Dextrose Market Share, Size, Trends, Industry Analysis Report

By Form (Liquid/Syrup, Crystalline, Powder); By Type; By Application; By Source; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3901

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

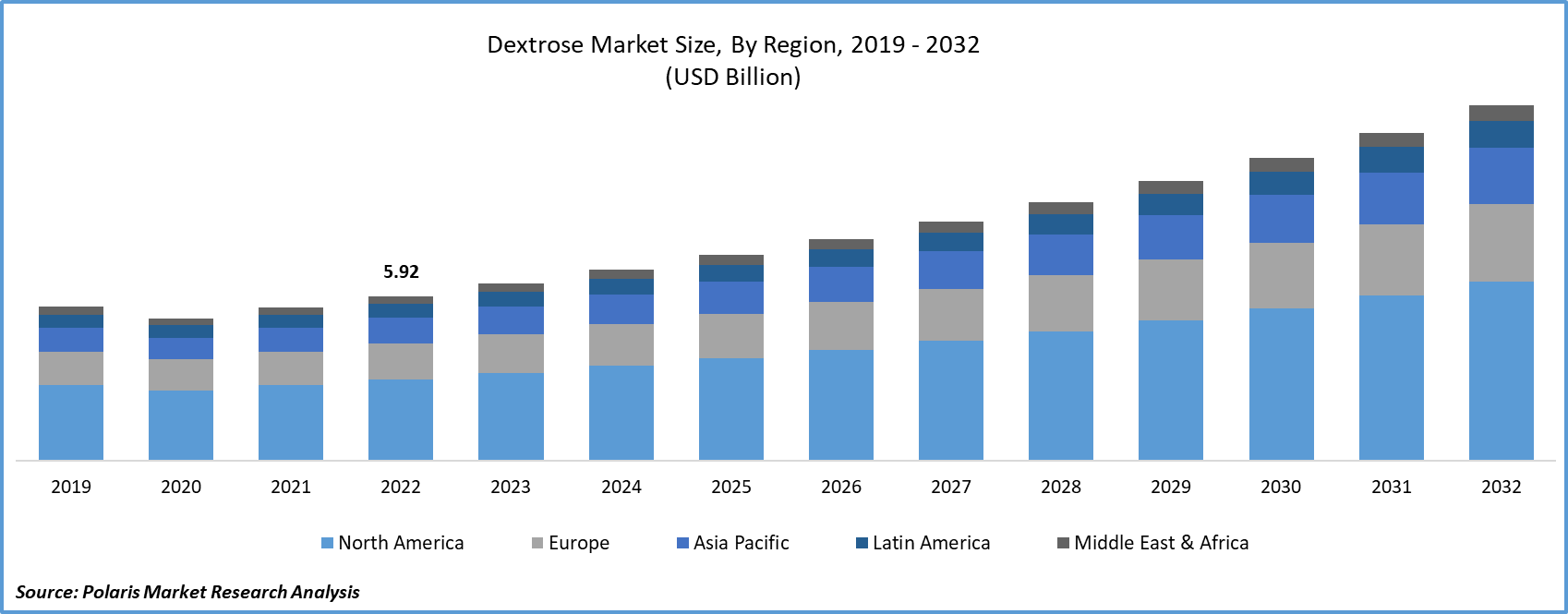

The global dextrose market was valued at USD 6.37 billion in 2023 and is expected to grow at a CAGR of 8.10% during the forecast period.

Dextrose is a frequently utilized sweetener in baked goods and is commonly present in processed food items such as bakery, dairy products, and confectionery due to its sugar-like taste, resembling sucrose by 60-70%. It also plays a role in confectionery applications by enhancing fruity flavors, imparting a subtle cooling sensation, and harmonizing sweetness. Additionally, dextrose finds applications in beverages, ice cream, culinary preparations, meat curing, and pharmaceuticals. In milk-based drinks like chocolate-flavored beverages, dextrose is widely employed to regulate overall sweetness when combined with other sugars.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the Dextrose Market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

To Understand More About this Research: Request a Free Sample Report

The food and beverage industry is experiencing a growing demand for dextrose due to changes in consumer preferences towards sweet snacks and desserts. Dextrose is an effective sweetener, which is why it's gaining popularity in segments like bakery, dairy, and confectionery products. The market is facing challenges such as price fluctuations in raw materials, particularly corn, supply chain disruptions, and the changing global economic conditions. Major players in the sugar industry are looking for sustainable alternatives like wheat and cook starch to make high-quality glucose syrups for use in baked goods, beverages, and ice creams. The emerging clean-label trend presents significant opportunities for glucose (dextrose) manufacturers, encouraging companies to improve their product lineups through innovation and technological advancements.

Dextrose has extensive application in the food industry as a sweetener, emulsifier, stabilizer, and thickening agent, enhancing the flavor and texture of various food products. Its usage in the pharmaceutical industry for clinical-grade products contributes to market growth. Increasing consumer health awareness has led to a heightened demand for low-calorie sweeteners like dextrose. As people seek healthier sugar alternatives, dextrose emerges as a viable choice, propelling market expansion. However, growing awareness of the adverse health effects linked to excessive sugar consumption poses a constraint on the Dextrose Market.

Industry Dynamics

Growth Drivers

Increasing Interest in Organic Beauty Products Facilitates Market Growth

Dextrose is in high demand as an ingredient in cosmetics and personal care products due to its natural attributes. It plays various roles, including flavor enhancement, humectant properties, and serving as a skin-conditioning agent, among others. Sugar-based components are favored in skincare items for their natural, non-toxic qualities, alongside their high water solubility, prebiotic benefits, and humectant characteristics. Cosmetics with sugar-based ingredients encompass day creams, night creams, eye creams, body lotions, as well as hair care products like masks and styling products.

According to the National Library of Medicine of the National Center for Biotechnology Information, sugar is a well-established cosmetic ingredient known for its skin-whitening and moisturizing effects with minimal side effects. Moreover, companies are increasingly investing in eco-friendly surfactants and sustainable materials within the cosmetics market. For example, Clariant AG, a Swiss multinational specialty chemicals company, offers green surfactants derived from plant sugars in its GlucoTain product line, contributing to dextrose market expansion.

Report Segmentation

The market is primarily segmented based on form, type, application, source, and region.

|

By Form |

By Type |

By Application |

By Source |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Dextrose Monohydrate segment held the largest revenue share in 2022

In 2022, the dextrose monohydrate segment dominated the Dextrose Market revenue. The increasing health-conscious consumer base has driven the inclusion of dextrose in various products, presenting an opportunity for market growth. Additionally, dextrose finds application in caramel coloring, beverage powders, and other formulations to enhance product shelf life. Furthermore, key players are adopting diverse strategies to broaden their product offerings and cater to different customer needs, ultimately expected to impact market expansion positively.

By Application Analysis

The Food and Beverages segment accounted for the highest market share during the forecast period

In the Dextrose Market's application segment, the Food & Beverage industry typically claims the largest share. Dextrose is widely employed as a sweetener, flavor enhancer, and functional ingredient in a multitude of food and beverage products. Its applications extend to baked goods, confectionery, beverages, processed foods, and dairy items. Although dextrose also finds uses in other sectors such as Personal Care Products, Pharmaceuticals, Paper and Pulp Products, and Agricultural Products, its market share in these segments is comparatively smaller.

On the other hand, Dextrose has a presence in personal care products, encompassing skincare, haircare, and oral care items, and it plays a role in the pharmaceutical industry as a carrier and excipient in various medications. Additionally, dextrose serves specialized applications in the paper and pulp industry, primarily in paper sizing and coatings, along with specific agricultural products such as animal feed and plant nutrient solutions. However, the primary catalyst for the Dextrose Market continues to be the Food and Beverage industry, where it experiences substantial demand and utilization across various product categories.

Regional Insights

Asia Pacific dominated the largest market in 2022

In 2022, The rising demand for raw materials like wheat and corn to produce dextrose in response to increasing consumer needs has prompted government authorities to boost wheat sales, thereby stimulating market growth. Furthermore, the adoption of expansive strategies by major industry players to diversify their product offerings and fortify their presence in the Asia-Pacific region is expected to contribute to segmental expansion. Notably, the dextrose market in India displayed the highest growth rate in the Asia-Pacific region and held the largest market share.

The North America Dextrose market, holding the second-largest market share, is projected to achieve the fastest growth. The region's substantial presence of key industry players offering dextrose for diverse applications, including bakery and confectionery, beverages, dairy products, culinary, and meat, alongside their ongoing innovations, is poised to have a positive impact on market expansion. Additionally, the U.S. Dextrose market claimed the largest market share, while the Dextrose market in Canada emerged as the fastest-growing within the North America region.

The Europe Dextrose Market retains a substantial market share and anticipates high CAGR growth. Europe maintains a significant presence in the Dextrose Market, primarily due to increased government investments in the pharmaceutical sector. Moreover, the diverse food and beverage sector across European nations is expected to drive dextrose demand, given its nutritional advantages that are sought to be integrated into their products. Furthermore, the Rest of Europe's Dextrose market secured the largest market share, with the German dextrose market following as the second-largest and fastest-growing market within the European region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- AGRANA Beteiligungs-AG

- Archer Daniels Midland Co (ADM)

- Cargill Incorporated

- Foodchem international corporation

- Fooding Group Limited

- Gulshan Polyols Ltd.

- Ingredion Incorporated

- Roquette Freres

- Tate & Lyle

- Tereos

Recent Developments

- In September 2022, Cargill has recently responded to the increasing demand for starches, sweeteners, and feed in Asia and Indonesia by launching a maize wet mill in Pandaan in September 2022. This new facility, which required an investment of USD 100 million, is expected to enable the growth of the food and beverage industry in the country and bolster the local economy.

- In February 2021, Ingredion Incorporated formed Ingrear Holding S.A. by entering into a contract with a subsidiary of the Argentine food company Grupo Arcor. This joint venture combined and operated five manufacturing facilities in Argentina. Ingrear Holding S.A. sells value-added ingredients to customers in the food, beverage, pharmaceutical, and other industries in Argentina, Chile, and Uruguay.

- In April 2021, Avebe Group, based in the Netherlands, collaborates with Solynta, also in the Netherlands, to engage in hybrid breeding of starch potato varieties. This approach, in contrast to traditional breeding, expedites the development of sustainable potato varieties, potentially leading to enhanced production and revenue for the company.

Dextrose Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.86 billion |

|

Revenue forecast in 2032 |

USD 12.77 billion |

|

CAGR |

8.10% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Form, By Type, By Application, By Source, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Uncover the dynamics of the Non-Invasive Prenatal Testing sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a Dextrose market forecast until 2029, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.Browse Our Top Selling Reports

Browse Our Top Selling Reports

Disposable Bronchoscope Market Size, Share 2024 Research Report

Full Dentures Market Size, Share 2024 Research Report

Medical Foods Market Size, Share 2024 Research Report

Medical Device Testing Services Market Size, Share 2024 Research Report

Connected Medical Devices Market Size, Share 2024 Research Report