Data Mining Tools Market Size, Share, Trend, Industry Analysis Report

By Component (Tools, Services), By Business Function, By Enterprise Size, By Deployment, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5833

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

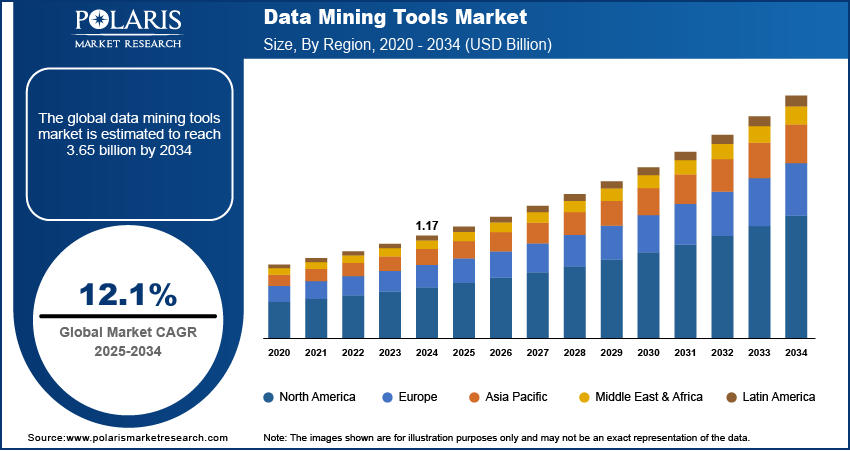

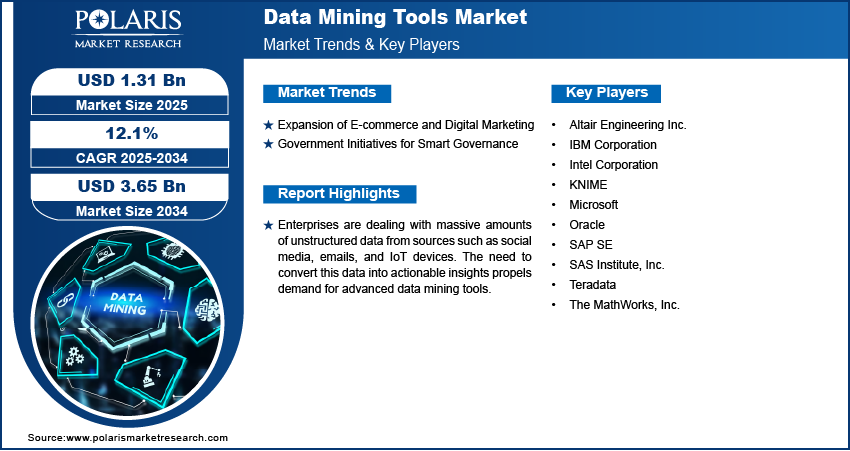

The global data mining tools market size was valued at USD 1.17 billion in 2024 and is projected to register a CAGR of 12.1% from 2025 to 2034. Enterprises are dealing with massive amounts of unstructured data from sources such as social media, emails, and IoT devices. The need to convert this data into actionable insights is increasing the demand for advanced data mining tools.

The market comprises software platforms and solutions designed to extract valuable patterns, relationships, and insights from large datasets. These tools use algorithms, statistical models, and machine learning techniques to support decision-making, predictive analytics, and business intelligence across various industries. Banks and financial institutions rely on data mining to detect fraud, assess risk, and personalize services. The growing demand for predictive analytics and compliance monitoring is strengthening tool adoption in this sector.

To Understand More About this Research: Request a Free Sample Report

Industries are prioritizing real-time analytics to improve operational efficiency and responsiveness. Data mining tools equipped with real-time processing capabilities are gaining traction in the logistics, healthcare, and manufacturing industries. Additionally, cloud deployment offers scalability, affordability, and ease of access. Vendors are launching cloud-native data mining platforms that support remote collaboration, attracting both SMEs and large enterprises.

Market Dynamics

Expansion of E-commerce and Digital Marketing

The rapid growth of e-commerce platforms and digital marketing strategies is pushing retailers to adopt data mining tools to stay competitive. For instance, according to the U.S. Census Bureau, in Q1 2025, e-commerce sales in the U.S. reached USD 300.2 billion, rising 6.1% from Q1 2024, and accounted for 16.2% of total retail sales. These tools allow businesses to track user interactions, purchase patterns, and preferences in real time. Insights gained from such analysis help in customer segmentation, targeted advertising, inventory planning, and pricing optimization. Retailers are also using predictive models to anticipate shopping trends and reduce cart abandonment. Personalized marketing campaigns based on mined data are significantly improving conversion rates and customer loyalty. Data mining is becoming a critical enabler for companies aiming to deliver seamless and tailored shopping experiences across digital channels, which continues to strengthen its relevance in a highly competitive retail ecosystem. Hence, the rising penetration of e-commerce platforms and the increasing trend of digital marketing boost the market growth.

Government Initiatives for Smart Governance

Governments are increasingly adopting data mining tools to modernize public administration and enhance service delivery. For instance, U.S. federal agencies, including Department of Homeland Security, used Palantir's platforms to integrate and analyze data from immigration systems, law enforcement databases, and border security operations. These tools support initiatives in fraud detection, tax compliance, public health surveillance, and infrastructure planning. Smart city programs rely on data-driven insights to improve traffic management, waste control, and energy efficiency. In social welfare systems, mining techniques are helping to identify patterns of misuse and ensure that benefits reach eligible citizens. Data mining also plays a key role in national security and emergency preparedness by analyzing vast volumes of structured and unstructured data. The move toward digital governance and transparency is creating a steady demand for advanced, scalable, and secure data analytics platforms within the public sector.

Segment Insights

Component Analysis

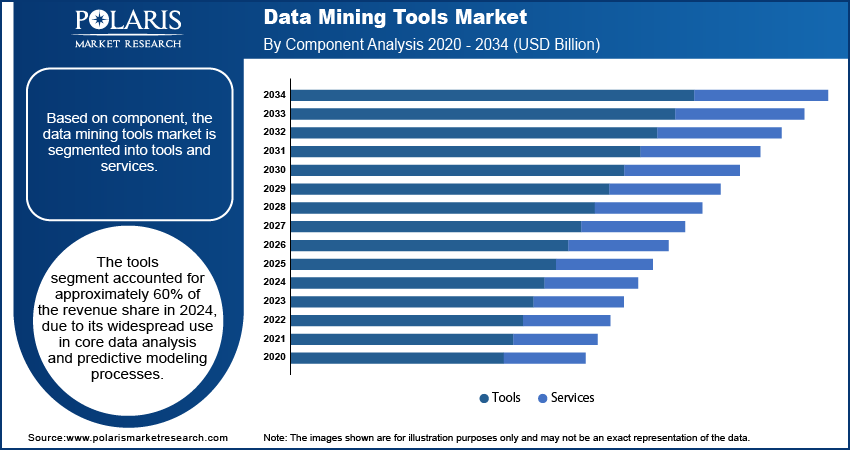

Based on component, the segmentation includes tools and services. The tools segment accounted for approximately 60% of the revenue share in 2024 due to its widespread use in core data analysis and predictive modeling processes. These platforms are being adopted across industries for their ability to automate data extraction, pattern recognition, and visualization. Organizations favor standalone or integrated tools to enhance decision-making speed and accuracy, particularly in high-volume data environments. Growing interest in machine learning platforms and self-service analytics platforms is further strengthening the demand for robust data mining tools that can be customized for domain-specific needs.

The service segment is projected to register a higher CAGR during the forecast period, supported by the rising demand for implementation, consultation, and training services. Enterprises seek expert support to integrate complex data mining platforms into legacy systems and streamline analytics workflows. The growing shift to cloud and hybrid environments also increases the need for managed services and ongoing technical support. Vendors are expanding their service offerings to help clients design data governance models and ensure compliance with privacy regulations.

Business Function Analysis

Based on business function, the segmentation includes marketing, finance, supply chain & logistics, and operations. In 2024, the marketing segment accounted for the largest revenue share, driven by the increasing use of customer analytics to personalize campaigns and measure ROI. Data mining tools are enabling marketing teams to uncover hidden consumer patterns, predict buying behavior, and refine targeting strategies. These insights help optimize ad spend, increase engagement, and boost conversion rates. The rising importance of omnichannel marketing is pushing businesses to analyze cross-platform data, making mining tools indispensable for extracting actionable intelligence.

The supply chain & logistics segment is expected to register the highest CAGR over the forecast period, driven by the need for real-time visibility and predictive planning. Companies are leveraging data mining tools to monitor inventory, forecast demand, and detect disruptions early. Predictive insights support more efficient route optimization, procurement decisions, and warehouse management. The growing complexity of global supply networks and just-in-time delivery models is increasing the value of advanced analytics in enhancing operational agility and reducing costs.

Enterprise Size Analysis

Based on enterprise size, the segmentation includes large enterprises and SMEs. In 2024, the large enterprises segment accounted for a larger revenue share, due to their ability to invest in comprehensive data analytics infrastructure. These organizations typically manage large volumes of structured and unstructured data across diverse departments, creating a strong need for scalable mining tools. Integration of data mining into business intelligence systems allows for deeper performance monitoring and competitive analysis. Large enterprises also lead adoption due to strong in-house IT capabilities and a strategic focus on data-driven growth.

The SMEs segment is expected to register the highest CAGR during the forecast period, driven by the rising availability of affordable, cloud-based data mining solutions. Smaller companies are increasingly recognizing the value of analytics in customer engagement, sales forecasting, and resource planning. Vendors are tailoring user-friendly platforms with subscription pricing models to cater to this industry. Greater emphasis on digital transformation and the need for agility in competitive environments are pushing SMEs to invest in data mining tools to gain operational insights without heavy infrastructure costs.

Vertical Analysis

Based on vertical, the segmentation includes BFSI, energy & utilities, healthcare, IT & telecom, retail, government & defense, manufacturing, and others. In 2024, the BFSI segment accounted for the largest revenue share, driven by high reliance on data for fraud detection, credit scoring, and risk assessment. Financial institutions are deploying data mining tools to uncover anomalies, assess transaction histories, and enhance compliance monitoring. These platforms support predictive modeling for customer lifetime value, churn analysis, and cross-selling. Increasing regulatory complexity and the push for personalized banking experiences are encouraging banks and insurers to adopt more sophisticated analytics tools.

The healthcare segment is expected to register the highest CAGR during the forecast period, driven by the need for clinical data analysis, patient risk stratification, and operational efficiency. Hospitals and medical research organizations are using data mining tools to identify disease trends, predict outcomes, and improve diagnostics. The growing use of electronic health records and wearable health devices is generating massive datasets, creating opportunities for real-time and predictive analytics. Focus on personalized medicine and preventive care is further encouraging the adoption of data mining across the healthcare value chain.

Regional Analysis

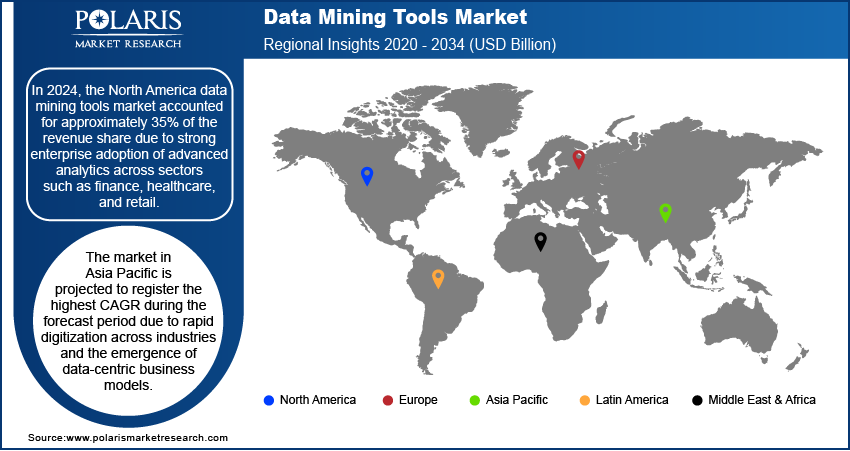

In 2024, the North America data mining tools market accounted for approximately 35% of the revenue share due to strong enterprise adoption of advanced analytics across sectors such as finance, healthcare, and retail. Organizations in the region are increasingly investing in AI-driven platforms to enhance forecasting, customer insights, and operational decision-making. For instance, in May 2025, Rad AI secured an additional USD 8 million in its Series C funding round, led by Memorial Hermann Health System, Atlantic Health System, Advocate Health, and Corewell Health. This gets the total funding to USD 68 million, highlighting a commitment to transforming care delivery and scaling generative AI in healthcare. Cloud infrastructure maturity and widespread digitization allow seamless deployment of data mining tools across business functions. The region’s emphasis on data compliance and governance is also contributing to the growing reliance on structured analytical tools. High levels of tech spending and skilled workforce availability support the development and implementation of scalable mining platforms that serve both large enterprises and agile startups.

U.S. Data Mining Tools Market Trends

The U.S. market is expected to grow significantly during the forecast period, supported by increasing demand for real-time analytics and the growing importance of personalized services in consumer-focused industries. Financial institutions are adopting these tools to strengthen fraud detection, while e-commerce players use them for behavioral segmentation and dynamic pricing. Government agencies are applying mining platforms for predictive analytics in areas such as public health and policy planning. The country’s robust startup ecosystem is fostering innovation in cloud-native and AI-powered mining platforms. Demand is rising for no-code and low-code tools, which are enabling non-technical users to extract value from data efficiently.

Asia Pacific Data Mining Tools Market Overview

The Asia Pacific market is projected to register the highest CAGR during the forecast period, due to rapid digitization across industries and the emergence of data-centric business models. Enterprises in sectors such as manufacturing, telecom, and retail are implementing mining tools to improve productivity and customer insights. Countries in the region are increasingly focusing on cloud adoption, which is enabling wider access to analytics tools among small and mid-sized firms. Government-led digital initiatives and smart city programs are generating vast data sets, encouraging demand for structured data analysis solutions. Local vendors are also entering the industry with cost-effective offerings tailored to regional business needs.

China Data Mining Tools Market Insights

The market in China accounted for the largest revenue share in Asia Pacific in 2024, fueled by large-scale adoption in e-commerce, fintech, and public sector applications. Leading tech companies are deploying sophisticated platforms to analyze consumer data and optimize digital services. Financial institutions are using predictive modeling tools for credit scoring, fraud prevention, and regulatory compliance. In sectors such as logistics and manufacturing, companies are investing in mining solutions to optimize operations and supply chains. For instance, in 2021, Alibaba invested USD 8.736 billion in research and development, highlighting its focus on advancing technologies such as e-commerce infrastructure, artificial intelligence (AI), and cloud solutions. Educational institutions and research centers are also expanding use cases for data analytics in academic and clinical research. China’s emphasis on AI and big data innovation continues to drive the need for integrated and high-performance data mining platforms.

Europe Data Mining Tools Market Analysis

The Europe market is expected to grow significantly during the forecast period, driven by increasing focus on data privacy, predictive analytics, and automation across industries. Enterprises are investing in GDPR-compliant analytics tools that ensure secure handling of customer and operational data. In sectors such as automotive, energy, and healthcare, companies are leveraging data mining tools to optimize resource use and forecast outcomes more accurately. The demand for explainable AI and ethical data processing is contributing to the development of transparent, customizable mining platforms. Collaborative research efforts, innovation funding, and public-private partnerships are accelerating adoption. Organizations are also using these tools to monitor ESG performance, sustainability goals, and supply chain risks.

The UK data mining tools market is witnessing steady growth driven by increased adoption of big data analytics across key industries such as retail, healthcare, BFSI, and manufacturing. Organizations are leveraging these tools to gain actionable insights, enhance operational efficiency, and support data-driven decision-making. Cloud-based data mining solutions are gaining popularity due to their scalability and cost-effectiveness, though on-premise tools remain essential for sectors with stringent data privacy regulations. The rise of artificial intelligence and machine learning integration has further accelerated tool sophistication, enabling more accurate predictions and automation. Despite this growth, challenges such as data privacy concerns, GDPR compliance, and a shortage of skilled professionals continue to impact the market's full potential in the UK.

Key Players and Competitive Analysis

The competitive landscape of the data mining tools market is defined by a strong focus on innovation, scalability, and integration capabilities. Industry analysis reveals growing use of expansion strategies such as joint ventures and strategic alliances to tap into emerging verticals and cross-industry applications. Mergers and acquisitions are reshaping the vendor ecosystem, with key players acquiring niche analytics startups to strengthen their AI and machine learning offerings. Post-merger integration efforts often center on unifying product portfolios and streamlining customer support frameworks. Vendors are heavily investing in cloud-native platforms and automated data mining functions, enabling real-time insights and advanced pattern recognition. Open-source integrations, API ecosystems, and customizable user interfaces are becoming competitive differentiators. Enterprise clients are demanding tools that support governance, compliance, and explainability, prompting rapid evolution in product roadmaps. Advancements in natural language processing (NLP), automated modeling, and predictive analytics continue to set the pace for competition in this data-centric landscape.

List of Key Companies

- Altair Engineering Inc.

- IBM Corporation

- Intel Corporation

- KNIME

- Microsoft

- Oracle

- SAP SE

- SAS Institute, Inc.

- Teradata

- The MathWorks, Inc.

Data Mining Tools Industry Developments

In May 2024, DCG introduced a sophisticated AI-driven data mining platform specifically designed for automotive dealership valuations. This software leverages advanced algorithms to analyze market trends, sales data, and other relevant metrics to provide precise appraisals of dealership worth.

In May 2023, Assembly Software launched data mining solution, Neos Advanced Analytics, designed for high-level analytical tasks. This robust platform leverages advanced algorithms and machine learning techniques to enhance data extraction, transformation, and visualization, allowing experts to derive deeper insights from complex datasets.

In July 2023, Microsoft launched Power Automate Process Mining, integrating advanced AI capabilities to enhance operational efficiency. This next-generation tool leverages sophisticated analytics to identify process inefficiencies, enabling organizations to optimize workflows and improve decision-making.

Data Mining Tools Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Tools

- Services

By Business Function Outlook (Revenue USD Billion, 2020–2034)

- Marketing

- Finance

- Supply Chain & Logistics

- Operations

By Enterprise Size Outlook (Revenue USD Billion, 2020–2034)

- Large Enterprises

- SMEs

By Deployment Outlook (Revenue USD Billion, 2020–2034)

- On-premises

- Cloud

By Vertical Outlook (Revenue USD Billion, 2020–2034)

- BFSI

- Energy & Utilities

- Healthcare

- IT & Telecom

- Retail

- Government & Defense

- Manufacturing

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Data Mining Tools Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.17 billion |

|

Market Size in 2025 |

USD 1.31 billion |

|

Revenue Forecast by 2034 |

USD 3.65 billion |

|

CAGR |

12.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.17 billion in 2024 and is projected to grow to USD 3.65 billion by 2034.

The global market is projected to register a CAGR of 12.1% during the forecast period.

In 2024, the North America data mining tools market accounted for approximately 35% of the revenue share due to strong enterprise adoption of advanced analytics across sectors such as finance, healthcare, and retail.

A few of the key players are Altair Engineering Inc.; IBM Corporation; Intel Corporation; KNIME; Microsoft; Oracle; SAP SE; SAS Institute, Inc.; Teradata; and The MathWorks, Inc.

The tools segment accounted for approximately 60% of the revenue share in 2024 due to its widespread use in core data analysis and predictive modeling processes.

In 2024, the marketing segment accounted for the largest revenue share, driven by the increasing use of customer analytics to personalize campaigns and measure ROI.