CubeSat Market Size, Share, Trends, & Industry Analysis Report

By Subsystem (Payloads, Solar Panels & Antenna Systems), By Size, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5999

- Base Year: 2024

- Historical Data: 2020-2023

Overview

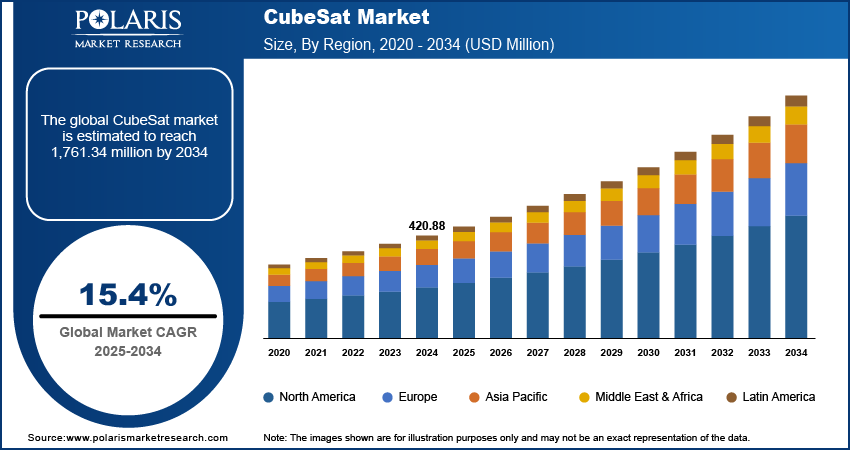

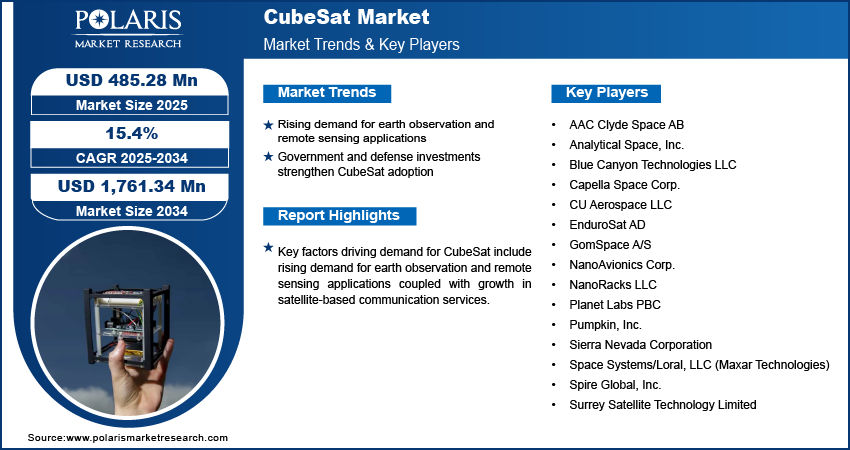

The global cubesat market size was valued at USD 420.88 million in 2024, growing at a CAGR of 15.4% from 2025–2034. Key factors driving demand for CubeSat include the rising demand for earth observation and remote sensing applications coupled with surging government and defense investments.

Key Insights

- The payloads segment accounted for largest market share in 2024.

- The 6U segment is projected to grow at a rapid pace in the coming years, owing to the increasing demand for higher payload volumes and extended mission lifespans.

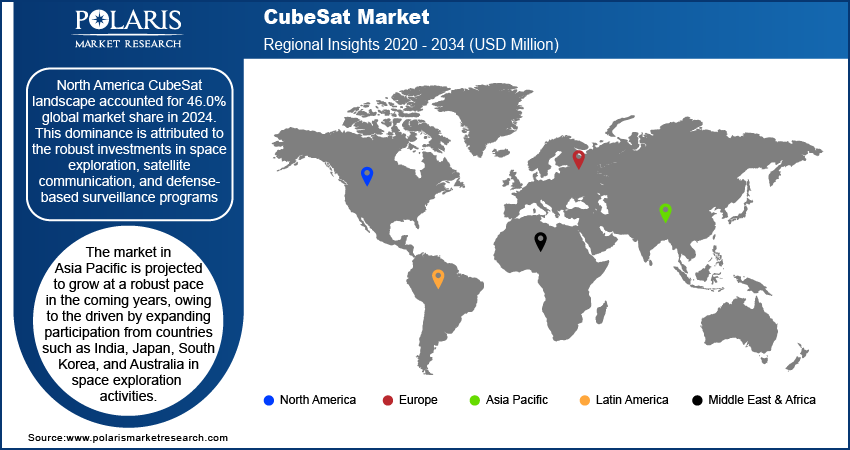

- The North America CubeSat market accounted for 46.0% of the global market share in 2024.

- The US CubeSat market held 66% share of the North America market share in 2024, due to strong demand from the defense, Earth observation, and technology demonstration sectors.

- The market in Asia Pacific is projected to grow at a CAGR of 20.01% from 2025-2034, driven by rising demand for low-cost satellite launches and increasing investment in space technology.

- The China market is expanding steadily, due to rising government-led space initiatives and growing private sector involvement.

CubeSats are standardized small satellites built in units of 10 cm × 10 cm × 10 cm and range in size from 1U to 12U or more. It serves a broad range of purposes including imaging, data relay, technology testing and space environment monitoring and are extensively used by startups, academic institutions and space agencies due to cost-efficiency and mission flexibility. The modular architecture and compatibility with rideshare missions made CubeSats highly scalable and adaptable to diverse mission profiles, from low Earth orbit (LEO) operations to interplanetary studies.

Rising demand for Earth observation and remote sensing applications is fueling the adoption of CubeSats across government and commercial sectors. Organizations are deploying these small satellites to monitor environmental changes, assess agricultural productivity, track forest cover, and manage disaster response. For instance, in July 2024, The University of Kansas aerospace engineering team launched KUbeSat‑1 through NASA’s ELaNa 43 program aboard Firefly Aerospace’s Alpha rocket, carrying instruments to measure cosmic rays and perform high-frequency calibration. The mission aligns with the growing demand for Earth observation and remote sensing services, including CubeSats used by government and research institutions for scientific monitoring, environmental assessment and space-based data collection. The ability to provide frequent imaging at lower cost compared to traditional satellites is expanding utility in climate science, land use mapping and natural resource management.

Growth in satellite-based communication services is further accelerating the expansion of the CubeSat market. The need to deliver global broadband connectivity in underserved and remote regions, is leading companies to invest in CubeSat-based communication constellations. For instance, in July 2025, Ananth Technologies received approval from India’s space regulator IN‑SPACe to launch the country’s first private GEO communication satellite by 2028, backed by an initial investment of around USD 34.93 million, aiming to deliver up to 100 Gbps broadband services across India. These systems support internet of things (IoT) technology, data relay and emergency communications. The rising demand for reliable low-latency communication in logistics, maritime operations, and rural connectivity is boosting the use of CubeSats as an affordable alternative to larger, more complex satellite platforms.

Industry Dynamics

- Rising demand for earth observation and remote sensing applications is fueling CubeSat deployment across government, commercial, and academic sectors, for environmental monitoring, disaster management, and precision agriculture.

- Government and defense investments are strengthening CubeSat adoption by funding missions focused on tactical communications, surveillance, and reconnaissance.

- Limited payload capacity and power constraints are restraining the market by narrowing the scope of high-complexity missions.

- Increasing integration of CubeSats in broadband constellations and global data relay systems is creating significant growth opportunities.

Rising Demand for Earth Observation and Remote Sensing Applications: The surge in the deployment of earth observation satellites and remote sensing applications is fueling the adoption of CubeSats across government and commercial sectors. For instance, in November 2023, the PLATERO CubeSat mission by Open Cosmos aims to monitor environmental hazards from space to support rapid response and sustainable policy planning. These compact satellites offer cost-effective, high-resolution imaging and are widely deployed by agencies, researchers and private firms for environmental monitoring, disaster response and resource management. The ability of CubeSat to operate in constellations allows for near-real-time data collection, supporting faster and more informed decision-making across climate, agriculture, and urban planning sectors.

Government and Defense Investments Strengthen CubeSat Adoption: Rising investments from government and defense sectors are accelerating the adoption of CubeSat technologies. As per the SIPRI, the global military spending reached USD 2,718 billion in 2024, rising 9.4% from the previous year. The overall spending grew 37% between 2015 and 2024, marking a decade of continuous growth. These compact satellites are leveraged as valuable assets for enhancing national security infrastructure, due to its affordability, rapid deployment capabilities and adaptability in low-Earth orbit operations. Defense agencies and space authorities are deploying CubeSats to create decentralized, resilient satellite networks that support secure communication, threat monitoring, and intelligence gathering. In addition, the growing emphasis on space-based security and communication systems is significantly boosting innovation and investment in the CubeSat ecosystem.

Segmental Insights

Subsystem Analysis

Based on subsystem, the segmentation includes payloads, solar panels & antenna systems, propulsion systems, attitude determination & control systems, electrical power systems (EPS), structure, command & data handling (C&DH), and others. The payloads segment accounted for largest revenue share in 2024 due to its direct role in defining the mission functionality of CubeSats. Payloads include imaging sensors, spectrometers, communication modules, and scientific instruments used for Earth observation, space exploration, and communication tasks. The versatility of CubeSat payloads allows users to tailor each satellite to a specific mission while optimizing for size, power, and data bandwidth. Increasing demand for advanced payloads in remote sensing and research applications is further enhancing segment growth.

The attitude determination and control systems (ADCS) segment is projected to grow at the fastest CAGR during the forecast period, driven by the increasing need for precise satellite orientation and stability during complex operations such as imaging, station-keeping, and inter-satellite communication. The advancement in miniaturized sensors, gyroscopes, and reaction wheels is making ADCS more reliable, thereby enhancing the performance and accuracy of CubeSat missions.

Size Analysis

In terms of size, the segmentation includes 0.25U-1U, 2U, 3U, 6U, 12U, and above 12U. The 3U segment dominated the revenue share in 2024, due to its ideal balance between payload capacity, power management, and mission flexibility. The 3U form factor is widely used in academic, commercial, and defense applications, as it allows more sophisticated systems to be integrated within a compact and cost-effective design. Its compatibility with standardized deployers and its proven flight record in LEO missions made it a preferred choice among developers and launch providers.

The 6U segment is expected to witness the fastest growth during the forecast period, owing to the increasing demand for higher payload volumes and extended mission lifespans. The 6U configuration allows for more powerful onboard systems, improved thermal regulation, and dual-payload options, supporting high-resolution imaging and real-time data transmission needs in Earth observation and telecommunications.

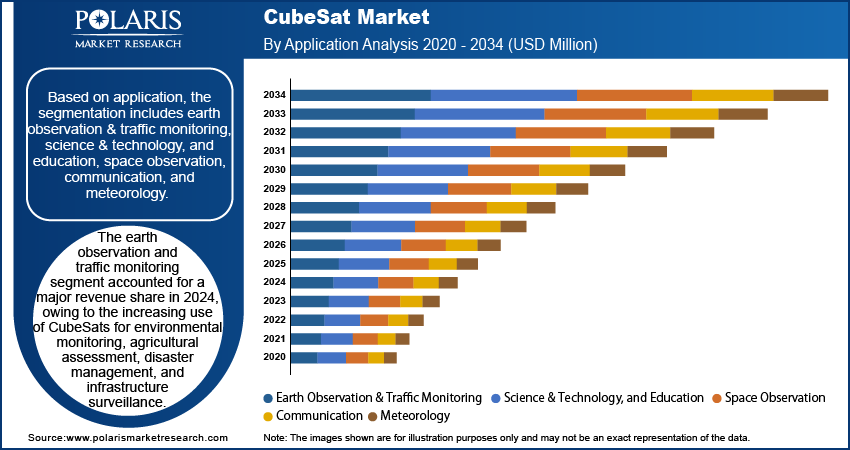

Application Analysis

Based on application, the segmentation includes earth observation & traffic monitoring, science & technology, and education, space observation, communication, and meteorology. The Earth observation and traffic monitoring segment accounted for the largest share in 2024, owing to the increasing use of CubeSats for environmental monitoring, agricultural assessment, disaster management, and infrastructure surveillance. These satellites are used to capture real-time images and geospatial data at a lower cost and higher revisit frequency than traditional satellites, which is valuable for governments, research institutions, and commercial operators involved in land and resource management.

The communication segment is expected to grow at the fastest pace during the forecast period. Growing demand for affordable connectivity solutions, including IoT data transfer, asset tracking, and emergency communications, is pushing telecom providers to adopt CubeSat-based constellations. Broadband expansion into remote and underserved areas is accelerating the use of CubeSats as a practical solution to bridge connectivity gaps and strengthen global data relay infrastructure.

End User Analysis

In terms of end user, the segmentation includes government & military, commercial, and non-profit organizations. The government and military segment dominated the CubeSat market in 2024, driven by rising investment in space-based surveillance, reconnaissance, weather monitoring, and defense communication systems. The World Economic Forum projects that the space economy expected to grow from USD 630 billion in 2023 to USD 1.8 trillion by 2035, reflecting an average annual growth rate of 9% well above the pace of global GDP expansion.

CubeSats offer an efficient platform for agencies to conduct experimental missions and validate new technologies with shorter development timelines and lower risk. National security applications and space situational awareness are further contributing to this segment’s steady demand.

The commercial segment is anticipated to grow at the fastest rate over the forecast period, supported by the rise of private space companies, startup-led satellite programs, and increased demand for low-cost remote sensing and telecom solutions. Commercial operators are leveraging CubeSats to launch scalable, data-driven businesses ranging from crop monitoring to maritime navigation and atmospheric science.

Regional Analysis

North America CubeSat market accounted for 46.0% of global market share in 2024. This dominance is attributed to the robust investments in space exploration, satellite communication, and defense-based surveillance programs. Also, the growing public-private partnerships along with increasing involvement of commercial space enterprises are increasing the deployment of CubeSat across scientific, environmental, and military missions. Moreover, increasing innovation through educational launches and research-driven missions by academic institutions and aerospace startups is driving market growth. In addition, the presence of well-established launch infrastructure and a favorable regulatory environment is further accelerating adoption of CubeSat platforms across multiple industries in the region.

The US CubeSat Market Insight

The US held 66% market share in North America CubeSat landscape in 2024, due to increasing demand in defense, Earth observation, and technology demonstration, government agencies such as NASA and the Department of Defense are deploying CubeSats for tactical communication, climate monitoring, and rapid-response imaging. For instance, in January 2024, NASA partnered with the US Department of Defense (DoD) to launch the Mission Concept 2024 Summer Series under the University Nanosatellite Program, engaging university faculty and students in systems engineering training to develop CubeSat mission proposals for future CSLI flight selection. The program aimed to improve mission readiness and expand CubeSat innovation by guiding participants through real-world design and integration challenges. The availability of funding grants and rideshare programs is enabling universities, startups, and private enterprises to develop low-cost missions for space technology validation. In addition, the growing commercialization of space-based services is pushing US-based players to invest in CubeSat constellations for telecom and data analytics applications.

Asia Pacific CubeSat Market Trend

The market in Asia Pacific is projected to grow at a CAGR of 20.1% from 2025-2034, driven by expanding participation from countries such as India, Japan, South Korea, and Australia. Rising investments in indigenous satellite manufacturing and the growing importance of space technologies in national development plans are fueling demand for small satellites. Moreover, government-led initiatives to improve broadband access, weather forecasting, and disaster preparedness are propelling CubeSat launches for regional communication and Earth observation. The region’s low-cost manufacturing environment and increasing collaboration with global aerospace firms are further supporting growth of the market.

China CubeSat Market Overview

The market in China is expanding due to the rising public and private sector investment in space exploration activities. Government-backed space programs and private aerospace ventures are deploying CubeSats to support Earth observation, satellite communication and research activities. For instance, in 2024, SSST raised USD 1.33 billion in its Series A funding round, marking the largest single-round investment ever secured by a Chinese satellite company. Also, China’s commercial space sector is targeting a market value of over USD 344 billion by 2025, as private rocket developers and satellite manufacturers ramp up production and advance reusable technologies. In addition, state-led academic missions and advancements in domestic launch capabilities are accelerating CubeSat adoption for technology demonstration and broadband constellations.

Europe CubeSat Market Outlook

The CubeSat landscape in Europe is projected to hold a substantial share in 2034, due to growing investments in climate research and environmental monitoring are driving CubeSat adoption for advanced scientific missions across space agencies and universities. According to the Germany Trade & Invest report, Germany’s greentech sector grew by 4.7%, reaching approximately USD 340 billion. This contributes to the rising demand for small, cost-effective satellites in the region. In addition, increasing focus on sustainable space operations and collision avoidance is leading the deployment of CubeSats for space situational awareness and debris tracking across the region.

Key Players & Competitive Analysis Report

The CubeSat market is moderately consolidated, with competition centered on payload capability, mission reliability and cost efficiency. Key players focus on technological innovation, miniaturized subsystems and rapid deployment models. The rising strategic initiatives include partnerships with space agencies and academic institutions, expansion of launch service networks, and adoption of CubeSats for climate monitoring, defense and scientific research accelerate the CubeSat market. Key players are also targeting emerging markets and standardizing platforms to meet evolving satellite mission demands.

Major companies operating in the CubeSat market include AAC Clyde Space AB, Analytical Space, Inc., Blue Canyon Technologies LLC, Capella Space Corp., CU Aerospace LLC, EnduroSat AD, GomSpace A/S, NanoAvionics Corp., NanoRacks LLC, Planet Labs PBC, Pumpkin, Inc., Sierra Nevada Corporation, Space Systems/Loral, LLC (Maxar Technologies), Spire Global, Inc., and Surrey Satellite Technology Limited.

Key Players

- AAC Clyde Space AB

- Analytical Space, Inc.

- Blue Canyon Technologies LLC

- Capella Space Corp.

- CU Aerospace LLC

- EnduroSat AD

- GomSpace A/S

- NanoAvionics Corp.

- NanoRacks LLC

- Planet Labs PBC

- Pumpkin, Inc.

- Sierra Nevada Corporation

- Space Systems/Loral, LLC (Maxar Technologies)

- Spire Global, Inc.

- Surrey Satellite Technology Limited

Industry Developments

- January 2025: NASA launched the Technology Education Satellite‑22 (TES‑22) CubeSat aboard a SpaceX Falcon 9 to study Earth’s thermosphere and demonstrate deorbit technology using a drag sail. The CubeSat also tested cost-effective reentry strategies, supporting debris mitigation in low-Earth orbit.

- January 2025: The Naval Postgraduate School (NPS), in collaboration with the U.S. National Reconnaissance Office (NRO) and New Zealand’s Defence Science & Technology (DST) agency, launched the 6U “Otter” CubeSat aboard SpaceX’s Falcon 9 Transporter‑12 mission.

CubeSat Market Segmentation

By Subsystem Outlook (Revenue, USD Million, 2020–2034)

- Payloads

- Solar Panels & Antenna Systems

- Propulsion Systems

- Attitude Determination & Control systems

- Electrical Power Systems (EPS)

- Structure

- Command & Data Handling (C&DH)

- Others

By Size Outlook (Revenue, USD Million, 2020–2034)

- 0.25U-1U

- 2U

- 3U

- 6U

- 12U

- Above 12U

By Application Outlook (Revenue, USD Million, 2020–2034)

- Earth Observation & Traffic Monitoring

- Science & Technology, and Education

- Space Observation

- Communication

- Meteorology

By End User Outlook (Revenue, USD Million, 2020–2034)

- Government & Military

- Commercial

- Non-profit Organizations

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

CubeSat Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 420.88 Million |

|

Market Size in 2025 |

USD 485.28 Million |

|

Revenue Forecast by 2034 |

USD 1,761.34 Million |

|

CAGR |

15.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 420.88 million in 2024 and is projected to grow to USD XX million by 2034.

The global market is projected to register a CAGR of 15.4% during the forecast period.

North America the market in 2024, holding 46.0% share.

A few of the key players in the market are AAC Clyde Space AB, Analytical Space, Inc., Blue Canyon Technologies LLC, Capella Space Corp., CU Aerospace LLC, EnduroSat AD, GomSpace A/S, NanoAvionics Corp., NanoRacks LLC, Planet Labs PBC, Pumpkin, Inc., Sierra Nevada Corporation, Space Systems/Loral, LLC (Maxar Technologies), Spire Global, Inc., and Surrey Satellite Technology Limited.

The payloads segment dominated the market in 2024.

The 6U segment is expected to witness the fastest growth during the forecast period.