Maritime Cybersecurity Market Size, Share, Trend, Industry Analysis Report

By Component (Solution, Services), By Security Type, By Deployment, By Organization Size, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6183

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

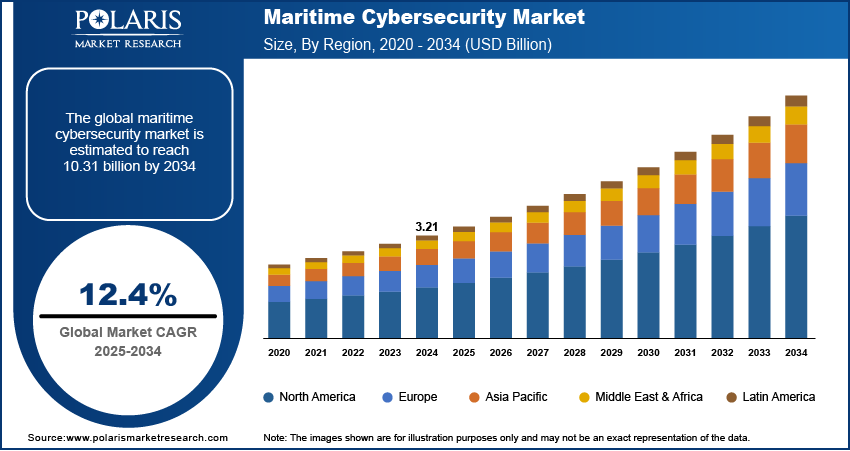

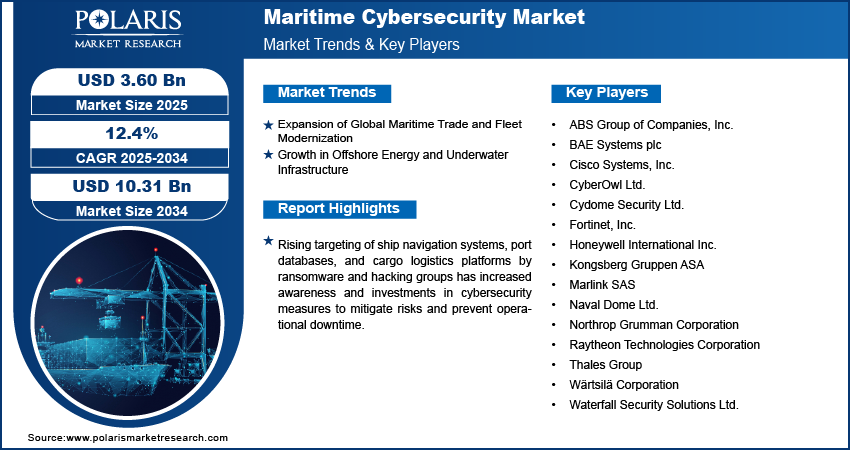

The global maritime cybersecurity market size was valued at USD 3.21 billion in 2024, growing at a CAGR of 12.4% from 2025 to 2034. Increased targeting of ship navigation systems, port databases, and cargo logistics platforms by ransomware and hacking groups has propelled the awareness and investments in cybersecurity measures to mitigate risks and prevent operational downtime.

Key Insights

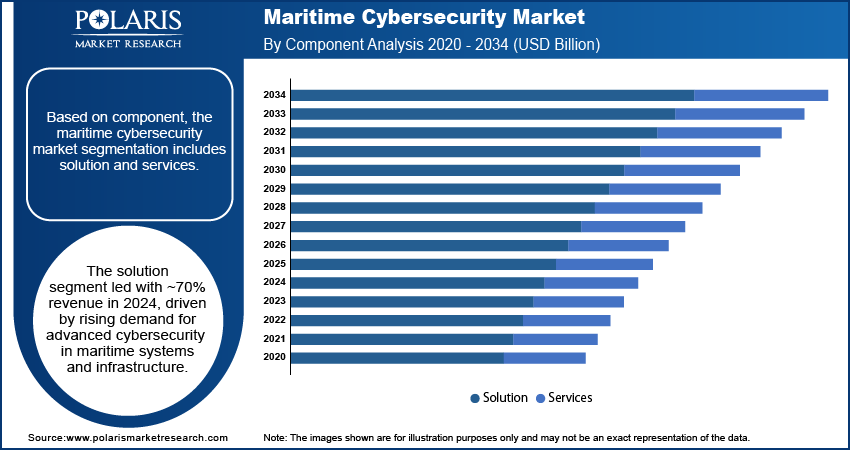

- The solution segment dominated the market with ~70% of the revenue share in 2024 due to growing demand for robust and specialized cybersecurity platforms.

- The network security segment held ~34% of the revenue share in 2024 due to its vital role in safeguarding vessel-to-shore and intra-ship communication channels.

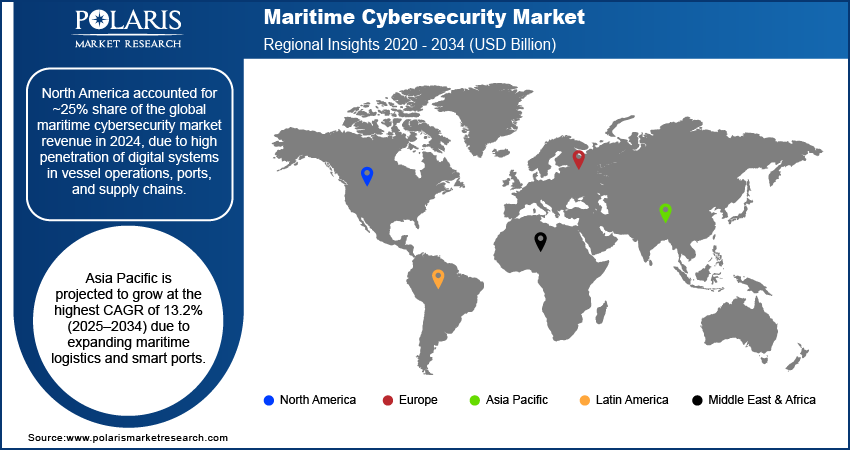

- The North America maritime cybersecurity market accounted for ~25% of the revenue share in 2024 due to the high penetration of digital systems in vessel operations, ports, and supply chains.

- The U.S. dominated the North America market in 2024 due to the early adoption of next-generation communication, navigation, and autonomous systems within the maritime industry.

- The market in Asia Pacific is expected to register the highest CAGR of 13.2% from 2025 to 2034 due to the rapid expansion of maritime logistics infrastructure and smart port development across emerging economies.

- China led the Asia Pacific market in 2024, due to the large-scale adoption of digital port systems and high-volume international shipping operations.

Industry Dynamics

- The increasing digitalization of ports and vessels is driving demand for robust cybersecurity solutions across global maritime operations.

- Rising number of cyberattacks on shipping networks and critical port infrastructure is accelerating the adoption of advanced threat detection systems.

- Integration of AI and real-time monitoring enables faster response to cyber threats in navigation, cargo, and communication systems.

- Lack of standardized regulations and global compliance frameworks hinders consistent cybersecurity implementation across international shipping fleets.

Market Statistics

- 2024 Market Size: USD 3.21 billion

- 2034 Projected Market Size: USD 10.31 billion

- CAGR (2025–2034): 12.4%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The maritime cybersecurity market refers to technologies, services, and strategies designed to protect critical maritime infrastructure, vessels, port operations, and offshore platforms from cyber threats. It focuses on safeguarding digital navigation, communication, cargo management, and control systems from unauthorized access and disruptions. Automation, IoT, and connected systems in maritime operations have increased efficiency but also expanded the attack surface, necessitating advanced cybersecurity solutions to secure digitally controlled engines, communication modules, and port logistics.

Mandatory implementation of frameworks such as the IMO’s Maritime Cyber Risk Management Guidelines (IMO 2021) is pushing shipping companies and port authorities to adopt comprehensive cybersecurity tools and services. Moreover, growth in smart ship technologies, including AI-powered navigation and remote-controlled vessels, requires robust cybersecurity protocols to prevent manipulation, data theft, and system takeovers in real-time environments.

Drivers and Opportunities

Expansion of Global Maritime Trade and Fleet Modernization: Global shipping is evolving rapidly, with operators modernizing fleets to meet higher efficiency and sustainability goals. According to the United Nations Conference on Trade and Development, in 2023, global maritime trade experienced a growth rate of 2.4% This includes using advanced digital tools for fuel monitoring, route planning, and cargo management. These upgrades improve performance but bring new cyber risks. Systems once isolated are connected to shore operations and cloud-based platforms, making them targets for cyber threats. Investments in cybersecurity has become critical to ensure these technologies work safely. Companies are prioritizing secure communication links, real-time monitoring, and protection for onboard digital systems to maintain operational safety and comply with international security standards.

Growth in Offshore Energy and Underwater Infrastructure: Offshore platforms and underwater installations are becoming increasingly digital, relying on connected systems to manage energy production, drilling operations, and data transmission. Wind farms, oil rigs, and subsea cables use automated technologies for control and monitoring, making cybersecurity essential. According to the National Renewable Energy Laboratory, Larger offshore wind turbines are moving toward commercial production, showcasing substantial growth over the past decade. The average capacity of installed turbines rose from 7.7 MW in 2022 to 9.7 MW in 2023. Any disruption caused by a cyberattack halt operations or compromise sensitive data. Protecting these remote assets requires advanced security strategies, including threat detection, secure communication protocols, and system hardening. Companies are also focusing on real-time alert systems and incident response plans to reduce downtime and prevent costly damage to infrastructure in these high-risk offshore environments. Hence, the growth in offshore energy and underwater infrastructure boosts the demand for maritime cybersecurity solutions and services.

Segmental Insights

Component Analysis

Based on component, the segmentation includes solutions and services. The solutions segment dominated the market with ~70% of the revenue share in 2024 due to growing demand for robust and specialized cybersecurity platforms that secure interconnected shipboard systems and maritime infrastructure. Shipping companies increasingly invest in intrusion detection systems, network firewalls, and vessel tracking protection tools to address rising incidents of cyberattacks. Regulatory compliance such as IMO’s cybersecurity guidelines further drives demand for comprehensive software-based frameworks. The need to ensure operational continuity, data integrity, and real-time threat visibility during voyages has led fleet operators to prioritize solution-based offerings. These tools also offer centralized monitoring across global fleets, reducing downtime and minimizing financial loss from potential cyber breaches.

The services segment is expected to register the highest CAGR of 13.0% from 2025 to 2034, driven by the increasing reliance on specialized consulting, training, and managed security services tailored for maritime needs. Companies are turning to external cybersecurity experts to design and implement customized security frameworks for vessel fleets and port operations. Ongoing threats and limited in-house technical capacity have boosted demand for 24/7 threat monitoring, incident response, and risk assessment services. Frequent software upgrades and policy compliance also require professional support. Service providers offer audits and penetration testing that are crucial in identifying vulnerabilities in both new and legacy maritime systems, driving this segment’s strong future outlook.

Security Type Analysis

In terms of security type, the segmentation includes network security, endpoint security, application security, cloud security, and operational technology (OT) security. The network security segment held ~34% of the revenue share in 2024 due to its vital role in safeguarding vessel-to-shore and intra-ship communication channels. Increasing digitalization of navigation, cargo handling, and fleet management has made onboard networks prime targets for malware and phishing attacks. Fleet operators are investing in secure gateways, traffic segmentation, and encrypted communications to protect against unauthorized access and data theft. Integration of maritime satellite communication and internet-based systems further amplifies the exposure, compelling operators to deploy firewalls and intrusion prevention tools. Ensuring uninterrupted, secure data flow between ships and control centers has become a critical focus, leading to dominance of network security solutions.

The operational technology (OT) security segment is expected to register the highest CAGR of 13.1% from 2025 to 2034 due to the increasing deployment of automated control systems in propulsion, navigation, and cargo handling. Cyber risks targeting programmable logic controllers and other OT systems can disrupt critical vessel operations and cause safety hazards. Maritime organizations are shifting focus toward securing real-time operating systems and hardware from manipulation or unauthorized access. Growing integration of IT and OT environments has made traditional security tools insufficient, fueling demand for specialized OT protection. Adoption of anomaly detection, system integrity monitoring, and threat intelligence for maritime control systems supports this segment’s projected high growth rate.

Deployment Analysis

In terms of deployment, the segmentation includes on-premise and cloud. The on-premise segment held the largest revenue share of ~65% in 2024 due to the high preference for localized security infrastructure on vessels and ports that allows complete control over data and system configurations. Operators dealing with sensitive cargo or defense-related activities often avoid cloud reliance due to security and latency concerns. Maritime firms prefer on-premise models to meet internal compliance and reduce exposure to third-party vulnerabilities. These systems offer direct access for updates, configuration, and monitoring even in low-connectivity conditions at sea. Such setups are particularly favored in high-security applications such as navigation, engine control, and surveillance systems, contributing to their dominant market presence.

The cloud segment is expected to register the highest CAGR of 13.2% from 2025 to 2034 due to the rising need for scalable, flexible, and cost-efficient cybersecurity models in the maritime sector. Companies managing multiple vessels and port terminals prefer cloud platforms for centralized monitoring, remote updates, and faster incident response. These systems enable real-time visibility across geographically dispersed assets without requiring major hardware investments. Increased collaboration between port authorities, logistics providers, and fleet managers has also made secure cloud-based communication essential. Cloud vendors are now offering maritime-specific security packages that include encrypted data transfer, automated compliance tools, and multi-layered authentication, supporting rapid adoption across the shipping ecosystem.

End User Analysis

In terms of end user, the segmentation includes commercial shipping, naval and defense, port operators, offshore operations, and others. The commercial shipping segment held the largest revenue share of ~40% in 2024 due to large-scale digital integration across cargo tracking, voyage planning, fuel management, and crew operations. Operators of container ships, bulk carriers, and tankers are adopting automation and IoT systems that require advanced cybersecurity measures. Growing use of electronic navigation charts, online documentation, and satellite connectivity increases exposure to cyber threats, especially during long-haul voyages. These risks can affect delivery schedules and cargo safety, prompting commercial fleets to invest in dedicated cybersecurity infrastructure. Pressure from insurers and regulators to comply with maritime security standards also drives adoption, making this the largest contributing segment.

The naval and defense segment is expected to record the highest CAGR of 13.0% from 2025 to 2034, due to the increasing deployment of autonomous vessels, AI-based surveillance, and strategic communication networks. Military vessels face heightened risk from cyber espionage, disruption attacks, and signal interference targeting sensitive defense operations. Armed forces are adopting advanced cybersecurity protocols to secure real-time data links, radar systems, and missile control platforms. Focus on national security, confidentiality, and operational continuity in hostile environments is fueling investments in both hardware and software security layers. Defense ministries are also working with tech providers to develop mission-specific cybersecurity tools, driving long-term growth.

Regional Analysis

The North America maritime cybersecurity market accounted for ~25% of the revenue share in 2024 due to high penetration of digital systems in vessel operations, ports, and supply chains. Investment in smart port infrastructure and integrated communication systems created a strong demand for cybersecurity tools that protect data and operations in real time. Regulatory requirements such as the U.S. Coast Guard cybersecurity framework further encouraged rapid adoption of secure technologies. Strong collaboration between maritime operators and cybersecurity vendors helped in the quick deployment of advanced protection solutions. Growth was also supported by high awareness of the financial and operational risks tied to cyber threats in maritime logistics.

U.S. Maritime Cybersecurity Market Insights

The U.S. dominated the market in 2024 due to early adoption of next-generation communication, navigation, and autonomous systems within the maritime industry. Ship owners and port authorities invested heavily in endpoint and network security to prevent threats from affecting operations and safety. Government-backed initiatives and funding programs supported cybersecurity innovation, pushing vendors to develop and deploy scalable solutions. The country also benefited from the presence of leading cybersecurity firms actively collaborating with maritime stakeholders. Rising geopolitical tensions and the increasing need for resilient maritime infrastructure led to strong demand for tailored solutions that ensure protection across digital and operational platforms.

Asia Pacific Maritime Cybersecurity Market Trends

Asia Pacific is expected to register the highest CAGR of 13.2% from 2025 to 2034 due to the rapid expansion of maritime logistics infrastructure and smart port development across emerging economies. In 2024, the Ministry of Transport of China reported a 12% year-on-year increase in smart port investments, reaching USD 8.5 billion, driven by automation and digital security upgrades across major ports. Investments in fleet modernization and automation created vulnerabilities that required strong cybersecurity strategies. Governments in the region introduced new policies to secure digital operations within seaports and maritime transport. Integration of AI, IoT, and cloud-based systems across fleets and terminals generated demand for customized protection tools. Expansion of maritime trade routes and increasing geopolitical complexity contributed to greater urgency among stakeholders to strengthen security frameworks and respond to emerging threats effectively.

China Maritime Cybersecurity Market Overview

China led the Asia Pacific market in 2024 due to the large-scale adoption of digital port systems and high-volume international shipping operations. The country prioritized cybersecurity through its national strategies, promoting secure technologies in critical infrastructure, including maritime transport. Massive investments in autonomous vessel trials and 5G-enabled smart ports increased exposure to cyber risks, driving demand for multi-layered security systems. Domestic technology providers collaborated closely with state-run maritime companies to deploy localized cybersecurity tools. Growing cross-border trade partnerships and rising focus on supply chain resilience also pushed Chinese companies to adopt stronger, scalable cybersecurity models that align with international standards.

Europe Maritime Cybersecurity Market Assessment

The market in Europe is growing significantly due to strong policy enforcement, including the EU Network and Information Security (NIS) directive, which mandates cyber protection across critical sectors such as maritime. Investments in greener and digital shipping solutions introduced advanced systems requiring security upgrades. European port authorities are prioritizing real-time threat detection, system resilience, and OT security, especially across container terminals and ferry operations. Collaborations between cybersecurity providers and shipping consortia led to the deployment of region-specific solutions. Increased awareness around cyber risk implications for environmental safety and data protection further encouraged strategic investments in maritime cybersecurity technologies across the region.

Key Players & Competitive Analysis

The competitive landscape of the maritime cybersecurity market is characterized by active consolidation, technological innovation, and global expansion. Industry analysis reveals that key players are leveraging market expansion strategies such as joint ventures and strategic alliances with shipbuilders, port authorities, and telecom providers to enhance their solution portfolios. Mergers and acquisitions have accelerated, allowing firms to integrate niche cybersecurity capabilities into broader maritime defense ecosystems. Post-merger integration efforts are focused on aligning product development and threat intelligence sharing across networks.

Technological advancements, particularly in AI-driven threat detection, endpoint protection, and OT-IT convergence, are central to gaining a competitive edge. Market participants are also investing in compliance-ready solutions tailored to evolving regulatory frameworks and cyber risk management protocols. The rising complexity of maritime operations has intensified the push for scalable, cloud-based platforms that offer continuous monitoring and real-time response.

Key Players

- ABS Group of Companies, Inc.

- BAE Systems plc

- Cisco Systems, Inc.

- CyberOwl Ltd.

- Cydome Security Ltd.

- Fortinet, Inc.

- Honeywell International Inc.

- Kongsberg Gruppen ASA

- Marlink SAS

- Naval Dome Ltd.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

- Wärtsilä Corporation

- Waterfall Security Solutions Ltd.

Maritime Cybersecurity Industry Developments

May 2025: Thales enhanced its naval cybersecurity systems by integrating AI-driven threat detection and secure digital architectures to improve cyber resilience in modern maritime operations.

June 2024: Speedcast integrated Cydome’s AI-powered threat analytics, real-time monitoring, vulnerability scanning, and SIEM capabilities into its SIGMA platform, enabling fleet-wide cybersecurity monitoring and compliance with IMO, IACS E26, and NIS2 regulations.

Maritime Cybersecurity Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Risk and Compliance Management

- Identity and Access Management

- Firewall and Intrusion Detection Systems

- Encryption

- Incident Response

- Services

- Professional Services

- Managed Services

By Security Type Outlook (Revenue, USD Billion, 2020–2034)

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Operational Technology (OT) Security

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-premise

- Cloud

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Commercial Shipping

- Naval and Defense

- Port Operators

- Offshore Operations

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Maritime Cybersecurity Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.21 billion |

|

Market Size in 2025 |

USD 3.60 billion |

|

Revenue Forecast by 2034 |

USD 10.31 billion |

|

CAGR |

12.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.21 billion in 2024 and is projected to grow to USD 10.31 billion by 2034.

The global market is projected to register a CAGR of 12.4% during the forecast period.

North America accounted for ~25% of the revenue share in 2024 due to the high penetration of digital systems in vessel operations, ports, and supply chains across the region.

A few of the key players in the market are ABS Group of Companies, Inc.; BAE Systems plc; Cisco Systems, Inc.; CyberOwl Ltd.; Cydome Security Ltd.; Fortinet, Inc.; Honeywell International Inc.; Kongsberg Gruppen ASA; Marlink SAS; Naval Dome Ltd.; Northrop Grumman Corporation; Raytheon Technologies Corporation; Thales Group; Wärtsilä Corporation; and Waterfall Security Solutions Ltd.

The solutions segment dominated the market with ~70% of the revenue share in 2024 due to growing demand for robust and specialized cybersecurity platforms that secure interconnected shipboard systems and maritime infrastructure.

The on-premise segment held the largest revenue share of ~65% in 2024 due to high preference for localized security infrastructure on vessels and ports that allows complete control over data and system configurations.