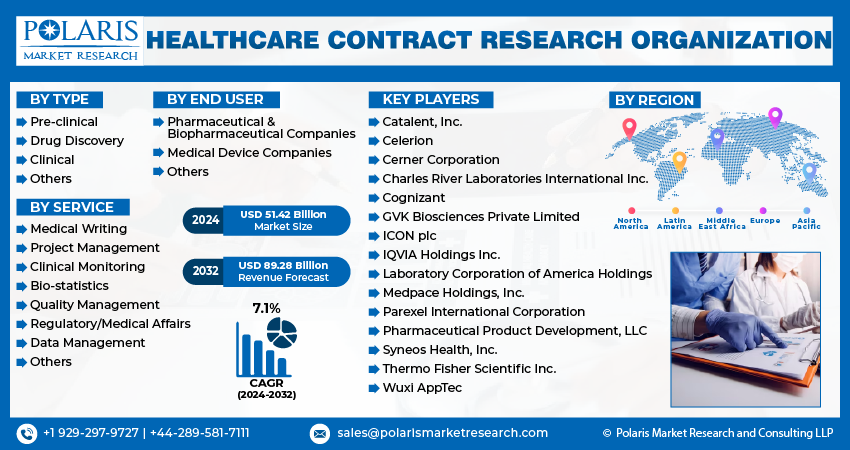

Healthcare Contract Research Organization Market Share, Size, Trends, Industry Analysis Report

By Type (Pre-clinical, Drug Discovery, Clinical, Others); By Service; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4505

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

- Healthcare Contract Research Organization Market size was valued at USD 48.16 billion in 2023.

- The market is anticipated to grow from USD 51.42 billion in 2024 to USD 89.28 billion by 2032, exhibiting the CAGR of 7.1% during the forecast period.

Market Introduction

The intensified focus on research and development within the biopharmaceutical sector, encompassing novel biologics and biosimilars, has led to a heightened demand for healthcare Contract Research Organization (CRO) services. Biopharmaceutical companies, seeking to accelerate drug development, increasingly outsource clinical trials and research functions to specialized CROs. These organizations offer expertise in navigating the intricacies of biopharmaceutical development, ensuring regulatory compliance, and conducting efficient clinical trials. As the biopharmaceutical landscape evolves, the healthcare CRO market is poised for sustained growth, playing a crucial role in supporting pipeline expansion and fostering the advancement of innovative therapeutic solutions.

In addition, companies operating in the market are collaborating to expand their market reach and strengthen presence.

- For instance, in March 2023, Cloudbyz introduced its groundbreaking Electronic Data Capture (EDC) solution, Cloudbyz EDC 2.0. This product is crafted to transform the clinical research domain, providing a streamlined, secure, and effective cloud platform for the collection, administration, and analysis of data from clinical trials. Cloudbyz EDC 2.0 empowers researchers, facilitating the expedited and intelligent delivery of transformative treatments, thereby revolutionizing the landscape of clinical research.

To Understand More About this Research: Request a Free Sample Report

The healthcare contract research organization market is thriving as globalized clinical trials reshape pharmaceutical and biotechnology landscapes. This shift underscores the crucial role of CROs in managing complex international trials, overcoming logistical challenges, and ensuring regulatory compliance across diverse regions. CROs facilitate efficient trial management, diverse patient recruitment, and standardized approaches. The trend reflects pharmaceutical companies' strategic pursuit of global patient populations and diverse healthcare infrastructures.

The research report offers a quantitative and qualitative analysis of the Healthcare Contract Research Organization Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Market Trends

Industry Growth Drivers

Increasing R&D activities in pharmaceuticals and biotechnology is projected to spur the product demand

The healthcare contract research organization market is thriving due to the upswing in pharmaceutical and biotechnology research and development activities. The demand for CRO services intensifies as pharmaceutical firms outsource processes, seeking specialized support from preclinical development to post-market surveillance. CROs are pivotal in navigating the complexities of drug discovery and clinical trials, aligning with the industry's shift towards precision medicine and personalized therapies. This collaborative trend underscores CROs' integral role in accelerating drug development, ensuring regulatory compliance, and advancing medical research.

Growing complexity of clinical trials is expected to drive healthcare contract research organization market growth

The healthcare contract research organization market is expanding significantly due to the rising complexity of clinical trials. With the healthcare industry witnessing intricate regulatory requirements and a shift towards precision medicine, pharmaceutical and biotechnology companies are increasingly relying on CROs for specialized expertise. These organizations excel in managing complex clinical trials, ensuring compliance, and navigating diverse therapeutic areas. As the demand for streamlined and efficient trial processes grows, CROs play a crucial role in providing essential support to the pharmaceutical and biotech sectors, contributing to the evolving landscape of modern medical research.

Industry Challenges

Stringent regulatory compliance is likely to impede the market growth

Stringent regulatory compliance poses a limiting factor for the healthcare contract research organization market. The increasingly complex global regulations demand meticulous adherence, placing a substantial burden on CROs. Meeting diverse and evolving standards necessitates extensive documentation, robust quality assurance, and heightened operational costs. Regulatory scrutiny can lead to approval delays, impacting clinical trial timelines. CROs must invest in ongoing training and technology to navigate this intricate landscape, affecting their operational efficiency. While imperative for patient safety and data integrity, the challenge lies in strategic adaptation to evolving regulatory frameworks within the constraints of stringent compliance requirements.

Report Segmentation

The healthcare contract research organization market analysis is primarily segmented based on type, service, end user, and region.

|

By Type |

By Service |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Clinical segment held significant market revenue share in 2023

The clinical segment held significant market revenue share in 2023. A clinical healthcare contract research organization is a specialized entity providing essential support to pharmaceutical, biotechnology, and medical device companies throughout the clinical research and development process. Focused on ensuring adherence to regulatory standards, these organizations offer services such as protocol development, patient recruitment, data management, regulatory submission, and site monitoring. Clinical CROs play a pivotal role in navigating the complexities of clinical trials, facilitating efficient drug development from initial stages to post-marketing surveillance. By outsourcing clinical research functions to CROs, healthcare companies optimize operations, enhance efficiency, and expedite the advancement of new and innovative healthcare interventions.

By Service Analysis

Clinical monitoring segment held significant market revenue share in 2023

The clinical monitoring segment held significant market revenue share in 2023. Clinical monitoring services within a healthcare contract research organization are integral to the clinical trial process. This involves systematic oversight by Clinical Research Associates (CRAs) to ensure protocol adherence, regulatory compliance, and data integrity. CRAs conduct site visits, assess trial conduct, verify data accuracy, and address any issues. Their role encompasses monitoring patient safety, ethical standards, and adherence to Good Clinical Practice (GCP) guidelines. Effective clinical monitoring is crucial for reliable trial data, patient welfare, and the successful execution of healthcare research and development initiatives.

By End User Analysis

Pharmaceutical & biopharmaceutical companies segment held significant market revenue share in 2023

The pharmaceutical & biopharmaceutical companies segment held significant revenue share in 2023. A healthcare contract research organization catering to pharmaceutical and biopharmaceutical companies serves as a strategic ally in drug development. These specialized CROs provide a comprehensive suite of services, including protocol development, clinical trial management, patient recruitment, regulatory affairs, data management, and quality assurance. Outsourcing these pivotal functions enables pharmaceutical and biopharmaceutical firms to access expert guidance, enhance trial efficiency, and ensure compliance with regulatory standards. This collaborative model facilitates accelerated drug development, optimized resource allocation, and streamlined operations, contributing to the successful advancement of pharmaceutical and biopharmaceutical products.

Regional Insights

Asia-Pacific region expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience significant growth during the forecast period. Asian countries, particularly China and India, have experienced a substantial increase in clinical trial activities. Diverse patient populations and lower operational costs have attracted pharmaceutical and biotech companies to initiate trials in the region, amplifying the demand for CRO services.

North America region accounted for significant market share in 2023. The healthcare contract research organization market in North America is marked by robust growth and strategic importance in pharmaceutical and biotechnology sectors. With advanced healthcare infrastructure, stringent regulatory frameworks, and exceptional research capabilities, North America stands as a key region for clinical research and drug development. CROs in this market provide comprehensive services, including clinical trial management, data management, and regulatory affairs. The demand for CRO services is propelled by the region's unwavering focus on innovation, a dynamic pharmaceutical landscape, and the necessity for specialized expertise in navigating intricate regulatory processes. North America's CRO market plays a pivotal role in advancing medical research and maintaining global leadership in the healthcare industry.

Key Market Players & Competitive Insights

The healthcare contract research organization market comprises diverse participants, and the expected arrival of numerous new players is poised to intensify market competition. Esteemed market frontrunners consistently enhance their technologies to maintain a competitive advantage, placing significant emphasis on aspects like efficiency, reliability, and safety. These entities prioritize strategic endeavors, including forging partnerships, refining products, and participating in collaborative ventures, all with the goal of outperforming their counterparts in the industry. Their primary aim is to secure a substantial healthcare contract research organization market share.

Some of the major players operating in the global healthcare contract research organization market include:

- Catalent, Inc.

- Celerion

- Cerner Corporation

- Charles River Laboratories International, Inc.

- Cognizant

- GVK Biosciences Private Limited

- ICON plc

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings

- Medpace Holdings, Inc.

- Parexel International Corporation

- Pharmaceutical Product Development, LLC

- Syneos Health, Inc.

- Thermo Fisher Scientific Inc.

- Wuxi AppTec

Recent Developments

- In September 2023, Curavit Clinical Research disclosed its appointment as the VCRO for a research study involving MR-001, MedRhythms' neurorehabilitation system engineered to enhance walking and ambulation in adults facing chronic walking impairments post-stroke.

- In October 2023, Curavit Clinical Research introduced a novel Health Economics and Outcomes Research (HEOR) Practice. This addition will integrate HEOR services into clinical trials, capturing evidence on the health economics value of innovative pharmaceutical products. The focus is particularly on digital therapeutics, aiming to propel market momentum.

- In February 2023, Labcorp announced that the forthcoming separation of its Clinical Development business will lead to the establishment of a new entity called Fortrea. Once the spin-off is finalized, Fortrea will operate independently as a publicly traded global Contract Research Organization (CRO), offering comprehensive services in the advancement of pharmaceuticals and medical devices.

Report Coverage

The healthcare contract research organization market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, services, end users, and their futuristic growth opportunities.

Healthcare Contract Research Organization Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 51.42 billion |

|

Revenue forecast in 2032 |

USD 89.28 billion |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the landscape of Healthcare Contract Research Organization Market in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Therapeutic Hypothermia Systems Market Size, Share 2024 Research Report

Digestive Health Supplements Market Size, Share 2024 Research Report

Europe Digestive Health Supplements Market Size, Share 2024 Research Report

Lidocaine Hydrochloride Market Size, Share 2024 Research Report

Live Commerce Platforms Market Size, Share 2024 Research Report

FAQ's

key companies in Healthcare Contract Research Organization Market are Charles River Laboratories International, Inc., GVK Biosciences Private Limited, ICON plc, IQVIA Holdings Inc

Healthcare Contract Research Organization Market exhibiting the CAGR of 7.1% during the forecast period.

The Healthcare Contract Research Organization Market report covering key segments are type, service, end user, and region.

key driving factors in Healthcare Contract Research Organization Market are Increasing R&D activities in pharmaceuticals and biotechnology

The global Healthcare Contract Research Organization market size is expected to reach USD 89.28 billion by 2032