Data Center Interconnect Market Share, Size, Trends, Industry Analysis Report

By Type (Products, Software, Services), By Application, By End Use, By Region; Segment Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 203

- Format: PDF

- Report ID: PM2379

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

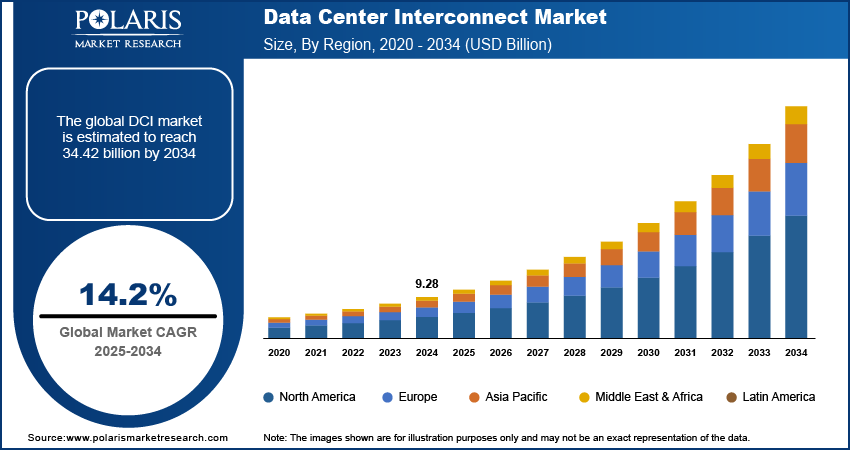

The data center interconnect (DCI) market size was valued at USD 9.28 billion in 2024 and is expected to register a CAGR of 14.2% from 2025 to 2034. Surge in digitization, edge computing, and the proliferation of cloud-native applications drives industry growth. Surging requirement for disaster recovery. The growing penetration of edge computing and 5G deployment is expected to propel the market expansion.

Key Insights

- The products segment is expected to lead the market during the forecast period. It is attributed to the growing need for fast and secure data transfer between data centers.

- In 2024, the communications service providers segment accounted for the largest share. The rapid rollout of 5G networks has significantly increased the demand for robust and efficient DCI solutions.

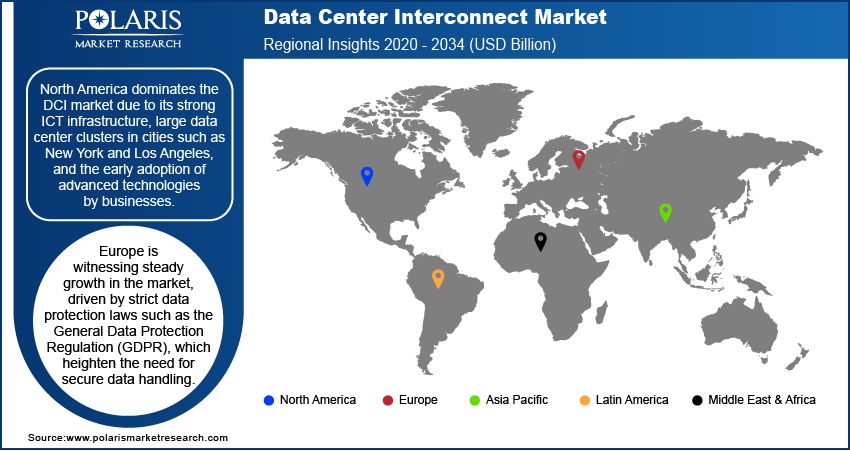

- North America dominated the industry share in 2024. The dominance is attributed to its strong ICT infrastructure, large data center clusters in cities, and the early adoption of advanced technologies by businesses.

- The Europe industry is witnessing steady growth, driven by strict data protection laws such as the General Data Protection Regulation (GDPR).

Industry Dynamics

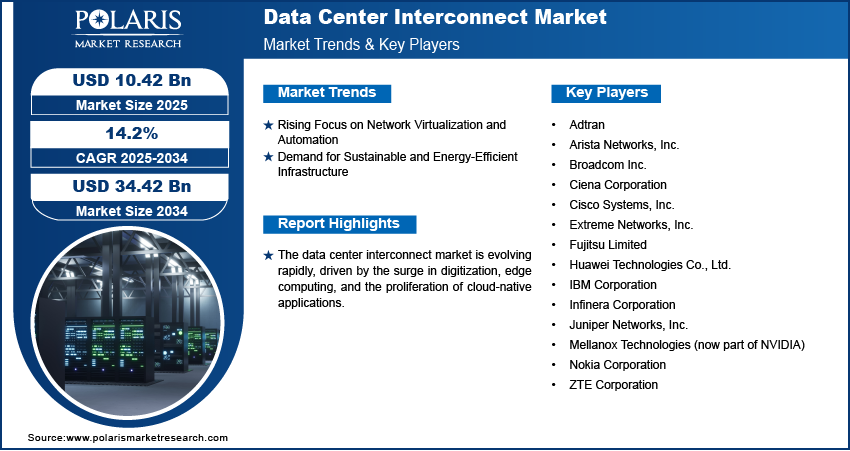

- Rising focus on network virtualization and automation propels the demand for DCI solutions.

- Growing demand for sustainable and energy-efficient infrastructure fuels the industry growth.

- Capacity limitations can hinder the growth of the data center interconnect (DCI) market.

- Increasing adoption of artificial intelligence (AI) and machine learning (ML) workloads is expected to offer lucrative opportunities during the forecast period.

Market Statistics

2024 Market Size: USD 9.28 Billion

2034 Projected Market Size: USD 34.42 Billion

CAGR (2025–2034): 14.2%

North America: Largest market in 2024

AI Impact on Data Center Interconnect Market

- Artificial intelligence (AI) technology fuels the demand for ultra-high-speed optics, including 400G/800G, with a roadmap toward 1.6T.

- It is used to increase traffic flows required for AI training, model synchronization, and replication.

- The DCI industry is witnessing the rapid adoption of co-packaged optics and energy-efficient DSPs.

- The technology facilitates automated DCI management through predictive analytics and advanced telemetry.

To Understand More About this Research: Request a Free Sample Report

The market refers to the technology and solutions used to connect two or more data centers over short, medium, or long distances to enable data replication, resource sharing, workload mobility, and business continuity.

The data center interconnect market is experiencing robust and sustained growth, driven by technological advancements and changing enterprise needs. As cloud computing expands rapidly, organizations are increasingly migrating to public, private, and hybrid cloud environments. This shift has heightened the demand for high-bandwidth, low-latency connectivity between data centers, driving market revenue.

Hybrid and multi-cloud strategies have become standard among enterprises and hyperscale providers, emphasizing the need for resilient and seamless interconnection solutions that support data consistency, business continuity, and high-performance applications. Additionally, the explosive growth in global data traffic—driven by emerging technologies such as AI, IoT, video streaming, and real-time analytics—is increasing the need for scalable and efficient infrastructure to manage distributed workloads, driving DCI market growth.

The data center interconnect (DCI) industry is evolving rapidly, driven by the surge in digitization, edge computing, and the proliferation of cloud-native applications. Enterprises are focusing on improving data mobility and latency reduction, pushing the demand for next-generation interconnect solutions. Increasing adoption of SDN and optical networking technologies is shaping key market trends, enabling smarter and more adaptive networks. Organizations seek secure and high-speed connectivity with the rise in 5G services rollouts and cross-border data flow regulations. The market forecast projects continued growth as businesses prioritize scalability, automation, and sustainability in managing inter-data center communications.

Market Dynamics

Rising Focus on Network Virtualization and Automation

As organizations increasingly adopt cloud computing and software-defined data center, they require faster and more flexible methods to connect multiple data centers. Virtualization enables data centers to operate more efficiently by managing resources through software, while automation minimizes manual tasks and facilitates quicker scaling. This transition is further supported by government initiatives aimed at promoting digital transformation. For instance, the U.S. National Institute of Standards and Technology (NIST) published frameworks to encourage cloud and network modernization in 2024. These initiatives urge both public and private sectors to upgrade their infrastructure, creating a strong demand for DCI solutions that support automated, virtualized, and high-speed data environments. Therefore, growing emphasis on network virtualization and automation is a major factor driving the market.

Demand for Sustainable and Energy-Efficient Infrastructure

The growing demand for sustainable and energy-efficient infrastructure is a major driver for the market. As global data usage continues to rise, the need for high-performance, energy-saving interconnect solutions has become critical. Governments and organizations are advocating for greener IT operations to reduce carbon footprints. For instance, the European Commission introduced the European Green Deal. The deal aims for climate neutrality by 2050, with data centers expected to achieve climate neutrality by 2030. This initiative has led to increased investments in low-power fiber optics, efficient cooling systems, and renewable energy-powered data centers. These sustainable efforts are driving the adoption of advanced DCI technologies that can connect multiple data centers while consuming less energy, thereby supporting greener digital transformation across various industries.

Segment Insights

Market Insight by Type

In terms of type, the DCI market is segregated into products, software, and services. The product segment is expected to lead the market during the forecast period due to the growing need for fast and secure data transfer between data centers. Companies are investing more in DCI products such as optical switches and routers to improve network performance and handle large amounts of data. Large tech companies such as Google and Amazon use advanced DCI products to connect their global data centers, ensuring smooth services for their users around the world.

The software segment is expected to grow steadily due to the increasing demand for efficient network management and automation. DCI software facilitates secure and seamless connections between different data centers as data traffic rises and businesses shift more services to the cloud. Companies utilize this software to monitor traffic, manage workloads, and ensure rapid recovery during outages. Software plays a crucial role in enhancing scalability and performance, with the market size projected to experience significant growth during the forecast period.

Market Evaluation by End Use

Based on end use, the market is divided into communication service providers, internet content providers/carrier-neutral providers, governments, enterprises, and others. In 2024, the communications service providers segment accounted for the largest share. The rapid rollout of 5G networks has significantly increased the demand for robust and efficient DCI solutions. 5G technology enables faster data transfers and supports a multitude of connected devices, such as Internet of Things (IoT) tools and smart technologies. This surge in connectivity generates vast amounts of data that CSPs must manage. To address this need, they depend on DCI solutions that offer low-latency and high-reliability connections between central data centers and edge locations. These solutions enhance network performance and ensure the seamless delivery of 5G services.

The internet content providers/carrier-neutral providers segment is expected to experience increased demand for DCI during the forecast period. As more companies adopt multi-cloud setups, they require DCI to connect different cloud systems effectively. This integration allows them to share resources, maintain flexibility, and deliver improved services to their users.

The expansion of the data center interconnect (DCI) market is poised to continue with both internet content providers and carrier-neutral providers investing in advanced DCI solutions. This rising demand is expected to enhance market revenue and solidify its role in the future of digital infrastructure.

Regional Analysis

By region, the data center interconnect industry report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market during the forecast period due to its strong ICT infrastructure, large data center clusters in cities such as New York and Los Angeles, and the early adoption of advanced technologies by businesses. The US, in particular, is experiencing high demand for data center interconnect (DCI) solutions because of the growing use of digital services and social media.

The market in Europe is witnessing steady growth, driven by strict data protection laws such as the General Data Protection Regulation (GDPR), which heighten the need for secure data handling. The UK and Germany are key contributors to this growth, fueled by rising data usage from online services and the rollout of 5G technology.

Key Players and Competitive Analysis

The market is highly competitive, driven by the rapid digital transformation, cloud adoption, and an increasing demand for high-speed, secure data transfer between data centers. Key players in this market are focusing on innovation, scalability, and energy efficiency to gain a competitive advantage. Companies are investing in advanced optical technologies, automation, and software-defined networking to provide more efficient and flexible DCI solutions.

Strategic partnerships, and mergers and acquisitions are common strategies used to expand market presence and enhance technological capabilities. The market is also influenced by the growing demand for AI, IoT, and big data, prompting vendors to deliver solutions that offer higher bandwidth and lower latency. Competitive differentiation now increasingly relies on performance, reliability, and ease of integration into hybrid cloud environments.

A few of the major key players in the data center interconnect industry include Cisco Systems, Inc.; Juniper Networks, Inc.; Broadcom Inc.; Arista Networks, Inc.; Nokia Corporation; Huawei Technologies Co., Ltd.; Mellanox Technologies (now part of NVIDIA); Ciena Corporation; Extreme Networks, Inc.; Fujitsu Limited; IBM Corporation; Infinera Corporation; Adtran; and ZTE Corporation.

Cisco Systems, Inc. is a global player in networking and IT infrastructure, renowned for delivering innovative solutions that power the internet and enterprise networks. Its product range includes routers, switches, security solutions, software-defined networking (SDN), and cloud services. In the market, Cisco provides high-performance solutions designed to enable seamless, secure, and scalable connectivity between data centers. A key DCI product is the Cisco NCS 2000 Series, which offers optical transport capabilities for both metro and long-haul networks. Cisco's DCI solutions support high bandwidth, low latency, and automation features, making them ideal for cloud environments, enterprises, and service providers.

IBM is a global technology company that provides innovative solutions in cloud computing, artificial intelligence (AI), and IT infrastructure. Its product range includes servers, storage systems, software, and hybrid cloud platforms such as IBM Cloud and Red Hat OpenShift. Additionally, IBM offers advanced networking and data management tools. In the data center interconnect (DCI) space, IBM facilitates seamless data transfer and workload mobility through its IBM Cloud Direct Link, which provides secure, high-speed connections between on-premises data centers and IBM Cloud environments.

Key Companies in Data Center Interconnect (DCI) Market

- Adtran

- Arista Networks, Inc.

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- Extreme Networks, Inc.

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Infinera Corporation

- Juniper Networks, Inc.

- Mellanox Technologies (now part of NVIDIA)

- Nokia Corporation

- ZTE Corporation

Data Center Interconnect Industry Developments

In March 2024, Infinera launched a new technology called ICE-D for use within data centers. The technology can transmit data at extremely high speeds of up to 1.6 terabits per second. It utilizes a specialized chip made from indium phosphide, which reduces energy consumption by up to 75% for each bit of data transmitted.

In February 2024, Huawei introduced a new Data Center Interconnect platform called OptiXtrans DC908 Pro at MWC Barcelona. This innovative system can transmit data at 1.2 terabits per second on a single light signal over a distance of 240 kilometers.

Data Center Interconnect Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Products

- Packet-Switching Networking

- Optical DCI

- Software

- Services

- Professional Services

- Managed Services

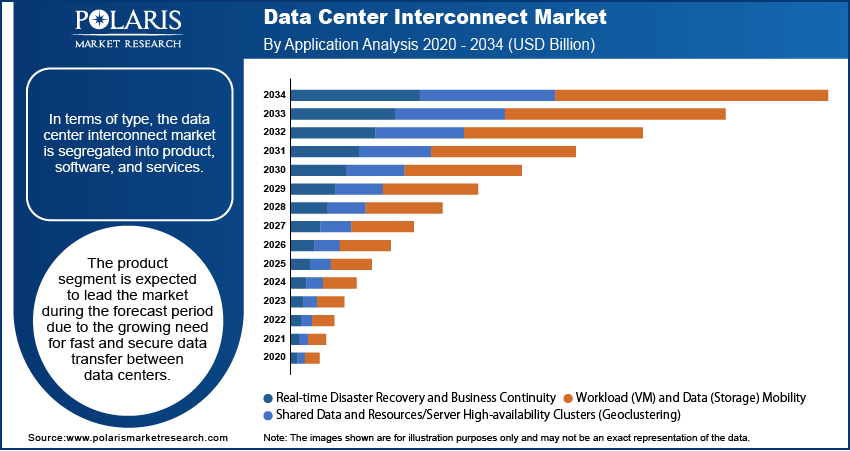

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Real-time Disaster Recovery and Business Continuity

- Shared Data and Resources/Server High-availability Clusters (Geoclustering)

- Workload (VM) and Data (Storage) Mobility

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Communication Service Providers

- Internet Content Providers/Carrier-Neutral Providers

- Governments

- Enterprises

- Banking & Finance

- Healthcare

- Utility & Power

- Media & Entertainment

- Retail & E-commerce

- Others

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Data Center Interconnect Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.28 Billion |

|

Market Forecast in 2025 |

USD 10.42 Billion |

|

Revenue Forecast in 2034 |

USD 34.42 Billion |

|

CAGR |

14.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.28 billion in 2024 and is projected to grow to USD 34.42 billion by 2034.

The global market is projected to register a CAGR of 14.2% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the major key players in the market includes Cisco Systems, Inc.; Juniper Networks, Inc.; Broadcom Inc.; Arista Networks, Inc.; Nokia Corporation; Huawei Technologies Co., Ltd.; Mellanox Technologies (now part of NVIDIA); Ciena Corporation; Extreme Networks, Inc.; Fujitsu Limited; IBM Corporation; Infinera Corporation; Adtran; and ZTE Corporation.

The product segment is expected to lead the market during the forecast period due to the growing need for fast and secure data transfer between data centers.

In 2024, the communications service providers segment accounted for the largest share of the market.