Crypto ATM Market Share, Size, Trends, Industry Analysis Report

By Type (One Way, Two Way); By Offering; By Type of Coin; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3870

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

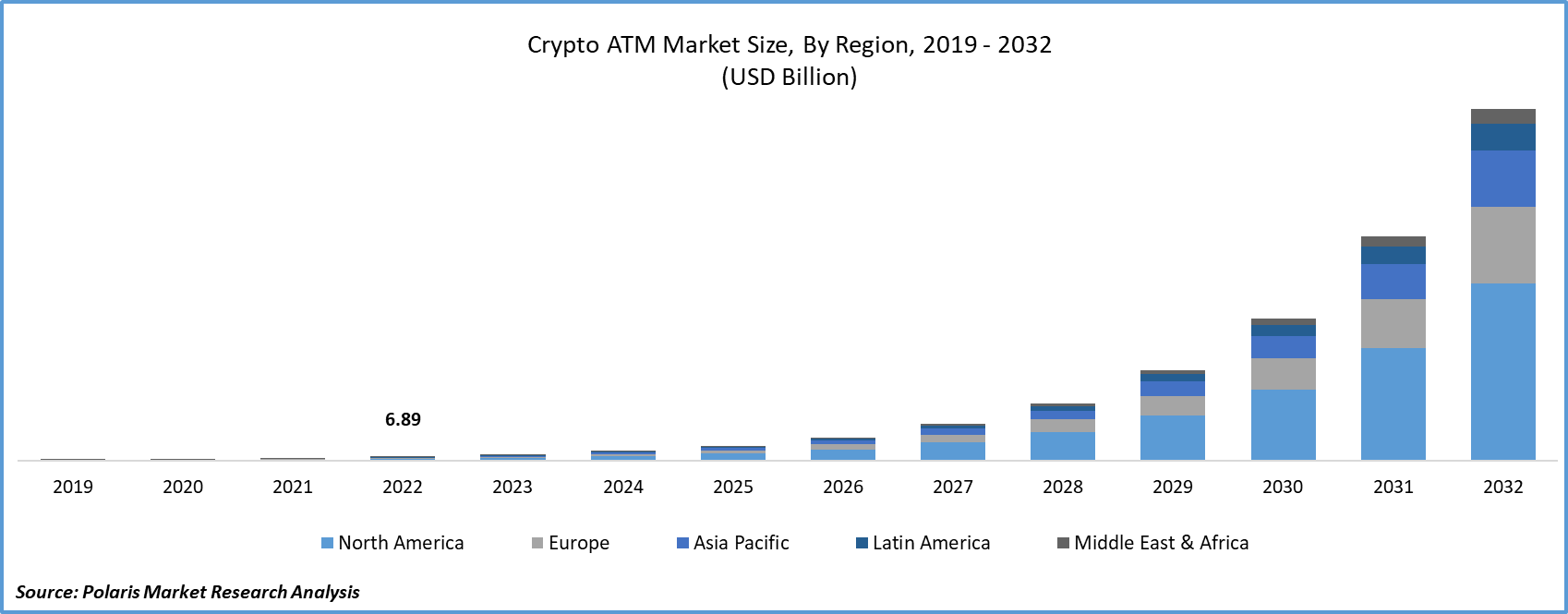

The global crypto ATM market was valued at USD 10.82 billion in 2023 and is expected to grow at a CAGR of 57.20% during the forecast period.

Over the past few years, the cryptocurrency market has undergone remarkable expansion, giving rise to a range of complementary services and technologies. Among these innovations is the Crypto ATM, a tangible terminal enabling users to trade cryptocurrency effortlessly. This sector has gained substantial momentum owing to a confluence of factors like the growing adoption of cryptocurrency, shifts in regulations, and the demand for straightforward and accessible avenues for crypto transactions.

To Understand More About this Research: Request a Free Sample Report

A cryptocurrency ATM, often referred to as a Crypto ATM or Bitcoin ATM, is a physical kiosk or terminal that allows users to buy or sell cryptocurrency using cash or credit/debit cards. These machines provide a bridge between the digital realm of cryptocurrency and the physical world, making it easier for people to engage with digital assets.

Further, crypto ATMs play a crucial role in bridging the gap between the digital world of cryptocurrency and traditional financial systems. They provide accessibility, security, and familiarity for users looking to engage with digital assets, contributing to the broader adoption and acceptance of cryptocurrency in global finance.

- For instance, in July 2023, Bitcoin Depot, a Bitcoin ATM operator, made its debut on the Nasdaq stock exchange, marking the pioneering move of a U.S. company in this sector to become publicly traded.

The Crypto ATM is on the spur of substantial expansion, fueled by the rising adoption of cryptocurrencies, evolving regulatory landscapes, and the call for straightforward crypto transactions. Nevertheless, it encounters hurdles like regulatory ambiguity and security apprehensions. By proactively tackling these challenges and seizing opportunities for diversification and technological progress, the Crypto ATM market has the potential to persistently develop and exert significant influence within the wider cryptocurrency sphere.

Manufacturers of Cryptographic ATMs require a diverse range of hardware components to construct these devices. It encompasses items like ATM stands, door locks, extension boxes, cash recyclers, cash boxes, and cash dispensers. Moreover, the escalating number of investors, heightened consumer awareness of cryptocurrency coins, and the surge in crypto ATM installations are driving up the demand for crypto ATM manufacturing, providing a significant impetus to the hardware segment.

Industry Dynamics

Growth Drivers

The rising adoption of cryptocurrency is projected to spur product demand.

As cryptocurrency gains mainstream acceptance, more individuals and businesses are seeking convenient ways to engage with digital assets. Crypto ATMs provide a tangible link between the digital and physical worlds, making them an attractive option for both newcomers and seasoned crypto enthusiasts.

Crypto ATMs offer a user-friendly interface, allowing individuals to trade cryptocurrency without any online exchange platform. This accessibility is especially appealing to those who may not be tech-savvy or prefer a more familiar, in-person experience.

Moreover, continued innovation in hardware and software leads to more efficient, secure, and cost-effective crypto ATM solutions. Thus, advancements in biometric authentication and real-time transaction monitoring enhance user experience and security. Thereby creating growth in the crypto ATM market.

Report Segmentation

The market is primarily segmented based on type, offering, type of coin, and region.

|

By Type |

By Offering |

By Type of Coin |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

One way segment held the largest market share in 2022

The one-way segment held the largest market share in 2022 and is likely to retain its market position throughout the forecast period. Prominent cryptocurrencies such as Bitcoin are gaining traction as a hedge against conventional currencies. Additionally, the potential for capital appreciation and staking profits is anticipated to incentivize cryptocurrency acquisitions. This surge in cryptocurrency purchases is projected to fuel the growth of the one-way segment, as these ATMs offer a secure means to acquire digital assets. Moreover, data from the Coin ATM Finder indicates that more than 66% of crypto ATMs operate as one-way terminals, signaling a favorable outlook for the segment's expansion.

By Offering Analysis

The software segment is expected to witness the highest growth during the forecast period.

The software segment is expected to witness the highest growth during the forecast period. This surge is primarily attributed to the escalating concern regarding mitigating the risks associated with fraudulent activities. Manufacturers of Crypto ATMs are collaborating with compliance solution providers to enhance the Know Your Customer (KYC) process. Furthermore, Crypto ATM providers are capitalizing on partnerships with software companies to enhance accessibility.

By Type of Coin Analysis

Bitcoin segment held a significant revenue share in 2022

The bitcoin segment held a significant revenue share in 2022. The growing recognition of Bitcoin as a legitimate payment method is poised to be a substantial catalyst for the segment's expansion. In September 2022, BigCommerce collaborated with the industry CoinPayments and Bitpay. This integration enabled merchants to accept payments in Bitcoin and various other cryptocurrencies seamlessly. Additionally, in May 2022, the fashion powerhouse Gucci initiated the acceptance of cryptocurrency payments, including Bitcoin, in select stores. This initiative swiftly expanded, with over 70% of their stores adopting cryptocurrency payments.

However, the forecasted period expects notable growth in the Litecoin segment. Unlike Bitcoin, Litecoin can be efficiently mined using personal computers. Additionally, the Litecoin blockchain boasts a capacity for higher transaction volumes, which is expected to drive demand for this cryptocurrency. This capability to handle increased transaction volume leads to quicker confirmation times for merchants, motivating many to embrace Litecoin as a form of payment.

Regional Insights

North America region dominated the largest market share in 2022

The North American region dominated the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. Market expansion in the North American region is chiefly led by the U.S., which boasts the largest network of operators in both hardware and software used for Crypto ATMs. The U.S. offers a conducive investment environment, characterized by a lack of legal hindrances and a plethora of providers for Crypto ATM hardware and software.

Moreover, Mexico's government officially recognized Bitcoin as legal in 2017, subjecting it to regulation under FinTech legislation. Additionally, Canada has witnessed a surge in startup activity, particularly in the bitcoin sector, further propelling the market in North America. Notably, North America is the base for several pivotal market players, such as Bitcoin Depot, Coin Cloud, and CoinFlip. Furthermore, the deployment of crypto ATMs in public areas is gaining significant momentum in this region, particularly in the U.S.

The Asia-Pacific region held the fastest growth in the market due to a combination of increasing cryptocurrency adoption, regulatory support, and the need for accessible and inclusive financial services. The increasing acceptance and adoption of cryptocurrency in Asia-Pacific countries, particularly in emerging economies such as China and India, are fueling the demand for Crypto ATMs. Also, collaborations between cryptocurrency companies, financial institutions, and technology providers are helping to expand the reach of Crypto ATMs in the region.

Key Market Players & Competitive Insights

The market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Bitaccess Inc.

- Coin Cloud

- CoinFlip Solutions LLC

- Coinme Inc.

- Coinsource LLC

- CoinVault ATM LLC

- Genesis Coin Inc.

- GENERAL BYTES s.r.o.

- Lamassu Industries AG

- LocalBitcoins Oy

- Orderbob

- Pundi X Labs Private Limited

- Robocoin Kiosk

- SatoshiPoint Ltd.

- Shitcoins Club

Recent Developments

- In August of 2022, HoneyBadger Enterprises, a Canadian online Bitcoin ATM provider, successfully deployed a cryptocurrency ATM at the Pangea Pod Hotel, located in Sunrise Alley in Whistler.

Crypto ATM Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17 billion |

|

Revenue forecast in 2032 |

USD 632.51 billion |

|

CAGR |

57.10% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Offering, By Type of Coin, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |