Coating Pretreatment Market Size, Share, Trends, Industry Analysis Report

By Type (Phosphate, Chromate, Chromate Free, Blast Clean), By Application (Automotive & Transportation, Construction, Appliance), By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5969

- Base Year: 2024

- Historical Data: 2020-2023

Overview

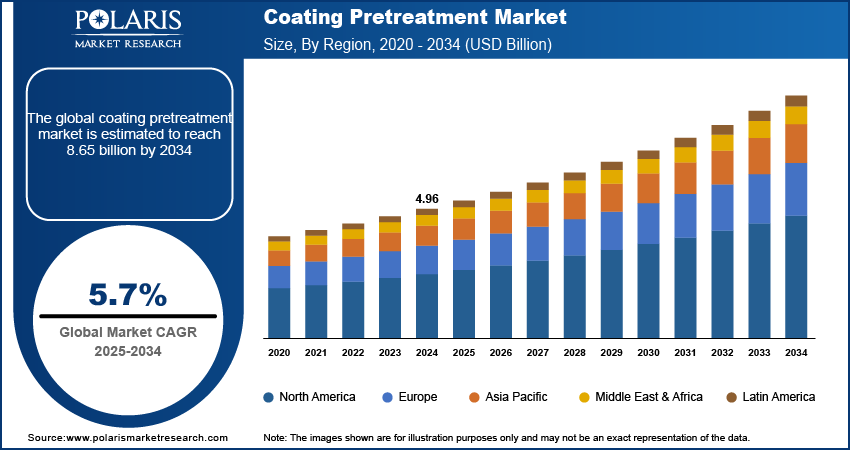

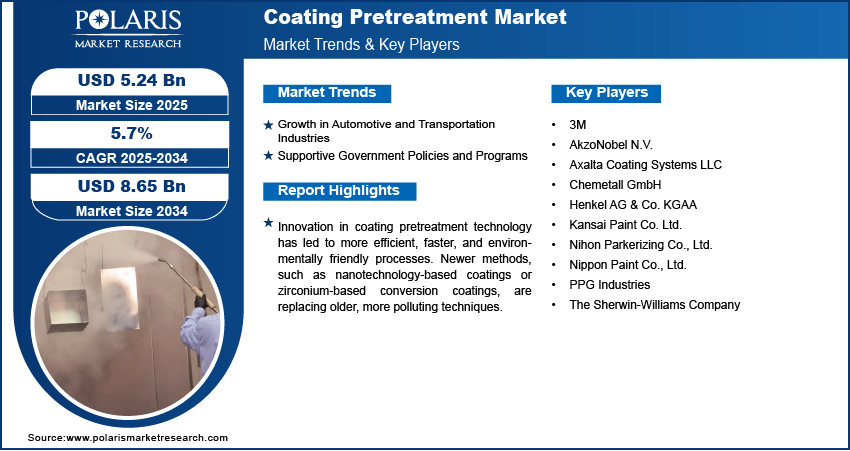

The global coating pretreatment market size was valued at USD 4.96 billion in 2024, growing at a CAGR of 5.7% from 2025 to 2034. The rising demand for coating pretreatment is driven by the growth of the automotive and transportation industries and supportive government policies and programs.

Key Insights

- In 2024, the phosphate segment dominated with the largest share due to its widespread use in industries such as automotive, appliances, and heavy machinery.

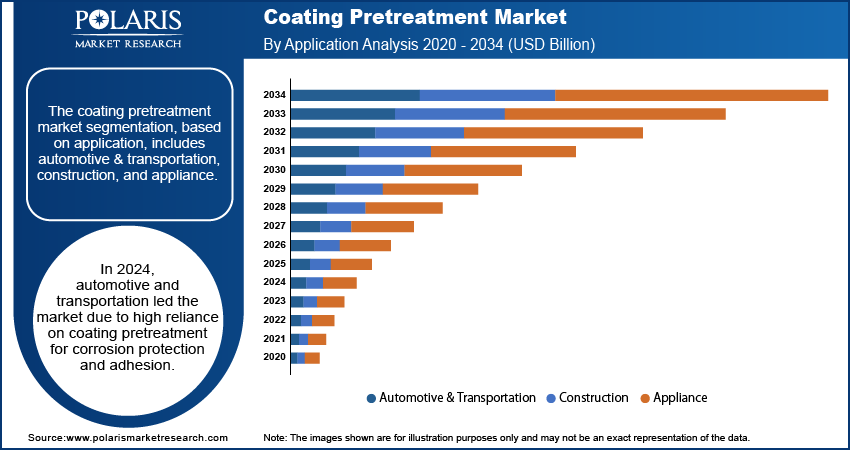

- In 2024, the automotive & transportation segment dominated with the largest share as cars, trucks, trains, and other vehicles rely heavily on coating pretreatment to protect metal parts from rust and ensure that paints and coatings adhere properly.

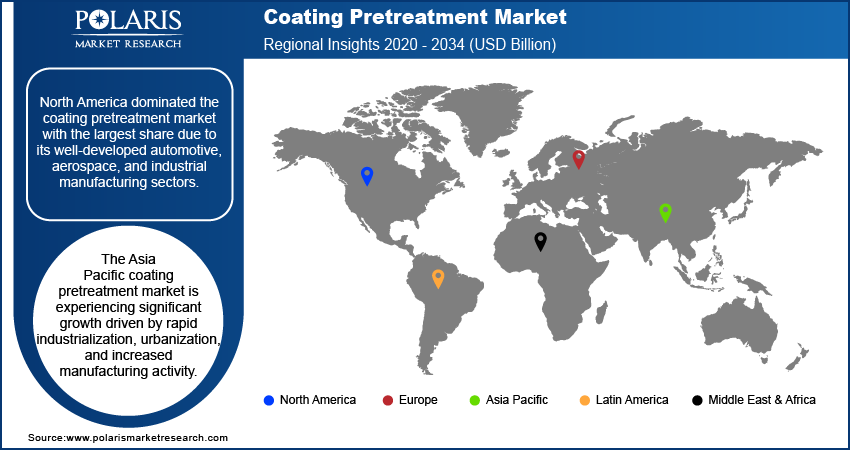

- The market in North America dominated with the largest share in 2024, due to its well-developed automotive, aerospace, and industrial manufacturing sectors.

- The market in the U.S. is expected to witness significant growth, driven by its large automotive base, advanced industrial technologies, and regulatory focus on sustainability.

- Coating Pretreatment Market in Asia Pacific is projected to witness substantial growth driven by rapid industrialization, urbanization, and increased manufacturing activity.

Coating pretreatment is the process of cleaning and chemically preparing a surface (typically metal) to improve the adhesion and durability of a subsequent coating, such as paint or powder. It involves removing contaminants such as oil, rust, or dirt and applying conversion coatings (e.g., phosphate or chromate) to enhance corrosion resistance.

Modern industries increasingly require coatings that perform under harsh conditions such as extreme temperatures, humidity, or exposure to chemicals. For these high-performance coatings to work effectively, the surface must be properly treated beforehand. Pretreatment improves adhesion, corrosion resistance, and overall coating durability. This is particularly important in sectors such as aerospace, marine, and industrial equipment. The role of coating pretreatment becomes more essential as performance expectations rise across these fields, thereby driving the growth.

Innovation in coating pretreatment technology has led to more efficient, faster, and environmentally friendly processes. Newer methods, such as nanotechnology-based coatings or zirconium-based conversion coatings, are replacing older, more polluting techniques. These advancements help reduce process time, water consumption, and energy use. Additionally, automated systems and smart controls are improving consistency and reducing labor costs. Industries are adopting modern pretreatment solutions as they look to upgrade their production lines, thereby driving the growth.

Industry Dynamics

- Growth in the automotive and transportation industries drives the demand for coating pretreatments.

- Growing construction activities driven by rising government investments fuel the need for coating materials, thereby driving demand for coating pretreatment.

- Advancements in formulation drive the reliability and appeal of product.

- Stringent environmental regulations on hazardous chemicals used in traditional pretreatment processes restrain the market growth.

Growth in Automotive and Transportation Industries: The automotive and transportation sectors are expanding rapidly across many regions of the world. According to the U.S. Bureau of Labor Statistics, in June 2024, the U.S. alone employed 1.0264 million people in automotive manufacturing. Vehicles require durable coatings to protect metal parts from rust, wear, and environmental damage. Pretreatment ensures that these coatings bond properly and last longer. Manufacturers are focusing more on surface preparation to maintain quality and extend vehicle lifespan as demand for vehicles increases. This drives the need for advanced pretreatment solutions that meet production speed, environmental standards, and performance expectations across a wide range of vehicle types and components, thereby driving the growth.

Growing Construction Activity: Growing infrastructure development, including the construction of bridges, commercial buildings, and public utilities, is driving the demand for coating pretreatment. According to the U.S. Census Bureau, construction spending in the U.S. alone was USD 2,145.5 billion in April 2025. Steel and metal structures used in construction need to be protected against corrosion and environmental effects to ensure safety and durability. Coating pretreatment prepares these surfaces before painting or coating, making it a crucial part of the construction process. The demand for pretreatment chemicals and systems increases alongside the need for long-lasting, protective coatings as countries invest more in urban development and public works, thereby driving the growth.

Segmental Insights

Type Analysis

The segmentation, based on product, includes phosphate, chromate, chromate free, and blast clean. In 2024, the phosphate segment dominated with the largest share due to its widespread use in industries such as automotive, appliances, and heavy machinery. These treatments form a protective phosphate layer on metal surfaces, improving paint adhesion and corrosion resistance. Their cost-effectiveness, proven performance, and compatibility with various metals make them a preferred choice for mass production. Phosphate pretreatment remains dominant due to its strong track record and established use in industrial processes, thereby driving the segment growth.

The chromate segment is expected to experience significant growth during the forecast period due to the growing demand from industries that require high corrosion resistance, such as aerospace, electronics, and defense. While traditional chromate processes involve toxic chemicals and face strict environmental regulations, newer, environmentally safer versions are emerging. These innovations make chromate pretreatments attractive again for manufacturers needing long-lasting protection and strong metal-to-coating bonds. Chromate systems are becoming more acceptable as technology evolves and safety standards improve, leading to increased adoption in specialized and high-performance applications, thereby driving the segment growth.

Application Analysis

The segmentation, based on application, includes automotive & transportation, construction, and appliance. In 2024, the automotive & transportation segment dominated with the largest share as cars, trucks, trains, and other vehicles rely heavily on coating pretreatment to protect metal parts from rust and ensure that paints and coatings adhere properly. Given the high production volume and strict quality standards in this industry, pretreatment is an essential step in manufacturing. Automotive companies continue to invest in advanced pretreatment systems to improve durability, meet emission norms, and reduce warranty claims. This strong demand is driving the segment growth.

The construction segment is expected to experience significant growth during the forecast period, driven by increasing infrastructure development worldwide. Buildings, bridges, pipelines, and metal frameworks are exposed to harsh environmental conditions and need protective coatings to extend their lifespan. Pretreatment is crucial to ensuring these coatings bond well and offer long-term protection. The demand for corrosion-resistant coatings and reliable pretreatment processes is rising as governments and private sectors invest in large-scale construction projects, especially in developing regions, thereby driving the segment growth.

Regional Analysis

North America Coating Pretreatment Market Trend

The market in North America dominated with the largest share in 2024, due to its well-developed automotive, aerospace, and industrial manufacturing sectors. The region places a strong emphasis on quality, safety, and environmental compliance, which drives the demand for advanced and eco-friendly pretreatment technologies. The traditional phosphate and chromate-based solutions are in use, and there is a growing shift toward greener alternatives in response to stringent regulations. Investments in infrastructure repair and upgrades, especially in the U.S. and Canada, are also boosting the need for corrosion-resistant coatings, making pretreatment a vital step in the process, thereby fueling the growth.

U.S. Coating Pretreatment Market Insight

The U.S. market is expected to witness significant growth driven by its large automotive base, advanced industrial technologies, and regulatory focus on sustainability. U.S. manufacturers are adopting innovative pretreatment systems that meet both performance and environmental standards. Growth in sectors such as electric vehicles, construction, and aerospace further drives the need for reliable surface preparation. Additionally, federal infrastructure spending is increasing demand for protective coatings in bridges, pipelines, and public facilities, thereby driving the growth of the U.S. market.

Asia Pacific Coating Pretreatment Market Analysis

The Asia Pacific market is projected to witness substantial growth driven by rapid industrialization, urbanization, and increased manufacturing activity. Countries in this region are producing more vehicles, electronics, appliances, and construction materials from recent decades, all of which require surface treatment before coating. The region is further experiencing a shift toward higher quality standards and environmentally safer processes. Newer and more efficient technologies are gaining ground in the region. Moreover, rising investments in infrastructure and industrial production fuel the growth in the region.

China Coating Pretreatment Market Overview

The market in China is expected to experience rapid growth due to its massive manufacturing capacity and global export activities. It is a major producer of automobiles, steel products, and electronics, all of which require surface preparation before final coating. Government initiatives promoting smart manufacturing and environmental sustainability are encouraging the adoption of modern, eco-friendly pretreatment systems. Additionally, China’s ongoing infrastructure projects and urban development create a strong need for corrosion-resistant coatings. China’s demand for coating pretreatment is expected to grow steadily across both domestic and export-driven sectors as industries upgrade their processes for better quality and compliance, thereby driving the growth.

Europe Coating Pretreatment Market Outlook

The market in Europe is expected to experience significant growth during the forecast period, driven by its strong industrial base, environmental policies, and technological innovation. The region has well-established automotive, aerospace, and construction sectors that rely on advanced pretreatment processes for quality and durability. Strict EU regulations on chemical usage and emissions have pushed industries toward eco-friendly and sustainable solutions, phasing out traditional chromate treatments in favor of safer alternatives. Additionally, growing investments in green infrastructure, electric vehicles, and renewable energy equipment are contributing to increased demand for reliable coating pretreatment in the region, thereby driving the growth.

Germany Coating Pretreatment Market Assessment

The Germany market growth is attributed to its large automotive manufacturing, engineering, and industrial technology sectors. Home to major car brands and advanced machinery producers, Germany has high standards for surface preparation to ensure performance and corrosion protection. The country is further at the forefront of adopting environmentally friendly pretreatment technologies, driven by strict national and EU environmental laws. Innovation and automation in manufacturing processes further support the adoption of modern, efficient pretreatment systems, thereby driving growth.

Key Players and Competitive Analysis

The industry features a competitive landscape dominated by a mix of multinational chemical companies and specialized coating solution providers. Key players such as 3M, PPG Industries, and The Sherwin-Williams Company leverage extensive product portfolios and global distribution networks to maintain strong market positions. Companies such as Henkel AG & Co. KGAA, Chemetall GmbH, and Axalta Coating Systems LLC focus on advanced surface treatment technologies that improve adhesion, corrosion resistance, and coating durability. Asian manufacturers, including Nippon Paint Co., Ltd.; Kansai Paint Co., Ltd.; and Nihon Parkerizing Co., Ltd., are expanding their reach through cost-effective solutions and regional expertise. Competitive strategies in the market include product innovation, sustainability-focused formulations, and mergers or partnerships to improve market access and technical capabilities. As environmental regulations tighten, companies are also shifting toward eco-friendly pretreatment processes, creating a new area of competition centered on compliance and low-impact chemistry.

Key Players

- 3M

- AkzoNobel N.V.

- Axalta Coating Systems LLC

- Chemetall GmbH

- Henkel AG & Co. KGAA

- Kansai Paint Co. Ltd.

- Nihon Parkerizing Co., Ltd.

- Nippon Paint Co., Ltd.

- PPG Industries

- The Sherwin-Williams Company

Industry Developments

In July 2024, Henkel launched Bonderite M CR 1405, a RoHS-compliant product that combined metal passivation and pretreatment into a single step, significantly reducing energy, water use, and process time while maintaining high corrosion resistance for color coating applications.

In June 2024, Henkel launched Bonderite M-NT 41044, a phosphate-free cleaner and coater that enabled metal industry users to cut processing steps from ten to four, reducing energy and water usage while improving corrosion protection.

Coating Pretreatment Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Phosphate

- Chromate

- Chromate Free

- Blast Clean

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive & Transportation

- Construction

- Appliance

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.96 Billion |

|

Market Size in 2025 |

USD 5.24 Billion |

|

Revenue Forecast by 2034 |

USD 8.65 Billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.96 billion in 2024 and is projected to grow to USD 8.65 billion by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are 3M; AkzoNobel N.V.; Axalta Coating Systems LLC; Chemetall GmbH; Henkel AG & Co. KGaA; Kansai Paint Co. Ltd.; Nihon Parkerizing Co., Ltd.; Nippon Paint Co., Ltd.; PPG Industries; and The Sherwin-Williams Company.

The phosphate segment dominated the market share in 2024.

The construction segment is expected to witness the significant growth during the forecast period.