BFSI Crisis Management Market Share, Size, Trends, Industry Analysis Report

By Component (Software and Service); By Deployment; By Enterprise; By Application; By End Use; By Region; Segment Forecast, 2023-2032

- Published Date:Jun-2023

- Pages: 119

- Format: PDF

- Report ID: PM3327

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

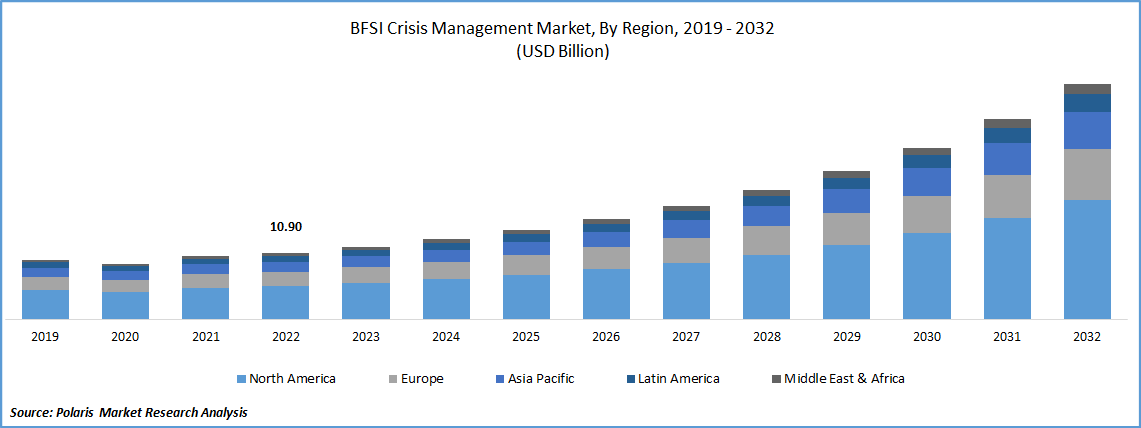

The global BFSI crisis management market was valued at USD 10.90 billion in 2022 and is expected to grow at a CAGR of 14.03% during the forecast period. Increasing BFSI crises are one of the foremost factors anticipated to boost the demand for management. The financial crisis is the worst economic disaster ever, caused by systemic and regulatory failures, overvalued assets, and resulting consumer panic. For example, in June 2022, the World Bank Group responded to overlapping crises with roughly USD 115 billion in financing. As a result, the demand for crisis management solutions is increasing across the globe. Banks are vulnerable to a variety of risks, which include liquidity risk, credit risk, and interest rate risk. Crisis management serves as an important safeguard for mitigating the impact of unpredicted events that have the potential to cause significant disruption and financial losses in many areas, including liquidity analysis, investment strategy, information management, consumer protection, and credibility. Hence, BFSI crisis management is considered critical to effective financial operations.

To Understand More About this Research: Request a Free Sample Report

The COVID-19 pandemic had a positive impact on the global market. The rising use and adoption of traditional and online financial products and services across many nations has resulted in a major increase in demand for BFSI crisis management. In the wake of the COVID-19 pandemic, businesses operating in the BFSI sector faced various losses and lots of challenges, such as operational and funding challenges, business shutdowns, changes in business models, and others. With these growing business issues, the market's demand has grown and is anticipated to continue growing over the course of the forecast period.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the BFSI crisis management market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

The companies became more well-known for coming up with creative ways to safeguard companies that deal with significant sums of money. For example, in April 2020, Temenos introduced new XAI models as SaaS to assist banks & credit unions to accelerate loan processing for economic relief to the SMEs & retail customers. Digital payment has seen a huge rise during the pandemic, which further increases the need for management services. As a result, COVID-19 has had a favourable impact on the global market.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Digital transformation of banks and financial institutions has witnessed huge growth in the global BFSI crisis management market. With noteworthy benefits such as improved operational efficiency and productivity, ensuring better fraud detection, helping stakeholders with better decision-making with improved analytics, and many other factors, the adoption of digitalization in the BFSI industry is attributed. For example, approximately 65.3% of the U.S. population uses digital banking services. While almost 80% of millennials reported using digital banking in 2022. Additionally, FinTech provides automated solutions to improve effectiveness and customer experience. As a result, the surge in digitalization has seen a larger uptake of management solutions, which is helping to boost the market's development.

Major players are increasingly focusing on the risk mitigation tactics & fraud detection through innovative crisis solutions. For example, in January 2023, Sentinels, introduced new platform solution for the transaction monitoring. SaaS platform is intended to assist banks & key financial institutions to detect & remove financial crime with superior speed and accuracy. Financial institutions and banks are implementing crisis management strategies in huge amounts to control their business operations, and deal with numerous crises in the industry. This is responsible for proliferating the growth of the market.

Report Segmentation

The market is primarily segmented based on component, deployment, enterprise, application, end user, and region.

|

By Component |

By Deployment |

By Enterprise |

By Application |

By End user |

By Region |

|

|

|

|

|

|

For Specific Research Requirements: Request for Customized Report

Software segment held largest share in the global market in 2022

In fiscal year 2022, the software segment dominates the market with major share. This is due to using a simple and effective cloud platform. Crisis management software helps crisis teams organize response actions, inform essential stakeholders, and deliver crucial documentation to all employees. Furthermore, software allows the key stakeholders to stay informed, helps the crisis teams to streamline response activities, and puts significant documentation with employees consideration with the help of cloud platform.

Cloud-based segment is dominating the global market & expected to maintain its dominance in projected timeframe

In 2022, the cloud based segment held the largest global share. This is attributed to various beneficial aspects, such as a high level of backup and redundancy at a minimal cost. Globally, banks have shifted their attention to figuring out how to better manage their data to facilitate quicker business problem solving. One of the top business concerns for banking CFOs today is optimizing the value of corporate data, and many of them are pushing for investments in cloud platforms to make use of the daily increasing amounts of data that banks handle. As a result, cloud based management solutions are largely adopted among various banks and financial institutions, which is further improving the market’s expansion.

Large enterprises segment accounts for the largest share in 2022

Large enterprises are the leading contributors to market development in 2022. This is due to the fact that large enterprises are investigating cutting-edge strategies to successfully modify their operational methods. These businesses are driven by substantial investments to install cutting-edge solutions and enhance interconnected hardware, servers, and software across corporate activities, which drive the demand for crisis management solutions. This is also attributed to the trend of implementing multi-cloud and hybrid cloud strategies among large enterprises, as they are organizing workloads on numerous public clouds while also storing some data on the private cloud.

Risk and compliance management is accounting for largest segment during forecast period

Compliance segment is the largest contributor to the global market. Increasing adoption of cloud-based management services is witnessing the growth of the market. For example, almost 91% of financial institutions are actively using cloud services. Management of risk and compliance aids in recognizing regulatory and compliance risks and foreseeing potential threats. Risks like data theft, cyber-attacks, and business risk addressed by the such solutions.

Bank segment is dominating the global market in 2022

In 2022, the bank segment is accounting a largest share in the global market. This is due to the huge adoption of management solutions in this segment for various cyber-attacks that arise during banking operations. The digital transformation has improved banking activities. Banks can deliver highly personalized offers, decrease time, augment the customer experience, and advance work flow. For example, as of now, around 2.5 billion users across the world use banking services digitally. Moreover, crisis management provides banks with strict compliance oversight & lower regulatory risks.

North America is dominating the global market in 2022

North America is projected to have the largest share in the global market. This can be linked to the growing implementation of cloud based management solutions, investments by various market participants, and many other factors. Growing awareness regarding banks and financial institutions is another key aspect of improving the size of the market in this region. For instance, in March 2023, the U.S. federal government initiated rigorous steps to after the crisis of the Silicon Valley Bank, promising deposits at the failed financial institution. This has improved the demand for crisis management solutions and further aided the market's acceleration.

Asia-Pacific is projected to grow at a higher CAGR during the forecast period. Enhancing BFSI Crisis Management is experiencing a growing demand for management solutions. For example, in August 2022, 5 of China's prominent banks showed high stress level due to crisis in real estate sector, on the line of bad loans and financial irregularities. This has enhanced the need for crisis management in BFSI sector.

Competitive Insight

The global BFSI crisis management market includes 4C Strategies; LogicGate, Inc.; MetricStream; CURA; Everbridge; Konexus; SAS Institute Inc; Deloitte Touche Tohmatsu Limited; RQA Europe Ltd.; IBM; NCC Group; Noggin & others.

Recent Developments

- In February 2022, Nordic Bank digitalised its crisis management across its operations in the Nordic and Baltic regions and response by executing the Exonaut Incident & Crisis Management Solution.

BFSI Crisis Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 11.95 billion |

|

Revenue forecast in 2032 |

USD 38.95 billion |

|

CAGR |

14.03% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Component, By Deployment, By Enterprise, By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

4C Strategies; LogicGate, Inc.; MetricStream; CURA; Everbridge; Konexus; SAS Institute Inc; Deloitte Touche Tohmatsu Limited; RQA Europe Ltd.; IBM; NCC Group; Noggin, and others. |

Navigate through the intricacies of the 2024 Intelligent BFSI crisis management market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report

FAQ's

The BFSI crisis management market report covering key segments are component, deployment, enterprise, application, end user, and region.

BFSI Crisis Management Market Size Worth $38.95 Billion By 2032.

The global BFSI crisis management market expected to grow at a CAGR of 14.03% during the forecast period.

North America is leading the global market.

key driving factors in BFSI crisis management market are rapid adoption of digitization in financial institutions across the globe.