Connected Rail Market Share, Size, Trends, Industry Analysis Report

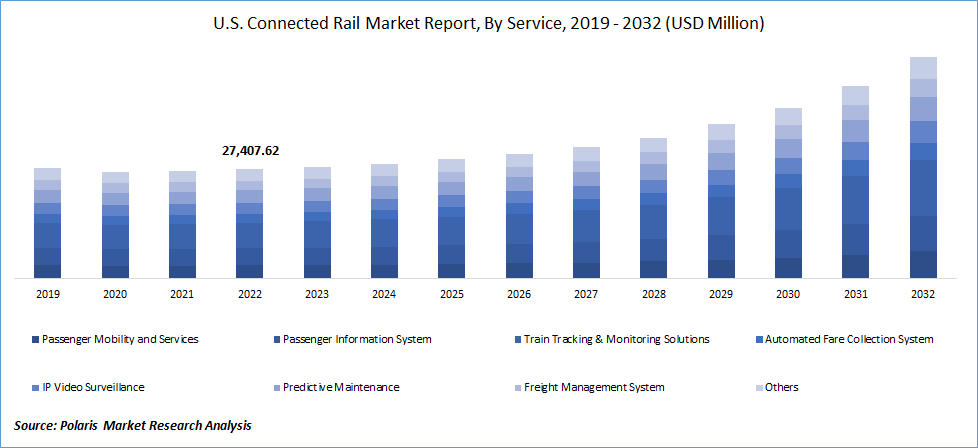

By Service; By Rolling Stock; By Safety & Signaling System (Positive Train Control, Communication/Computer-based Train Control, and Automated/Integrated Train Control); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 114

- Format: PDF

- Report ID: PM2477

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global Connected Rail market was valued at USD 93,831.91 million in 2022 and is expected to grow at a CAGR of 5.9% during the forecast period.The major factors driving the industry growth include rapid urbanization, technological advancement, and the rising demand for safer and more efficient mobility among consumers.

To Understand More About this Research: Request a Free Sample Report

The demand for the connected rail market is directly associated with the growing digital transformation and the Internet of Things (IoT) integration. Hundreds of sensors are included in today's locomotives, which perform several functions ranging from tracking internal properties such as consumable levels to external attributes such as wind speed and direction. The future of system-level connectivity is the capacity to utilize the data that each connected piece of equipment generates to enhance efficiencies and safety while cutting costs.

Furthermore, the demand for the industry is propelled by the rising environmental concern and the need for energy conservation. The connected rail system can potentially improve the energy sector and the environment. It can reduce transportation energy use, carbon dioxide, and local pollutant emissions by diversifying energy sources and offering more efficient mobility.

During the onset of COVID-19, the connected rail market has experienced negative impacts due to factors such as stringent lockdowns across the globe and transportation bans. In addition, the sluggish supply chain and decreased demand led the component manufacturers to stop production at their manufacturing facilities, which affected the industry's growth.

Furthermore, the outbreak of the Covid-19 pandemic had a strong impact on transport and mobility. Interpersonal distancing affected the travel demand of the masses during the period that witnessed a gradual downfall to reduce the spread of the contagious virus across the globe, hampering the market development.

Industry Dynamics

Growth Drivers

The global need for transportation is rapidly increasing. Passenger and freight traffic will double by 2050 if such trends continue. Growth like this is a sign of social and economic development, but it also means more energy demand, CO2 emissions, and more pollutants in the air. Therefore, increased reliance on connected rail could assist in slowing those challenges over the forecast period.

Connected rail travel suits urban needs in an increasingly urbanized world. Short-distance air travel can be replaced by high-speed connected rail, while traditional and freight rail systems can be used along with other forms of transportation to provide efficient mobility. This factor is anticipated to accelerate the growth of the market.

In addition, the technological advancements in the connected rail sector are attributed to the market’s growth. Safety, railway control, traffic management, and automated visual monitoring on trains and platforms also benefit from connected technology. Data consumption is expected to rise as passenger traffic rises, driving demand for the connected rail market.

Report Segmentation

The market is primarily segmented based on service, rolling stock, safety & signaling system, and region.

|

By Service |

By Rolling Stock |

By Safety & Signaling System |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The freight wagons segment dominated the global market in 2022.

The market was dominated by freight wagons in 2022, with an expected, leading position over the forecast period. This growth is primarily driven by implementing new technologies in the connected rail system, which is anticipated to expand the market further. Railway networks in various countries have decided to equip their freight wagons with GPS technology to enable real-time tracking and provide information to parties involved in wagon bookings.

Additionally, passenger coaches are projected to hold a significant global market share throughout the forecast period. This growth can be attributed to the rapid increase in travel and the subsequent rise in demand for passenger coaches within the railway system. In particular, the Indian railways have taken steps to meet the growing passenger inflow by increasing the number of coaches in their system. This proactive approach has contributed to the market's expansion by meeting the surging demand for passenger coaches.

Overall, integrating GPS technology in freight wagons facilitates efficient tracking and improves information transparency for stakeholders involved in wagon bookings. Simultaneously, the emphasis on enhancing the passenger experience and managing increasing passenger numbers has driven the demand for passenger coaches, particularly in countries like India. As a result, both the freight wagon and passenger coach segments are expected to contribute significantly to the market's growth and development over the forecast period.

North America holds the largest market share over the projected period.

North America will hold the largest market share throughout the forecast period. Ongoing developments in data management applications and advanced analytics are expected to significantly change the connected railway sector and enhance the commuter experience. The Internet of Things (IoT) expansion is set to drive substantial growth potential in the connected rail industry. Technology and telecom companies are collaborating to enhance the infrastructure to improve network connectivity further.

Asia Pacific, a substantial market share, is also projected over the forecast period. This growth can be attributed to several factors, including the rising demand for passenger travel, increased focus from railway operators and authorities on providing a safe and enhanced passenger experience, and support for the transformation towards connected rail systems. The region's railway industry is witnessing significant advancements in technology adoption and digitalization, leading to improved efficiency, reliability, and passenger services.

North America and the Asia Pacific region are witnessing a surge in investments and initiatives to modernize and upgrade their railway networks. This includes implementing advanced technologies like IoT, data analytics, and connectivity solutions to enable real-time monitoring, predictive maintenance, and efficient operations. These developments are expected to drive the growth of the rail market in both regions.

Competitive Insight

Some of the major players operating in the global market include ABB, Atos, Cisco, Hitachi, Huawei, IBM, Nokia, Robert Bosch GmbH, Scomi Group BHD, Siemens, Sierra Wireless, Tech Mahindra, Toshiba, Trimble, Wabtec Corporation.

Recent Developments

- In June 2019, Huawei launched a series of ICT solutions according to the needs of urban connectivity in digital time. For fully connected rail transportation, Huawei released its 5G Digital Indoor System (DIS) solutions, Urban Rail Light Cloud, as well as LTE-Railway (LTE-R) Solution, which were jointly released with Tianjin 712 Communication & Broadcasting Co., LTD. (TCB 712) for next general rail wireless communications at the UITP Global Public Transport Summit 201

Connected Rail Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 95,764.84 million |

|

Revenue forecast in 2032 |

USD 192,482.92 million |

|

CAGR |

5.9% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Service, By Rolling Stock, By Safety & Signaling System, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB, Atos, Cisco, Hitachi, Huawei, IBM, Nokia, Robert Bosch GmbH, Scomi Group BHD, Siemens, Sierra Wireless, Tech Mahindra, Toshiba, Trimble, Wabtec Corporation. |

FAQ's

The global Connected Rail market size is expected to reach USD 192,482.92 million by 2032.

Top market players in the Connected Rail Market are ABB, Atos, Cisco, Hitachi, Huawei, IBM, Nokia, Robert Bosch GmbH, Scomi Group BHD, Siemens.

North America contribute notably towards the global Connected Rail Market.

The global Connected Rail market expected to grow at a CAGR of 5.9% during the forecast period.

The Connected Rail Market report covering key segments are service, rolling stock, safety & signaling system, and region.