Pressure Transmitter Market Size, Share, & Industry Analysis Report

: By Fluid Type (Liquid, Gas, and Steam), By Measurement Application, By Type, By End-Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM2704

- Base Year: 2024

- Historical Data: 2020-2023

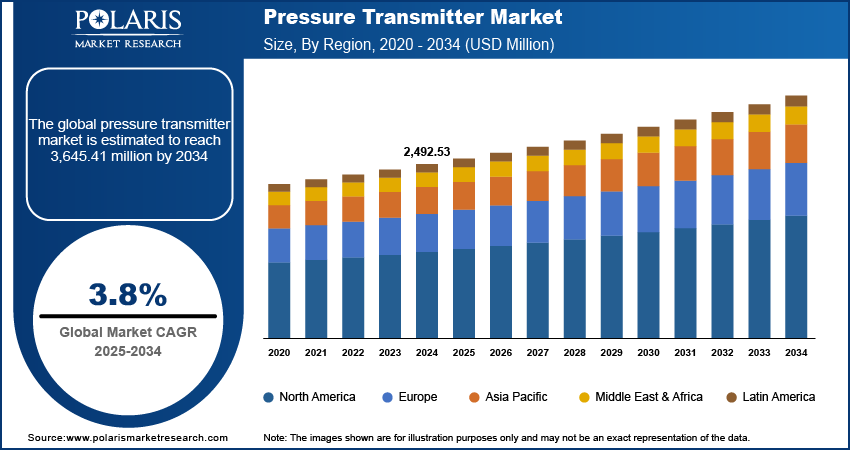

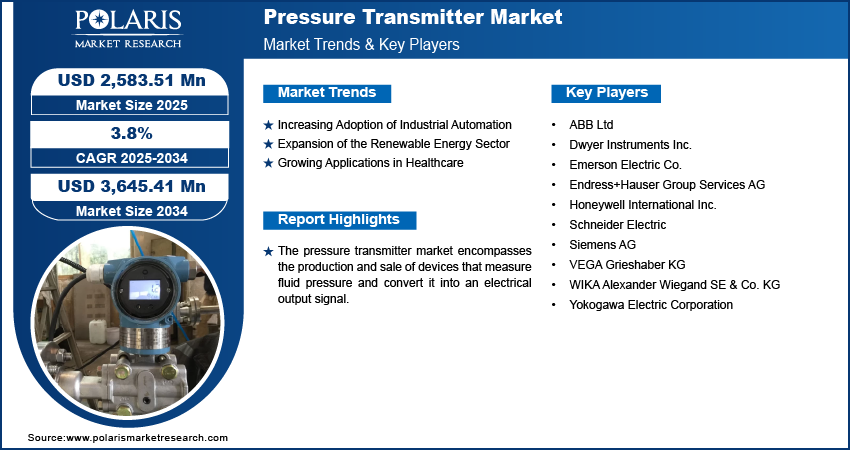

The pressure transmitter market size was valued at USD 2,492.53 million in 2024. The market is projected to grow from USD 2,583.51 million in 2025 to USD 3,645.41 million by 2034, exhibiting a CAGR of 3.8% during 2025–2034.

The pressure transmitter market is driving due to rising demand for industrial automation and process instrumentation, growth in oil & gas and chemical sectors, the need for accurate pressure monitoring, and stringent safety and compliance standards.

Market Overview

The pressure transmitter market revolves around devices designed to measure pressure, typically of gases or liquids, and convert it into an electrical signal. This signal is then used for monitoring, control, or data analysis in various industrial applications. Pressure transmitters are essential components in numerous sectors, including oil and gas, chemical processing, water treatment chemicals, power generation, and even healthcare. They ensure operational efficiency and safety by providing accurate and reliable pressure measurements. The market is driven by the increasing demand for automation and process control across industries, as these systems rely heavily on accurate pressure measurements for optimal operation.

To Understand More About this Research: Request a Free Sample Report

Industries are increasingly using advanced technologies to streamline processes, reduce waste, and improve productivity. The expansion of the renewable energy sector, particularly wind and solar power including solar panels, also significantly shapes the demand for pressure transmitters, which are crucial for efficient energy management and system performance. Furthermore, the increasing use of pressure transmitters in consumer electronics and the healthcare sector contributes to the growth.

Industry Dynamics:

Increasing Adoption of Industrial Automation

The escalating adoption of industrial automation across various sectors serves as a significant driver for pressure transmitters. Industries are progressively integrating automated systems to enhance operational efficiency, improve product quality, and reduce labor costs. Pressure transmitters are fundamental components in these automated processes, providing crucial real-time pressure data for monitoring and control loops. For instance, a study published on NCBI in 2023 highlighted the growing integration of automation in the pharmaceutical industry to ensure precise control over manufacturing processes, where pressure monitoring is critical for maintaining product integrity. This increasing reliance on automated systems across diverse industries directly fuels the demand trends for pressure transmitters, as these devices are indispensable for the seamless and efficient operation of automated machinery and processes, thereby driving the growth.

Expansion of the Renewable Energy Sector

The significant expansion of the renewable energy sector, particularly wind and solar power, is a vital driver for pressure transmitters. These technologies require sophisticated monitoring and control systems to optimize energy generation and ensure operational safety. Pressure transmitters play a crucial role in applications such as hydraulic systems in wind turbines and coolant pressure monitoring in solar power plants. According to data from the Department of Energy in 2024, the United States witnessed a substantial increase in renewable energy capacity, necessitating advanced monitoring and control infrastructure. As the global focus on sustainable energy sources intensifies and investments in renewable energy projects continue to rise, the demand for reliable pressure transmitters in these applications will also witness significant growth, contributing substantially to the overall development.

Growing Applications in Healthcare

The healthcare sector presents a growing potential for pressure transmitters, driven by the increasing need for precise pressure monitoring in various medical devices and applications. These devices are used in infusion pumps to control fluid delivery, in respiratory equipment for monitoring air pressure, and in blood pressure monitoring systems, among others. A research article published on PubMed in 2022 discussed the critical role of accurate pressure sensors in medical devices to ensure patient safety and treatment efficacy. The rising demand for advanced medical devices, coupled with the increasing emphasis on patient monitoring and diagnostics, is expanding the applications of pressure transmitters in the healthcare industry. This growing utilization in the medical field is a notable growth factor.

Segmental Insights

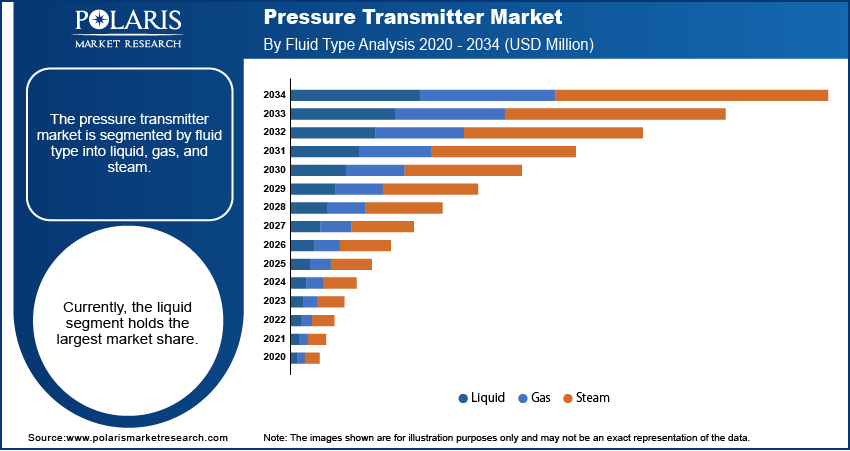

Market Assessment By Fluid Type

The liquid segment holds the largest share during forecast period. This dominance is primarily attributed to the extensive use of pressure transmitters in various industries for measuring and controlling the pressure of liquids in a wide range of applications. These include monitoring liquid levels in storage tanks, controlling flow rates in pipelines carrying liquid substances, and ensuring optimal pressure in hydraulic systems across diverse sectors such as chemical processing, water treatment, and food and beverage. The broad applicability of pressure transmitters in managing liquid-based processes contributes significantly to the substantial share of this segment.

The gas segment is anticipated to exhibit the highest growth rate over anticipated years. This growth is driven by the increasing demand for accurate and reliable pressure measurement in various gas-related applications across industries like oil and gas, power generation, and chemical manufacturing. The expanding use of natural gas as a cleaner energy source, the growing focus on industrial gas processing and transportation, and the rising adoption of advanced monitoring systems for gas-based processes are fueling the demand for pressure transmitters designed for gaseous media. This increasing utilization in diverse gas-handling industries positions the gas segment for the highest growth.

Market Evaluation By Measurement Application

The pressure measurement application accounts for the largest share in the upcoming years. This significant share is primarily due to the fundamental role of pressure transmitters in a wide spectrum of industrial processes. Accurate pressure monitoring is essential for ensuring the safe and efficient operation of equipment across diverse sectors, including chemical processing, oil and gas, power generation, and many others. The ubiquitous need for pressure measurement in various stages of production and control solidifies its leading position.

The level measurement application segment is projected to experience the highest growth rate. This increasing growth is driven by the rising demand for precise liquid level monitoring and control in industries such as water and wastewater treatment equipment, food and beverage, and pharmaceuticals. Accurate level measurement is critical for inventory management, process optimization, and regulatory compliance in these sectors. The growing adoption of advanced automation technologies and the increasing focus on efficient resource management are fueling the demand for pressure transmitters used in level measurement applications, positioning this segment for the highest growth.

Market Assessment By Type

The gauge pressure transmitter segment holds the largest share in the upcoming years. This dominance is from the extensive utilization of gauge pressure transmitters across a broad range of industrial applications. Their ability to measure pressure relative to the ambient atmospheric pressure makes them a versatile choice for numerous processes, including tank level monitoring, general pressure indication, and control systems within industries like refining, chemical manufacturing, and utilities. The widespread applicability and cost-effectiveness of gauge pressure transmitters contribute significantly to their leading position.

The differential pressure transmitter segment is anticipated to register the highest growth rate. This accelerated growth is fueled by the increasing need for precise flow and level measurements in complex industrial environments. Differential pressure transmitters are essential for determining flow rates in pipelines, measuring liquid levels in closed tanks, and monitoring pressure drops across filters and other equipment, which are critical for process optimization and efficiency in sectors such as oil and gas, pharmaceuticals, and wastewater treatment. The growing emphasis on advanced process automation and stringent accuracy requirements are driving the heightened demand for differential pressure transmitters, positioning this segment for the most significant growth.

Market Assessment By End-Use

The gas & oil end-use segment accounts for the largest share during forecast period. This significant share is primarily driven by the extensive use of pressure transmitters in various upstream, midstream, and downstream operations within the oil and gas industry. Pressure transmitters are critical for monitoring and controlling pressure in pipelines, storage tanks, refineries, and offshore platforms, ensuring operational safety and efficiency in this large and well-established sector, thus contributing to its dominant position.

The pharmaceuticals end-use segment is anticipated to exhibit the highest growth rate over anticipated period. This rapid growth is fueled by the increasing stringency of regulations, the growing demand for high-quality pharmaceutical products, and the rising adoption of advanced automation in pharmaceutical manufacturing processes. Pressure transmitters play a vital role in ensuring precise pressure control in reactors, clean rooms, and various other critical applications within the pharmaceutical industry. The increasing investments in research and development and the expansion of the pharmaceutical sector globally are expected to drive significant demand for pressure transmitters, positioning this end-use segment for the highest growth.

Regional Analysis

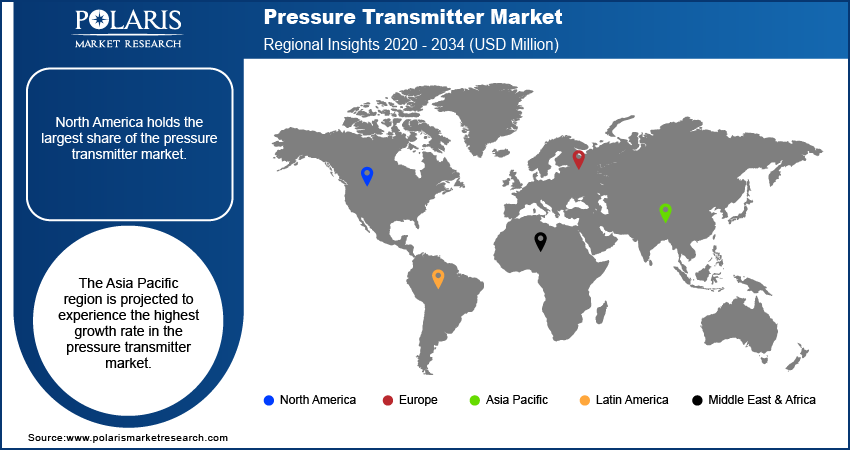

North America pressure transmitter market holds the largest share during forecast period. This can be attributed to the region's well-established industrial base, particularly in sectors such as oil and gas, chemicals, and power generation, all of which are significant consumers of pressure transmitters. Furthermore, the high adoption rate of advanced automation technologies and stringent regulatory standards in North America contribute to the substantial demand and the leading position of this region. The presence of key players and continuous technological advancements further solidify North America's dominance.

The Asia Pacific pressure transmitter market is projected to experience the highest growth rate. This rapid expansion is driven by the robust industrial growth across countries like China, India, and Southeast Asian nations. Increasing investments in manufacturing, infrastructure development, and the expansion of key end-use industries such as chemicals, oil and gas, water treatment, and power generation are fueling the demand trends for pressure transmitters in this region. Moreover, the rising adoption of automation technologies and favorable government initiatives promoting industrial development are significant growth factors contributing to the Asia Pacific region's position as the fastest-growing for pressure transmitters.

Key Players and Competitive Insights

Some of the major players in the pressure transmitter market include Emerson Electric Co., ABB Ltd, Endress+Hauser Group Services AG, Yokogawa Electric Corporation, Honeywell International Inc., Siemens AG, Schneider Electric, VEGA Grieshaber KG, WIKA Alexander Wiegand SE & Co. KG, and Dwyer Instruments Inc.

The competitive landscape is characterized by a mix of well-established global corporations and smaller, specialized manufacturers. These players compete on factors such as product innovation, accuracy, reliability, range of offerings, application-specific solutions, and geographical presence. The market witnesses continuous technological advancements, including the integration of digital communication protocols, wireless capabilities, and smart features for enhanced diagnostics and predictive maintenance. Strategic collaborations, partnerships, and product development focused on meeting the evolving needs of various end-use industries shape the competitive dynamics.

List of Key Companies:

- ABB Ltd

- Dwyer Instruments Inc.

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Honeywell International Inc.

- Schneider Electric

- Siemens AG

- VEGA Grieshaber KG

- WIKA Alexander Wiegand SE & Co. KG

- Yokogawa Electric Corporation

Pressure Transmitter Industry Developments

- April 2025: Emerson launched the Rosemount 490A Optical Dissolved Oxygen Sensor, a digital Modbus-enabled device designed to enhance operational flexibility and reduce maintenance costs in water and wastewater treatment and other industrial applications.

- November 2024: ABB introduced its newly enhanced pressure transmitter portfolio at the China International Import Expo (CIIE) 2024. The updated lineup includes the P-100, P-300, and P-500 series, designed to deliver precise and high-performance measurements for various industrial and utility applications.

Pressure Transmitter Market Segmentation

By Fluid Type Outlook (Revenue – USD Million, 2020–2034)

- Liquid

- Gas

- Steam

By Measurement Application Outlook (Revenue – USD Million, 2020–2034)

- Level

- Pressure

- Flow

By Type Outlook (Revenue – USD Million, 2020–2034)

- Differential Pressure

- Absolute

- Gauge

- Multivariable

By End-Use Outlook (Revenue – USD Million, 2020–2034)

- Gas & Oil

- Chemical

- Treatment of Water & Wastewater

- Power

- Pharmaceuticals

- Paper & Pulp

- Mining & Metals

- Food & Beverage

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Pressure Transmitter Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,492.53 million |

|

Market Size Value in 2025 |

USD 2,583.51 million |

|

Revenue Forecast by 2034 |

USD 3,645.41 million |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The market has been segmented into detailed segments of fluid type, measurement application, type, and end-use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A key growth strategy revolves around continuous technological innovation, focusing on enhanced accuracy, reliability, and integration capabilities like wireless communication and digital protocols. Penetration can be improved by targeting emerging economies with increasing industrialization and infrastructure development. Offering customized solutions tailored to specific end-use industry requirements, such as those in the pharmaceutical or renewable energy sectors, can drive demand trends. Strategic partnerships with automation system providers and expansion of digital marketing efforts to reach a wider customer base are also crucial. Emphasizing the long-term cost benefits and efficiency gains offered by advanced pressure transmitters can further propel growth factors and increase potential.

FAQ's

The global market size was valued at USD 2,492.53 million in 2024 and is projected to grow to USD 3,645.41 million by 2034.

The market is projected to register a CAGR of 3.8% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some of the major players include Emerson Electric Co., ABB Ltd, Endress+Hauser Group Services AG, Yokogawa Electric Corporation, Honeywell International Inc., Siemens AG, Schneider Electric, VEGA Grieshaber KG, WIKA Alexander Wiegand SE & Co. KG, and Dwyer Instruments Inc.

The liquid segment accounted for the larger share in 2024.

Following are some of the trends: ? Increasing Adoption of Industrial Automation: The continuous drive to optimize resources, enhance efficiency, and improve product quality across various industries is increasing the demand for pressure transmitters as integral components of automated systems. ? Integration of Smart Technologies: The incorporation of digital communication protocols, wireless capabilities (like Wi-Fi and Bluetooth), and IoT features in pressure transmitters enables real-time data monitoring, remote diagnostics, and predictive maintenance, leading to improved operational efficiency and reduced downtime. ? Rising Demand for Multivariable Transmitters: These transmitters, capable of measuring multiple parameters like pressure, temperature, and flow simultaneously, are gaining traction due to their ability to reduce the number of devices required and lower the total cost of ownership.

A pressure transmitter is a device that measures the pressure of a fluid (liquid or gas) and converts this measurement into an electrical signal. This electrical signal, typically an analog current signal (like 4-20 mA) or a digital signal, can then be transmitted to a control system, display, or data acquisition system for monitoring and control purposes. Essentially, it acts as a translator, taking a physical pressure value and making it understandable for electronic systems.