Deep Eutectic Solvents Market Size, Share, Trends, & Industry Analysis Report

: By Type (Quaternary Ammonium Salt Based, Metal-Based, and Others), By Application, By End-Use Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5726

- Base Year: 2024

- Historical Data: 2020-2023

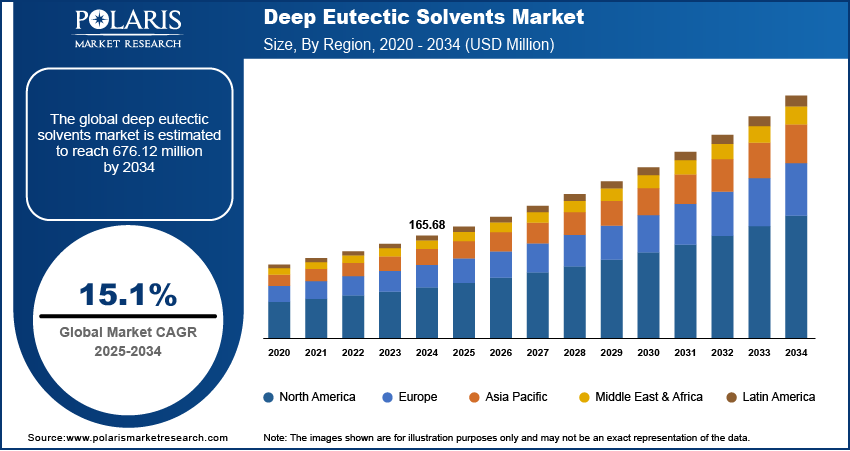

The global deep eutectic solvents market size was valued at USD 165.68 million in 2024, exhibiting a CAGR of 15.1% during 2025–2034. The market is growing due to increasing demand for greener alternatives, expanding industrial applications, and favorable regulatory support promoting sustainable chemical practices. The growing awareness and concern regarding the health and environmental hazards associated with traditional organic solvents and the increasing focus on resource efficiency, including metal recovery and biomass valorization, drive the adoption of deep eutectic solvents.

Market Overview

Deep eutectic solvents are a class of ionic solvent systems formed by mixing two or more components. Generally, a hydrogen bond acceptor and a donor exhibit a melting point much lower than that of the individual components forming DES. The global deep eutectic solvents (DES) market is witnessing significant growth as industries actively pursue safer, cost-effective, and environmentally friendly alternatives to conventional solvents. Also, the growing preference for green chemistry practices and the implementation of stricter environmental regulations are accelerating the adoption of DESs across developed and emerging markets. Global industries are seeking sustainable chemical processing solutions. Therefore, DESs are being increasingly explored for extraction, separation, and catalysis processes.

The growing shift toward circular economy and sustainability by governments and industries across the world is significantly fueling the eutectic solvents market growth. The International Air Transport Association (IATA) passed a resolution to its members committing to achieve net-zero emissions from aviation operating by 2050. Such macroeconomic initiatives boost the demand for DESs across various industries seeking compliance with environment goals.

To Understand More About this Research: Request a Free Sample Report

Rapid industrialization in emerging countries such as China, India, Indonesia, and Malaysia is propelling the growth of sustainable and cost-effective solvent solutions. According to the Asian Development Bank, the economic growth of Asia Pacific is expected to exhibit resilient with 4.9% growth in 2025. These countries are the key manufacturing hubs of the region with growing consumption of solvents, which is creating opportunities for DES deployment.

Asia Pacific countries are actively introducing and enforcing environmental regulations aimed at reducing industrial pollution and encouraging the adoption of greener chemical processes. For example, initiatives promoting cleaner application techniques and sustainable manufacturing are creating favorable conditions for the integration of DES in industrial workflows. Government support for innovation in green chemistry, coupled with the cost advantages of DES over ionic liquids, makes these solvents particularly attractive for industries operating under budget constraints but seeking compliance with environmental standards. Thus, the industrialization trend in these regions is expected to significantly contribute to the expansion of the global DES market.

Industry Dynamics

Stringent International Environmental Regulations

Global environmental regulations such as the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in the European Union and the Toxic Substances Control Act (TSCA) in the US are pushing industries toward safer and more sustainable chemical alternatives. For instance, the European Union’s REACH regulation restricts 224 chemical substances, while RoHS limits 10 hazardous substances in electronics and electrical equipment (EEE). These regulations set strict compliance benchmarks for manufacturers and importers. Non-compliance results in costly application recalls, averaging around USD 11 million. These regulations aim to reduce the environmental impact of hazardous substances by restricting the use of toxic chemicals in manufacturing processes. As part of this transition, industries are actively seeking replacements for conventional solvents, which are often associated with significant environmental and health risks. Deep Eutectic Solvents (DES) are becoming popular due to their nontoxic, biodegradable, and environmentally friendly properties. In highly regulated industries such as pharmaceuticals, food processing, and chemicals, DESs are seen as viable alternatives to hazardous solvents. These industries are closely monitored for regulatory frameworks, and the adoption of DES provides a pathway to meet compliance standards while maintaining operational efficiency. The pressure from international regulations, combined with the need for cost-effective and environmentally safer solutions, is thus accelerating the adoption of DES across various sectors.

Rising R&D Investments and Green Chemistry Funding Globally

The growing emphasis on green technologies is driving increased investments in research and development (R&D) for alternative solvents, including deep eutectic solvents (DES). Public and private stakeholders are significantly contributing to the funding of green chemistry initiatives, aiming to develop sustainable solutions that minimize the environmental impact of industrial processes. For instance, in 2024, under the Green Chemistry Projects Award, UNESCO provided a grant of around USD 0.191 million to seven scientists for the research and development of green chemistry solutions. An increase in funding is fostering innovation in DES formulations and expanding their potential applications across a variety of industries, including pharmaceuticals, agriculture, and energy. Collaborative efforts between universities, research institutes, and chemical companies are accelerating progress in understanding the fundamental properties of DES and enhancing their performance in diverse chemical processes. These initiatives accelerate technological advancements, coupled with the commercialization of DES, by making them more feasible and cost-effective for industrial use. The strategic investments in green chemistry help bridge the gap between scientific research and practical implementation, ultimately improving the scalability and market adoption of DES. This surge in R&D investments and green chemistry funding is shaping the future of DES and is significantly boosting the growth of the market globally.

Segmental Insights

By Type Analysis

The global deep eutectic solvents market segmentation, by type, includes quaternary ammonium salt based, metal-based, and others. The quaternary ammonium salt-based segment held the largest revenue share in 2024. This dominance is attributed to its excellent physicochemical properties such as low volatility, high thermal stability, and strong solvating ability. These solvents are synthesized from widely available and low-cost components, making them attractive across several industrial applications, including pharmaceuticals, catalysis, and chemical synthesis. Moreover, their nontoxic nature and biodegradability align with global sustainability targets, encouraging large-scale industrial usage. These salts serve as the hydrogen bond acceptors in the majority of DES formulations, ensuring flexibility in designing solvent systems tailored to specific industrial needs.

The metal-based DES segment is projected to register the highest CAGR during the forecast period. This growth is driven by increasing interest in electrochemical applications, including electrodeposition, battery electrolyte solutions, and recycling of critical metals such as lithium, cobalt, and rare earth elements. Metal-based DESs offer advantages such as enhanced electrical conductivity, selectivity, and controlled ion mobility, making them suitable for emerging clean energy technologies. The transition toward sustainable electrochemical processes and innovations in green metallurgy are key catalysts pushing the adoption of metal-based DESs in various industrial sectors, particularly electronics and energy storage.

By Application Analysis

The global market, by application, includes catalysis and synthesis, metal processing, pharmaceuticals, cosmetics, extraction processes, and others. The extraction processes segment dominated the DES market in terms of revenue in 2024. This dominance is largely attributed to the increasing demand for green solvents in bio-extraction and purification processes. DESs are widely used to extract bioactive compounds from plants, agro-waste, and marine sources, replacing harmful organic solvents such as hexane and chloroform. Their tunable polarity and compatibility with natural compounds make them ideal for applications in nutraceuticals, cosmetics, and pharmaceuticals. This aligns with the rising trend of clean-label and organic applications globally, thereby driving DES consumption in this segment.

The pharmaceuticals segment is expected to register the highest CAGR during the forecast period. DESs offer significant potential in type, solubilization, and delivery systems. They can improve the solubility of poorly water-soluble drugs, enhance bioavailability, and reduce the toxicity associated with conventional excipients. Increasing regulatory pressure on traditional solvents and the ongoing shift toward green chemistry principles in pharmaceutical R&D are promoting DES usage. Moreover, strategic collaborations between pharmaceutical firms and research institutions are expanding the role of DES in drug discovery and development, contributing to the segment’s rapid expansion.

By End-Use Industry Analysis

The global market, by end-use industry, includes chemical, electronics, pharmaceutical and healthcare, food and beverage, and others. The chemical industry emerged as the leading end-use segment in 2024, accounting for a substantial market share. The sector extensively utilizes DESs in organic synthesis, polymer processing, and as reaction media for environmentally sensitive processes. Their broad applicability, combined with regulatory compliance benefits, has accelerated their adoption across specialty and bulk chemical applications. Companies in the chemical sector are increasingly replacing volatile organic compounds (VOCs) with DESs to meet stringent environmental norms while improving process efficiency.

The electronics segment is projected to register the highest CAGR during the forecast period. DESs are gaining traction as next-generation electrolytes for lithium-ion batteries, supercapacitors, and metal finishing applications. Their inherent stability, non-flammability, and wide electrochemical window make them a safe and sustainable alternative to conventional electrolytes. Furthermore, the rising demand for electric vehicles (EVs), renewable energy storage solutions, and miniaturized electronics is boosting DES research and commercialization in the electronics sector. This segment’s growth is further supported by government incentives for sustainable manufacturing and circular economy practices in high-tech industries.

Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific deep eutectic solvents market dominated with the largest share in 2024 and is expected to maintain its dominance over the forecast period. Countries such as India and China, recognized as global pharmaceutical manufacturing hubs, have emerged as key adopters of DESs in pharmaceutical R&D and nutraceutical applications. This trend aligns with the regional push toward cost-effective, green chemistry alternatives for ingredient isolation and synthesis. In India, the pharmaceutical sector witnessed significant expansion, supported by public and private investments in healthcare infrastructure and research capabilities. According to the India Brand Equity Foundation, the Indian pharmaceutical sector was projected to record a CAGR of over 10%, reaching ∼USD 130 billion by 2030. This significant growth in the pharmaceutical space has created a favorable landscape for the adoption of sustainable and efficient solvent technologies such as DESs, propelling the India deep eutectic solvents market. The continuous prioritization of healthcare innovation and cost-effective drug development in the region is further boosting the demand for DES-based processing, thus propelling the market growth.

The Europe deep eutectic solvents market is anticipated to exhibit the highest growth rate during the forecast period. This growth is attributed to the transition toward a circular economy, supported by progressive policy frameworks and sustained investments in sustainable technologies in the region. Deep eutectic solvents (DESs), known for their low environmental impact and biodegradability, are emerging as an ideal substitute to traditional toxic solvents in a range of green applications such as biomass extraction, metal recycling, and environmentally friendly catalysis. In May 2025, COMET Technology, through its SOLDAC initiative, launched a major innovation program focused on advancing sustainable fuels and green chemistry solutions across Europe. The project aims to enable the development of next-generation renewable energy carriers and high-performance, low-toxicity solvents that align with circular economy objectives. This highlights the broader EU initiatives, such as the European Green Deal and Horizon Europe, that allocate significant funding for eco-innovations and low-carbon technologies. These combined efforts are positioning DESs as preferred solvent systems in industrial and research settings across the region.

In Germany, the government’s push for a national circular economy strategy and decarbonized industrial production is encouraging industries to shift toward greener alternatives. These initiatives are boosting the adoption of DESs in green manufacturing processes and chemical synthesis, driving the Germany deep eutectic solvents market. Also, the rising regulatory pressure to phase out volatile organic compounds (VOCs) from industrial and consumer products is pushing companies to replace conventional solvents with DESs, especially in the cosmetics and agrochemical sectors, fueling the France deep eutectic solvents market.

Key Players and Competitive Analysis

The deep eutectic solvents (DES) market is becoming more competitive, with key players increasing their interest in green innovations and application-specific solvent systems. Firms are heavily investing in research and development to grow their portfolios of environmentally friendly and biodegradable solvents across end-use applications such as pharmaceuticals, food processing, metal finishing, and cosmetics. These R&D initiatives are frequently supported by strategic partnerships with universities, green chemistry centers, and tech companies in order to boost application commercialization. Also, industry players are embracing localization initiatives to enhance supply chains, lower expenses, and meet region-specific regulatory requirements, especially within Europe and Asia Pacific, where demand for nontoxic and compliant alternatives is increasing.

A few major companies in the global deep eutectic solvents market are Proionic GmbH; Arkema S.A.; BASF SE; Brainerd Chemical Company, Inc.; ChemEutectics Inc.; DES Developments Pty Ltd; GATTEFOSSE SAS; Iolitec Ionic Liquids Technologies GmbH; Merck KGaA; Solvay S.A.; The Chemours Company; and Thermo Fisher Scientific Inc. These players are adopting growth strategies such as acquisitions, Application launches, and geographical expansion into high-growth sectors to strengthen their market position. The emphasis on substituting classic hazardous solvents with safer, cleaner chemicals has made DESs a pillar of sustainable chemical innovation, providing pioneers with a competitive advantage in this shifting marketplace environment.

Key Players

- Arkema S.A.

- BASF SE

- Brainerd Chemical Company, Inc.

- ChemEutectics Inc.

- DES Developments Pty Ltd

- GATTEFOSSE SAS

- Iolitec Ionic Liquids Technologies GmbH

- Merck KGaA

- Proionic GmbH

- Solvay S.A.

- The Chemours Company

- Thermo Fisher Scientific Inc.

Industry Developments

In June 2025, Mitsubishi Corporation invested in UK-based DEScycle Ltd.. The strategic partnership is formed to develop a pilot plant utilizing deep eutectic solvents (DES) for eco-friendly metal recovery from e-waste. This collaboration aimed to replace traditional smelting with low-energy, low-emission DES-based processes, with plans to expand operations to North America and Japan by 2028.

In June 2024, Syensqo invested in Bioeutectics, a startup producing natural, high-performance solvents designed to replace traditional petrochemical solvents across various industries. This investment supported the growth of sustainable solvent alternatives, promoting the adoption of DES in industrial applications.

In November 2023, Gattefossé developed eco-friendly Natural Deep Eutectic Solvents (NaDES) for use in cosmetics and plant extractions. These solvents, composed of natural compounds such as sugars and amino acids, offer biodegradable and sustainable alternatives to traditional solvents.

Deep Eutectic Solvents Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Quaternary Ammonium Salt Based

- Metal-Based

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Catalysis and Synthesis

- Metal Processing

- Pharmaceuticals

- Cosmetics

- Extraction Processes

- Others

By End-Use Industry Outlook (Revenue, USD Million, 2020–2034)

- Chemical

- Electronics

- Pharmaceutical and Healthcare

- Food and Beverage

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Deep Eutectic Solvents Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 165.68 million |

|

Market Size Value in 2025 |

USD 190.55 million |

|

Revenue Forecast by 2034 |

USD 676.12 million |

|

CAGR |

15.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 165.68 million in 2024 and is projected to grow to USD 676.12 million by 2034.

The global market is projected to register a CAGR of 15.1% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Abbott Laboratories; Arkema S.A.; BASF SE; Brainerd Chemical Company, Inc.; and ChemEutectics Inc.

The quaternary ammonium salt based segment dominated the market share in 2024.

The extraction processes segment is expected to witness the fastest growth during the forecast period.