Container Handling Equipment Market Size, Share, Trends, & Industry Analysis Report

By Type, By Propulsion Type (Diesel, Electric, and Hybrid), By Lifting Capacity, By Handling Mode, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5765

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

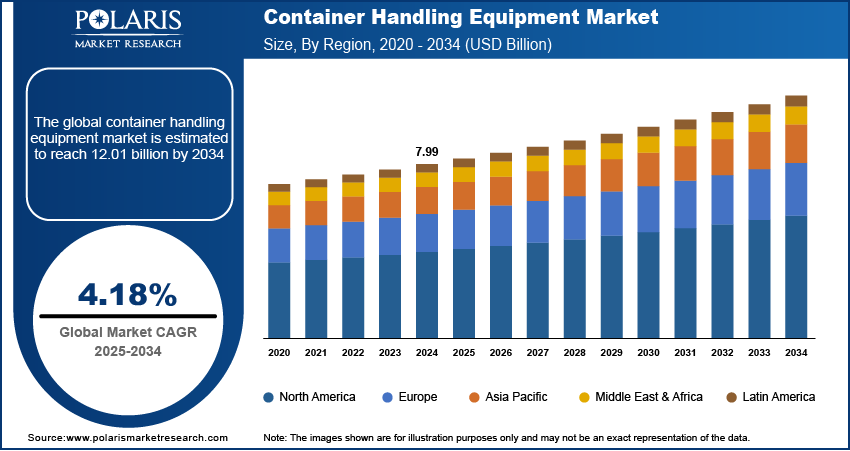

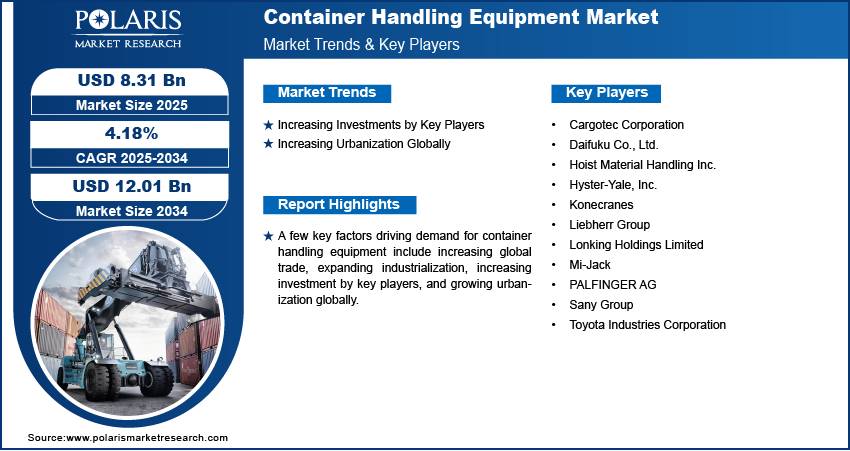

The global container handling equipment market size was valued at USD 7.99 billion in 2024, growing at a CAGR of 4.18 % during 2025–2034. Increasing global trade, expanding industrialization, increasing investments by key players, and growing urbanization globally are among the key factors driving demand for container handling equipment.

Container handling equipment (CHE) refers to the specialized machinery and tools designed for the efficient movement, storage, and management of shipping containers in ports, terminals, warehouses, and distribution centers. The primary usage of the equipment is to automate and streamline the processes of loading, unloading, stacking, relocating, and retrieving containers. It encompasses a diverse range of machinery, each designed for specific operational needs. Key types include quay cranes, reach stackers, straddle carriers, and forklifts.

The increasing global trade is driving the market growth. According to the Global Trade Update by UN Trade and Development (UNCTAD), global trade hit a record $33 trillion in 2024, expanding 3.7% compared to 2023. This increase in global trade is creating a need for efficient equipment to load, unload, and transport containers quickly and safely, propelling port operators to invest heavily in advanced container handling equipment such as cranes, reach stackers, and automated systems to reduce turnaround time and manage congestion.

The demand for container handling equipment is driven by the expanding industrialization. Industrialization is leading to a rapid inflow of raw materials and components, most of which arrive in standardized containers. This surge in containerized cargo is putting pressure on ports, inland terminals, and logistics hubs to upgrade their handling capacity. To meet these growing demands, logistics operators are investing heavily in container handling equipment such as high-capacity cranes, automated stacking systems, and advanced material handling vehicles. According to the Economic Survey 2023-24, robust industrial growth of 9.5% was witnessed in India in the financial year 2023-2024. Therefore, the expanding industrialization, particularly in emerging economies such as India and Brazil, is fueling the adoption of container handling equipment.

Industry Dynamics

Increasing Investments by Key Players

Key manufacturers are investing heavily and increasing their production capacity to allow ports, terminals, and logistics operators to acquire equipment more quickly to handle growing trade volumes. Expanding production is also lowering per-unit costs, making high-quality container handling equipment more affordable for smaller ports and emerging nations. Additionally, manufacturers are investing in the expansion of production capacity to fulfill bulk orders from mega-ports and shipping hubs undergoing expansion, further fueling demand for container handling equipment. In April 2025, Kalmar announced that it had begun production of its electric empty container handler and heavy forklift truck at the company’s Shanghai manufacturing facility. Therefore, the increasing investment by key players is expanding the production of handling equipment, contributing to market growth.

Increasing Urbanization Globally

Urban expansion is leading to the development of new ports, inland terminals, and logistics hubs near metropolitan areas to handle increased freight volumes, creating demand for container handling equipment such as cranes, forklifts, and automated stacking systems. Growing urbanization is also pushing governments and private operators to invest in smart port technologies and high-capacity handling equipment to reduce congestion and speed up supply chains. Additionally, e-commerce growth in expanding urban areas is forcing logistics providers to expand warehouse and intermodal facilities, contributing to the need for advanced container handling solutions. Hence, the increasing urbanization globally is fueling the market revenue.

Segmental Insights

By Type Analysis

Based on type, the segmentation includes forklift trucks, rubber-tired gantry (RTG) cranes, stacking cranes, mobile harbor cranes, ship-to-shore (STS) cranes, reach stackers, straddle carriers, and automated equipment. The forklift trucks segment accounted for a major revenue share in 2024 due to their versatility, cost-effectiveness, and widespread adoption across ports, warehouses, and logistics hubs. These machines handle a variety of container sizes efficiently, making them crucial for short-distance transportation and stacking in confined spaces. The growth of e-commerce and the expansion of warehouse facilities further fueled demand for forklift trucks, as businesses prioritized fast and scalable solutions to manage increasing cargo volumes. Additionally, advancements in electric and hybrid forklifts attracted environmentally conscious buyers, aligning with global sustainability initiatives and stricter emissions regulations.

The automated equipment segment is expected to grow at a robust pace in the coming years, owing to the rising demand for efficiency, safety, and growing labor costs in port operations. Automated stacking cranes (ASCs) and autonomous guided vehicles (AGVs) are increasingly being adopted as major ports are investing in smart infrastructure to enhance throughput and minimize human error. The push for Industry 4.0, coupled with advancements in AI and IoT, is further driving demand for automated equipment. Furthermore, rising labor shortages and the need for 24/7 operations in mega-ports are fueling the shift toward automation, including automated equipment.

By Propulsion Type Analysis

In terms of propulsion type, the segmentation includes diesel, electric, and hybrid. The diesel segment dominated the revenue share in 2024 due to its high torque, durability, and ability to handle heavy loads at ports and intermodal yards. Many operators preferred diesel engines for their reliability in outdoor operations, where consistent power and long runtimes are critical. The widespread availability of diesel and established maintenance infrastructure further supported its dominance, especially in regions with less developed electric charging networks.

By Lifting Capacity Analysis

Based on lifting capacity, the segmentation includes < 50 tons, 50-100 tons, and > 100 tons. The > 100 tons segment held the largest share in 2024 due to the rise of mega-ships and ultra-large container vessels (ULCVs) that require heavy-duty handling solutions. Ports worldwide upgraded their infrastructure to accommodate these vessels, adopted stronger cranes and carriers capable of managing multiple high-capacity containers simultaneously. Ship-to-shore (STS) cranes and rubber-tired gantry (RTG) cranes in this segment witnessed increased investments, particularly in deep-water ports and major trade hubs. Furthermore, automation and smart technologies integration into these high-capacity machinery improved precision and safety, which contributed to the dominance of the segment.

By Handling Mode Analysis

Based on handling mode, the segmentation includes manual and automatic. The automatic segment is expected to grow at a robust pace in the coming years, owing to the growing investments in port modernization, especially in developed regions such as Europe and North America. Port operators are increasingly adopting automated cranes, guided vehicles, and AI-driven control systems to boost operational efficiency, reduce human error, and meet rising cargo volumes. Stringent safety regulations and labor shortages in developed economies are also pushing port authorities to implement autonomous handling solutions. Additionally, digitalization trends and integration with port community systems and 5G infrastructure are enhancing the appeal of automated modes, as they offer real-time tracking, faster turnaround, and predictive maintenance capabilities.

.webp)

Regional Analysis

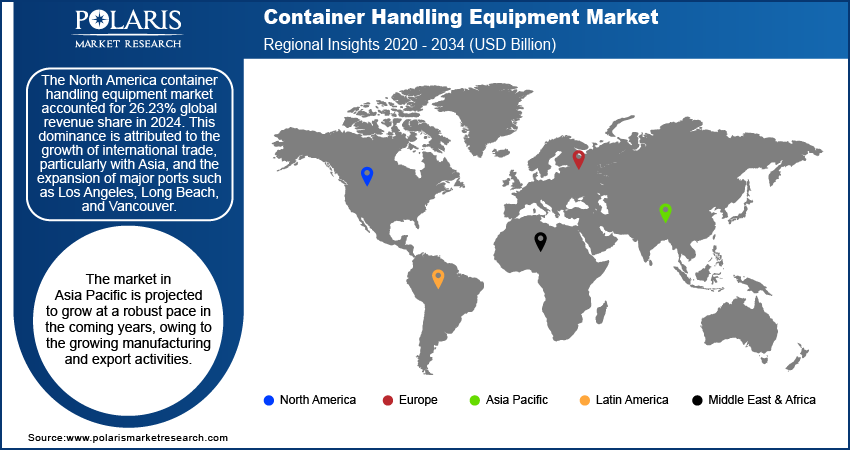

The North America container handling equipment market accounted for 26.23% global market share in 2024. This dominance is attributed to the growth of international trade, particularly with Asia, and the expansion of major ports such as Los Angeles, Long Beach, and Vancouver. The increasing adoption of automation and smart port technologies to improve efficiency and reduce labor costs also propelled container handling equipment adoption in the region. Additionally, investments in port infrastructure modernization and the rise of e-commerce in the region, which requires faster cargo handling, fueled demand. The shift toward electric equipment due to stricter environmental regulations further contributed to the regional market dominance.

US Container Handling Equipment Market Insight

The US dominated the market in North America in 2024 due to high import-export volumes, especially at key ports such as Los Angeles, New York, and Savannah. The Infrastructure Investment and Jobs Act (IIJA), enacted by the Biden administration in 2021, allocated USD 17 billion for port upgrades, which boosted demand for advanced container handling machinery. Labor shortages and the need for operational efficiency also pushed ports in the country toward automation, including automated stacking cranes (ASCs) and robotic terminal tractors.

Asia Pacific Container Handling Equipment Market

The market in Asia Pacific is projected to grow at a robust pace in the coming years, owing to the growing manufacturing and export activities. The rapid expansion of mega-ports such as Shanghai, Shenzhen, and Singapore is driving demand for high-capacity cranes and automated guided vehicles (AGVs). Growing regional trade and the rise of transshipment hubs are further boosting demand for container handling equipment. Governments in the region are also investing heavily in smart port initiatives and green technologies to reduce emissions, leading to increased adoption of electric and hybrid container handling equipment.

India Container Handling Equipment Market Overview

The market in India is rising due to the government’s Sagarmala Programme, which aims to modernize ports and enhance maritime trade. Major ports such as Jawaharlal Nehru Port Trust (JNPT) and Mundra are expanding their capacity, requiring more terminal tractors, cranes, and reach stackers. The growth of manufacturing under the "Make in India" initiative and increasing exports are also contributing to higher demand for container handling equipment. According to data released by the Reserve Bank of India, India’s total exports grew by 6.01% in the financial year 2024–25. Additionally, private sector participation in port development and the adoption of automation to reduce congestion are fueling the market expansion in India.

Europe Container Handling Equipment Market

In Europe, demand for container handling equipment is driven by the rising need to upgrade aging port infrastructure and accommodate larger vessels, particularly at key hubs such as Rotterdam, Hamburg, and Antwerp. The European Green Deal is pushing ports to adopt zero-emission equipment, such as electric rubber-tired gantry (RTG) cranes and hydrogen-powered terminal trucks, leading to market growth. The increasing containerized trade with Asia and Africa is also boosting demand for container handling equipment in the region.

Key Players & Competitive Analysis Report

The container handling equipment market is highly competitive, due to the presence of global players, regional leaders, and specialized manufacturers offering a diverse range of solutions, including ship-to-shore cranes, rubber-tired gantry cranes (RTGs), reach stackers, straddle carriers, and forklifts. Major players such as Konecranes, Liebherr Group, and Cargotec Corporation dominate the industry with their advanced automation technologies, energy-efficient designs, and strong service networks. These companies focus on innovation, integrating IoT and AI-driven predictive maintenance to enhance operational efficiency and reduce downtime, giving them a competitive edge. Toyota Industries Corporation and Hyster-Yale, Inc. are prominent in the material handling segment, leveraging their expertise in forklifts and electric-powered equipment to cater to port and warehouse logistics. Meanwhile, Daifuku Co., Ltd. specializes in automated container handling systems, particular for smart ports and logistics hubs, aligning with the growing demand for automation.

A few major companies operating in the container handling equipment market include Cargotec Corporation; Daifuku Co., Ltd.; Hoist Material Handling Inc.; Hyster-Yale, Inc.; Konecranes; Liebherr Group; Lonking Holdings Limited; Mi-Jack; PALFINGER AG; Sany Group; and Toyota Industries Corporation.

List of Key Players

- Cargotec Corporation

- Daifuku Co., Ltd.

- Hoist Material Handling Inc.

- Hyster-Yale, Inc.

- Konecranes

- Liebherr Group

- Lonking Holdings Limited

- Mi-Jack

- PALFINGER AG

- Sany Group

- Toyota Industries Corporation

Industry Developments

December 2024: Hyster-Yale confirmed full adherence to Build America, Buy America rules for electric container handlers, enabling access to federal funding opportunities.

December 2024: Konecranes finalized the acquisition of Peinemann Port Services in Rotterdam for more than EUR 40 million, strengthening its Port Solutions division.

September 2024: APM Terminals Suape, Brazil, completed the purchase of 28 all-electric container handling equipment from SANY.

October 2023: HD Hyundai Construction Equipment India announced the launch of 2 new models of electric forklifts in 2.5 ton and 3.0 ton in the material handling equipment category to strengthen its position.

May 2023: Toyota added three new electric forklift models to its lineup of material handling products and solutions. The new electric product launch features a Side-Entry End Rider, a Center Rider Stacker, and an Industrial Tow Tractor.

Container Handling Equipment Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Forklift Trucks

- Rubber-Tired Gantry (RTG) Cranes

- Stacking Cranes

- Mobile Harbor Cranes

- Ship-to-Shore (STS) Cranes

- Reach Stackers

- Straddle Carriers

- Automated Equipment

By Propulsion Type Outlook (Revenue, USD Billion, 2020–2034)

- Diesel

- Electric

- Hybrid

By Lifting Capacity Outlook (Revenue, USD Billion, 2020–2034)

- < 50 Tons

- 50-100 Tons

- > 100 Tons

By Handling Mode Outlook (Revenue, USD Billion, 2020–2034)

- Manual

- Automatic

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Ports

- Container Freight Stations (CFS)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Container Handling Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.99 Billion |

|

Market Size in 2025 |

USD 8.31 Billion |

|

Revenue Forecast by 2034 |

USD 12.01 Billion |

|

CAGR |

4.18% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.99 billion in 2024 and is projected to grow to USD 12.01 billion by 2034.

The global market is projected to register a CAGR of 4.18% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Cargotec Corporation; Daifuku Co., Ltd.; Hoist Material Handling Inc.; Hyster-Yale, Inc.; Konecranes; Liebherr Group; Lonking Holdings Limited; Mi-Jack; PALFINGER AG; Sany Group; and Toyota Industries Corporation

The forklift trucks segment dominated the market share in 2024.

The automatic segment is expected to witness the fastest growth during the forecast period.