Cryoablation Probe Market Size, Share, & Industry Analysis Report

By Application (Cardiac Arrhythmias, Oncology, Dermatology, and Others), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5783

- Base Year: 2023

- Historical Data: 2020-2023

Market Overview

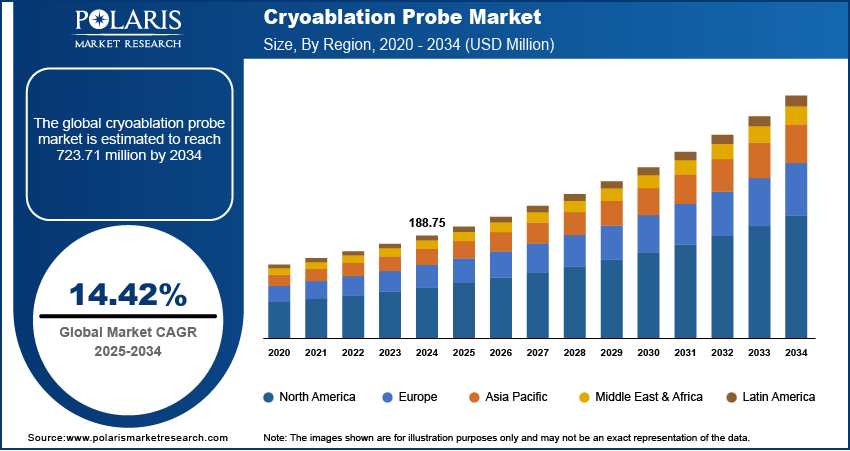

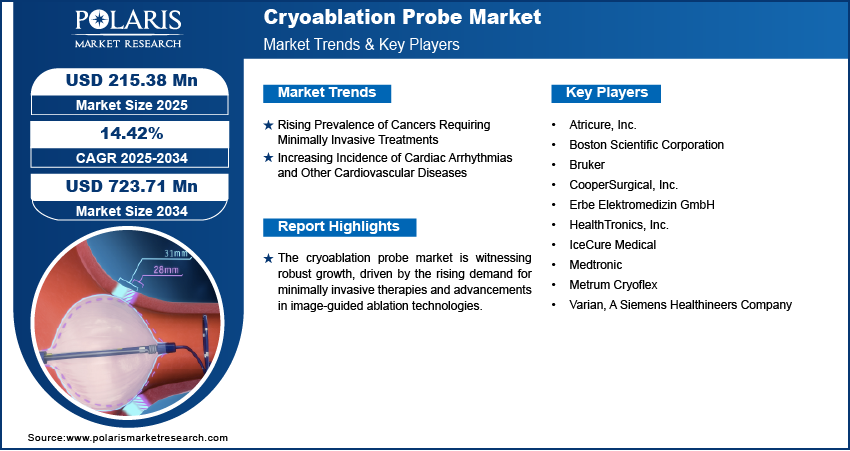

The global cryoablation probe market size was valued at USD 188.75 million in 2024, growing at a CAGR of 14.42% during 2025–2034. The growth is driven by the expansion of outpatient and ambulatory surgery centers, increasing access to cryoablation procedures.

A cryoablation probe is a minimally invasive medical device used to destroy abnormal or diseased tissue through controlled freezing, often employed in the treatment of cancer and cardiac arrhythmias. The increasing global geriatric population is more susceptible to chronic conditions such as cancer and cardiovascular diseases, further boosting the demand for probes. According to an October 2024 WHO report, by 2030, the global population aged 60 and above will reach 1.4 million, representing 1 in 6 people worldwide. There is a rise in demand for targeted, low-complication therapies such as cryoablation, as age-related physiological changes increase the risk of developing malignancies and arrhythmic disorders. The growing preference for minimally invasive procedures among elderly patients due to reduced recovery time and lower procedural risk further reinforces the adoption of cryoablation probes in clinical environments.

To Understand More About this Research: Request a Free Sample Report

The ongoing advancement in probe design and imaging technologies contributes to the market expansion opportunities. Technological innovations have led to the development of next-generation probes with improved precision, temperature control, and adaptability to various anatomical sites. Simultaneously, improvements in imaging modalities such as real-time ultrasound, CT, and MRI have increased the efficacy and safety of cryoablation procedures by enabling better visualization and guidance. For instance, in February 2025, DeepHealth launched AI-driven radiology solutions, such as its Diagnostic Suite for modern PACS workflows and SmartMammo, a mammography SaaS platform. These tools, powered by their DeepHealth OS, aim to improve diagnostic accuracy and streamline clinical workflows in radiology. These advancements boost clinician confidence in performing complex ablations and also expand the clinical indications of cryoablation, making it a viable treatment for a broader range of conditions. Together, these innovations are fostering wider acceptance of cryoablation probes across oncology and cardiology specialties.

Industry Dynamics

Rising Prevalence of Cancers Requiring Minimally Invasive Treatments

The increasing prevalence of cancers such as prostate, liver, kidney, and lung propels the demand for minimally invasive treatment options. According to a December 2024 CDC report, the US recorded 236,659 prostate cancer cases in 2021, with an incidence rate of 112 per 100,000 males. Approximately 70% of cases were diagnosed at the localized stage. These cancers are often diagnosed in early to intermediate stages, where localized therapies such as cryoablation offer effective tumor control with reduced trauma and faster recovery times. These probes allow for precise targeting and destruction of malignant tissues while preserving surrounding healthy structures, which is especially critical in organs with complex anatomy. Therefore, as patient and clinician preferences increasingly shift toward less invasive, organ-sparing techniques, the adoption of cryoablation in oncological interventions continues to expand.

Increasing Incidence of Cardiac Arrhythmias and Other Cardiovascular Diseases

The increasing incidence of cardiac arrhythmias and other cardiovascular diseases is significantly driving the demand for probes in the electrophysiology space. According to a 2023 World Heart Organization report, cardiovascular diseases affect over 500 million people globally, causing 20.5 million deaths in 2021. Conditions such as atrial fibrillation require targeted ablation of cardiac tissue to restore normal heart rhythm, and cryoablation offers distinct advantages, such as reduced risk of collateral tissue damage and improved procedural safety. The precision and controlled application of extreme cold in cryoablation help create durable lesions with minimal inflammation, making it a preferred option for both physicians and patients. The integration of cryoablation into routine cardiac care protocols is contributing to sustained growth as cardiovascular diseases remain among the leading causes of morbidity globally.

Segmental Insights

By Application Analysis

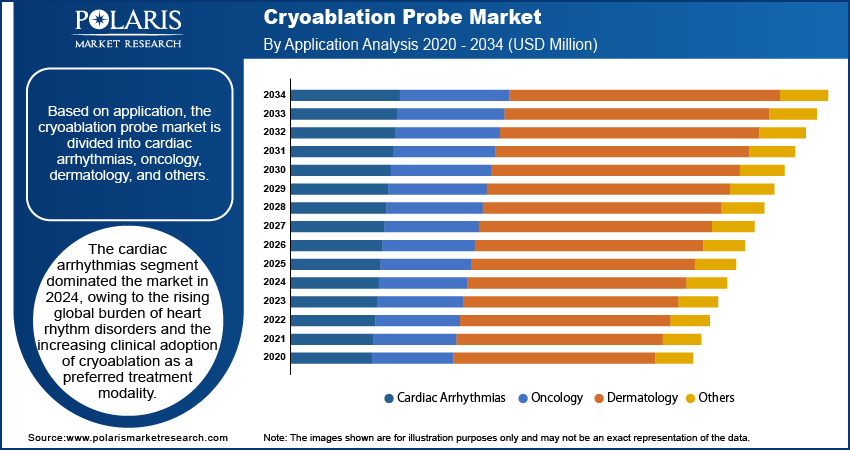

The segmentation, based on application, includes cardiac arrhythmias, oncology, dermatology, and others. The cardiac arrhythmias segment dominated the market in 2024, owing to the rising global burden of heart rhythm disorders and the increasing clinical adoption of cryoablation as a preferred treatment modality. Cryoablation offers unique advantages in cardiac electrophysiology devices, such as controlled lesion formation and minimized risk of damaging surrounding tissue, particularly in procedures such as pulmonary vein isolation for atrial fibrillation. These benefits have strengthened its use in complex cardiac procedures where precision and safety are paramount. The growing number of electrophysiology labs and the expanding availability of advanced cryoablation systems across healthcare institutions further supported the segment's dominance.

By End Use Analysis

The segmentation, based on end use, includes hospitals, specialty clinics, ambulatory surgery centers (ASCs), and others. The ambulatory surgery centers (ASCs) segment is expected to witness the fastest growth during the forecast period due to the increasing shift toward outpatient care for minimally invasive procedures, such as cryoablation. ASCs offer cost-effective alternatives to hospital-based treatments, reduced patient wait times, and quicker discharge processes, all of which align with the evolving healthcare delivery model. The compact, targeted nature of cryoablation procedures makes them particularly suitable for outpatient settings. Additionally, improvements in cryoablation device portability and procedural safety are enabling broader deployment in ASCs, thereby contributing to accelerated growth in this segment.

Regional Analysis

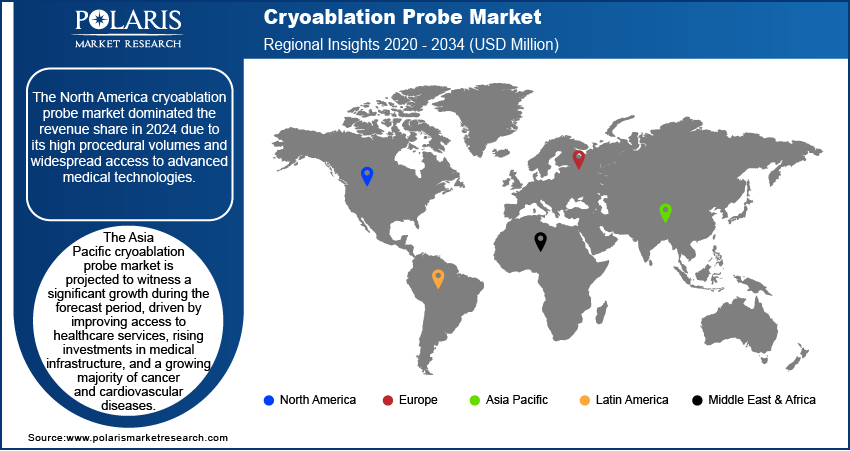

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America cryoablation probe market dominated the revenue share in 2024 due to its high procedural volumes and widespread access to advanced medical technologies. According to a report by the ASTP, as of 2021, approximately 78% of office-based physicians and 96% of non-federal acute care hospitals had implemented a certified electronic health record (EHR) system in America. The region benefits from the early adoption of innovative ablation techniques, the robust presence of leading device manufacturers, and strong reimbursement frameworks that facilitate the utilization of cryoablation in both oncology and cardiology applications. Furthermore, rising awareness among physicians and patients about the benefits of cryoablation contributed to greater market penetration across the North American healthcare sector.

The US cryoablation probe market held the largest share, due to a combination of high procedure volumes, strong clinical adoption, and the presence of advanced healthcare infrastructure. The country benefits from the early integration of innovative technologies into medical practice and a well-established network of electrophysiology and oncology centers. Additionally, favorable regulatory pathways and robust support for clinical research have accelerated the availability and utilization of next-generation cryoablation devices.

The Asia Pacific cryoablation probe market is projected to witness a significant growth during the forecast period, driven by improving access to healthcare services, rising investments in medical infrastructure, and a growing prevalence of cancer and cardiovascular diseases. According to a February 2025 report by India's Ministry of Health and Family Welfare, approximately 20 million new cancer cases were diagnosed in 2022, with 9.7 million cancer-related deaths recorded that year. Rapid urbanization and an expanding middle-class population are contributing to increased demand for minimally invasive procedures across emerging economies. Moreover, regional governments are actively promoting early diagnosis and advanced treatment options, which is expected to accelerate the adoption of cryoablation technology in hospitals and specialty clinics throughout the region.

The China cryoablation probe sector is experiencing growth, driven by increased healthcare investments and expanding access to specialized treatments in urban and semi-urban regions. The rising burden of chronic diseases, coupled with a growing focus on early diagnosis and precision-based therapies, is fostering demand for advanced ablation tools. Furthermore, domestic innovation and partnerships with global medical device firms are enhancing product availability and accelerating market penetration.

The Europe cryoablation probe market is projected to witness substantial growth during the forecast period due to rising demand for noninvasive treatment modalities and a growing focus on improving patient outcomes in chronic disease management. The region’s healthcare systems are increasingly incorporating cryoablation into standard care protocols for both cardiac and oncological conditions, supported by clinical guidelines and ongoing research. In addition, strong regulatory support for medical innovations and a high level of physician awareness are contributing to the increased adoption of cryoablation across various European countries, reinforcing expansion opportunities.

The UK cryoablation probe market growth is driven by a strong focus on improving clinical outcomes through noninvasive technologies and a strategic focus on optimizing healthcare delivery. The National Health Service (NHS) continues to support the adoption of advanced ablation procedures to improve patient safety and operational efficiency. In addition, rising clinical awareness and the growing number of trained specialists are contributing to the wider implementation of cryoablation techniques across therapeutic areas.

Key Players and Competitive Analysis Report

The cryoablation probe sector is experiencing revenue growth, driven by technological advancements, such as AtriCure’s cryoSPHERE MAX and Varian’s Isolis probes, which improve procedural efficiency. Industry trends highlight increasing demand for minimally invasive treatments, particularly in oncology and pain management. Competitive intelligence reveals players such as AtriCure and Siemens Healthineers are leveraging strategic investments in R&D to strengthen their regional footprint.

Emerging markets present expansion opportunities due to rising healthcare infrastructure and the adoption of advanced therapies. Disruptions and trends, such as single-use disposable probes, are reshaping product offerings, while sustainable value chains and partnerships with healthcare providers are critical for long-term success. Growth projections indicate strong potential in developed markets, where precision medicine adoption is high. Revenue share remains concentrated among established players, but latent demand and opportunities exist in untapped therapeutic areas. Future development strategies will likely focus on AI integration and cost-effective solutions to address economic and geopolitical shifts impacting supply chains. A few key players are Atricure, Inc.; Boston Scientific Corporation; Bruker; CooperSurgical, Inc.; Erbe Elektromedizin GmbH; HealthTronics, Inc.; IceCure Medical; Medtronic; Metrum Cryoflex; and Varian, A Siemens Healthineers Company.

Key Players

- Atricure, Inc.

- Boston Scientific Corporation

- Bruker

- CooperSurgical, Inc.

- Erbe Elektromedizin GmbH

- HealthTronics, Inc.

- IceCure Medical

- Medtronic

- Metrum Cryoflex

- Varian, A Siemens Healthineers Company

Cryoablation Probe Industry Developments

April 2024: AtriCure, Inc. launched its cryoSPHERE+ cryoablation probe, featuring new insulation technology that reduces freeze times by 25% compared to its predecessor.

May 2023: Varian (a Siemens Healthineers company) launched the Isolis cryoprobe, a single-use device for CryoCare systems. Designed for cryoablation procedures, it aims to enhance precision in treating tumors and pain through targeted tissue freezing.

Cryoablation Probe Market Segmentation

By Application Outlook (Revenue, USD Million, 2020–2034)

- Cardiac Arrhythmias

- Oncology

- Lung Cancer

- Prostate Cancer

- Breast Cancer

- Kidney Cancer

- Liver Cancer

- Dermatology

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Specialty Clinics

- Ambulatory Surgery Centers (ASCs)

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cryoablation Probe Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 188.75 million |

|

Market Size in 2025 |

USD 215.38 million |

|

Revenue Forecast by 2034 |

USD 723.71 million |

|

CAGR |

14.42% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 188.75 million in 2024 and is projected to grow to USD 723.71 million by 2034.

The global market is projected to register a CAGR of 14.42% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Atricure, Inc.; Boston Scientific Corporation; Bruker; CooperSurgical, Inc.; Erbe Elektromedizin GmbH; HealthTronics, Inc.; IceCure Medical; Medtronic; Metrum Cryoflex; and Varian, A Siemens Healthineers Company.

The cardiac arrhythmias segment dominated the market in 2024.

The ambulatory surgery centers (ASCs) segment is expected to witness the fastest growth during the forecast period.