Cultured Marble Market Size, Share, Trends, & Industry Analysis By Type (Polyester, Cement, Composite, and Sintered), By Application, By End-Use Industry and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5886

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

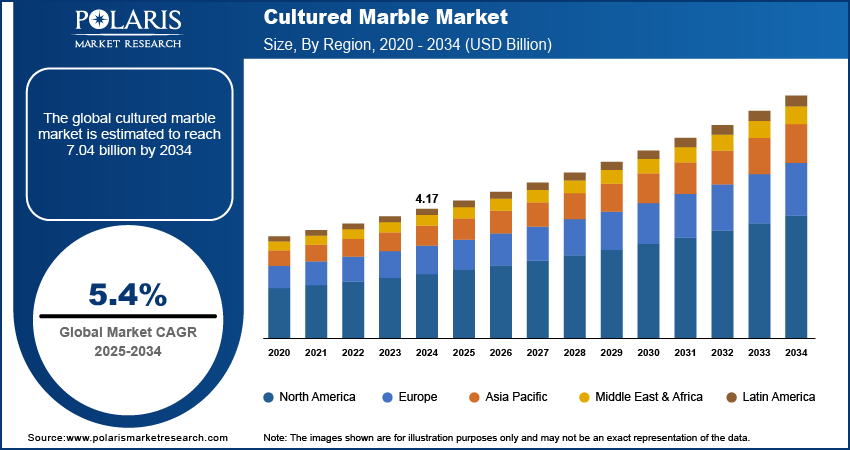

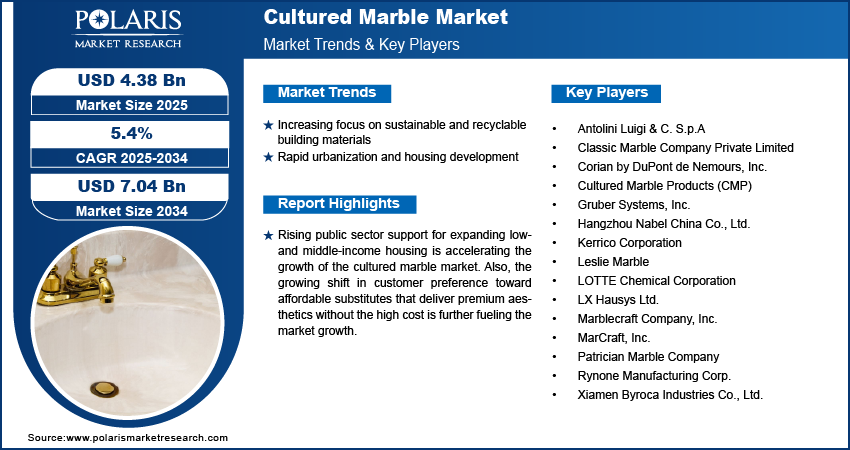

The cultured marble market size was valued at USD 4.17 billion in 2024, growing at a CAGR of 5.4% from 2025–2034. Increasing focus on sustainable and recyclable building materials coupled with rapid urbanization and housing development is boosting the market growth.

The cultured marble market includes engineered composite materials manufactured by blending crushed marble with resins and pigments to create surfaces that mimic the appearance of natural stone. These materials are molded into specific shapes and finished with a durable gel coating, resulting in products that offer a seamless, non-porous, and low-maintenance alternative to traditional stone. Cultured marble is widely used in bathroom accessory vanity tops, shower walls, bathtubs, and backsplashes due to its affordability, customizable aesthetics, and resistance to mold, stains, and water infiltration. Its ability to be produced in a range of colors, patterns, and finishes allows manufacturers to meet varied consumer and architectural preferences.

To Understand More About this Research: Request a Free Sample Report

The global adoption of cultured marble expanded due to improvements in production technologies and material formulations, allowing for increased durability and visual appeal. The product’s lightweight nature and ease of installation are driving its growing use in residential, hospitality, and institutional construction projects. Manufacturers are emphasizing precision mold design, consistent quality control, and surface innovation to cater to evolving interior design trends. Cultured marble maintains a strong position in the decorative surfacing industry due to its effective blend of functionality, aesthetic appeal, and affordability.

Rising public sector support for expanding low- and middle-income housing is accelerating the growth of the cultured marble market. Governments across the globe are introducing fiscal measures to stimulate affordable housing development, including tax incentives, interest subsidies, and public-private partnerships. For instance, In July 2024, the European Affordable Housing Plan was launched, aiming to support housing reforms and financial deployment through EU Cohesion Policy Funds. The initiative involves co-financing from the European Investment Bank Group (EIBG), National Promotional Banks and Institutions (NPBIs), and private investors. Also, in November 2024, China’s Ministry of Finance announced a preliminary budget of USD 7.9 billion in central government financial subsidies for urban affordable housing projects planned for 2025. These initiatives are pushing builders to choose durable and aesthetically appealing materials that are also cost-effective. Cultured marble fits well within this framework by replicating the appearance of natural stone while offering simplified installation, lower lifecycle maintenance costs, and compatibility with mass production and prefab housing formats.

In addition, the growing shift in customer preference toward affordable substitutes that deliver premium aesthetics without the high cost is further fueling the market growth. Cultured marble offers a seamless surface finish and molded into a variety of shapes and sizes, eliminating the cutting and polishing processes. This enables faster turnaround times in construction projects while maintaining an appearance closely resembling genuine marble or granite.

Industry Dynamics

Increasing Focus on Sustainable and Recyclable Building Materials

Growing global emphasis on sustainable construction is propelling the growth of the market. For instance, in May 2024, the European Union adopted the revised energy performance of buildings directive, requiring all new buildings to be zero-emission by 2030. The directive also introduces minimum energy performance standards (MEPS) for non-residential buildings and mandates long-term renovation strategies. The demand for cultured marble is increasing, as it incorporates recycled stone particles and synthetic resins that reduce environmental impact. Unlike natural stone processing, which involves quarrying and intensive mechanical treatment, the production of cultured marble generates less material waste and consumes relatively lower energy. These advantages coupled with green certification standards such as LEED and BREEAM, making it suitable for projects targeting environmental compliance.

In addition, the product’s long service life and recyclability support lifecycle sustainability goals. Architects and developers working on commercial and residential projects are increasingly specifying cultured marble to enhance project eligibility for government incentives or tax credits tied to green building practices. Furthermore, manufacturers are introducing formulations with bio-based resins and low-emission additives to improve indoor air quality and support occupant health. The growing demand for sustainability in design and construction is increasing the need for cultured marble into environmentally responsible architecture.

Rapid Urbanization and Housing Development

The accelerating pace of urbanization is significantly impacting material choices in residential construction across the globe. According to United Nations data, over 68% of the global population is expected to reside in urban areas by 2050, which is increasing the demand for cost-effective, easily installable building materials. This demographic trend is boosting the expansion of multi-family housing units, mid-rise and high-rise buildings, and planned urban communities. Cultured marble is increasingly used in these developments due to its ability to meet the dual requirements of cost-efficiency and aesthetic consistency. The product’s moldability and reduced total installed cost compared to quarried stone make it particularly suitable for volume-based residential construction.

In addition, the availability of cultured marble in standardized, pre-fabricated units such as shower surrounds, wall panels, vanities, and countertops supports fast-paced construction schedules. This is crucial in urban projects where meeting tight deadlines and minimizing on-site labor is essential. The material’s resistance to mildew, staining, and moisture intrusion further increases its suitability for high-density housing complexes with shared bathroom and kitchen areas. Rising demand for urban housing, particularly among middle-income groups, is fueling the wider use of cultured marble due to its practical advantages and cost-efficiency in residential construction.

Segmental Insights

Type Analysis

The global segmentation, based on type includes, polyester, cement, composite, and sintered. The polyester segment is projected to reach substantial share by 2034. This dominance is attributed to the material’s cost-effectiveness, versatility in moldability, and compatibility with a wide range of pigments and additives. Polyester resins offer a balanced mix of strength and visual appeal, enabling mass production of cultured marble components with consistent quality and minimal waste. The formulation is particularly well-suited for applications in residential and commercial interiors where aesthetic uniformity and affordability are critical. Additionally, ease of handling and quicker curing cycles gives polyester-based cultured marble an edge in high-throughput manufacturing environments, making it the preferred choice among regional and international producers.

Composite cultured marble is the fastest-growing segment. The material’s enhanced durability, thermal resistance, and structural integrity are supporting its increasing use in more demanding applications such as high-end countertops and flooring. Architects and designers are increasingly drawn to engineered materials that offer functionality and modern aesthetics, making composite formulations appealing for their enhanced performance qualities. Moreover, composite cultured marble is engineered to meet specific sustainability criteria, including recycled content and reduced volatile organic compound (VOC) emissions.

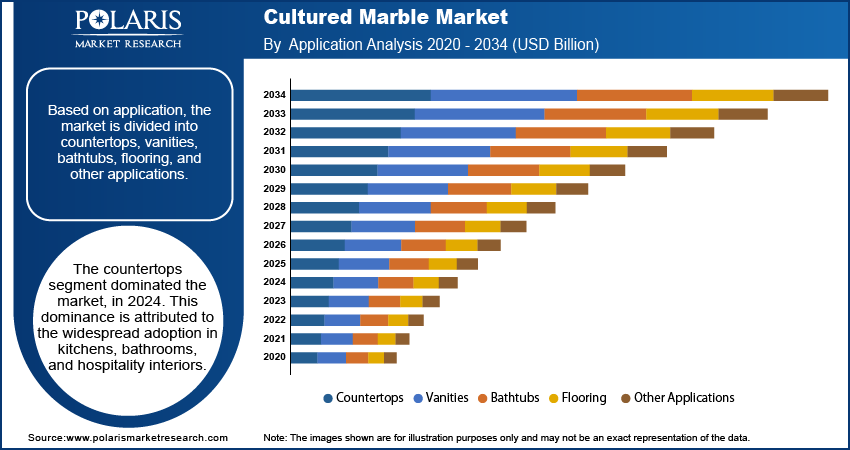

Application Analysis

The global segmentation, based on application includes, countertops, vanities, bathtubs, flooring, and other applications. The countertops segment dominated the market, in 2024. This dominance is attributed to the widespread adoption in kitchens, bathrooms, and hospitality interiors. Cultured marble countertops offer non-porous surfaces that resist staining, mildew, and water absorption, making them suitable for areas exposed to moisture and high footfall. The ability to replicate the look of high-end stones such as marble and quartz at significantly lower cost also makes it a preferred material for budget-conscious consumers and builders. Furthermore, easy fabrication and installation processes allow for shorter project timelines, driving its continuous use across single-family homes, apartments, and hotel chains.

The flooring segment is the fastest-growing application in the market, particularly in urban high-rise developments and luxury commercial interiors. Cultured marble tiles and slabs are increasingly replacing traditional materials due to their scratch resistance, seamless appearance, and compatibility with radiant heating systems. Advances in fabrication technologies have made it possible to produce larger tile sizes and custom designs that meet the contemporary architectural preferences. Additionally, the ease of maintenance and longer product lifespan are proving attractive in commercial environments such as shopping centers, office lobbies, and upscale retail stores. The segment’s expansion is also supported by developers seeking unified aesthetic themes throughout built environments using marble-look flooring solutions that remain within budget constraints.

End-Use Industry Analysis

The global segmentation, based on end-use industry includes, residential and non-residential. The residential segment accounted for significant market share in 2024, driven by rising demand for stylish yet cost-efficient interior materials. The product is particularly prevalent in mid-range to premium housing developments, with homeowners seeking durable alternatives to natural stone for kitchens, bathrooms, and decorative elements. Cultured marble’s light weight, ease of customization, and minimal maintenance needs make it an ideal solution for residential builders looking to optimize construction timelines without sacrificing visual appeal. In addition, the growing trend of do-it-yourself (DIY) home improvement and online customization platforms is boosting consumer engagement with ready-to-install cultured marble units for vanities, backsplashes, and integrated sinks.

The non-residential sector is projected to exhibit the fastest growth over the coming years. This growth is due to the increased construction activity across hotels, healthcare facilities, educational institutions, and corporate offices. Cultured marble is a valuable solution in these settings due to its ability to meet stringent hygiene standards while offering premium finishes at scalable cost. Furthermore, facility managers and architects are increasingly specifying cultured marble for lobbies, restrooms, and decorative wall cladding in high-traffic environments. Its performance under heavy use, combined with the ability to match branding and interior design themes, is making it a preferred alternative to natural stone and ceramic materials.

Regional Analysis

Asia Pacific cultured marble market accounted for largest revenue share in 2024, driven by large-scale urban development and favorable government policies fueling residential growth. Affordable housing initiatives and real estate reforms across India, China, and Indonesia are contributing to the expansion of the construction sector and stimulating demand for low-cost, high-performance building materials. Cultured marble, with its aesthetic resemblance to natural stone and cost advantages, is increasingly used in kitchen countertops, vanities, and flooring within mass housing projects. The accessibility of raw materials and improving regional manufacturing capacity are further fueling market the market growth in this region.

China Cultured Marble Market Insight

China cultured marble market, in particular, dominated the regional share, due to rising investments in infrastructure and large-scale urbanization projects. Government-supported programs focused on transport hubs, public institutions, and mixed-use real estate are creating strong demand for cost-effective materials with durable and aesthetic appeal. According to the Green Finance & Development Center, Chinese involvement in the Belt and Road Initiative reached a record level in 2024, with construction contracts valued at USD 70.7 billion and investments totaling around USD 51 billion. The strength of the local construction ecosystem, combined with a growing preference for pre-fabricated and engineered surfaces, is accelerating the adoption of cultured marble across private and public sector construction in the country.

North America Cultured Marble Market

North America cultured marble market is projected to grow during the forecast period. The growth is attributed to the expanding high-end residential construction and heritage preservation programs. For example, in May 2025, Congress authorized the full allocation of USD 225 million to the Historic Preservation Fund (HPF) for the fiscal year 2025. Federal and state-level initiatives aimed at preserving and retrofitting historic buildings are incorporating cultured marble into renovation projects due to its ability to match traditional aesthetics while meeting modern durability and safety requirements. This continued support for preservation initiatives is boosting the use of cultured marble in restoration and adaptive reuse projects across the region.

In addition, growth in the luxury real estate sector increased the use of cultured marble as an affordable alternative to natural marble in upscale housing and condominium projects. Builders and interior designers are favoring the material for its customizability, ease of installation, and cost efficiency without compromising visual quality. Moreover, the demand is further elevated by shifting consumer preferences toward low-maintenance yet elegant finishes for kitchens, bathrooms, and common living areas.

Europe In Cultured Marble Market Overview

Europe cultured marble market is projected to reach significant revenue share by 2034 due to the increasing emphasis on sustainability in construction materials. Regulatory frameworks such as the EU Ecodesign Directive and national green building certification systems are fueling the adoption of engineered and recyclable materials. The demand for cultured marble is growing among architects and developers for its energy-efficient production, recyclability, and low emissions compared to quarried stone. Its compatibility with modern design trends and ability to replicate premium surfaces at lower environmental cost make it an ideal choice for green construction initiatives across Western Europe.

Furthermore, the surge in renovation of aging infrastructure in Germany, France, and the UK is propelling the demand for cultured marble in residential and public buildings. For example, the European Commission's Renovation Wave initiative was introduced to enhance the energy performance of buildings throughout the EU. It set an ambitious goal to double the renovation rate by 2030, with a strong emphasis on improving energy and resource efficiency. The plan aimed to renovate up to 35 million buildings by the end of the decade. Upgrades to public housing, schools, healthcare facilities, and historical landmarks are driving the use of durable, visually appealing interior materials that are easy to install and maintain. The stringent environmental compliance coupled with refurbishment demand boosting cultured marble as a crucial material within the European construction landscape.

Key Players & Competitive Analysis Report

The cultured marble market is characterized by a mix of regional manufacturers and global material solution providers focusing on design innovation, product customization, and supply chain efficiency. Companies are prioritizing R&D investments to develop lightweight, mold-resistant, and visually enhanced alternatives that address growing demand in residential and non-residential construction. The competitive landscape is further shaped by technological integration in production processes, including improved resin formulations, 3D mold printing, and automated casting systems. Manufacturers are also expanding global footprint through strategic partnerships with distributors, real estate developers, and interior contractors to enhance product accessibility across urban and rural construction projects.

Prominent players in the global cultured marble market include Antolini Luigi & C. S.p.A, Classic Marble Company Private Limited (KalingaStone), Corian by DuPont de Nemours, Inc., Cultured Marble Products (CMP), Gruber Systems, Inc., Hangzhou Nabel China Co., Ltd., Kerrico Corporation, Leslie Marble, LOTTE Chemical Corporation, LX Hausys Ltd., Marblecraft Company, Inc., MarCraft, Inc., Patrician Marble Company, Rynone Manufacturing Corp., and Xiamen Byroca Industries Co., Ltd.

Key Players

- Antolini Luigi & C. S.p.A

- Classic Marble Company Private Limited (KalingaStone)

- Corian by DuPont de Nemours, Inc.

- Cultured Marble Products (CMP)

- Gruber Systems, Inc.

- Hangzhou Nabel China Co., Ltd.

- Kerrico Corporation

- Leslie Marble

- LOTTE Chemical Corporation

- LX Hausys Ltd.

- Marblecraft Company, Inc.

- MarCraft, Inc.

- Patrician Marble Company

- Rynone Manufacturing Corp.

- Xiamen Byroca Industries Co., Ltd.

Industry Developments

August 2024: LOTTE Chemical Corporation introduced the Premiere Collection, a new artificial marble series under its engineered stone brand, Staron. This launch reflects the company's focus on offering high-design surfaces that meet aesthetic and functional demands in modern interior applications.

April 2024: DuPont’s Corian brand expanded its North American portfolio with the launch of Corian Quartz. The new range features quartzite-inspired designs with multidirectional veining and enhanced visual depth, paired with the durability and performance benefits of engineered quartz.

Cultured Marble Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Polyester

- Cement

- Composite

- Sintered

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Countertops

- Vanities

- Bathtubs

- Flooring

- Other Applications

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Non-residential

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cultured Marble Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.17 Billion |

|

Market Size in 2025 |

USD 4.38 Billion |

|

Revenue Forecast by 2034 |

USD 7.04 Billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.17 billion in 2024 and is projected to grow to USD 7.04 billion by 2034

The global market is projected to register a CAGR of 5.4% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Antolini Luigi & C. S.p.A, Classic Marble Company Private Limited (KalingaStone), Corian by DuPont de Nemours, Inc., Cultured Marble Products (CMP), Gruber Systems, Inc., Hangzhou Nabel China Co., Ltd., Kerrico Corporation, Leslie Marble, LOTTE Chemical Corporation.

The countertops segment dominated the market share in 2024.

The composite cultured marble segment is expected to witness the fastest growth during the forecast period.