Dental Consumables Market Size, Share, Trends, Industry Analysis Report

By Product (Dental Implants, Crowns & Bridges), By Specialty, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM3066

- Base Year: 2024

- Historical Data: 2020-2023

Overview

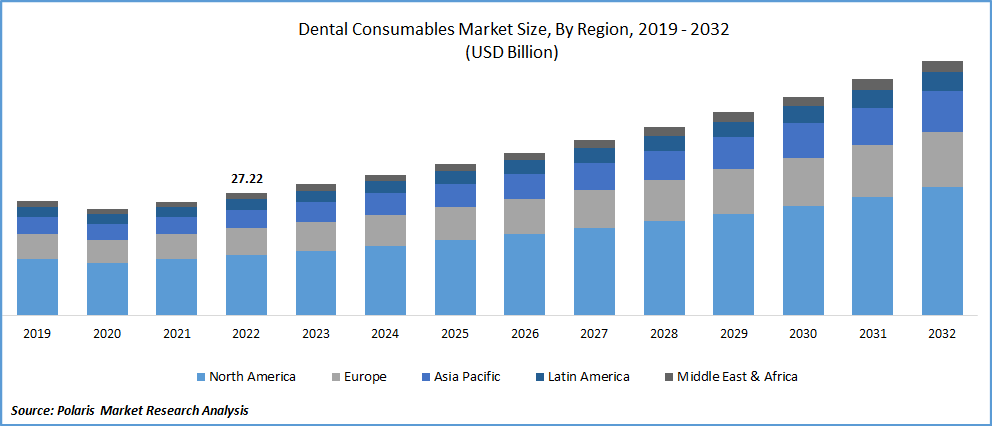

The global dental consumables market size was valued at USD 36.76 billion in 2024, growing at a CAGR of 8.3% from 2025 to 2034. The market is driven by rising oral health awareness, increasing cosmetic dentistry demand, growing geriatric population, technological advancements, and expanding dental tourism. Additionally, higher disposable incomes and government initiatives promoting dental care further fuel market growth globally.

Key Insights

- In 2024, the dental implants segment dominated with the largest share due to the growing demand for long-lasting and natural-looking tooth replacements.

- The dental clinics segment dominated with largest share as they remain the most preferred place for routine dental care and specialized treatments.

- North America dominated the global market with the largest share in 2024, due to high awareness of oral health, advanced healthcare infrastructure, and strong dental insurance coverage

- The industry in the U.S. is expected to witness significant growth during the forecast period, due to its large healthcare spending, high rate of dental visits, and growing demand for cosmetic procedures.

- The Asia Pacific industry is projected to witness substantial growth during the forecast period, driven by increasing dental awareness, rising disposable incomes, and rapid urbanization.

Industry Dynamics

- Rising prevalence of dental diseases drives the demand for dental consumables.

- Expansion of dental clinics and chain practices is fueling the industry growth.

- The technological advancement in the materials make consumables more durable, safer, and better looking.

- High costs of advanced dental treatments and limited reimbursement policies in some regions limit the growth.

Market Statistics

- 2024 Market Size: USD 36.76 billion

- 2034 Projected Market Size: USD 81.55 billion

- CAGR (2025–2034): 8.3%

- North America: Largest market in 2024

AI Impact on Dental Consumables Market

- Various dental consumables such as impression kits, filling materials, and bonding agents are paired with AI-driven imaging and diagnostic systems to improve detection of fractures, cavities, and gum disease, which helps select right material.

- Consumable manufacturers use AI simulations to test properties of new dental materials to improve aesthetics, durability, and biocompatibility before mass production.

- In the endodontics segment, AI tools are used to enhance imaging accuracy, enable robotic-assisted instrumentation, support predictive treatment planning, and tailor instrument design to patient anatomy.

Dental consumables are products used by dental professionals during procedures for the prevention, diagnosis, treatment, and restoration of oral health. These include materials such as fillings, impression materials, bonding agents, disinfectants, and dental cements. Unlike equipment, consumables are typically single-use or need regular replenishment.

Many people seek dental treatments for health as well as to improve their appearance. Cosmetic dentistry includes procedures such as teeth whitening, veneers, and smile makeovers. These treatments rely heavily on consumables such as whitening gels, bonding agents, and composite materials. The demand for cosmetic dental services is rising as social media and beauty trends influence more people to improve their smiles. This shift has created a strong demand for high-quality, aesthetically pleasing consumables, especially in urban and high-income areas where cosmetic procedures are more popular and affordable, driving the growth.

Technology is playing a major role in improving dental consumables. Newer materials are more durable, safer, and more aesthetically pleasing. Modern composites match the natural color of teeth while lasting longer. Self-adhesive cements, bioactive materials, and digital impression systems are making procedures quicker and easier for both patients and dentists. These innovations improve patient satisfaction and encourage dentists to use high-end consumables. The demand for these new materials grows as more clinics invest in advanced solutions, thereby fueling the growth.

Drivers & Opportunities

Rising Prevalence of Dental Diseases: Tooth decay, gum disease, and oral infections are affecting people of all age groups globally. According to the World Health Organization (WHO), oral disease affects approximately 3.7 billion people globally. Poor oral hygiene, unhealthy diets, smoking, and lack of awareness contribute to rising dental problems. Consequently, there’s a growing demand for treatments such as fillings, root canals, and crowns, all of which require dental consumables. Additionally, countries with aging populations, such as Japan and Germany, are witnessing more cases of dental disease, further boosting the need for these materials. This increase in oral health issues is driving the growth.

Expansion of Dental Clinics and Chain Practices: Dental clinics, especially private and corporate chains, are growing in number across both developed and emerging countries. According to the Dental Board Ahpra, Australia alone had 27,583 dental practitioners in 2024. These setups offer a wide range of services and maintain higher standards of care, which requires regular and bulk use of dental consumables. Chain practices have standardized treatment protocols, ensuring consistent use of certain products. Their expansion increases the volume of materials purchased, which boosts overall demand. Additionally, dental tourism in countries such as India, Mexico, and Thailand is bringing in more patients, driving up the need for consumables used in fast, high-quality dental procedures, thereby driving the growth.

Segmental Insights

Product Analysis

The segmentation, based on product, includes dental implants, crowns & bridges, dental biomaterials, orthodontic materials, endodontic materials, periodontic materials, dentures, CAD/CAM devices, retail dental hygiene essentials, and others. In 2024, the dental implants segment dominated with the largest share due to the growing demand for long-lasting and natural-looking tooth replacements. An increase in the incidence of tooth loss due to aging, accidents, or dental diseases has pushed more patients to choose implants over dentures or bridges. Rising awareness of oral aesthetics, advancements in implant materials, and minimally invasive techniques have made implants more accessible and appealing. Additionally, a higher number of skilled professionals and expanded dental insurance coverage in developed countries are supporting implant adoption, thereby driving the segment growth.

Specialty Analysis

The segmentation, based on specialty, includes general, pediatric, endodontics, and oral surgery. The endodontics segment accounted for significant growth due to the increase in dental infections and untreated cavities that lead to pulp damage. Endodontic procedures are becoming more common as more patients seek to save their natural teeth rather than extract them. Technological advances such as improved irrigation solutions, biocompatible sealers, and faster rotary tools are further improving treatment outcomes. This specialty is growing particularly in developing regions where access to advanced dental care is expanding, driving the segment growth.

End Use Analysis

The segmentation, based on end use, includes hospitals and dental clinics. The dental clinics segment dominated with the largest share in 2024, as they remain the most preferred place for routine dental care and specialized treatments. These clinics offer a wide range of services, all of which require regular use of consumables. The growing number of private clinics, group practices, and dental chains, especially in urban areas, has significantly increased product demand. Clinics are further quicker to adopt new technologies and materials, keeping patient satisfaction high. Their flexibility, accessibility, and focus on personalized care further boost the segment growth.

The hospital segment is expected to experience significant growth during the forecast period, driven by rising demand for complex procedures and emergency dental care. Public hospitals in many countries are expanding their dental departments, offering affordable or insured treatments. Additionally, hospitals are better equipped for oral surgeries and multidisciplinary care, attracting more patients with serious dental conditions. Government-funded oral care programs and the integration of dental care in general health policies are further increasing the patient footfall in hospitals. Consequently, hospitals are becoming a vital growth area for dental consumables, especially in emerging and underserved regions, thereby fueling the segment growth.

Regional Analysis

North America Dental Consumables Market Trends

North America dominated the global market with the largest share in 2024, due to high awareness of oral health, advanced healthcare infrastructure, and strong dental insurance coverage. The region has a large number of dental professionals and clinics that adopt the latest technologies and materials quickly. Cosmetic dentistry is further very popular, driving demand for aesthetic-focused consumables such as composites and whitening agents. The aging population and high prevalence of dental diseases like periodontitis and tooth decay further increase the need for restorative and preventive products. Strong support from dental associations and frequent product innovations further contribute growth.

U.S. Dental Consumables Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period, due to its large healthcare spending, high rate of dental clinic visits, and growing demand for cosmetic procedures. An increasing number of elderly patients, combined with better insurance access through Medicare and private plans, supports the use of advanced consumables. The rise in digital dentistry and widespread adoption of implants and endodontic materials further fuel growth. Moreover, the U.S. market benefits from a strong network of dental schools, research centers, and manufacturers that continuously introduce innovative materials, propelling the industry growth.

Asia Pacific Dental Consumables Market Analysis

The Asia Pacific industry is projected to witness substantial growth during the forecast period, driven by increasing dental awareness, rising disposable incomes, and urbanization. More people in countries such as India, Indonesia, and Vietnam seek dental treatments, especially in urban centers. Government efforts to improve public oral health and expand access to care have further increased demand. Additionally, dental tourism is booming in this region due to cost-effective treatments. The demand for high-quality consumables is rising rapidly as clinics modernize and adopt newer technologies, boosting the region growth.

China Dental Consumables Market Insights

The China industry is projected to witness substantial growth during the forecast period due to increasing demand for both basic dental care and cosmetic dentistry. Rising middle-class income, improving healthcare infrastructure, and growing awareness of oral hygiene have led to more frequent dental visits. The government’s focus on healthcare reform and public oral health campaigns has expanded access to dental services across urban and rural areas. Dental chains and private clinics are rapidly growing, especially in major cities. Additionally, local manufacturing and favorable regulations are encouraging domestic production of consumables, helping meet rising demand and fueling the growth of the industry.

Europe Dental Consumables Market Overview

The industry in Europe is expected to experience significant growth in the future, due to its well-established healthcare systems, high dental care standards, and aging population. Countries such as the UK, France, Italy, and Spain offer widespread dental services supported by both public and private insurance systems, which makes treatments more accessible. There's further growing demand for cosmetic dentistry and minimally invasive procedures, boosting the use of advanced consumables. Additionally, Europe’s focus on research, quality standards, and sustainability in medical materials encourages continuous product innovation, thereby driving the growth.

Germany Dental Consumables Market Outlook

The market in Germany is expected to experience significant growth driven by a high frequency of dental clinic visits and a population that values preventive care. The country benefits from a universal healthcare system where many dental procedures are reimbursed, increasing the uptake of treatments that use consumables such as fluoride, bonding agents, and composites. Germany’s strong dental manufacturing base and strict quality regulations support the development and use of premium dental materials. The country further has a high number of practicing dentists and dental clinics, which ensures steady demand. Moreover, a rapidly aging population, restorative treatments such as implants are especially in demand, further driving the growth.

Key Players and Competitive Analysis

The industry is highly competitive, with key players focusing on innovation, product quality, and global reach. Leading multinational corporations such as 3M, Dentsply Sirona, and Envista Holdings dominate through extensive R&D and comprehensive portfolios spanning restorative, preventive, and orthodontic solutions. Henry Schein and Patterson Companies leverage strong distribution networks to maintain market presence. Companies such as Ivoclar, Coltene Group, and GC Asia Dental emphasize aesthetic and prosthodontic advancements, while Straumann and Zimmer Biomet compete strongly in implantology. Septodont focuses on pharmaceutical consumables, especially anesthetics, whereas Komet Dental leads in rotary instruments. Benco Dental and Prime Dental Products cater to regional markets with value-driven offerings. Strategic partnerships, acquisitions, and digital integration are reshaping the landscape, pushing companies to innovate in CAD/CAM, biocompatible materials, and minimally invasive solutions. This dynamic environment fosters both consolidation and differentiation across global and emerging markets.

Key Players

- 3M

- Benco Dental

- Coltene Group

- Dentsply Sirona

- Envista Holdings Corporation (Danaher Corporation)

- GC Asia Dental

- Henry Schein, Inc.

- Ivoclar

- Komet Dental (Brasseler GmbH & Co. KG group)

- Patterson Companies, Inc.

- Prime Dental Products Pvt. Ltd.

- Septodont Holding

- Straumann Holding

- Zimmer Biomet

Dental Consumables Industry Developments

In September 2024, Solventum launched 3M Clinpro Clear Fluoride and 3M Filtek Easy Match at the 2024 FDI World Dental Congress, showcasing innovations that enhanced efficiency and patient-centred care, building on 3M’s legacy in dental healthcare technology.

In August 2024, SUN MEDICAL launched the i-TFC Luminous II dental material range, developed through a partnership with Mitsui Chemicals and SHOFU, combining proprietary technologies to reduce polymerization shrinkage and enhance adhesion in post-and-core dental treatments.

Dental Consumables Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Dental Implants

- Crowns & Bridges

- Dental Biomaterials

- Orthodontic Materials

- Endodontic Materials

- Periodontic Materials

- Dentures

- CAD/CAM Devices

- Retail Dental Hygiene Essentials

- Others

By Specialty Output Outlook (Revenue, USD Billion, 2020–2034)

- General

- Pediatric

- Endodontics

- Oral Surgery

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Dental Clinics

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Dental Consumables Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 36.76 Billion |

|

Market Size in 2025 |

USD 39.74 Billion |

|

Revenue Forecast by 2034 |

USD 81.55 Billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 36.76 billion in 2024 and is projected to grow to USD 81.55 billion by 2034.

The global market is projected to register a CAGR of 8.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are 3M; Benco Dental; Coltene Group; Dentsply Sirona; Envista Holdings Corporation; GC Asia Dental; Henry Schein, Inc.; Ivoclar; Komet Dental (Brasseler GmbH & Co. KG group); Patterson Companies, Inc.; Prime Dental Products Pvt. Ltd.; Septodont Holding; Straumann Holding; and Zimmer Biomet.

The dental implant segment dominated the market share in 2024.

The hospital segment is expected to witness the significant growth during the forecast period.