U.S. Cell and Gene Therapy Clinical Trials Market Size, Share, Trend, Industry Analysis Report

By Phase (Phase I, Phase II, Phase III, Phase IV), By Indication – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6191

- Base Year: 2024

- Historical Data: 2020-2023

Overview

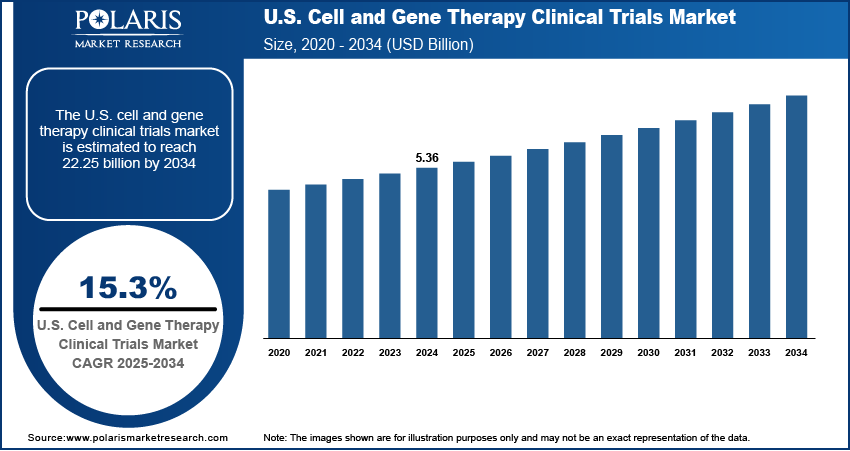

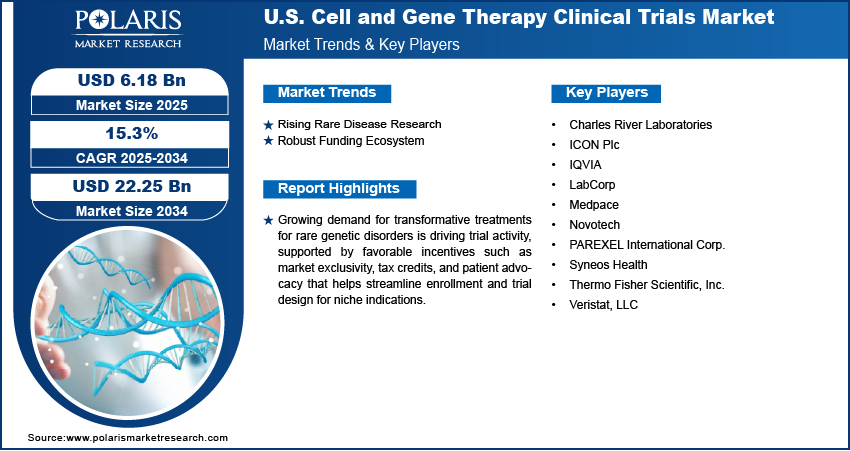

The U.S. cell and gene therapy clinical trials market size was valued at USD 5.36 billion in 2024, growing at a CAGR of 15.3% from 2025 to 2034. Growing demand for transformative treatments for rare genetic disorders is driving trial activity, supported by favorable incentives such as market exclusivity, tax credits, and patient advocacy that helps streamline enrollment and trial design for niche indications.

Key Insights

- The phase III segment dominated in 2024 due to a surge in late-stage trials for cancer and rare genetic diseases.

- The phase I segment is projected to grow fastest from 2025 to 2034, driven by early-stage innovation in biotech and academia.

- The oncology segment led the market in 2024, fueled by demand for therapies overcoming resistance to traditional cancer treatments.

- The cardiology segment is expected to register the highest CAGR from 2025 to 2034, due to advances in gene therapies for inherited and ischemic heart conditions.

Industry Dynamics

- Rising number of FDA-approved cell and gene therapies is accelerating clinical trial activity across academic and commercial research centers.

- Strong funding from NIH and private investors supports rapid expansion of early and late-stage trials in the U.S.

- Integration of real-world data and digital health tools enhances trial design, patient monitoring, and regulatory submission processes.

- Complex manufacturing and cold chain logistics for cell-based therapies increase costs and delay trial timelines significantly.

Market Statistics

- 2024 Market Size: USD 5.36 billion

- 2034 Projected Market Size: USD 22.25 billion

- CAGR (2025–2034): 15.3%

The U.S. cell and gene therapy clinical trials market refers to the ecosystem that supports research, development, and regulatory evaluation of therapies that use cellular modification or genetic engineering to treat or cure diseases. This includes infrastructure, services, and technologies required to conduct preclinical and clinical trials for such therapies, involving patient recruitment, biomarker analysis, vector delivery systems, regulatory compliance, and advanced manufacturing. Deployment of AI-driven analytics, remote monitoring, and decentralized trial models is enhancing recruitment efficiency, data quality, and protocol adherence, making it easier to manage complex cell and gene therapy trials within stringent timelines.

Increasing partnerships between academic centers, biotech firms, and contract research organizations are facilitating shared expertise, access to patient registries, and reduced operational burdens, fostering a collaborative environment for trial execution and innovation. Moreover, government-led and institutional efforts to promote precision medicine prompt sponsors and market players to focus on cell and gene therapies tailored to individual genetic profiles, boosting demand for specialized clinical trials that address unmet medical needs.

Drivers and Opportunities

Rising Rare Disease Research: Growing attention toward rare genetic disorders is leading to a sharp rise in clinical trial activity across the U.S. Traditional treatment options for many of these conditions are limited or non-existent, creating an urgent demand for breakthrough therapies. Cell and gene therapies offer promising solutions that target the root genetic cause of disease, making them a priority for both researchers and patients. Supportive measures such as tax credits, market exclusivity provisions, and fast-track designations are making it easier for sponsors to navigate the development landscape. Patient advocacy groups are also playing a key role in improving trial awareness and accelerating enrollment. Hence, the rising rare disease research is driving the industry expansion.

Robust Funding Ecosystem: Strong financial support continues to drive innovation in the U.S. cell and gene therapy clinical trials market. For instance, in 2024, North Carolina secured significant capital investments in the life sciences sector, with 25 companies disclosing plans for expansions or the establishment of new facilities. These initiatives represent an investment exceeding USD 10.8 billion, highlighting the state's growing prominence as a hub for biopharmaceutical and biotech innovation. A steady flow of investment from venture capitalists, federal research agencies, and public-private partnerships is giving sponsors the resources needed to design and launch trials with speed and scale. This funding supports early-stage research and also helps cover the high costs of complex manufacturing, regulatory compliance, and patient monitoring. Flexible financial structures are enabling companies to pursue bold therapeutic strategies that might otherwise be too risky. This vibrant funding environment is essential in maintaining the momentum behind advanced clinical trial programs.

Segmental Insights

Phase Analysis

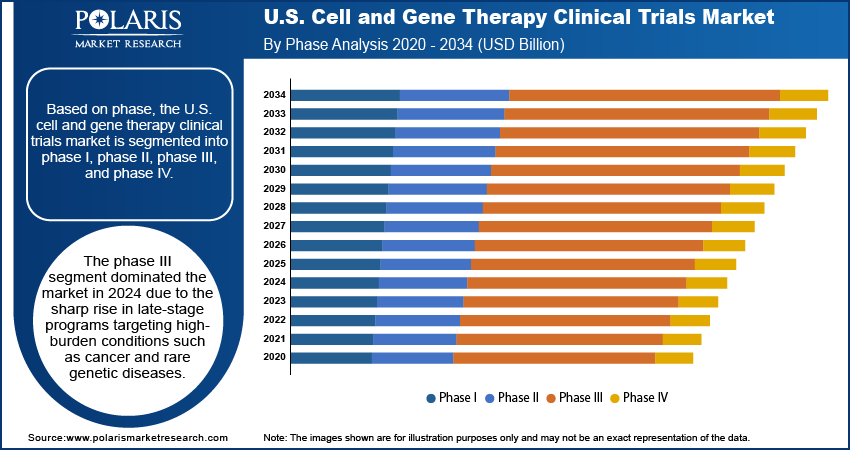

Based on phase, the segmentation includes phase I, phase II, phase III, and phase IV. The phase III segment dominated the market in 2024 due to the sharp rise in late-stage programs targeting high-burden conditions such as cancer and rare genetic diseases. Sponsors prioritized phase III development to secure regulatory approvals and commercial readiness, often backed by breakthrough designations and accelerated pathways. Increasing collaboration between biotech firms and large healthcare institutions helped streamline patient recruitment, data monitoring, and endpoint validation. Trials in this phase often involve large, diverse patient populations and aim to confirm safety and efficacy at scale, making them a focal point for investment and regulatory strategy.

The phase I segment is expected to register the highest CAGR from 2025 to 2034 due to a surge in early-stage innovation, especially from emerging biotech firms and academic research centers. These trials are becoming more common as advanced delivery platforms and gene-editing technologies move from preclinical testing to first-in-human studies. Relaxed early-phase regulatory pathways, such as the FDA’s regenerative medicine advanced therapy designation, are encouraging rapid entry into clinical development. Sponsors are also using adaptive trial designs and biomarker-driven enrollment strategies, allowing for more efficient safety evaluation and dose optimization in a smaller patient group.

Indication Analysis

In terms of indication, the segmentation includes oncology, cardiology, CNS, musculoskeletal, infectious diseases, dermatology, endocrine, metabolic, genetic, immunology & inflammation, ophthalmology, hematology, gastroenterology, and others. The oncology segment held the largest revenue share in 2024 due to the strong demand for cell and gene therapies that overcome resistance to conventional treatments such as chemotherapy and radiation. CAR-T therapies, tumor-infiltrating lymphocytes, and gene-edited immune cells have gained significant traction in clinical research. High prevalence of cancers such as leukemia, lymphoma, and solid tumors has increased both public and private funding for oncology trials. Regulatory agencies have also granted fast-track and priority review designations to several cancer-focused cell and gene therapies, enabling faster clinical advancement. This high level of activity continues to position oncology as a core area of focus in the U.S. trial landscape.

The cardiology segment is expected to register the highest CAGR from 2025 to 2034 due to developments in gene therapy targeting inherited heart conditions and ischemic disease. New delivery systems are enabling more precise targeting of heart tissue to repair damaged cells or replace faulty genes, reducing long-term risk for heart failure and arrhythmias. The rising incidence of chronic cardiovascular diseases and limited curative treatment options are pushing research efforts toward durable, disease-modifying therapies. Companies are also initiating trials using novel vectors for in vivo gene editing and cell therapies aimed at regenerating heart tissue, accelerating the growth of clinical activity in this segment.

Key Players & Competitive Analysis

The competitive landscape of the U.S. cell and gene therapy clinical trials market is shaped by aggressive market expansion strategies and rapid technological advancements. Industry analysis reveals that companies are increasingly engaging in joint ventures and strategic alliances with research institutions to access novel therapeutic platforms and accelerate trial timelines. Mergers and acquisitions are frequent, often aimed at integrating advance vector technologies, enhancing pipeline diversity, or gaining access to clinical-stage assets. Post-merger integration efforts focus on consolidating regulatory expertise, streamlining clinical operations, and maximizing trial success rates.

Firms are investing heavily in platform technologies such as CRISPR, AAV-based vectors, and autologous and allogeneic cell systems to broaden therapeutic applications. Strategic partnerships with healthcare contract research organizations (CROs) and biotech accelerators are improving trial design, patient recruitment, and compliance with evolving FDA guidelines. The competitive environment is further intensified by the emergence of specialized biotech firms focusing exclusively on rare or orphan indications, creating niche but high-value competition. Companies are also exploring decentralized and adaptive trial models to reduce costs and timelines.

Key Players

- Charles River Laboratories

- ICON Plc

- IQVIA

- LabCorp

- Medpace

- Novotech

- PAREXEL International Corp.

- Syneos Health

- Thermo Fisher Scientific, Inc.

- Veristat, LLC

U.S. Cell and Gene Therapy Clinical Trials Industry Developments

April 2025: Labcorp expanded its oncology portfolio to support clinical research and biopharma and clinical research in advancing drug development programs.

February 2024: IQVIA partnered with CIRM, City of Hope, WuXi AppTec, and Charles River Laboratories to strengthen gene and cell therapy clinical trial capabilities, improving patient recruitment and trial efficiency

U.S. Cell and Gene Therapy Clinical Trials Market Segmentation

By Phase Outlook (Revenue, USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Cardiology

- CNS

- Musculoskeletal

- Infectious diseases

- Dermatology

- Endocrine, metabolic, genetic

- Immunology & inflammation

- Ophthalmology

- Hematology

- Gastroenterology

- Others

U.S. Cell and Gene Therapy Clinical Trials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.36 billion |

|

Market Size in 2025 |

USD 6.18 billion |

|

Revenue Forecast by 2034 |

USD 22.25 billion |

|

CAGR |

15.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 5.36 billion in 2024 and is projected to grow to USD 22.25 billion by 2034.

The U.S. market is projected to register a CAGR of 15.3% during the forecast period.

A few of the key players in the market are Charles River Laboratories; ICON Plc; IQVIA; LabCorp; Medpace; Novotech; PAREXEL International Corp.; Syneos Health; Thermo Fisher Scientific, Inc.; and Veristat, LLC.

The phase III segment dominated the market in 2024 due to the sharp rise in late-stage programs targeting high-burden conditions such as cancer and rare genetic diseases.

The oncology segment held the largest revenue share in 2024 due to the strong demand for cell and gene therapies that overcome resistance to conventional treatments such as chemotherapy and radiation.