Crime Risk Report

Market Size, Share, & Industry Analysis Report: By Type (Financial & Cybercrime, Personal, Property, and Others), By Deployment, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 119

- Format: PDF

- Report ID: PM2902

- Base Year: 2024

- Historical Data: 2020-2023

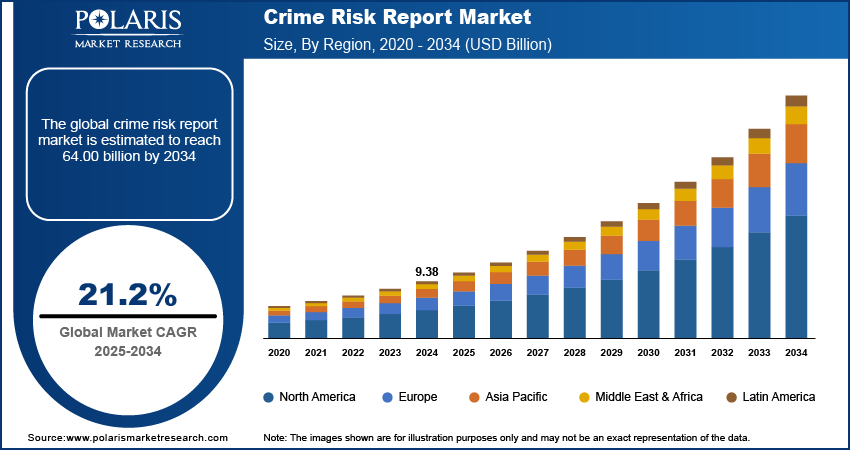

The crime risk report market size was valued at USD 9.38 billion in 2024. The market is projected to grow from USD 11.34 billion in 2025 to USD 64.00 billion by 2034, exhibiting a CAGR of 21.2% during 2025–2034.

The crime risk report market is driven by rising urbanization, increasing corporate security concerns, demand for data-driven decision-making, real estate risk assessment, and the need for predictive crime analytics and insurance insights.

Market Overview

The crime risk report market focuses on providing detailed assessments and analyses of potential criminal activities. These reports are designed to help organizations and individuals understand the likelihood, nature, and potential impact of crimes in specific areas or related to particular entities. The core function of a crime risk report is to offer a structured approach to risk management, enabling better-informed decision-making regarding security measures, resource allocation, and overall safety strategies. By analyzing historical crime data, patterns, and emerging trends, these reports aim to improve the understanding of illegal activities and ultimately deliver more effective risk mitigation outcomes.

To Understand More About this Research: Request a Free Sample Report

The increasing sophistication and frequency of cyber threats and financial frauds, such as online scams and money laundering, are significant drivers. Furthermore, rising concerns about personal and property crimes are pushing individuals and organizations to seek proactive risk assessments. Technological advancements, including the integration of big data analytics and artificial intelligence, are also fueling growth by enabling more accurate and predictive crime risk evaluations. The growing awareness among businesses and governments about the importance of implementing robust security measures to prevent criminal activities is further propelling the demand for comprehensive crime risk reports and related services.

Industry Dynamics

Increasing Cyber Threats

The increasing frequency and sophistication of cyberattacks are significantly driving the market. Businesses and individuals are seeking comprehensive risk assessments to protect their data and systems. According to the Press Information Bureau (PIB), the total number of cyber security incidents in India has risen steadily, with 2,041,360 incidents reported in 2024. Moreover, as per the World Economic Forum, phishing and social engineering attacks saw a sharp increase in 2024, with 42% of organizations reporting such incidents, underscoring the need to evaluate human-related cyber risks. This increase highlights the growing need for robust cybersecurity measures and, consequently, the demand for detailed crime risk reports to mitigate these threats. This surge in cyber threats directly fuels the expansion as organizations prioritize proactive security strategies.

Rise in Financial Frauds

Financial frauds, including online scams and money laundering, are another key driver. The need to protect financial transactions and maintain investor confidence is pushing the demand for detailed risk assessments. As per the Verafin 2024 Global Financial Crime Report, globally, losses from fraud scams and bank fraud schemes totaled an estimated $485.6 billion in 2023, indicating the massive scale of financial fraud affecting individuals and organizations. Business Email Compromise (BEC) schemes fueled an estimated $6.7 billion in global losses in 2023, demonstrating the substantial risk to businesses from sophisticated financial fraud. This substantial financial loss highlights the critical role of crime risk reports in helping financial institutions and individuals identify and prevent fraudulent activities, thereby boosting the market.

Growing Concerns About Personal and Property Crimes

Rising concerns about personal and property crimes are also contributing to the overall growth. Individuals and organizations are seeking risk reports to enhance their safety and security measures. The Australian Bureau of Statistics (ABS) reported that in 2023-24, 1.7% of persons experienced physical assault and 2.1% of households experienced a break-in. In the European Union, police-recorded crimes against property increased in 2023, with thefts rising by 4.8%, robberies by 2.7%, and burglaries by 4.2% compared to the previous year, indicating a growing trend in these types of offenses. These statistics demonstrate the ongoing need for crime risk assessments to inform security strategies and preventive measures, which in turn drive market growth.

Segmental Insights

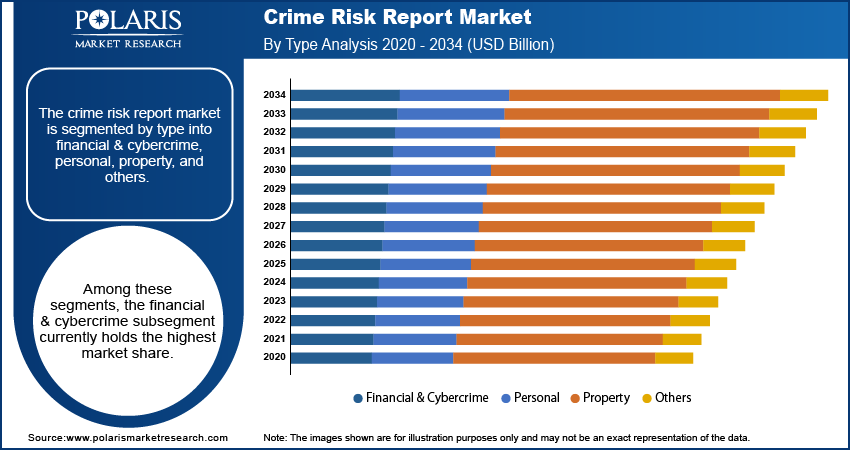

Market Assessment By Type

The financial & cybercrime subsegment holds the highest share during forecast period. This dominance is attributed to the increasing awareness and concern surrounding sophisticated financial frauds and the escalating threat of cyberattacks on businesses and individuals alike. The complex nature and potentially high financial impact of these crimes necessitate thorough risk assessments and detailed reporting, leading to a significant demand for specialized crime risk reports focused on these areas. Organizations across various sectors are investing heavily in understanding and mitigating these risks, solidifying the financial & cybercrime segment's leading position.

The personal subsegment is anticipated to exhibit the highest growth rate in the anticipated period. This projected growth is driven by a heightened public awareness of personal safety concerns and an increasing demand for information that can help individuals understand and mitigate risks related to violent crimes, harassment, and other personal security threats. The growing accessibility of data and analytical tools that can provide insights into local crime patterns and individual risk factors is also contributing to this expansion. As individuals become more proactive in safeguarding their well-being, the demand for personalized crime risk assessments is expected to increase significantly, making the personal segment the fastest-growing.

Market Evaluation By Deployment

The on-premise deployment model accounts for the largest share during forecast period. This significant share can be attributed to the stringent data security and compliance requirements of many organizations, particularly government agencies and large enterprises handling sensitive information. These entities often prefer maintaining direct control over their data and infrastructure, leading them to opt for on-premise solutions that offer greater perceived security and customization options. The established infrastructure and existing IT frameworks within these organizations also contribute to the continued dominance of the on-premise deployment segment.

The cloud deployment segment is expected to witness the highest growth rate over the forecast period. This rapid growth is fueled by the increasing adoption of cloud-based solutions across various industries due to their scalability, flexibility, and cost-effectiveness. Cloud deployment offers benefits such as easier accessibility to data and analytics tools, streamlined collaboration, and reduced infrastructure costs, making it an increasingly attractive option for a wider range of businesses, including small and medium-sized enterprises. The growing acceptance of cloud security measures and the continuous advancements in cloud technologies are further accelerating the penetration of cloud-based crime risk report solutions.

Market Assessment By Application

The government segment accounts for the largest share in the anticipated period. This dominance is primarily driven by the extensive utilization of crime risk reports by law enforcement agencies, public safety departments, and various government bodies for strategic planning, resource allocation, and policy formulation. The need for comprehensive analysis of crime patterns, prediction of potential threats, and effective management of public safety initiatives contributes significantly to the high demand for crime risk report services within the government sector. The crucial role of these reports in maintaining law and order and ensuring national security underpins the government segment's leading position.

The BFSI (banking, financial services, and insurance) segment is anticipated to exhibit the highest growth rate within. This rapid growth is fueled by the increasing sophistication and prevalence of financial crimes and cyber threats targeting financial institutions and their customers. The stringent regulatory requirements and the imperative to safeguard assets and customer trust are compelling the BFSI sector to invest heavily in advanced crime risk assessment and reporting tools along with cybersecurity insurance. The need to detect and prevent fraudulent activities, money laundering, and cyberattacks is driving a significant increase in the demand for specialized crime risk reports within the BFSI industry, along with BFSI crisis management, positioning it as the fastest-growing application segment.

Regional Analysis

The crime risk report market demonstrates varied adoption and growth across different geographical regions. North America and Europe have historically shown significant penetration due to well-established legal frameworks, advanced technological infrastructure, and a high degree of awareness regarding the importance of risk management and security. The Asia Pacific region is emerging as a significant growth hub, driven by rapid digitalization, increasing urbanization, and a growing focus on public safety and security concerns. Latin America and the Middle East & Africa are also witnessing increasing adoption, albeit at a relatively moderate pace, influenced by factors such as economic development and evolving security landscapes. Each region presents unique dynamics and growth opportunities shaped by local regulations, economic conditions, and specific security challenges.

North America crime risk report market holds the largest share within market during forecast period. This dominant position can be attributed to the presence of a large number of established businesses and government agencies that widely utilize crime risk reports for strategic decision-making, law enforcement, and regulatory compliance. Furthermore, the high adoption rate of advanced technologies and the strong emphasis on data-driven security solutions in North America contribute significantly to its leading share. The mature nature and the presence of key players further solidify North America's position as the largest regional market for crime risk reports.

The Asia Pacific crime risk report market is projected to exhibit highest growth rate over forecast period. This rapid expansion is fueled by several factors, including the increasing investments in digital infrastructure, the rising awareness of cyber threats and financial frauds, and the growing focus on public safety initiatives across various countries in the region. Rapid urbanization and economic development are also contributing to a greater demand for crime risk assessment solutions by businesses, governments, and individuals. The increasing adoption of advanced analytics and AI in cybersecurity and in crime prevention and management is further accelerating the growth in the Asia Pacific region.

Key Players and Competitive Insights

Some of the major players currently active in the crime risk report market include LexisNexis Risk Solutions (RELX Group), TransUnion, Experian, FICO (Fair Isaac Corporation), CoreLogic, Recorded Future, Flashpoint (Riskified), Cellebrite DI Ltd., Thomson Reuters, SAS Institute Inc., IBM (International Business Machines Corporation), and Palantir Technologies are some of the major players. These companies offer a range of services and solutions aimed at assessing and mitigating various types of crime risks for businesses, governments, and individuals.

The competitive landscape is characterized by a mix of established players with extensive data resources and newer, agile companies leveraging advanced technologies like artificial intelligence and machine learning. Competition is driven by factors such as the accuracy and comprehensiveness of the risk assessments, the ability to provide real-time insights, the customization options available, and the integration capabilities with existing systems. Key competitive strategies include expanding data partnerships, enhancing predictive analytics capabilities, and tailoring solutions to specific industry needs.

List of Key Companies in Crime Risk Report Industry

- Cellebrite DI Ltd.

- CoreLogic

- Experian

- FICO (Fair Isaac Corporation)

- Flashpoint (Riskified)

- IBM (International Business Machines Corporation)

- LexisNexis Risk Solutions (RELX Group)

- Palantir Technologies

- Recorded Future

- SAS Institute Inc.

- Thomson Reuters

- TransUnion

Crime Risk Report Industry Developments

- February 2025: LexisNexis Risk Solutions, a part of RELX, finalized its acquisition of IDVerse, an AI-driven identity verification and fraud detection provider. This acquisition aims to enhance LexisNexis Risk Solutions' digital identity verification capabilities and strengthen its fraud prevention efforts, particularly against AI-generated threats like deepfakes

Crime Risk Report Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Financial & Cybercrime

- Personal

- Property

- Others

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- On-Premise

- Cloud

By Application Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Government

- Real Estate

- Other Applications

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Crime Risk Report Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.38 billion |

|

Market Size Value in 2025 |

USD 11.34 billion |

|

Revenue Forecast by 2034 |

USD 64.00 billion |

|

CAGR |

21.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The market has been segmented into detailed segments of type, deployment, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A key growth strategy involves continuous innovation in data analytics and the integration of emerging technologies like artificial intelligence and machine learning to enhance predictive accuracy and real-time insights. Penetration can be improved by tailoring solutions to specific industry verticals, such as the BFSI sector and government agencies, highlighting the tangible benefits of risk mitigation and compliance. Strategic alliances with technology providers and data aggregators can further expand reach and enrich the data offerings. Emphasizing the return on investment through reduced losses from criminal activities and improved operational efficiency will be crucial for driving demand trends and fostering development. Educational initiatives and awareness campaigns about the increasing sophistication of crimes can also drive demand and highlight the value proposition of crime risk reports.

FAQ's

The global market size was valued at USD 9.38 billion in 2024 and is projected to grow to USD 64.00 billion by 2034.

The market is projected to register a CAGR of 21.2% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some of the major players include LexisNexis Risk Solutions (RELX Group), TransUnion, Experian, FICO (Fair Isaac Corporation), CoreLogic, Recorded Future, Flashpoint (Riskified), Cellebrite DI Ltd., Thomson Reuters, SAS Institute Inc., IBM (International Business Machines Corporation), and Palantir Technologies.

The financial & cybercrime segment accounted for the largest share of the market in 2024.

Following are some of the trends: ? Increased Focus on Cybercrime and Fraud: With the rising sophistication and frequency of digital offenses, there's a growing demand for specialized reports focusing on cyber warfare and threats, data breaches, and financial fraud. This trend is driven by the significant financial and reputational risks associated with these crimes. ? Integration of Advanced Analytics and AI: The market is witnessing a greater adoption of artificial intelligence, machine learning, and big data analytics to enhance the accuracy and predictive capabilities of crime risk assessments. These technologies enable the identification of complex patterns and emerging threats more effectively.

A crime risk report is a detailed analysis and assessment of the potential for criminal activity in a specific area, related to a particular entity, or concerning a certain type of threat. These reports utilize various data sources, including historical crime statistics, demographic information, economic indicators, and increasingly, digital footprint analysis, to evaluate the likelihood, nature, and potential impact of crimes.