Creator Economy Platforms Market Size, Share, Trends, Industry Analysis Report

-By Platform Type (Distribution Platforms, Monetization Platforms, Community Engagement Platforms, and Others), Revenue Model, Content Format, Creator Tier, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5591

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

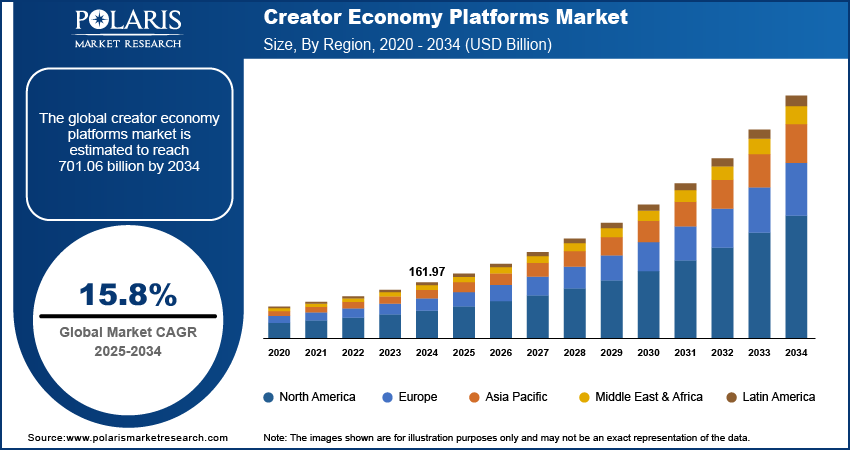

The global creator economy platforms market size was valued at USD 161.97 billion in 2024, exhibiting a CAGR of 15.8% during 2025–2034. The market is driven by the rise of influencer culture, growing demand for real-time audience engagement, increasing creator independence from traditional revenue models, and the availability of affordable, user-friendly content creation tools.

Key Insights

- Distribution platforms dominate market share due to broad content reach and integrated monetization features.

- Video content dominates with over 50% revenue share, driven by its versatility, high engagement, and support from major platforms such as YouTube and TikTok.

- North America leads in market revenue with strong digital infrastructure and legal support for creators.

- Asia Pacific shows the highest growth potential fueled by digital adoption, mobile access, and government initiatives.

Overall Dynamics

- Rising influencer culture drives demand for platforms that enable content monetization and audience interaction.

- Expansion of live streaming and real-time engagement deepens creator-audience connections and boosts revenue streams.

- Creators increasingly prefer subscription and tipping models to reduce reliance on traditional ad revenues.

- Affordable, user-friendly tools lower entry barriers, encouraging more creators to join the ecosystem.

- Growing demand for niche and authentic content diversifies platform usage and market growth.

Market Statistics

2024 Market Size: USD 161.97 billion

2034 Projected Market Size: USD 701.06 billion

CAGR (2025–2034): 15.8%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The creator economy platforms market refers to the ecosystem of digital platforms, tools, and services that enable creators (influencers, content producers, artists, etc.) to monetize their skills, content, and audiences. These platforms provide infrastructure for digital content creation, distribution, audience engagement, and revenue generation through ads, subscriptions, tips, merchandise, or other means. Affordable and user-friendly tools for video editing, graphic design, and audio production are driving creator economy platforms market development by lowering barriers to entry for aspiring creators.

Creators seeking independence from traditional ad revenue models are fueling creator economy platforms market growth, with subscription-based and tipping platforms gaining traction as viable income sources. Additionally, rising audiences toward specialized and authentic content are creating opportunities for niche creators, thereby boosting platform adoption and diversifying market demand.

Market Dynamics

Rising Popularity of Influencer Culture

The growing influence of social media personalities and content creators is driving demand for platforms that facilitate monetization and audience interaction. As influencers play a crucial role in shaping consumer behavior, leading brands boost budgets for influencer-driven marketing. A 2023 report by Meta shows that over 70% of Instagram users engage with influencers weekly, driving a significant increase in branded content partnerships. This trend highlights the critical role influencers play in shaping platform ecosystems. For instance, Meta’s recent initiative to introduce advanced analytics tools for creators highlights the importance of supporting influencer culture. These innovations empower creators to refine their strategies, attracting more users and advertisers to data monetization platforms. Hence, the rising popularity of influencer culture contributes to the creator economy platforms market demand.

Expansion of Live Streaming and Real-Time Engagement

Live streaming has revolutionized real-time content delivery, boosting deeper creator-audience connections. Platforms such as Twitch and YouTube Live have capitalized on this trend, offering interactive features such as live chats and virtual gifts. According to Twitch, the platform streamed over 20 billion hours of live content in 2022, reflecting the massive adoption of live streaming globally. This format boosts engagement and also enables creators to monetize through subscriptions and donations. Governments are also recognizing its potential. For example, South Korea’s Ministry of Culture, Sports, and Tourism launched a program in 2023 to train over 10,000 live streamers annually, emphasizing the format’s economic and cultural significance. Thus, the expansion of live video streaming and real-time engagement is expected to emerge as a key creator economy platforms market trend in the coming years.

Segment Insights

Market Assessment by Platform Type

The global creator economy platforms market segmentation, based on platform type, includes distribution platforms, monetization platforms, community engagement platforms, and others. In 2024, the distribution platforms segment accounted for more than 60% of the creator economy platforms market revenue share due to its widespread adoption as the primary channel for content dissemination. Platforms such as YouTube, TikTok, and Instagram dominate this space by offering creators unparalleled reach and scalability. Their robust algorithms and user-friendly interfaces attract millions of creators globally. The segment's leadership stems from its ability to cater to diverse content formats while integrating monetization tools. These platforms also benefit from continuous innovation, such as AI-driven recommendations and live streaming features, solidifying their position as the backbone of the creator economy.

The monetization platforms segment is expected to witness the highest CAGR of 25% over the forecast period due to increasing demand for direct income streams. Creators are shifting away from ad-dependent models, favoring subscription-based services such as Patreon and tipping platforms, including Buy Me a Coffee. This trend is emerging as creators seek financial independence and audiences willing to pay for exclusive, high-quality content. Additionally, enhanced payment integrations and blockchain technology innovations, such as cryptocurrency, are making monetization platforms more accessible and secure, accelerating their adoption.

Market Evaluation by Content Format

The global creator economy platforms market segmentation, based on content format, includes video, audio, written content, and others. According to the creator economy platforms market statistics, the video segment accounted for more than 50% of the revenue share in 2024 due to its universal appeal and high engagement levels. Platforms such as YouTube, TikTok, and Instagram Reels have capitalized on short-form and long-form video trends, driving massive audience growth. Video content’s versatility allows creators to experiment with storytelling, tutorials, and entertainment, making it the preferred format for brands and advertisers. Its dominance is further reinforced by advancements in mobile technology and affordable editing tools, enabling even amateur creators to produce professional-grade videos.

The audio segment is expected to register the highest CAGR of 22% over the forecast period due to the rising popularity of podcasts and music streaming. Platforms such as Spotify and Anchor are empowering creators to monetize their audio content through subscriptions and sponsorships. The growing demand for on-the-go consumption, coupled with improved audio production tools, is fueling this expansion. Additionally, niche podcast communities and serialized audio content are attracting dedicated audiences, creating new growth opportunities for creators to build sustainable businesses around audio formats.

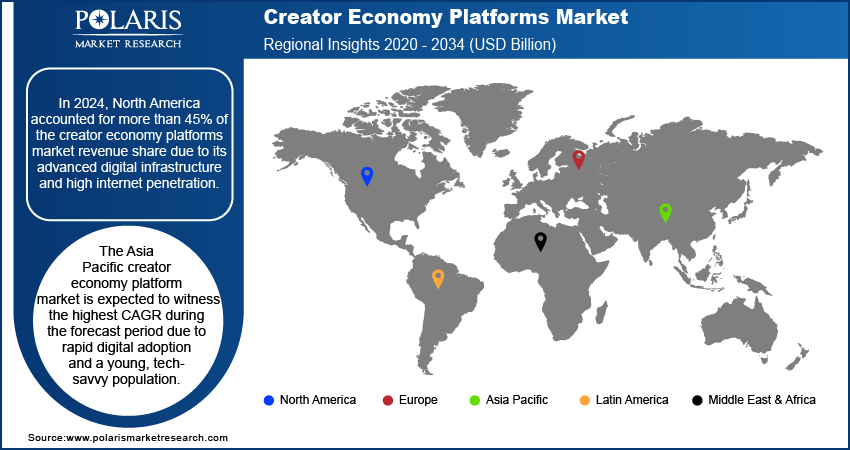

Regional Analysis

By region, the study provides creator economy platforms market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for more than 45% of the market revenue share due to its advanced digital infrastructure and high internet penetration. The region’s dominance is driven by the presence of major platforms such as YouTube, Patreon, and Twitch, which are headquartered in the US. A report from the US Department of Commerce (2023) highlighted that over 50 million Americans engaged in freelance or gig-based creative work, contributing significantly to the economy. This ecosystem is further supported by robust copyright laws and investments in AI-driven content tools, making North America a hub for innovation and monetization in the creator economy.

The Asia Pacific creator economy platforms market is expected to witness the highest CAGR during the forecast period due to rapid digital adoption and a young, tech-savvy population. Countries such as India and Indonesia are leading this growth, fueled by affordable smartphones and mobile data plans. According to a 2023 report by the Indian Ministry of Electronics and Information Technology (MeitY), India added over 100 million new internet users in 2022, with significant engagement on platforms such as ShareChat. Additionally, government initiatives promoting digital entrepreneurship, such as India’s “Digital India” campaign, are empowering local creators to monetize their skills, driving exponential creator economy platforms market expansion in the region.

Creator Economy Platforms Key Market Players & Competitive Analysis Report

The competitive landscape of the creator economy platforms market is characterized by intense innovation, rapid technological advancement, and growing diversification of services. Market participants range from long-established tech companies to emerging startups, all competing to capture the attention and loyalty of creators seeking to monetize their content and engage with audiences more effectively. One of the key competitive dynamics in this space revolves around monetization flexibility. Platforms that offer multiple income streams such as subscriptions, tipping, merchandise sales, and brand partnerships are better positioned to attract and retain creators. Additionally, seamless integration with payment systems, user-friendly interfaces, and creator-first policies play a crucial role in differentiating platforms in this crowded market. Another competitive factor is audience reach and engagement. Platforms with built-in large user bases provide immediate visibility and distribution advantages, which are critical for creators aiming to scale quickly. As a result, there is a continuous race to innovate engagement tools, including community-building features, algorithm-driven content discovery, and real-time interaction capabilities.

Data transparency and analytics are becoming central to competition. Platforms that equip creators with detailed performance insights, audience demographics, and content optimization tools are gaining favor as creators increasingly demand control over their growth strategies. Moreover, vertical specialization is emerging as a competitive edge. Platforms targeting niche segments such as writers, educators, fitness coaches, or gamers are carving out dedicated ecosystems with tailored features and monetization models that generalist platforms may lack.

Patreon, founded in 2013 and headquartered in California, US, is a membership-based platform focused on helping creators earn recurring income directly from their fans. The company provides tools for creators to offer exclusive content, early access, and behind-the-scenes material to subscribers. Patreon’s product offerings include tiered membership systems, analytics dashboards for audience insights, and integrations with platforms such as Discord and YouTube. The company serves a wide range of creators, including musicians, podcasters, writers, and visual artists. Patreon supports creators across multiple countries by facilitating direct fan engagement and sustainable revenue generation through its subscription-based model.

Meta Platforms, Inc. was established in 2004 and headquartered in California, US. The company is engaged in the development and operation of digital social platforms and tools that enable content creation, sharing, and monetization within the creator economy. The company specializes in social networking, virtual reality, and digital content ecosystems, offering a suite of products that includes Facebook, Instagram, WhatsApp, and Messenger. Meta’s product portfolio for creators is extensive, featuring tools for direct-to-consumer engagement such as paid online events, subscriptions, digital badges, and the Facebook Stars and Reels Play Bonus programs. The company also provides a creator marketplace on Instagram, where creators can connect with brands and monetize their content, and is testing digital collectibles (NFTs) integration for new forms of digital ownership and fan interaction. Services provided by Meta encompass advertising, audience analytics, and monetization support, with a growing focus on integrating these features across its platforms. Meta maintains a global presence, serving creators, businesses, and users in nearly every country, and continues to expand its offerings in both established and emerging digital markets.

List of Key Companies

- Buy Me a Coffee

- Cameo

- Discord

- Gumroad

- Ko-fi

- Linktree

- Meta

- OnlyFans

- Patreon

- Podia

- Substack

- TikTok

- Twitch (Amazon.com, Inc.)

- YouTube

Creator Economy Platforms Industry Developments

March 2025: India's government announced a $1 billion fund to boost the creator economy ahead of WAVES 2025. The government also launched the Indian Institute of Creative Technology (IICT) as a National Centre of Excellence.

In October 2023, Snapchat Launched a suite of advanced tools designed to optimize collaboration between content creators and brands. These new functionalities aim to facilitate smoother communication, streamline the partnership process, and enhance the overall efficiency of brand campaigns on the platform.

In August 2023, Meta launched Threads, a new text-sharing app designed to compete with Twitter. Built by Instagram, Threads offers a space for real-time updates and public conversations, allowing users to follow friends, creators, and brands just like on Instagram.

Creator Economy Platforms Market Segmentation

By Platform Type Outlook (Revenue – USD Billion, 2020–2034)

- Distribution Platforms

- Monetization Platforms

- Community Engagement Platforms

- Others

By Revenue Model Outlook (Revenue – USD Billion, 2020–2034)

- Subscription-Based

- Ad-Supported

- Pay-per-View or Tip-Based

- E-commerce integration

- Others

By Content Format Outlook (Revenue – USD Billion, 2020–2034)

- Video

- Audio

- Written Content

- Others

By Creator Tier Outlook (Revenue – USD Billion, 2020–2034)

- Individuals or Small Teams

- Influencers and Celebrities

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 161.97 billion |

|

Market Size Value in 2025 |

USD 186.94 billion |

|

Revenue Forecast in 2034 |

USD 701.06 billion |

|

CAGR |

15.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global creator economy platforms market size was valued at USD 161.97 billion in 2024 and is projected to grow to USD 701.06 billion by 2034.

The global market is projected to register a CAGR of 15.8% during the forecast period.

In 2024, North America accounted for the largest market share due to its advanced digital infrastructure and high internet penetration.

A few of the key players in the market are Buy Me a Coffee, Cameo, Discord, Gumroad, Meta, Ko-fi, Linktree, OnlyFans, Patreon, Podia, Substack, TikTok, Twitch (Amazon.com, Inc.), and YouTube.

In 2024, the distribution platforms segment accounted for more than 60% of the revenue share due to its widespread adoption as the primary channel for content dissemination.

In 2024, the video segment accounted for more than 54% of the revenue share due to its universal appeal and high engagement levels.