Conductive Inks Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Conductive Silver Ink, Conductive Polymers, Conductive Copper Ink, Conductive Nanotube Inks, Carbon/Graphene Ink, Dielectric Ink, and Others), Applications Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 118

- Format: PDF

- Report ID: PM1558

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

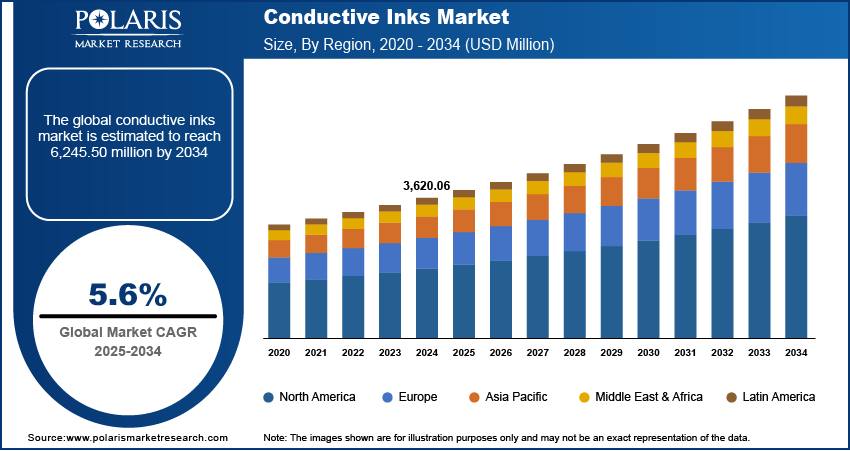

The global conductive inks market size was valued at USD 3,620.06 million in 2024 and is projected to grow at a CAGR of 5.6 % from 2025 to 2034. Rising technological advancements in photovoltaic systems and the introduction of thin film PV technologies are driving market development.

Key Insights

- The conductive silver ink segment led the market in 2024, primarily due to its increased popularity across sectors such as flexible electronics and printed electronics.

- The photovoltaic segment dominated the market in 2024, owing to its rising use in the fabrication of photovoltaic textiles.

- Asia Pacific accounted for the largest market share in 2024. The regional market dominance is attributed to rapid urbanization and growing focus on offering reasonably priced modern electronics.

- The market in North America is expected to be driven by increased demand for conductive inks from the electronic device manufacturing sector.

Industry Dynamics

- The implementation of environmental regulations by governments globally for the use of lightweight, advanced materials is fueling market expansion.

- Innovations in economical substitutes for silver-based conductive inks are propelling the development of the market.

- The growing demand for conductive inks from the automotive and renewable energy sectors presents significant market opportunities.

- High volatility of the silver price may present challenges to market growth.

Market Statistics

2024 Market Size: USD 3,620.06 million

2034 Projected Market Size: USD 6,245.50 million

CAGR (2025-2034): 5.6%

Asia Pacific: Largest Market in 2024

Conductive ink is a type of ink that conducts electricity when printed. It is created by mixing conductive materials such as graphite or silver particles into ink. Since the development of nanotechnology, there has been a growing interest in replacing metallic materials with nanomaterials. Conductive inks can be used to create electrical circuits on a wide range of materials, including wood, metal, textiles, some plastic types, compressed wood (cork), and paper. The inks can be used to replace traditional copper or wired circuits in electronics. They have a wide range of applications, including membrane switches, subdural electrodes, capacitive touch film sensors, screen-printed antennas, in-mold electronics, and e-textiles. Conductive inks are often used in wearable clothing as they can stretch and flex with the wearer.

Growing technological advancements in photovoltaic systems are expected to propel the global conductive ink market demand. PV cells are semiconductor devices used in direct electricity generation. The manufacturing process for PV cells is laborious. As a result, the introduction of thin film PV technologies resulted in a significant increase in market share. This factor is expected to contribute to the conductive ink market growth over the forecast period.

New product types are being developed that are suitable for rigid and flexible substrates and have low electrical resistivity, thereby contributing to the conductive ink market development. Rising demand for efficient and miniature consumer electronics has increased demand for conductive inks. Throughout the forecast period, these will replace energy-consuming wires and bulky circuits. These inks are used as a substitute for traditional wire circuits owing to their better power efficiency, durability, and smaller size.

Conductive Inks Market Dynamics

Growing Necessity of Miniaturization and Efficiency in Devices

Governments across the world have enforced environmental regulations to encourage industries to use lightweight, advanced materials instead of heavy ones in devices. Additionally, consumers' inclination for lightweight and compact devices has enhanced the need for product miniaturization in the consumer electronics sector. Conductive inks are commonly used instead of traditional wire and circuit arrangements to increase efficiency and reduce the weight of electronic components, as they are reliable, efficient, and effective. Therefore, the use of conductive inks to meet the rising demand for smaller and more effective devices propels the conductive inks market development.

Innovations in Economical Substitutes for Silver-Based Conductive Inks

Demand for more affordable substitutes for silver-based conductive inks is rising due to the growing silver cost. Conductive inks based on graphene have emerged as a substitute. Even at complex levels, graphene-based conductive inks can achieve high conductivity in complex devices. The primary ingredients used to make conductive inks are carbon, copper, and silver. Copper is less expensive but more susceptible to oxidation than silver, which is highly conductive but more costly. Graphene, on the other hand, is a useful substitute for these materials and can provide the same qualities at significantly lower costs. A number of businesses are using this alternative to provide efficient solutions in terms of cost and performance, which opens lucrative opportunities for conductive ink producers.

Conductive Inks Market Segment Insights

Outlook by Product Type

Based on product type, the conductive inks market is segmented as conductive silver ink, conductive polymers, conductive copper ink, conductive nanotube inks, carbon/graphene ink, dielectric ink, and others. The conductive silver ink segment dominated the market with 22.9% of the market share in 2024. In the coming years, the growing popularity of conductive silver ink in sectors such as flexible electronics and printed electronics is expected to drive the segment expansion. By facilitating the use of nanomaterials, product configuration advancements have helped to make conductive silver inks extremely popular across a range of industries.

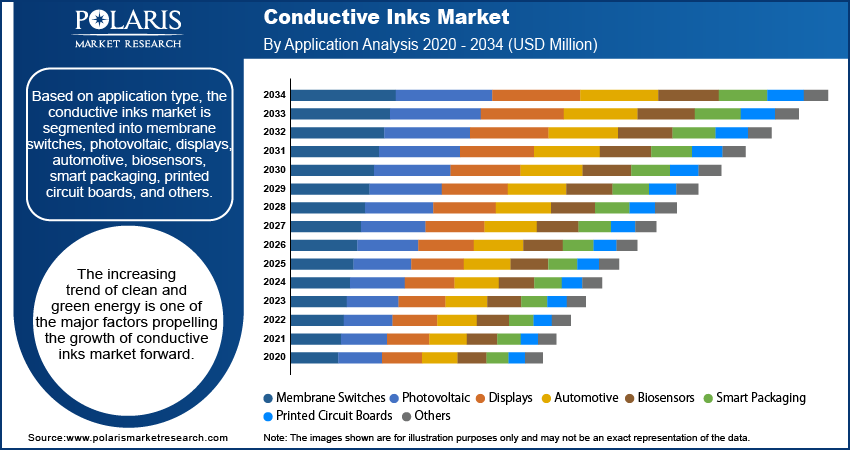

Assessment by Applications Outlook

Based on application, the conductive inks market is segmented into membrane switches, photovoltaic, displays, automotive, biosensors, smart packaging, printed circuit boards, and others. The photovoltaic segment held the largest share of over 23.0% of the market revenue in 2024. The dominance is attributed to its use in the fabrication of photovoltaic textiles. During the forecast period, the growing importance of clean energy is probably going to drive the photovoltaic segment's growth. The rising development of solar plants is driven by the growing demand for electricity on a global scale. Therefore, the market for conductive inks is anticipated to grow at a strong rate during the forecast period due to the increasing demand for clean energy.

Assessment by Regional Insights

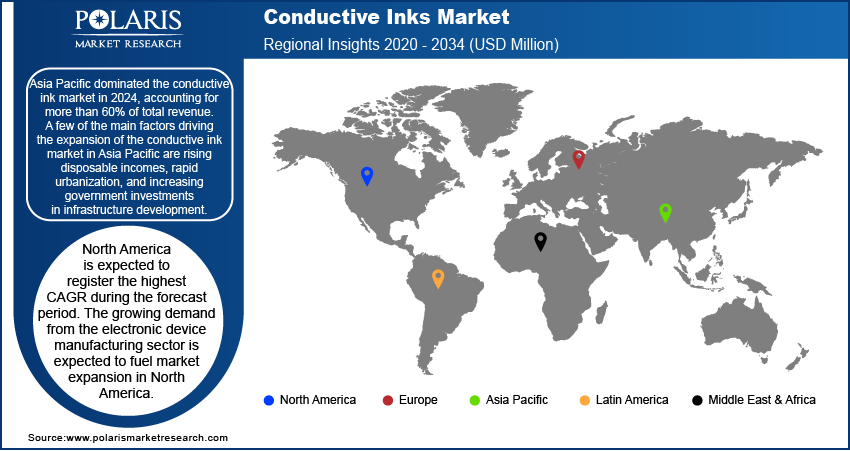

By region, the report provides a thorough analysis and conductive inks market insights into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

Asia Pacific dominated the conductive ink market with over 60.0% of the revenue share in 2024. A few of the main factors driving the conductive ink market expansion in Asia Pacific are rising disposable incomes, rapid urbanization, and improved government balance sheets that lead to higher infrastructure spending. Additionally, the rising focus on offering reasonably priced modern electronics is propelling the Asia Pacific market.

The growing demand from the electronic device manufacturing sector is expected to fuel market expansion in North America. With the presence of regional production sites of international automakers such as Ford, General Motors, Chevrolet, and Tesla, the US is one of the world's largest automakers. Major automakers' involvement in vehicle electrification is anticipated to increase demand for conductive inks in the production of electronic components used in these electric vehicles. Therefore, growing consumer demand for cars with more sophisticated features creates the requirement for more electronic devices and sensors in cars, which drives the regional conductive ink market expansion.

Key Players and Competitive Insights

The conductive ink market exhibits a consolidated and monopolistic structure. The market players are fiercely competitive with one another, primarily over product quality, pricing, and customization. The expansion of the conductive inks market's end-use segments is probably going to push producers to offer their clients better goods and technologies and to look into undiscovered markets. In order to grow their businesses and obtain a competitive edge over other major players in the market, manufacturers are taking part in strategic initiatives such as mergers and acquisitions, and partnerships.

The conductive inks market will continue to grow in the coming years as a result of the key players in the industry investing a major amount in research and development to broaden their product lines. A few of the major players involved in the market are DuPont.; Sun Chemical Corporation; PPG Industries; Henkel AG; Applied Nanotech Holdings, Inc.; Vorbeck Materials Corp.; Poly-Ink; Chem Associates, Inc.; Methode Electronics; Henkel Ag & Co. KgaA; and Fujikura Ltd.

List of Key Players

- DuPont.

- Sun Chemical Corp

- PPG Industries

- Henkel AG

- Applied Nanotech Holdings, Inc

- Vorbeck Materials Corp.

- Poly-Ink

- Chem Associates, Inc.

- Methode Electronics

- Henkel Ag & Co. KgaA

- Fujikura Ltd.

Conductive Inks Industry Development

In September 2024, Electroniks unveiled the first sophisticated conductive copper ink line. Wafer and module-based semiconductor packages benefit from the special qualities that this metal-organic decomposition ink offers.

In September 2024, Creative Materials introduced two new high-performance inks—the 130-05GL high dielectric strength ink and the 125-10ADP cost-effective conductive ink. These advanced inks offer improved performance, lower costs, and increased reliability, marking a substantial advancement in the field of electronic manufacturing.

Conductive Inks Market Segmentation

By Product Type Outlook

- Conductive Silver Ink

- Conductive Polymers

- Conductive Copper Ink

- Conductive Nanotube Inks

- Carbon/Graphene Ink

- Dielectric Ink

- Others

By Application Type Outlook

- Membrane Switches

- Photovoltaic

- Displays

- Automotive

- Biosensors

- Smart Packaging

- Printed Circuit Boards

- Others

By Region Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Conductive Inks Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,620.06 Million |

|

Market Size Value in 2025 |

USD 3,818.60 Million |

|

Revenue Forecast by 2034 |

USD 6,245.50 Million |

|

CAGR |

5.6 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market is projected to grow from USD 3,818.60 million in 2025 to USD 6,245.50 million by 2034.

The market is expected to register a CAGR of 5.6% during the forecast period.

Asia Pacific held the largest market share in 2024 with over 60% of total conductive inks market revenue.

DuPont.; Vorbeck Materials Corp.; Sun Chemical Corporation; PPG Industries; Chem Associates, Inc.; Henkel AG; Applied Nanotech Holdings, Inc.; Poly-Ink; Methode Electronics; Henkel Ag & Co. KgaA; and Fujikura Ltd. are among the key players in the market.

The conductive silver ink segment dominated the market in 2024 with over 22.9% of the global revenue share.

The photovoltaic segment led the market with a revenue share of over 23.0% in 2024.