Defense Electronics Obsolescence Market Share, Size, Trends, Industry Analysis Report

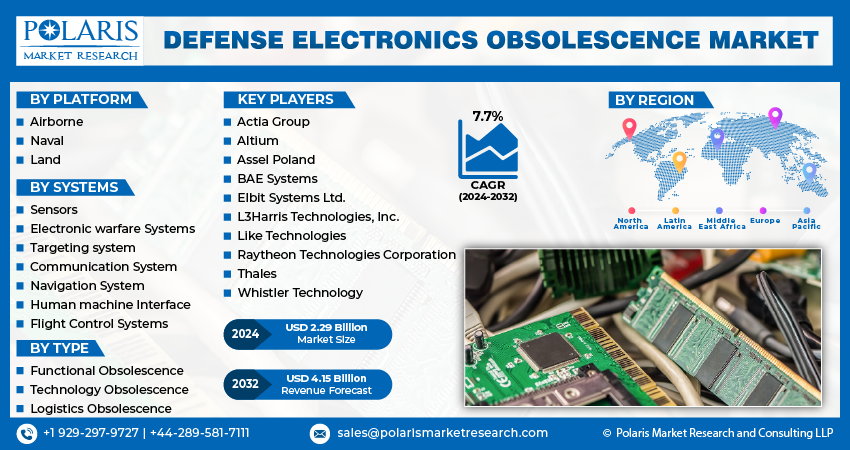

By Platform (Airborne, Naval and Land); By Systems (Sensors, Electronic warfare systems, Targeting Systems); By Type; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 115

- Format: PDF

- Report ID: PM4833

- Base Year: 2023

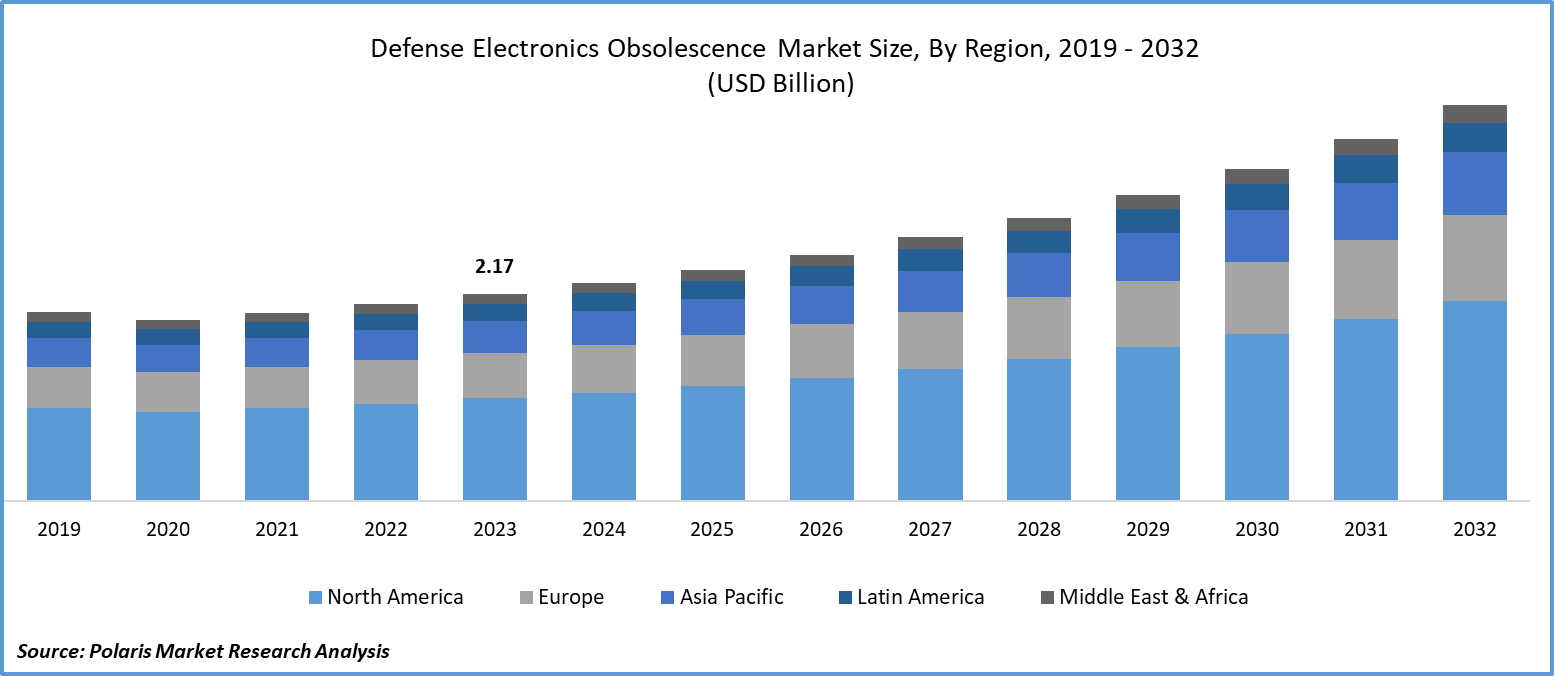

- Historical Data: 2019-2022

Report Outlook

Global defense electronics obsolescence market size was valued at USD 2.17 billion in 2023. The market is anticipated to grow from USD 2.29 billion in 2024 to USD 4.15 billion by 2032, exhibiting the CAGR of 7.7% during the forecast period

Market Overview

The defense electronics obsolescence market is a specialized sector dedicated to addressing challenges related to aging electronic components and systems in defense infrastructure. A major issue in defense electronics obsolescence market expansion is the limited availability of spare parts for older systems. As electronic components age, manufacturers may cease production, creating difficulties in finding replacements when these components fail. This can result in heightened downtime for critical defense systems, potentially compromising operational readiness.

- For instance, in January 2024, BAE Systems secured a contract from the Commonwealth of Australia to enhance the current Mk 45 Mod 2 naval gun systems on Anzac class frigates with a Common Control System (CCS).

To Understand More About this Research:Request a Free Sample Report

Moreover, to address such challenges, the market provides various solutions such as obsolescence management services, component reengineering, lifecycle extension programs, and technology insertion. These solutions assist defense organizations in maintaining the operational readiness of their systems, reducing life-cycle costs, and mitigating obsolescence risks. The defense electronics obsolescence market growth is primarily driven by factors such as rising defense budgets, technological advancements, and the necessity for interoperability and compatibility with modern systems. However, it encounters obstacles such as rigorous regulatory demands, intricate supply networks, and the substantial expenses linked to managing obsolescence. In essence, the defense electronics obsolescence market development significantly contributes to guaranteeing the efficiency and dependability of defense systems within a constantly evolving technological environment.

Market Dynamics

Market Drivers

Growing spending on defense sector by many countries

Many countries worldwide are increasing their defense budgets to modernize armed forces and enhance capabilities, driven by factors such as geopolitical tensions, evolving security threats, and aging equipment replacement needs. This surge in defense spending fuels demand for advanced military technologies, including defense electronics. Consequently, there are significant opportunities for investments in obsolescence management solutions, as defense systems rely increasingly on sophisticated electronics, heightening the risk of obsolescence. Such solutions are crucial for ensuring that defense systems remain operational and effective throughout their lifecycle, helping countries avoid costly downtime and the need for disruptive system upgrades or replacements.

Following strict regulatory requirements and standards

Strict regulatory requirements and standards in the defense electronics obsolescence market opportunity shape system and component lifecycles, ensuring high reliability and functionality. These regulations, covering operational, environmental, and interoperability standards, drive innovation but pose challenges for contractors and suppliers. Adherence to evolving standards such as MIL-STD-810H requires periodic reviews and upgrades, often leading to obsolescence of older components. Regulatory standards also impact procurement decisions and defense diplomacy, which are crucial for maintaining competitiveness and operational readiness in evolving global threats and technologies.

Market Restraints

High cost associated with the upgradation of system and replacement.

The significant economic burden of upgrading outdated components in defense systems poses a major challenge in the defense electronics obsolescence market development. This challenge includes various costs, such as research and development for new technologies, integrating them into existing systems, testing, certification, and managing global supply chains. These activities require substantial investments, often amounting to millions or billions of dollars for extensive system overhauls. Moreover, defense budgets are limited and compete with other priorities, necessitating a careful balance between funds allocated for upgrades, new acquisitions, personnel costs, and maintenance. The prolonged lifecycles of defense platforms exacerbate this challenge, as advancements in technology lead to ongoing cycles of obsolescence and replacement. This financial constraint restricts the frequency and scope of upgrades, impacting operational effectiveness and national security. To address these challenges and manage defense budgets more effectively, innovative approaches such as modular design, utilizing commercial off-the-shelf technologies, and forming strategic partnerships with industry are essential.

Report Segmentation

The market is primarily segmented based on platform, systems, type, and region.

|

By Platform |

By Systems |

By Type |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Segmental Analysis

By Platform Analysis

- The land segment is projected to grow at a significant CAGR during the defense electronics obsolescence market forecast period. The increasing complexity and reliance on electronics in land-based defense systems, such as armored vehicles, artillery systems, and command and control centers, contribute significantly to the need for obsolescence management. These systems integrate various electronic components and systems, including sensors, communication systems, and computing devices, all prone to obsolescence. Additionally, the land segment's growing need for modernization and upgrade programs, influenced by changing security threats, evolving mission requirements, and the necessity for interoperability with allied forces, further drives this demand. These modernization efforts often entail integrating new electronic systems and technologies, potentially leading to obsolescence issues for existing systems.

- The airborne segment led the industry market with a substantial revenue share in 2023. This is primarily because military aircraft heavily rely on complex electronics prone to obsolescence. These aircraft incorporate crucial electronic systems such as aerial delivery systems, communication systems, helmet-mounted displays (HMDs), palletized loading systems (PLS), and radars. The rapid pace of technological advancements means that electronics used in military aircraft can quickly become outdated, leading to a high risk of obsolescence. Consequently, defense organizations are increasingly focused on implementing obsolescence management strategies to ensure their aircraft remain operational and effective.

By Systems Analysis

- The sensors segment accounted for a significant market share in 2023 and is likely to retain its position throughout the defense electronics obsolescence market forecast period. Sensors play a crucial role in defense systems, providing vital data for applications such as surveillance, reconnaissance, target tracking, and navigation. As defense systems increasingly depend on sensors for these functions, the risk of sensor obsolescence rises. Furthermore, rapid advancements in sensor technology quickly render older models obsolete, prompting defense organizations to upgrade their sensor systems with newer, more advanced technologies to stay competitive and respond effectively to evolving threats.

- The targeting systems arsenide segment is expected to grow at the fastest CAGR rate over the next coming years. Radars play a crucial role in military applications, serving as the cornerstone of advanced targeting systems. They provide essential capabilities for threat identification and situational awareness. For instance, the AN/TPY-2 radar, utilized in ballistic missile defense systems, is vital for identifying and monitoring approaching missile threats. These radars help protect critical infrastructure and populated areas by offering early warning and tracking information, enabling the interception of ballistic missiles.

Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. With its robust industrial base, advanced technology, and substantial defense expenditures, leading North American enterprises are devising sophisticated obsolescence management strategies tailored to the unique requirements of various platforms, including terrestrial, aquatic, and airborne systems. By spearheading obsolescence management efforts, these businesses empower the military to uphold its technological edge and operational readiness. They achieve this by strategically allocating resources for collaboration, research and development (R&D), and innovation. North America's dominance in the defense electronics obsolescence sector is crucial for preserving stability in a progressively intricate geopolitical landscape and safeguarding national security interests.

The Asia Pacific region is anticipated to grow significantly during the defense electronics obsolescence market forecast period. Many countries in the Asia-Pacific region are increasing their defense budgets to modernize their armed forces and enhance their capabilities, creating opportunities for investments in obsolescence management solutions to maintain and upgrade existing equipment. The region's thriving technology sector, with rapid advancements in areas such as electronics, software, and engineering, can facilitate the development of innovative obsolescence management strategies tailored to the specific needs of defense electronics. Additionally, countries such as China, South Korea, and India are expanding their domestic defense industries, offering opportunities for local companies to provide obsolescence management services and solutions, thereby contributing to the overall growth of the sector in the region.

Competitive Landscape

The defense electronics obsolescence market is fragmented and is anticipated to witness competition due to several players' presence. Major obsolescence management providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Actia Group

- Altium

- Assel Poland

- BAE Systems

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Like Technologies

- Raytheon Technologies Corporation

- Thales

- Whistler Technology

Recent Developments

- In October 2023, Collins Aerospace, a business of Raytheon Technologies Corporation, entered into a licensing agreement with Hanwha Systems to produce airborne tactical radios in South Korea for the Second-generation Anti-jam Tactical UHF Radio for NATO waveform (SATURN) upgrade program.

- In September 2023, BAE Systems chose Collins Aerospace as the large-area display provider for the Eurofighter Typhoon cockpit development. Collins Aerospace will collaborate with BAE Systems to create an Large Area Display solution that utilizes established, field-proven design elements while integrating the latest display technologies to reduce obsolescence and development schedule risks.

Report Coverage

The defense electronics obsolescence market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, platform, systems, type, and their futuristic growth opportunities.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.29 billion |

|

Revenue forecast in 2032 |

USD 4.15 billion |

|

CAGR |

7.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Platform, By Systems, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global defense electronics obsolescence market size is expected to reach USD 4.15 billion by 2032

Key players in the market are Raytheon Technologies Corporation, BAE Systems, L3Harris Technologies, Inc., Thales, Elbit Systems Ltd

North America contribute notably towards the global Defense Electronics Obsolescence Market

Defense Electronics Obsolescence Market exhibiting the CAGR of 7.7% during the forecast period

The Defense Electronics Obsolescence Market report covering key segments are platform, systems, type, and region.