Near Infrared Imaging Market Size, Share, Trends, Industry Analysis Report

By Product (Devices, Reagents), By Indication, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6180

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

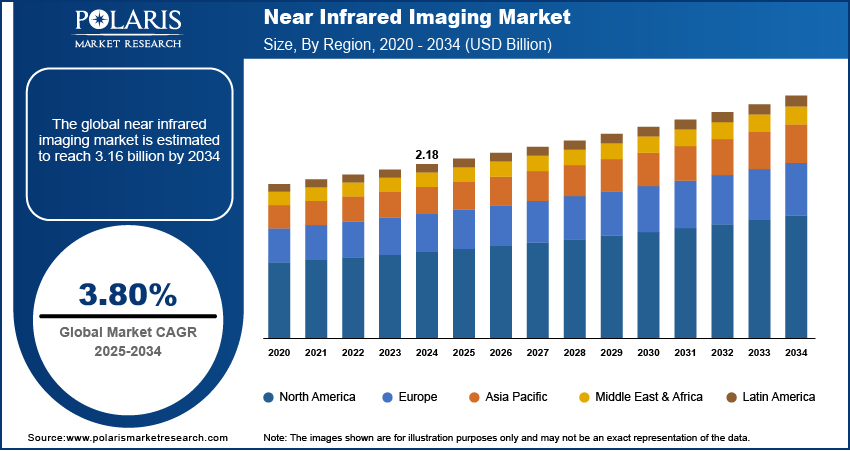

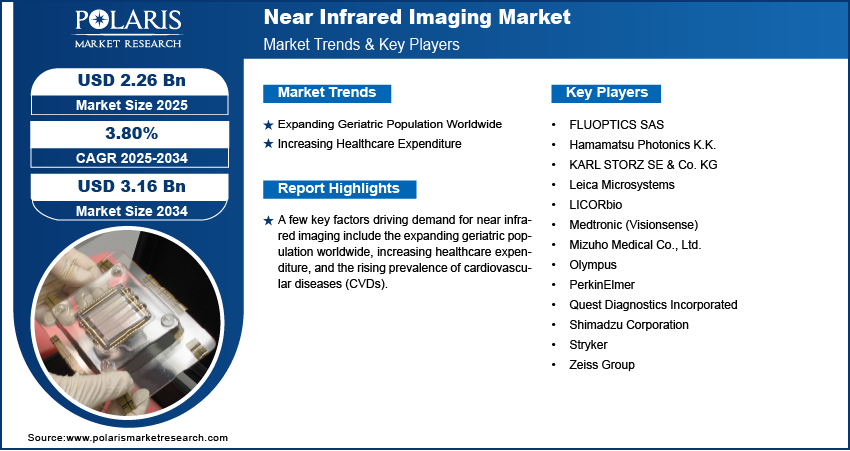

The global near infrared imaging market size was valued at USD 2.18 billion in 2024, growing at a CAGR of 3.80% from 2025 to 2034. Key factors driving demand for near infrared imaging include expanding geriatric population worldwide, increasing healthcare expenditure, and rising prevalence of cardiovascular diseases (CVDs).

Key Insights

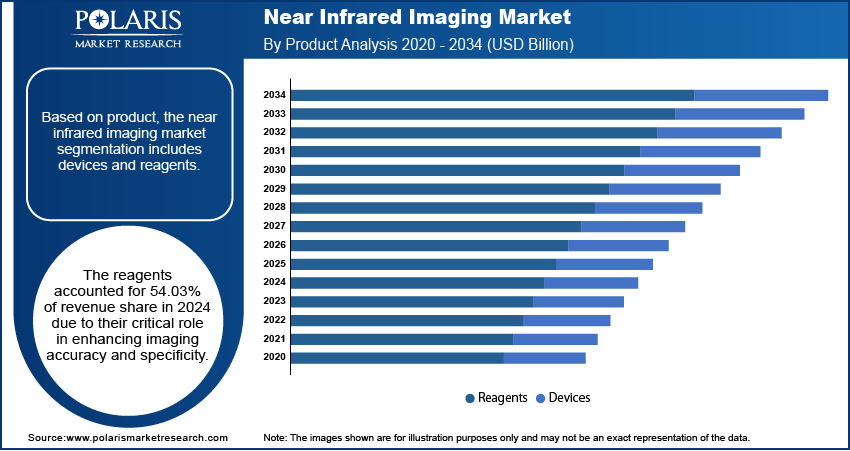

- The reagents accounted for 54.03% of revenue share in 2024 due to its important role in enhancing imaging specificity and accuracy.

- The preclinical imaging segment accounted for 33.16% of revenue share in 2024 due to near infrared imaging extensive use in drug development.

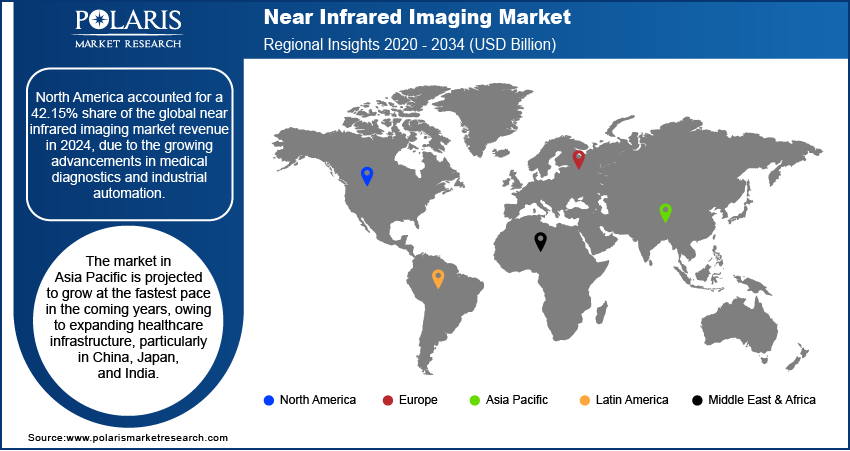

- North America near infrared imaging market accounted for 42.15% of global revenue share in 2024, due to growing advancements in medical diagnostics.

- The U.S. held the largest revenue share in North America near infrared imaging landscape in 2024 due to widespread use of near infrared imaging in minimally invasive surgeries.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to rising healthcare infrastructure in countries such as China, Japan, and India.

Industry Dynamics

- The expanding geriatric population worldwide is driving market growth, as surgeons utilize near infrared (NIR) technology during surgical procedures on elderly patients to monitor blood flow.

- The increasing healthcare expenditure is driving the adoption and developments of NIR imaging, enabling hospitals and clinics to invest in advanced diagnostic and surgical technologies.

- The rising incidence of gastrointestinal disease is expected to create a lucrative opportunity during the forecast period.

- Continuous NIR may cause unexpected photoaging and muscle thinning, which hinders the market growth.

Market Statistics

- 2024 Market Size: USD 2.18 Billion

- 2034 Projected Market Size: USD 3.16 Billion

- CAGR (2025–2034): 3.80%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Near Infrared (NIR) imaging is a noninvasive technique that captures light in the near-infrared spectrum, beyond the visible light range. NIR imaging is widely used in various fields due to its ability to penetrate deeper into tissues and provide high-contrast images. In medicine, it is employed for functional brain imaging, tumor detection, and monitoring blood oxygenation levels, as hemoglobin and other biomolecules have distinct NIR absorption patterns. NIR imaging in agriculture assesses crop health, soil quality, and moisture content by analyzing plant reflectance, enabling precision farming. The food industry uses it to detect contaminants, measure nutrient content, and ensure quality control.

Industrial applications of near infrared imaging include material inspection, such as identifying defects in semiconductors or analyzing chemical compositions in pharmaceuticals. Additionally, NIR imaging is utilized in night vision devices, as many objects emit or reflect NIR light even in low visible light conditions. Its non-destructive nature makes it ideal for art restoration, allowing experts to uncover hidden layers in paintings or detect aging in historical artifacts. Advances in camera technology and machine learning are projected to further enhance NIR imaging's accuracy and accessibility, expanding its applications.

The global near infrared imaging market demand is driven by the rising prevalence of cardiovascular diseases (CVDs). According to the World Health Organization (WHO), cardiovascular diseases (CVDs) are the leading cause of death globally, accounting for an estimated 17.9 million deaths each year. This is driving healthcare providers to seek noninvasive, real-time imaging solutions, including near infrared imaging to detect blockages, assess blood flow, and monitor tissue oxygenation.

Drivers & Opportunities

Expanding Geriatric Population Worldwide: Aging often leads to weakened vascular systems, slower wound healing, and a greater need for precise, noninvasive diagnostic tools, key areas where NIR imaging excels. Surgeons use NIR technology during surgical procedures on elderly patients to monitor blood flow and tissue viability, reducing complications in high-risk cases. Additionally, the geriatric population requires frequent medical monitoring, and NIR imaging’s safety profile makes it ideal for repeated use without radiation exposure. World Health Organization, in its report, stated that the number of people aged 60 and above worldwide is projected to increase from 1.1 billion in 2023 to 1.4 billion by 2030. Therefore, as the aging population expands, hospitals and clinics increasingly adopt NIR imaging.

Increasing Healthcare Expenditure: The rising global healthcare expenditure is enabling hospitals and clinics to invest in advanced diagnostic and surgical technologies, including near infrared (NIR) imaging. Governments and private healthcare providers are allocating more funds to modernize medical infrastructure, prioritizing tools such as NIR imaging that enhance precision, reduce invasiveness, and improve patient outcomes. Higher budgets are also allowing research institutions to explore new applications of NIR technology, such as cancer detection or intraoperative guidance. Thus, increasing healthcare expenditure is accelerating the adoption of NIR imaging.

Segmental Insights

Product Analysis

Based on product, the segmentation includes devices and reagents. The reagents accounted for 54.03% of revenue share in 2024 due to their critical role in enhancing imaging accuracy and specificity. Fluorescent dyes and contrast agents, essential for targeting biomarkers, witnessed high demand in precision medicine and targeted therapies. The growing number of cancer diagnostics and surgical guidance procedures further propelled reagent sales in 2024. Moreover, pharmaceutical companies and biotech firms invested heavily in novel reagent development, ensuring their dominance.

The devices segment is projected to grow at a robust pace in the coming years, owing to the widespread adoption of advanced imaging devices in clinical and preclinical applications. Surgeons and researchers are increasingly relying on high-resolution cameras and handheld scanners for real-time visualization during procedures, boosting demand. Technological advancements, such as improved sensitivity and portability, are further driving the segment's growth. Additionally, rising investments in healthcare infrastructure, particularly in North America and Europe, are fueling the deployment of devices in hospitals and research laboratories.

Indication Analysis

In terms of indication, the segmentation includes preclinical imaging, cancer surgeries, gastrointestinal surgeries, cardiovascular surgeries, plastic/reconstructive surgeries, and others. The preclinical imaging segment accounted for 33.16% of revenue share in 2024 due to near-infrared imaging use in pharmaceutical research and drug development. Academic institutions, biotech firms, and contract research organizations increasingly relied on near infrared imaging to study disease progression, evaluate therapeutic efficacy, and optimize preclinical trials. The ability to provide high-resolution, real-time visualization of biological processes in small animals significantly enhanced research accuracy, driving adoption. Additionally, rising investments in biomedical research and the growing demand for personalized medicine further contributed to preclinical imaging as the dominant segment.

The cancer surgeries segment is expected to grow at a rapid pace in the coming years, owing to the rising global incidence of malignancies and the need for precise tumor detection. Surgeons are adopting NIR imaging to improve tumor margin identification and reduce recurrence rates. Advances in targeted contrast agents, which enhance the visibility of cancerous tissues, are accelerating adoption in oncology. Furthermore, increasing regulatory approvals for imaging-assisted surgical tools and the expansion of minimally invasive procedures are projected to propel the segment’s growth during the forecast period.

End Use Analysis

In terms of end use, the segmentation includes hospitals & clinics, pharmaceutical & biotechnology companies, and research laboratories. The pharmaceutical & biotechnology companies segment is projected to register the highest CAGR from 2025 to 2034, owing to their expanding role in drug discovery and preclinical research. These firms are increasingly integrating near infrared imaging into their R&D pipelines to study drug efficacy, monitor disease progression, and optimize therapeutic agents. The rise of biologics and targeted therapies, which require high-resolution visualization for validation, is estimated to further boost demand. Moreover, growing collaborations between academic research labs and biopharma companies to develop novel imaging biomarkers are expected to strengthen the segment’s growth in the coming years.

Regional Analysis

The North America near infrared imaging market accounted for 42.15% of the global revenue share in 2024. This dominance is attributed to growing advancements in medical diagnostics and industrial automation. The region’s strong healthcare infrastructure and increasing adoption of NIR imaging in surgeries, cancer detection, and ophthalmic diagnostics further contributed to market dominance. Additionally, the expansion of agricultural technology (AgTech) and food quality inspection systems in the region fueled demand for near infrared imaging. The presence of key industry players and significant investments in research and development (R&D) also propelled the market expansion in North America.

U.S. Near Infrared Imaging Market Insights

The U.S. held the largest revenue share of the North America near infrared imaging landscape in 2024 due to widespread use of near infrared imaging in healthcare, particularly in minimally invasive surgeries, brain imaging, and cardiovascular diagnostics. The growing emphasis on precision medicine and early disease detection further supported the adoption of near infrared imaging. Furthermore, the food and agriculture sectors leveraged NIR for quality control and crop monitoring in 2024, supported by government initiatives promoting advanced agricultural technologies.

Europe Near Infrared Imaging Market Trends

The market in Europe is projected to hold a substantial revenue share by 2034 due to stringent regulatory standards in pharmaceuticals and food safety, where NIR is used for quality assurance. The medical sector in Europe also benefits from NIR’s applications in oncology and neurology, supported by robust healthcare systems. Industrial automation and automotive safety systems in the region are also contributing to growth. Additionally, environmental monitoring and aerospace applications are stimulating market demand, with countries such as the UK, France, and Germany leading in technological adoption.

Germany Near Infrared Imaging Market Overview

Germany is witnessing high demand for NIR imaging in automotive manufacturing and industrial automation. The country’s strong medical device industry is utilizing NIR for surgical guidance and diagnostics. Furthermore, Germany’s focus on Industry 4.0 and smart manufacturing is driving the integration of NIR imaging for quality control. Research institutions and government funding for innovation are playing a crucial role in market expansion in Germany.

Asia Pacific Near Infrared Imaging Market Analysis

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to expanding healthcare infrastructure, particularly in China, Japan, and India. Medical applications, including cancer detection and endoscopic procedures, are heavily utilizing near infrared imaging in the region. The agricultural sector is also leveraging NIR for crop monitoring and food safety. Increasing defense spending and surveillance needs in countries such as India and China are further boosting adoption. STOCKHOLM INTERNATIONAL PEACE RESEARCH INSTITUTE, in its report, stated that India’s military expenditure grew by 1.6% to $86.1 billion in 2024 from 2023. Additionally, government initiatives supporting technological advancements and local manufacturing are propelling market expansion in the region.

Key Players & Competitive Analysis

The near infrared (NIR) imaging market is highly competitive, with key players such as Hamamatsu Photonics K.K., Olympus, and Stryker leading in technological innovation and profitability share. Hamamatsu Photonics specializes in advanced photonic sensors and imaging systems, while Olympus focuses on medical and surgical NIR applications, particularly in endoscopy and fluorescence-guided surgery. Stryker, through its subsidiary Novadaq, dominates in intraoperative imaging with its SPY fluorescence systems. Medtronic (Visionsense) and KARL STORZ compete closely in neurosurgical and minimally invasive imaging, leveraging high-resolution NIR cameras and augmented reality integration. Zeiss Group and Leica Microsystems are prominent in preclinical and research-based NIR imaging, offering high-precision microscopy solutions. FLUOPTICS SAS and Mizuho Medical Co., Ltd. cater to niche segments, such as fluorescence-guided oncology and open surgical imaging. Meanwhile, PerkinElmer and Shimadzu Corporation provide hybrid NIR systems for both medical diagnostics and pharmaceutical research. Quest Diagnostics plays a role in diagnostic NIR applications, though its presence is more limited compared to device manufacturers. The market is characterized by rapid advancements in AI integration, real-time imaging, and miniaturization, with companies competing on resolution, portability, and clinical applicability.

A few major companies operating in the near infrared imaging industry include FLUOPTICS SAS; Hamamatsu Photonics K.K.; KARL STORZ SE & Co. KG; Leica Microsystems; Medtronic (Visionsense); Mizuho Medical Co., Ltd.; Olympus; PerkinElmer; Quest Diagnostics Incorporated; Shimadzu Corporation; Stryker; and Zeiss Group.

Key Players

- FLUOPTICS SAS

- Hamamatsu Photonics K.K.

- KARL STORZ SE & Co. KG

- Leica Microsystems

- LICORbio

- Medtronic (Visionsense)

- Mizuho Medical Co., Ltd.

- Olympus

- PerkinElmer

- Quest Diagnostics Incorporated

- Shimadzu Corporation

- Stryker

- Zeiss Group

Near Infrared Imaging Industry Developments

In February 2025, Stryker announced the acquisition of Inari Medical, Inc., a company that provides innovative solutions for venous thromboembolism (VTE) clot removal without the use of thrombolytic drugs.

In April 2024, LICORbio launched a pair of brand-new Odyssey F biomolecular imaging systems to provide researchers with significantly faster scans, greater value and expanded assay support.

Near Infrared Imaging Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Devices

- Near-infrared Fluorescence Imaging Systems

- Near-infrared Fluorescence & Bioluminescence Imaging Systems

- Reagents

- Indocyanine Green (ICG)

- Other

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Preclinical Imaging

- Cancer Surgeries

- Gastrointestinal Surgeries

- Cardiovascular Surgeries

- Plastic/Reconstructive Surgeries

- Other

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Research Laboratories

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Near Infrared Imaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.18 Billion |

|

Market Size in 2025 |

USD 2.26 Billion |

|

Revenue Forecast by 2034 |

USD 3.16 Billion |

|

CAGR |

3.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.18 billion in 2024 and is projected to grow to USD 3.16 billion by 2034.

The global market is projected to register a CAGR of 3.80% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are FLUOPTICS SAS; Hamamatsu Photonics K.K.; KARL STORZ SE & Co. KG; Leica Microsystems; Medtronic (Visionsense); Mizuho Medical Co., Ltd.; Olympus; PerkinElmer; Quest Diagnostics Incorporated; Shimadzu Corporation; Stryker; and Zeiss Group.

The reagents segment dominated the market revenue share in 2024.

The pharmaceutical & biotechnology companies segment is projected to witness the fastest growth during the forecast period.