevalence of Cardiovascular Diseases Driving Demand for Coagulation Monitoring

The rising prevalence of cardiovascular diseases is driving the growth of the coagulation reagent market. Cardiovascular conditions such as atrial fibrillation, venous thromboembolism, and myocardial infarction require long-term anticoagulant therapy, necessitating regular and precise monitoring of blood clotting parameters. According to the World Health Organization, cardiovascular diseases are the leading cause of mortality worldwide, accounting for approximately 17.9 million deaths each year. This rising number reflects the growing burden on global healthcare systems, increasing the need for investments in diagnostic technologies that aid in the timely detection and ongoing management of thrombotic risks. Coagulation reagents are essential tools in these processes, enabling accurate testing through laboratory and point-of-care systems. As patients increasingly rely on anticoagulants such as warfarin, dabigatran, and rivaroxaban, the demand for effective coagulation reagents has surged, particularly in cardiac care units and specialized clinics.

Aging Global Population Increasing the Need for Coagulation Testing Solutions

The aging global population is propelling the rapid expansion of the coagulation reagent market. Aging is associated with a higher prevalence of chronic health conditions such as cancer, diabetes, stroke, and cardiovascular disease, which present hemostatic challenges or require anticoagulation therapy. These conditions require regular and precise monitoring of coagulation parameters to prevent adverse events such as uncontrolled bleeding or clot formation. Coagulation reagents provide the necessary analytical precision to guide treatment decisions in elderly patients across hospital settings and home-based care systems. According to the United Nations, the global population aged 65 years and older is projected to reach around 2.2 billion by the late 2070s, overtaking the number of children under 18. This demographic transformation is increasing the pressure on healthcare infrastructure to adapt to the unique needs of geriatric populations.

Additionally, the market is expected to expand significantly, driven by the growing clinical demand for reliable, fast, and easy-to-use testing solutions designed for older adults. Manufacturers are innovating reagent formulations and platforms that support automated, scalable, and cost-effective diagnostic capabilities tailored for the aging population around the world.

Segmental Insights

By Test Type Analysis

The global segmentation, based on test type includes, APTT, D-Dimer, fibrinogen, prothrombin, and others. the prothrombin segment is projected to reach substantial share of the market by 2034. Prothrombin time (PT) tests are crucial in coagulation diagnostics, evaluating blood clotting and monitoring patients undergoing oral anticoagulant therapy. The rising incidence of cardiovascular conditions, including atrial fibrillation and venous thromboembolism, is accelerating the demand for anticoagulation management and prothrombin time (PT) testing. According to a report by the National Library of Medicine as of February 2021, the global prevalence of atrial fibrillation reached approximately 37.57 million cases, accounting for 0.51% of the world’s population. Moreover, the increasing number of surgical procedures, growing awareness of blood clotting disorders, and the development of high-sensitivity reagents are further boosting the demand for prothrombin tests.

The D-Dimer segment is projected to grow at a robust pace in the coming years. D-Dimer testing plays a crucial role in the diagnosis of thrombotic events such as deep vein thrombosis (DVT) and pulmonary embolism (PE), which are becoming more prevalent with rising sedentary lifestyles and aging populations.

By Technology Analysis

The global segmentation, based on technology includes, mechanical, electrochemical, optical, and others. The optical technology segment accounted for substantial market share in 2024. Optical detection methods offer high precision, faster analysis, and seamless integration into automated laboratory systems, making them a preferred choice across high-volume clinical labs and hospital settings. The increasing demand for advanced laboratory automation, improved workflow efficiency, and accurate diagnostic outputs is driving the widespread adoption of optical-based systems. Moreover, ongoing innovations in optical sensor technologies, including photometric and nephelometric enhancements, are making these platforms more robust and versatile, thereby further boosting growth across this segment. For instance, in November 2024, OKI developed an ultracompact photonic integrated circuit (PIC) chip using silicon photonics, advancing optical sensor technologies by enabling miniaturized, high-precision, and cost-effective solutions for applications in infrastructure monitoring, healthcare, and industrial sensing.

The electrochemical segment is projected to grow at a significant pace during the assessment phase, due to the rising demand for decentralized testing and portable diagnostic platforms. Electrochemical technologies are suitable for point-of-care (POC) applications due to their compact design, low reagent consumption, and ability to deliver rapid results. As healthcare providers expand services to remote and resource-limited settings, electrochemical-based coagulation testing is significantly growing, particularly for patient self-monitoring and outpatient anticoagulation management. Moreover, the shift toward personalized medicine and the integration of these devices with mobile health technologies are expected to further boost adoption of electrochemical technology.

By End Use Analysis

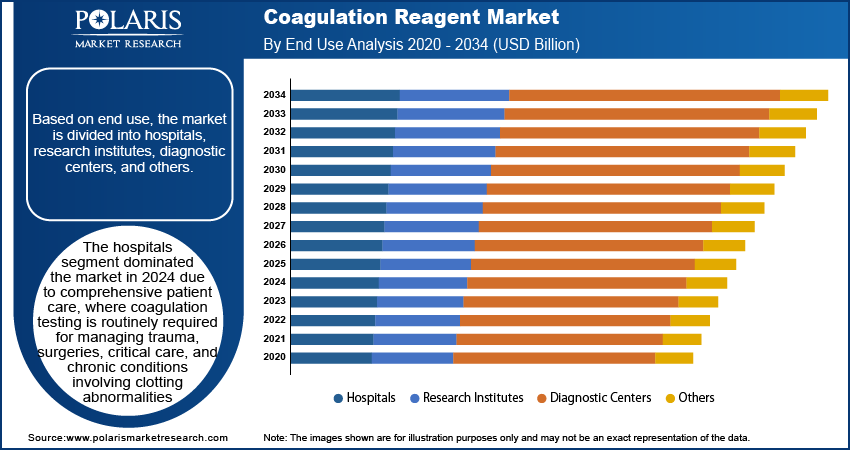

The global segmentation, based on end use includes, hospitals, research institutes, diagnostic centers, and others. The hospitals segment dominated the market in 2024 due to comprehensive patient care, where coagulation testing is routinely required for managing trauma, surgeries, critical care, and chronic conditions involving clotting abnormalities. The increasing global prevalence of cardiovascular and hematological disorders, coupled with a rising number of surgical procedures and emergency admissions, is increasing the demand for coagulation reagents across hospitals. Modern hospitals are now equipped with advanced analyzers that utilize a range of reagent-based assays to enable rapid diagnosis and real-time patient monitoring.

The diagnostic centers segment is anticipated to grow at the fastest pace during the forecast period. This is attributed to the increasing public awareness of preventive health checkups and the importance of early disease detection, leading to higher patient volumes in standalone diagnostic laboratories. These centers offer specialized testing services with fast turnaround times, making them increasingly preferred by patients and healthcare providers. The increasing adoption of automated and semi-automated coagulation testing platforms within these facilities further enhances operational efficiency and supports high-volume testing demands. Thus, the increasing demand for accessibility and affordability, along with the shift of diagnostics closer to patients, is expected to drive significant growth for diagnostic centers in the coming years.

Regional Analysis

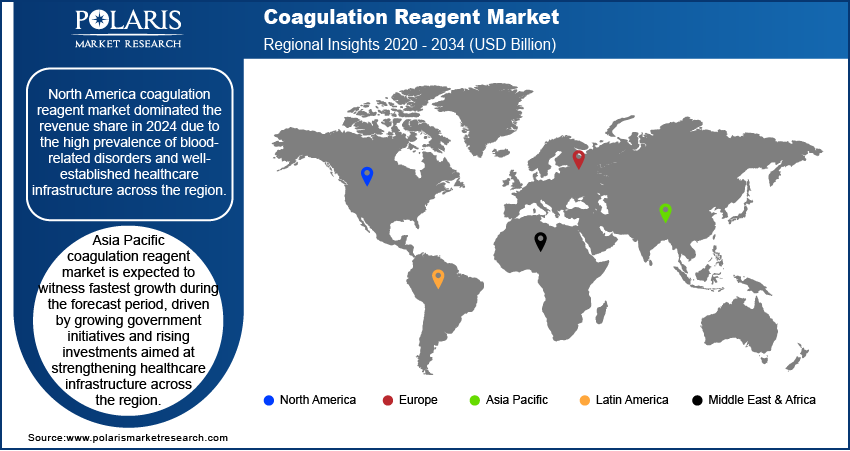

North America coagulation reagent market dominated the revenue share in 2024 due to the high prevalence of blood-related disorders and well-established healthcare infrastructure across the region. The presence of advanced diagnostic laboratories and widespread availability of coagulation analyzers further propel the demand for coagulation reagents. Additionally, the region’s focus on personalized medicine and early disease detection is also promoting the adoption of high-performance coagulation reagents across hospitals and diagnostic centers.

US Coagulation Reagent Market Insight

The US coagulation reagent market, in particular, dominated regional share. This dominance is due to the rising prevalence of venous thromboembolism (VTE). The increasing incidence of blood clot-related conditions, such as deep vein thrombosis and pulmonary embolism, has fueled the demand for accurate and timely coagulation testing. In January 2025, the US Centers for Disease Control and Prevention reported that venous thromboembolism (VTE), a type of blood clot, affects up to 900,000 individuals annually in the US. It is further estimated that VTE contributes to 60,000 to 100,000 deaths in the country each year. Additionally, increasing investment in R&D and partnerships between pharmaceutical firms and research institutions are accelerating the development of advanced reagents for accurate and faster diagnosis. Furthermore, government initiatives focused on expanding access to diagnostic services, along with favorable reimbursement policies, continue to strengthen the US. market position.

Europe Coagulation Reagent Market

The Europe coagulation reagent market growth is attributed to the increasing public health awareness and ongoing efforts to modernize clinical laboratories across the region. Countries such as Germany, France, and the UK are expanding national screening programs targeting bleeding disorders, which is contributing to the rising demand for coagulation reagent. Regulatory policies in the European Union aimed at standardizing diagnostic quality and ensuring patient safety are further propelling the adoption of certified coagulation reagents. For instance, the implementation of the In Vitro Diagnostic Regulation (IVDR) across EU member states has encouraged hospitals and labs to upgrade their reagent portfolios to meet the new compliance standards.

Moreover, the growing lifestyle diseases, including obesity and diabetes, which increase the risk of thrombotic events, are fueling routine coagulation testing in the region. Healthcare facilities across Western and Northern Europe are adopting fully automated coagulation analyzers and reagent systems to improve workflow efficiency and ensure timely diagnosis. These advancements, along with the push toward digitized and integrated healthcare systems, are creating favorable conditions for market expansion across Europe.

Asia Pacific Coagulation Reagent Market Overview

Asia Pacific coagulation reagent market is expected to witness fastest growth during the forecast period, driven by growing government initiatives and rising investments aimed at strengthening healthcare infrastructure across the region. Programs such as China’s “Healthy China 2030” initiative, which targets the expansion of the national health service industry to approximately USD 2.4 trillion by 2030, highlights the region's growth in healthcare development. Moreover, the Government of India allocated USD 11.50 billion toward the healthcare sector for 2025–26, a 9.78% increase from the previous year’s allocation of USD 10.47 billion, to improve the country’s healthcare system through infrastructure enhancement.

These measures are significantly contributing to the modernization of diagnostic services, expanding public access to healthcare, and encouraging collaboration with private diagnostic providers. As a result, the adoption of advanced diagnostic technologies, including coagulation testing solutions, is accelerating across both urban and rural healthcare environments. Additionally, the rising burden of chronic diseases and an expanding patient population is further fueling the growth of the coagulation reagent market across Asia Pacific.

Key Players & Competitive Analysis Report

The coagulation reagent industry is highly competitive, as leading players striving to expand their technological capabilities, diversify their product lines, and strengthen their global footprints through strategic alliances and mergers & acquisitions (M&A). Major companies in the market are actively investing in research and development to introduce specialized reagents catering to a broad range of clinical and laboratory applications, including chronic disease diagnosis, surgical monitoring, and hematological analysis. The growing integration of automation, artificial intelligence, and point-of-care technologies in diagnostic laboratories is further increasing competition among market players.

Prominent companies in the coagulation reagent market include Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, Haemonetics Corporation, Sekisui Diagnostics, LLC, Randox Laboratories Ltd, and Agappe Diagnostics Ltd. Other notable players include Sclavo Vaccines Association, BIO DIAGNOSTICS Ltd, Robonik India Pvt. Ltd., Rayto Life and Analytical Sciences Co., Ltd., China BeiJing Steellex Scientific Instrument Company, and Gesan Production S.r.l.

Key Players

- Sclavo Vaccines Association

- Randox Laboratories Ltd

- BIO DIAGNOSTICS Ltd

- Robonik India Pvt. Ltd.

- Sekisui Diagnostics, LLC

- Haemonetics Corporation

- Agappe Diagnostics Ltd

- Rayto Life and Analytical Sciences Co., Ltd

- China Beijing Steellex Scientific Instrument Company

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd

- Gesan Production S.r.l.

Industry Developments

June 2025: Sysmex received US FDA 510(k) clearance for its CN-6000 automated blood coagulation analyzer, which includes approval for five key reagent assays: prothrombin time/international normalized ratio (PT/INR), activated partial thromboplastin time (APTT), fibrinogen, antithrombin, and D-dimer.

February 2024: Roche introduced three new coagulation tests targeting direct oral Factor Xa inhibitors apixaban, edoxaban, and rivaroxaban on its cobas t 711 and 511 coagulation analyzers. The tests are designed with reagent cassette systems to minimize contamination and handling errors while improving operational efficiency.

Coagulation Reagent Market Segmentation

By Test Type Outlook (Revenue, USD Billion, 2020–2034)

- APTT

- D-Dimer

- Fibrinogen

- Prothrombin

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Mechanical

- Electrochemical

- Optical

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Research Institutes

- Diagnostic Centers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Coagulation Reagent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.39 Billion |

|

Market Size in 2025 |

USD 3.70 Billion |

|

Revenue Forecast by 2034 |

USD 8.29 Billion |

|

CAGR |

9.36% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.39 billion in 2024 and is projected to grow to USD 8.29 billion by 2034.

The global market is projected to register a CAGR of 9.36% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, Haemonetics Corporation, and Sekisui Diagnostics, LLC.

The hospital segment dominated the market share in 2024.

The optical technology segment accounted for substantial market share in 2024.