Maritime Satellite Communication Market Share, Size, Trends, Industry Analysis Report

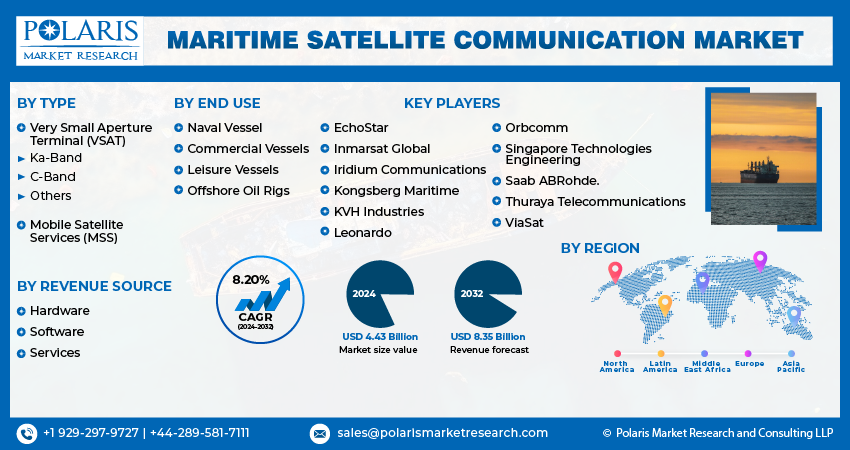

By Type (VSAT, MSS), By Revenue Source (Hardware, Software, Services), By End Use, By Region, And Segment Forecasts, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3785

- Base Year: 2023

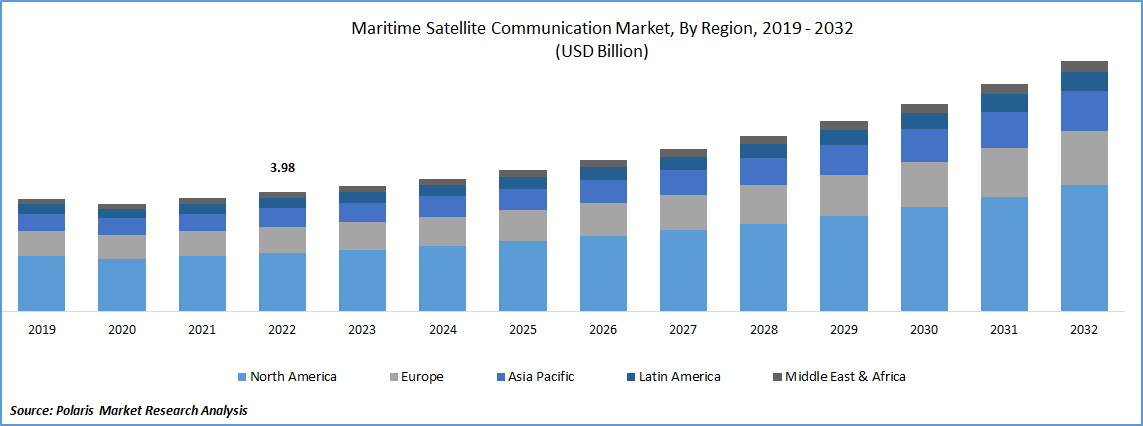

- Historical Data: 2019-2022

Report Outlook

The global maritime satellite communication market was valued at USD 4.18 billion in 2023 and is expected to grow at a CAGR of 8.20% during the forecast period.

Telecommunication needs have become the requisite for interim and extended commuting. Although maritime satellite communication is becoming increasingly crucial, the solutions that operate on land do not normally function on the sea. The maritime satellite communication market size is expanding as the ship-to-shore radio wavelengths, and costly phone calls are no longer the only alternatives for marine communications. Officers, crews, ships, and supervisors need reliable, easily operable, and uncomplicated sustenance communication service while at sea. The critical motivation of maritime satellite communication involves voice calling meant for commercial ship functioning, crew spirit, and sustenance of vessels in contact with family. The other impetus is Wi-Fi email, which initiates satellite Wi-Fi entry points for email on smartphones, laptops, or tablets and, finally, the internet for browsing mobile locations and acquiring weather data.

One of the central benefits of satellite communications is their capacity to offer dependable and strong connectivity in distant spots away from terrestrial frameworks. This is particularly important for maritime functioning, where apparatus frequently functions in remote and difficult ambiances. With satellite communications, ship chiefs can sustain proximity with their mission control, sanctioning flawless communication and improved decision-making.

Industry is poised for expansion due to the growing demand for voice communications applications in various sectors, including passenger ships, fishing, and marine shipping. Maritime satellite communication systems play a crucial role in facilitating effective operations within these industries, while also bolstering security and surveillance capabilities. It is further driven by the increasing adoption of advanced satellite systems and big data computing applications, as well as the rising awareness about the advantages of cloud solutions. Additionally, the integration of satellite and mobile communication technologies is on the rise, presenting new opportunities for the market's development.

To Understand More About this Research: Request a Free Sample Report

Growth in the market is being propelled by the increasing demand for dependable and budget-friendly communication solutions at sea. Additionally, the rising adoption of these services for navigational purposes further contributes to revenue growth. Key players in the maritime communication equipment manufacturing sector, like Iridium Communications & Inmarsat Global, are making substantial investments in introducing new and cost-effective equipment. These efforts are anticipated to significantly boost market growth in the coming years.

Maritime telecommunication equipment has now become a fundamental requirement for both short and long-term voyages. In the maritime transport industry, be it for recreational boats, mega yachts, commercial fishing vessels, or other naval transport, reliable communication has become an indispensable necessity. While cellular services are accessible only within limited offshore areas and have restricted functionality, satellite networks have emerged as the ideal solution to address communication challenges. Satellite-based services offer a competitive advantage over land-based communications, ensuring seamless and efficient communication across vast maritime expanses.

Prominent communication equipment utilized on marine vessels includes receivers, transmitters/transponders, transceivers, antennas, modems/routers, & satellite phones. These communication tools also serve essential roles in air and marine navigation and meteorological monitoring. While marine satellite communications have become increasingly vital, it is noteworthy that solutions designed for land-based operations may not function optimally at sea. As a result, there is a constant focus on research and development efforts in this field. Ongoing R&D aims to minimize the size of antennas and enhance the data transfer rate to reduce time lag effectively. This continuous improvement in technology is a significant driver influencing the growth of the market.

Industry Dynamics

Growth Drivers

Rising investments is driving the market growth

Marine satellite communication equipment plays a crucial role in supporting naval defense forces by facilitating aerial monitoring, distress call transmission and reception, and meeting navigational needs. Additionally, increasing investments in upgrading legacy systems within naval fleets across various regions are expected to drive demand for these communication solutions during the forecast period. In the defense and security sector, maintaining seamless communication with zero-time lag is of utmost importance to effectively address challenges such as pirate activities, inter-country conflicts, and border infiltrations, among others. As a result, marine satellite communication is gaining significant attention and adoption among coast guards, naval forces, and other security organizations to enhance their operational capabilities and ensure robust and reliable communication in critical situations.

Report Segmentation

The market is primarily segmented based on type, revenue source, end use, and region.

|

By Type |

By Revenue Source |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type analysis

Very Small Aperture Terminal (VSAT) segment accounted for the largest share in 2022

VSAT accounted for major global share. This growth can be attributed to the numerous advantages that VSAT offers over Mobile Satellite Services (MSS), including reduced time lag and global coverage, among others. The utilization of Broadband VSAT networks has become prevalent for establishing onboard VPN networks, enabling seamless connectivity across fleets and connecting ships to shore. This connectivity supports critical business applications, facilitates VoIP traffic, and enhances ships' access to essential information.

By End-Use Analysis

Commercial vessel segment expected to hold substantial market share in 2022

Commercial segment is projected to hold significant market share. The international shipping industry plays a pivotal role in transporting approximately 90% of global trade, and maritime trade continues to grow, benefiting consumers worldwide by offering competitive logistics costs. As manufacturing and global trade continue to rise, there has been a corresponding increase in the number of marine vessels being added to the existing fleet. This expansion in the fleet size, including both commercial ships and naval vessels, is expected to drive the market's growth during the forecast period.

By Revenue Source Analysis

Hardware segment expected to hold substantial market share in 2022

Hardware segment is projected to hold significant market share. This dominant position is expected to be maintained throughout the forecast period. The high demand and significant usage of hardware components contribute to its strong market presence, and the high cost associated with these components is projected to positively impact revenue generation in the coming years. The increasing adoption of VSAT broadband equipment in both new and existing marine vessel fleets is set to drive further growth in the market. Continuous technological advancements, including the reduction in the size of the dish and the cost of data usage, are expected to create a surge in demand for the installation of new VSAT services instead of MSS services.

Software segment projected to grow at the fastest rate. As marine vessels across different industries seek to optimize their communication and navigation capabilities, the demand for specialized software solutions tailored to their specific requirements is expected to contribute to the segment's moderate growth.

Regional Insights

APAC region dominated the global market in 2022

APAC dominated the global market. This prominence can be attributed to the growing adoption of VSAT technologies in merchant and cruise ships across the region. Additionally, there is a significant modernization drive for legacy systems in defense vessels in the region, which includes air defense systems, radar, & communication systems. The region's geopolitical landscape, characterized by rising political tensions & border disputes in countries like India & China, is further driving the demand for advanced satellite communication technologies.

Europe is likely to emerge as fastest growing region. This demand surge can be attributed to factors like the rising number of High-Net-Worth Individuals (HNWI) and the growing popularity of marine tourism, driven by the increasing interest in water sports and fishing activities. As the region becomes more attractive to tourists, passenger traffic in marine and coastal tourism is expected to witness significant growth in the upcoming years.

The implementation of tourism-friendly policies, including on-arrival visa facilities, is expected to drive increased investments in coastal areas, specifically aimed at promoting recreational activities such as fishing, white-water rafting, kayaking, sail training adventures, one-day boating trips, scuba diving, free diving, & snorkeling. To cater to the demands of luxury tourism experiences, these vessels are equipped with the dedicated satellite communication technology. The upward trend in the sales of these luxury vessels is set to have a positive impact on the market.

Key Market Players & Competitive Insights

The maritime satellite communication market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market:

- EchoStar

- Inmarsat Global

- Iridium Communications

- Kongsberg Maritime

- KVH Industries

- Leonardo

- Orbcomm

- Singapore Technologies Engineering

- Saab ABRohde.

- Thuraya Telecommunications

- ViaSat

Recent Developments

- In May 2024, Inmarsat Maritime, a ViaSat company, launched its new global maritime connectivity service NexusWave. The new connectivity service combines the coastal LTE service, Global Xpress (GX) Ka-band, and low-Earth orbit (LEO) services with an additional layer of L-band. With the new integration, the company can deliver fast, unlimited internet and always-on connectivity with global coverage.

- In January 2024, Singaporean telecommunication company Singtel added Starlink’s low-earth orbit (LEO) satellite broadband service to its connectivity suite for maritime consumers. The new addition is expected to drive the adoption of digital solutions by ship owners and telecom operators globally.

- In June 2023, Inmarsat Maritime, partnered with the Atlantic Offshore to deploy Fleet LTE technology in the Norwegian offshore region. This strategic agreement aims to deliver seamless and reliable high-speed, low-latency maritime satellite communication services in the North Sea area.

- In October 2022, AXESS Networks Maritime entered into a strategic partnership agreement with the Viasat. This collaboration aims to facilitate the global expansion of maritime satellite communication services, offering a diverse array of solutions and services to meet the needs of the maritime industry.

Maritime Satellite Communication Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.43 billion |

|

Revenue forecast in 2032 |

USD 8.35 billion |

|

CAGR |

8.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Revenue Source, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global maritime satellite communication market size is expected to reach USD 8.35 billion by 2032.

Key players in the maritime satellite communication market are type, revenue source, end use, and region.

Asia Pacific contribute notably towards the global maritime satellite communication market.

The global maritime satellite communication market is expected to grow at a CAGR of 8.20% during the forecast period.

The maritime satellite communication market report covering key segments are type, revenue source, end use, and region.