Container Transshipment Market Size, Share, Trends, & Industry Analysis Report

: By Container Size (40-foot (FEU), 20-foot (TEU), Other Container Size), By Container Type, By Service Type, By Operation Method, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5727

- Base Year: 2024

- Historical Data: 2020-2023

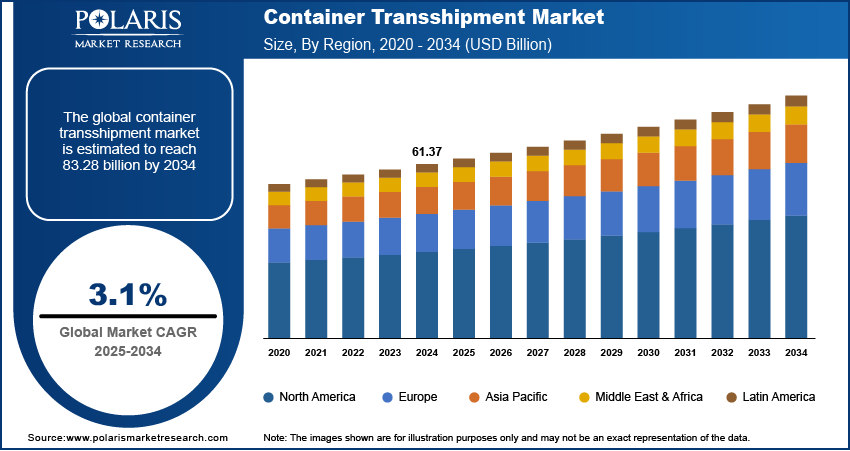

The global container transshipment market size was valued at USD 61.37 billion in 2024, growing at a CAGR of 3.1% during 2025–2034. The market is witnessing substantial growth, driven by the increasing reliance on transshipment to support the rapid growth of global e-commerce logistics, the deployment of mega container vessels requiring efficient redistribution, and the rise of the hub-and-spoke model in global trade networks. The adoption of smart port technologies is enhancing operational efficiency and cargo handling capacity, while the strategic positioning of emerging transshipment hubs in Asia-Pacific, the Middle East, and Africa is driving stronger regional connectivity and international shipping competitiveness.

Market Overview

Container transshipment refers to the process of transferring shipping containers from one vessel to another at an intermediate port before reaching their final destination. This system plays a crucial role in optimizing global logistics, allowing for efficient consolidation, redistribution, and routing of cargo across regions.

The rising number of free trade agreements and regional economic partnerships is driving demand for container transshipment. For instance, in May 2025, India and the UK signed a new free trade deal aimed at reducing tariffs on 90% of British goods entering India including whisky, food, and electronic devices. The agreement is projected to add USD 34 billion in annual bilateral trade by 2040. These agreements are streamlining trade processes and eliminating barriers, which, in turn, are increasing cargo volumes across borders and strengthening the role of transshipment hubs. Also, in January 2025, the European Union concluded negotiations on a modernized Global Agreement with Mexico aimed at boosting trade and cooperation. The agreement is expected to increase EU agri-food exports by eliminating high tariffs, open up access for EU companies to Mexico’s public procurement and service sectors, and simplify standards and procedures to support small businesses. As regional trade expands, countries need efficient systems to redistribute containers to their final destinations, and transshipment terminals offer that cost-effective connectivity. These frameworks enhance trade flexibility and boost cargo volume between member countries. Thus, there is growing reliance on regional container transshipment ports to manage higher traffic volumes and facilitate smoother intra-regional trade. This shift is making container transshipment a crucial component of modern trade infrastructure, especially in emerging economies seeking trade efficiency and cost reduction.

To Understand More About this Research: Request a Free Sample Report

Growing regional trade corridors is driving the container transshipment industry. These corridors increased the importance of transshipment hubs by connecting smaller ports to major international shipping networks. For example, the expansion of China-Europe maritime and rail trade routes, along with initiatives such as China’s Belt and Road Initiative (BRI), led to significant investments in transshipment ports across South and Southeast Asia, the Middle East, and Eastern Africa. According to a 2024 report by the Green Finance & Development Center, the Belt and Road Initiative involved over USD 1.05 trillion in total investments over the past ten years. This includes ∼USD 634 billion in construction contracts and USD 419 billion in other types of investments. These transshipment ports are becoming crucial interchange points that support multimodal transport, helping to reduce transit times for international trade.

Sri Lanka’s Port of Colombo developed into one of the world’s top transshipment hubs due to its strategic location on major East-West shipping routes. The ability of such ports to serve as regional redistribution centers enhances their strategic value, attracting more container traffic and foreign investments. With the expansion of regional trade corridors, there is a demand for efficient transshipment at these key locations continues to grow.

Industry Dynamics

Surge in Global Maritime Trade Fueling the Market Growth

The growing volume of global trade, especially containerized shipments, is significantly driving the container transshipment market. Container transshipment hubs, which serve as intermediate points where containers are offloaded and reloaded onto other vessels, are becoming indispensable for enhancing connectivity between global shipping routes and regional ports. These hubs help streamline shipping operations by reducing the need for direct port-to-port calls, thus improving operational efficiency and lowering transportation costs. This trend is especially significant given that around 80% of global trade by volume is carried via sea routes. The reliance on containerized cargo continues to grow, driven by expanding global consumption, production, and e-commerce activity. According to the United Nations Conference on Trade and Development (UNCTAD), global maritime trade rebounded in 2023 with a growth of 2.4%, reaching 12.3 billion tons, following a contraction in 2022. Also, the maritime trade sector is projected to maintain this momentum, growing at an average annual rate of 2.4% through 2029. This long-term upward trend in trade volumes is expected to create increasing pressure on ports and shipping lines to optimize cargo handling and transit efficiency. Therefore, the demand for advanced and strategically located transshipment hubs is rising significantly, making them key facilitators in sustaining the pace of global trade expansion in the years to come.

Expansion and Modernization of Port Infrastructure with Advanced Cargo Handling Technologies

Ports worldwide are upgrading their facilities to deepen berths, accommodate larger container vessels, expand container yards, and improve storage capacities to handle increasing cargo volumes. These physical upgrades are supported by advanced cargo handling technologies, such as automated gantry cranes, robotic stacking systems, and digital terminal operating software.

The integration of artificial intelligence (AI) and Internet of Things (IoT) technologies is improving port operations by enabling real-time cargo tracking, predictive maintenance, and better resource management. These innovations help increase efficiency and reduce vessel turnaround times. For example, in March 2025, Sweden’s Netmore Group partnered with Zenze and Alliot Technologies to deploy IoT solutions and LoRaWAN networks for cargo monitoring, aiming to make logistics more efficient, cost-effective, and environmentally friendly.

Modern ports are also focusing on sustainability by adopting eco-friendly technologies to reduce their environmental impact. These improvements increase capacity and efficiency while enhancing safety and reliability. This focus strengthens the role of transshipment hubs in global supply chains, enabling ports to better meet the evolving demands of international maritime trade. Hence, the development and modernization of port infrastructure boost the container transshipment market growth.

Segmental Insights

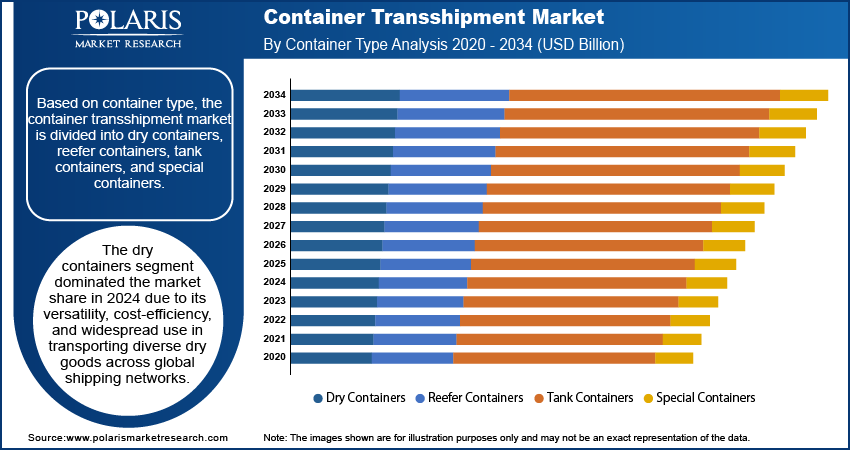

Market Assessment by Container Type

The container transshipment market, by container type, is segmented into dry containers, reefer containers, tank containers, and special containers. In 2024, the dry containers segment held the largest share in global cargo movement. These containers are widely used to transport bulk dry goods such as electronics, textiles, machinery, and packaged consumer products. Their versatility and cost-effectiveness make them highly preferred. Dry containers offer standard sizes of 20-foot (TEU) and 40-foot (FEU) lengths and are compatible with multiple transport modes, including sea, rail, and road. This compatibility enhances their efficiency within global shipping networks. Dry containers are especially favored in transshipment operations as they are easy to handle, stack, and load or unload quickly. This helps reduce vessel turnaround time at ports.

Market Evaluation by Service Type

The market, by service type, is segmented into loading services, unloading services, storage services, and transportation services. The storage services segment is expected to grow the fastest during the forecast period. This growth is driven by increasing global trade volumes and rising port traffic, which has created a strong need for efficient and scalable container storage solutions. Container storage plays a critical role in transshipment by holding containers temporarily before they are loaded onto connecting vessels. This function becomes especially important during schedule mismatches, customs delays, or when cargo needs to be consolidated. The introduction of megaships and complex shipping alliances increased the time containers spend at transshipment ports, further boosting the demand for organized and high-quality storage facilities. To address this, ports are investing in smart yard management systems, automated stacking cranes, and digital inventory controls to optimize storage space and reduce congestion.

Regional Analysis

The study covers key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific container transshipment market held the largest share, driven by its well-developed maritime infrastructure and expanding trade routes. Key ports such as Singapore, Shanghai, Busan, and Hong Kong rank among the world’s busiest transshipment hubs. These ports are equipped with deep-water facilities, allowing them to efficiently manage high container volumes while maintaining strong connectivity with major global markets.

The region’s market leadership is supported by a strong manufacturing base, especially in China, Japan, South Korea, and Southeast Asia, which generates high containerized cargo volumes. According to China’s 2025 government report, the economy grew by 5.4% in the first quarter, driven by industrial production and steady trade recovery. Outward investment also increased by 6.2%, with over 57 billion private enterprises registered. Supportive fiscal and monetary policies maintain macroeconomic stability and target an average annual GDP growth of 5%. These factors are strengthening China’s role in regional trade and boosting the growth of the China container transshipment market.

Infrastructure development and maritime connectivity projects, including the Belt and Road Initiative (BRI) and regional free trade agreements, reinforced Asia’s dominance in transshipment. Ongoing investments in port modernization, automation, and digitalization boost cargo handling capacity and precision. The region’s strategic location is a key advantage and is expected to help it maintain its leadership position for the foreseeable future.

The North America container transshipment market is expected to grow at the highest rate over the forecast period. This growth is driven by rising trade volumes, upgrades to port infrastructure, and increasing use of intermodal logistics. The U.S. government committed nearly USD 580 billion to 31 port development projects across 15 states and one territory through the Port Infrastructure Development Program. These investments aim to increase port capacity, improve supply chain efficiency, and build sustainable and resilient infrastructure, thus driving the U.S. container transshipment market growth.

Key ports such as Los Angeles, Long Beach, Savannah and Vancouver are expanding their transshipment facilities to handle larger ships and higher cargo volumes. These improvements are supported by investments to enhance port connectivity; reduce congestion; and introduce advanced technologies, including automated cranes, digital logistics platforms, and real-time cargo tracking systems.

Growth in e-commerce and cross-border trade with Latin America is also increasing the demand for efficient transshipment operations in the region. In response to environmental regulations and sustainability goals, ports are adopting green technologies to improve operational efficiency and compliance. With increased capacity and rising demand for integrated logistics, North America is set to lead transshipment container trends in the coming years.

Key Players and Competitive Analysis Report

The container transshipment industry is characterized by alliances between strategic ports, digitalization, and rising vessel sizes that require highly integrated and technologically capable transshipment operations. Competition is changing as global port operators, shipping alliances, and logistics companies invest in terminal capacity expansion, automation, and digitalization to improve the handling of containers and decrease turnaround times. The large enterprises are making joint ventures and long-term concession deals to establish themselves in busy trade routes, particularly in Asia Pacific, Europe, and North America.

Technological advancement is a major differentiator, with top transshipment ports deploying smart port technologies, terminal operating systems based on AI, IoT-based container tracking, and autonomous yard and quay equipment. Competition is also being influenced by sustainability, with investments in electrified handling gear, shore power facilities, and green hydrogen fueling stations. Blockchain integration for secure documentation and predictive scheduling for vessels is improving operational transparency and efficiency.

Operators are increasingly providing end-to-end logistics solutions, such as intermodal connectivity and value-added warehouse services, to increase their competitive advantage. The formation of mega alliances of shipping companies is impacting industry power structures, compelling transshipment terminals to transform in response to changing network requirements and bigger vessel calls. Regional development into secondary ports and inland dry ports is also being witnessed, spurred by congestion reduction and hinterland connectivity strategies.

Key Players

- A.P. Moller - Maersk

- China Ocean Shipping (Group) Company

- CMA CGM Group

- DP World

- Evergreen Marine Corporation Ltd.

- Hapag-Lloyd AG

- HMM Company Limited

- Mediterranean Shipping Company (MSC)

- Ocean Network Express Holdings, Ltd.

- Orient Overseas Container Line

- Pacific International Lines

- PSA International Pte. Ltd.

- Yang Ming Marine Transport Corporation

- Zim Integrated Shipping Services Ltd.

Industry Developments

In June 2025, Maersk partnered with Hapag‑Lloyd to launch the TP9 Trans‑Pacific service under their Gemini alliance, offering a 14-day direct link from East China and Northeast Asia (Xiamen, Busan) to the US Port of Long Beach. The route enhances supply‑chain resilience with added capacity and flexibility, supporting a continuous Xiamen–Busan–Long Beach rotation.

In April 2025, Mediterranean Shipping Company (MSC) initiated a new weekly container service directly connecting the Port of Gothenburg to major Asian ports, deploying 15,000+ TEU ships such as the MSC Auriga. This route enhances logistics for Swedish industry by integrating maritime and rail connections, expanding reach into key markets, including China, Japan, Korea, Thailand, and Vietnam.

In May 2024, COSCO Shipping launched the Green Water 01, the world’s largest river‑to‑sea fully electric container ship, boasting a 700 TEU capacity and over 50,000 kWh battery system. Operating on the Yangtze River, it reduces CO₂ emissions by around 12.4 tonnes per 100 nautical miles. It is equivalent to saving over 3,900 kg of fuel and cuts emissions by nearly 2,918 tonnes annually.

Container Transshipment Market Segmentation

By Container Type Outlook (Revenue, USD Billion, 2020–2034)

- Dry Containers

- Reefer Containers

- Tank Containers

- Special Containers

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Loading Services

- Unloading Services

- Storage Services

- Transportation Services

By Operation Method Outlook (Revenue, USD Billion, 2020–2034)

- Automated Operations

- Manual Operations

- Semi-Automated Operations

By Container Size Outlook (Revenue, USD Billion, 2020–2034)

- 40-foot (FEU)

- 20-foot (TEU)

- Other Container Size

By Mode of Transport Outlook (Revenue, USD Billion, 2020–2034)

- Sea-Based Transshipment

- Land-Based Transshipment

- Air-Based Transshipment

By Provider Type Outlook (Revenue, USD Billion, 2020–2034)

- Shipping Lines

- Freight Forwarders

- Logistics Providers

- Retailers

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Retail and E-commerce

- Automotive

- Consumer Electronics

- Agriculture and Food

- Pharmaceuticals

- Oil & gas

- Chemicals

- Other End User

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Container Transshipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 61.37 billion |

|

Market Size Value in 2025 |

USD 63.22 billion |

|

Revenue Forecast by 2034 |

USD 83.28 billion |

|

CAGR |

3.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 61.37 billion in 2024 and is projected to grow to USD 83.28 billion by 2034.

The global market is projected to register a CAGR of 3.1% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players include A.P. Moller – Maersk, China Ocean Shipping (Group) Company, CMA CGM Group, Evergreen Marine Corporation Ltd., Hapag-Lloyd AG, and Mediterranean Shipping Company (MSC).

The dry containers segment dominated the market share in 2024.

The storage services segment is expected to witness the fastest growth during the forecast period.