Diet Pills Market Share, Size, Trends, Industry Analysis Report

By Product Type (Prescription Based Drugs, Over the Counter Drugs, and Herbal Supplements); By Distribution Channel; By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Jun-2023

- Pages: 118

- Format: PDF

- Report ID: PM3311

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

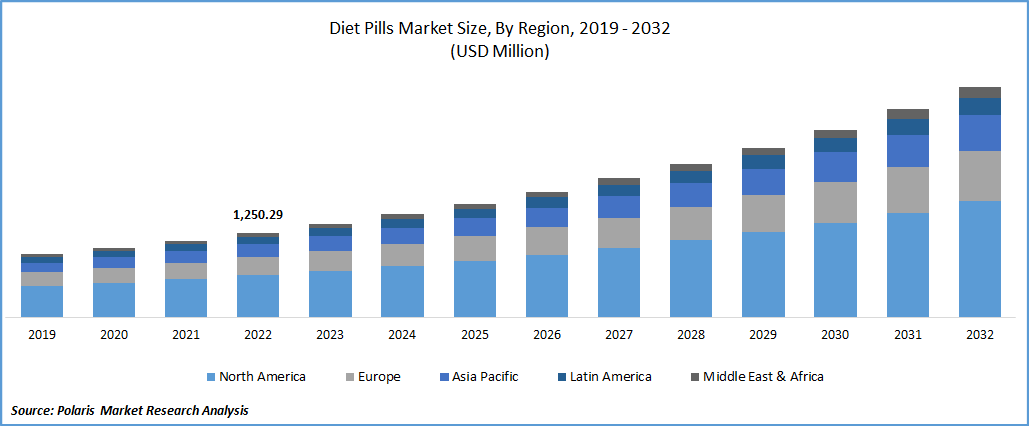

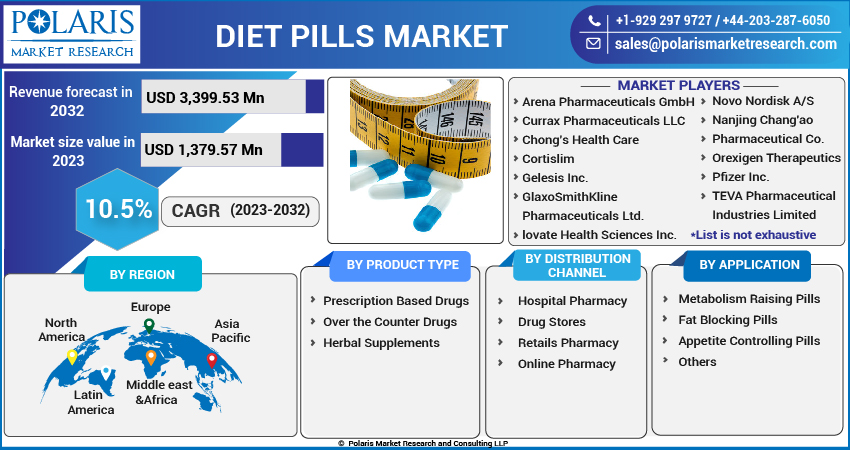

The global diet pills market was valued at USD 1,250.29 million in 2022 and is expected to grow at a CAGR of 10.5% during the forecast period. Diet pills are tablets used to aid in weight loss together with a healthy diet and exercise program. There are several possibilities. However, the NHS believes that the majority of them are useless. Some weight loss supplements are ineffective, while others work but are unsafe. Dietary supplements known as "diet pills" are promoted as a "quick fix" for weight loss. These goods are typically marketed as fat burners and appetite suppressants with the promise of aiding weight loss quickly.

To Understand More About this Research: Request a Free Sample Report

In addition, they might include herbs, stimulants like caffeine, or other compounds that could increase metabolism or curb appetite. Be advised that certain products may not be safe or effective because the FDA does not regulate them. Weight-loss pills, including phentermine and topiramate, are effective. Self-care is increasing, obesity is becoming a bigger concern, the older population is growing, and the number of women taking dietary supplements is rising. All of these factors are predicted to support the expansion of the diet pill market.

Demand for diet pills is being driven by increased purchasing power brought on by various nations' rising gross domestic product. The rising per capita income of the people is also driving the demand for diet pills. For instance, as per the World Bank, in 2021, India's per capita income was US$ 2,256.6. Therefore, people are more attracted to purchasing diet pills. The prominent reason driving diet pill sales is the overall level of customer awareness. The reason diets are becoming increasingly popular is because of people's growing health consciousness. Furthermore, the expected expansion in the market for diet pills has been boosted by an increase in the employment of both men and women.

However, sales of diet tablets are being impacted by side effects like pulmonary hypertension linked to excessive usage of dietary supplements. These medications occasionally cause customers' blood pressure, pulse rates, and anxiety. According to Schedules 3 and 4 of the Controlled Substances Act, diet tablets are manufactured under various restrictions. This should limit the distribution of diet medicines to those requiring them. Despite these restrictions, the harm of diet medications is becoming alarmingly common. Vendors of diet pills are most concerned with the compliance and regulatory issues related to drug production. The price of raw materials and maintaining a reliable supply chain network are additional difficulties for the producers of diet pills.

Due to temporary lockdowns and the closure of gyms and fitness centers brought on by the COVID-19 epidemic, people adopted unhealthy lifestyle changes and dramatically decreased physical activity. During the epidemic, market participants noticed alterations in consumer behavior. The outbreak significantly changed how society and the environment operated in people's daily lives. These sudden and obvious changes hurt people's diet and lifestyle habits.

For Specific Research Requirements, Speak With a Research Analyst

Industry Dynamics

Growth Drivers

According to this health-centricity, the market is expected to grow in revenue over the forecast period. The pills are marketed as a comparably less expensive alternative to other formulations. Due to their longer shelf life, diet pills are increasingly becoming accepted by people of all ages. Obesity is a major challenge on a global scale when it comes to modern healthcare. The biggest worries are cardiovascular diseases and diabetes, two more chronic disorders that obesity can lead to. Specific prescription and over-the-counter medications may be useful for those with trouble managing their weight. The medicine helps with efficient weight management in a variety of ways.

Some diet tablets may prevent fat absorption and reduce appetite to help an individual lose weight. The key players in the market are focusing on the launches of weight loss pills that are assisting the need to grow rapidly. For instance, in August 2022, One Size Does Not Fit All is the name of a new marketing campaign from Currax Pharmaceuticals, a specialized biopharmaceutical company and maker of the #1 oral weight loss drug brand CONTRAVE (naltrexone HCl/bupropion HCl). The campaign highlights the need for a personalized approach to weight loss to attain long-term accomplishment. Therefore, during the projected period, rising prevalence and worries about obesity are anticipated to promote the growth of the diet pills market.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, application, and region.

|

By Product Type |

By Distribution Channel |

By Application |

By Region |

|

|

|

|

For Specific Research Requirements: Request for Customized Report

The online pharmacy segment is expected to witness the fastest growth during projected period

Online businesses that offer attractive rebates and monthly prescriptions typically aim to please their customers. The flexibility of the online channels to distribute to different places that outline offline establishments is a popular choice. Online shopping is more practical than shopping at markets and other physical stores. Due to the availability of price comparison websites, low prices and promotional offers, time savings, lack of customers, and secure payment methods, more individuals are engaging in online shopping.

According to UNCTAD and Netcomm Suisse research, eCommerce has climbed by 6% to 10% across most product categories, and during pandemics, prescription drug sales have increased by 9%. Online shopping is becoming more popular, which proves that it is here to stay and necessitates that physical businesses begin offering product delivery online. The online market for necessities and medications is expanding extremely quickly.

Additionally, internet penetration is fast increasing worldwide due to the low cost of smartphones and the migration to new technology developments like the 4G and 5G networks. According to a forecast from the ongoing Digital India program, 600 million internet users will be worldwide by 2025. 51% of people used the internet alone in 2019, according to an ITU report. For the duration of the forecast, this segment's growth is projected to be fueled by an increase in self-driven consumers.

Prescription based drugs segment accounted for the largest market share during forecast period

Drugs a doctor recommends to assist patients in losing weight are known as prescription diet pills. These medications function in many ways, including reducing hunger, boosting metabolism, or preventing fat absorption. They are typically taken with an exercise regimen and a diet containing fewer calories. Due to its accessibility in the form of chewable and sublingual pills, there is good growth in the prescription-based consumption of diet pills, which is anticipated to see the highest growth rate. Under prescription diet pills, sales are dominated by vitamins and minerals. It is expected that mineral supplements in pill form will aid in managing weight and promote a healthy metabolism. Most of these tablets are indicated to treat iron deficiency in all age groups and improve health performance.

The demand in Asia-Pacific is expected to witness significant growth during upcoming years

Asia Pacific has the highest diet pill sales concentration due to the high incidence of obesity-related illnesses and growing health consciousness. Rising salaries are another factor in the region, which increases peoples' out-of-pocket expenses. To promote their best physical condition and overall well-being, the adult and geriatric population is rapidly expanding and heavily dependent on appetite suppressants and weight control drugs. Adult residents depend on diet pills to control their weight and develop healthy bodies. As evidenced by the region's expanding demand, there is innovative potential for product creation and distribution methods. The need for diet pills in Asia Pacific regions is expected to be driven by escalating diseases and lifestyle-related problems.

The North American region is anticipated to grow significantly due to the alarming rise in patients with poor eating habits and obesity. The public has enthusiastically embraced the increase in fitness facilities and gyms and adopted them to pursue a physically active lifestyle. Opportunities for major businesses to create new products are being made by the rising demand for natural, plant-based supplements in North America. The population in this region is also more aware of the value of fitness training, which has led to an increase in gym memberships. Large industry players are also available on the market, which is expected to spur growth in the sales of diet pills.

Competitive Insight

Some of the major players operating in the global diet pills market include Arena Pharmaceuticals, Currax Pharmaceuticals, Chong’s Health Care, Cortislim, Gelesis Inc., GlaxoSmithKline Pharmaceuticals, Lovate Health Sciences, Novo Nordisk, Nanjing Chang'ao Pharmaceutical, Orexigen Therapeutics, Pfizer Inc., TEVA Pharmaceutical, Vivus, Inc., & Zoller Laboratories.

Recent Developments

- In September 2022, GSK introduced a new Sustainable Procurement Programme to assist its suppliers. The information released during Environment Week NYC will support the suppliers' efforts to have a net zero effect on the environment and a net positive effect on nature.

Diet Pills Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,379.57 million |

|

Revenue forecast in 2032 |

USD 3,399.53 million |

|

CAGR |

10.5% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product Type, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Arena Pharmaceuticals GmbH, Currax Pharmaceuticals LLC, Chong’s Health Care, Cortislim, Gelesis Inc., GlaxoSmithKline Pharmaceuticals Ltd., lovate Health Sciences Inc., Novo Nordisk A/S, Nanjing Chang'ao Pharmaceutical Co., Orexigen Therapeutics, Pfizer Inc., TEVA Pharmaceutical Industries Limited, Vivus, Inc., and Zoller Laboratories Corporation |

FAQ's

The global diet pills market size is expected to reach USD 3,399.53 million by 2032.

Key players in the diet pills market are Arena Pharmaceuticals, Currax Pharmaceuticals, Chong’s Health Care, Cortislim, Gelesis Inc., GlaxoSmithKline Pharmaceuticals, Lovate Health Sciences.

Asia-Pacific contribute notably towards the global diet pills market.

The global diet pills market expected to grow at a CAGR of 10.5% during the forecast period.

The diet pills market report covering key segments are product type, distribution channel, application, and region.