Digital Freight Brokerage Market Size, Share, Trends, Industry Analysis Report

By Transportation Mode (Road Freight, Rail Freight, Air Freight, Ocean Freight); By Service Type; By Customer Type; By Industry Vertical; By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM5634

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

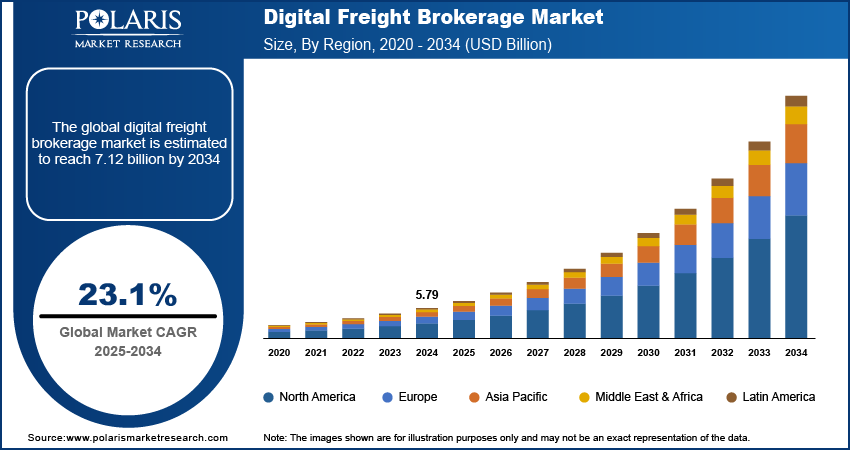

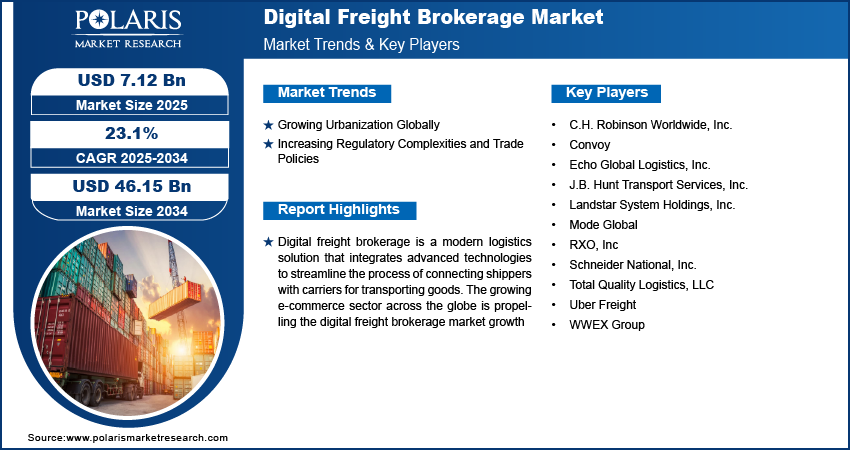

The digital freight brokerage market was worth USD 5.79 billion in 2024. It is estimated to grow at a CAGR of 23.1% between 2025 and 2034. Digital freight brokerage offers a modern logistics solution that leverages new technologies to connect shippers with carriers for streamlining the transportation of goods. These solutions may involve online platforms, mobile applications, and algorithms to automate and optimize operations.

Market Insights

- Based on transportation mode, the road freight segment held the largest market share in 2024. Segment growth is driven by the proliferation of e-commerce operations, which underlines the need for efficient and timely transportation.

- The full-truckload (FTL) brokerage segment dominated the market by service type in 2024 due to high demand from the retail, manufacturing, and automotive sectors, as their operations involve the rigorous shipment of goods in vast volumes.

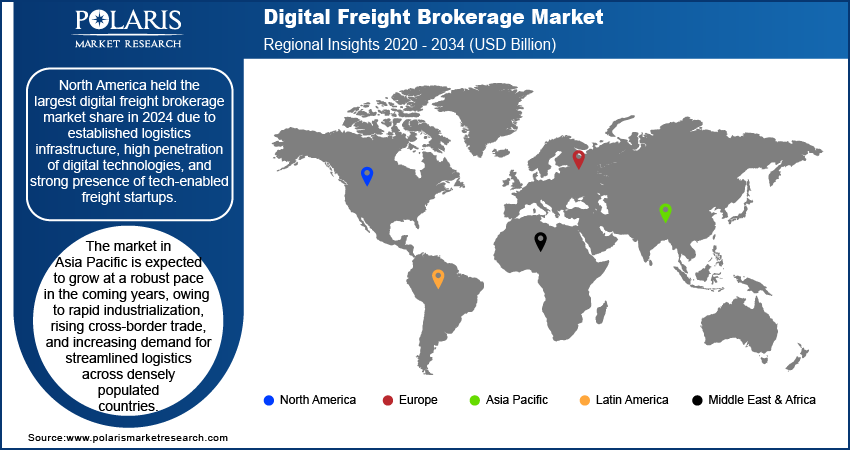

- North America dominated the global digital freight brokerage industry in 2024 due to extensive logistics infrastructure, high acceptance for digital technologies, and strong presence of tech-enabled freight startups.

- The market in Asia Pacific is expected to exhibit a robust CAGR from 2025 to 2034, owing to rapid industrial growth and rising cross-border trade.

Industry Dynamics

- Governments worldwide continue to modify trade agreements and tighten enforcement. As a result, businesses adopt digital freight solutions to remain agile, avoid disruptions, and maintain competitiveness in the global market.

- Continued growth in e-commerce, food and beverage, manufacturing, and construction industries propels the need for digital freight brokerage to support faster delivery times and optimize routes, thereby minimizing transit costs.

- As larger population pools move to cities for a better standard of living and consumer expectations shift toward faster order fulfillment, the need for digital freight brokerage solutions continues to rise alongside the adoption of smart, flexible freight solutions.

- The growing inclination toward eco-friendly shipping operations is expected to present attractive opportunities for market growth in the future. Digital operations promote sustainability by reducing empty miles and carbon emissions, and decreasing paper-based operations.

- The high cost of technology and specialized staff training requirements hamper the adoption of these solutions.

Market Statistics

Market Size in 2024: USD 5.79 billion

Projected Market Size in 2034: USD 7.12 billion

CAGR, 2025–2034: 23.1%

Largest Regional Market, 2024: North America

AI Impact on Digital Freight Brokerage Market

- Digital freight brokers can leverage AI algorithms to improve margins and transparency based on demand–supply patterns, fuel costs, and historical data on freight pricing.

- AI can enhance digital operations by instantly matching shippers with carriers based on capacity, optimized routes, and service reliability, thereby boosting efficiency.

- AI-based analytics helps brokers anticipate freight volumes, seasonal surges, and customer needs, enabling better resource allocation and appropriate planning.

- AI with telematics improves visibility into shipments and aids in more practical route planning for on-time deliveries.

- Agentic AI can help build trust in digital brokerage by identifying irregularities in transactions, eliminating the possibility of double brokering, and improving carrier compliance checks. Moreover, chatbots and virtual assistants can streamline communications, quotations, and dispute resolution, enhancing customer satisfaction.

To Understand More About this Research: Request a Free Sample Report

Digital freight brokerage is a modern logistics solution that integrates advanced technologies to streamline the process of connecting shippers with carriers for transporting goods. Digital freight brokerage uses online platforms, mobile applications, and algorithms to automate and optimize operations. Digital freight brokerage platforms act as intermediaries, matching shippers with suitable carriers based on shipment requirements, availability, and pricing models. Digital freight brokerage is widely used across industries such as e-commerce, food and beverage, manufacturing, and construction. It supports faster delivery times, optimizes routes to minimize transit costs, and promotes sustainability by reducing empty miles and carbon emissions.

The growing e-commerce sector across the globe is propelling the digital freight brokerage market growth. E-commerce businesses require fast, flexible, and cost-effective transportation solutions to meet customer expectations for quick deliveries and real-time tracking. Digital freight brokerage platforms streamline the process by instantly connecting shippers with available carriers, automating load matching, and offering transparent pricing. Moreover, digital freight brokerage services enable rapid response to fluctuating demand, optimize route planning, and improve supply chain visibility. This agility helps e-commerce businesses maintain service levels, reduce delivery costs, and scale operations during peak seasons. Therefore, the demand for digital freight brokerage is increasing with the growing e-commerce sector across the globe. For instance, as per the article published in the International Trade Administration report, the global B2C e-commerce revenue is expected to grow to USD$5.5 trillion by 2027 at a steady 14.4% compound annual growth rate.

The digital freight brokerage market demand is driven by increasing international trade globally. Increased international trade drives companies to coordinate shipments across multiple borders, carriers, and regulations. Traditional freight systems struggle to keep up with the complexity and scale of modern supply chains. Digital freight brokerage platforms address these challenges by offering real-time tracking, automated matching of loads with carriers, and transparent pricing. Shippers and carriers rely on these platforms to reduce delays, cut costs, and improve reliability. Therefore, the growing volume and urgency of international shipments are pushing businesses to adopt digital freight brokerage solutions that simplify freight management and increase operational agility. For instance, as per the data published by the UN Trade and Development (UNCTAD), global trade hit a record $33 trillion in 2024, growing by 3.7% from 2023.

Market Dynamics

Increasing Regulatory Complexities and Trade Policies

Governments worldwide are frequently updating customs regulations, tariffs, and compliance requirements, which confuse shippers and slow down traditional freight operations. Digital freight brokerage platforms address these challenges by integrating regulatory data, automating documentation, and providing real-time updates on policy changes. Shippers use these tools to avoid fines, reduce border delays, and ensure smooth cross-border movement. Moreover, digital freight brokerage platforms allow real-time visibility and analytics, which pushes companies to respond swiftly to new trade policies and reroute shipments as needed. Hence, as governments continue to modify trade agreements and tighten enforcement, more businesses adopt digital freight solutions to remain agile, avoid disruptions, and maintain competitiveness in the global market.

Growing Urbanization Globally

The demand for fast and reliable delivery of goods is rising sharply, creating pressure on supply chains to operate more efficiently within tight urban areas. Traditional freight systems often struggle to meet these demands due to traffic congestion, limited delivery windows, and strict city regulations. Digital freight brokerage platforms help businesses navigate these challenges by optimizing route planning, matching loads with local carriers, and providing real-time tracking. Retailers and logistics providers rely on these digital tools to improve delivery speed, reduce costs, and meet customer expectations in crowded urban markets. Thus, as cities continue to grow and consumer behavior shifts toward faster fulfillment, the need for smart, flexible freight solutions drives more adoption of digital freight platforms. For instance, the World Bank published a report stating that the urban population is expected to double by 2050.

Segment Analysis

Market Evaluation by Transportation Mode

Based on transportation mode, the digital freight brokerage market is divided into road freight, rail freight, air freight, and ocean freight. The road freight segment held the largest digital freight brokerage market share in 2024 due to its flexibility, extensive network connectivity, and rapid adoption of digital platforms among small and medium-sized carriers. The proliferation of e-commerce significantly boosted demand for efficient and timely transportation, further contributing to road freight's dominance. Moreover, the integration of telematics, real-time tracking, and automated freight matching through mobile apps for road freight has streamlined operations, reduced empty miles, and increased carrier utilization. These technological advancements have made road freight a preferred choice for shippers and brokers seeking responsiveness and operational transparency.

Market Insight by Service Type

In terms of service type, the digital freight brokerage market is segregated into full-truckload (FTL) brokerage, less-than-truckload (LTL) brokerage, intermodal brokerage, expedited freight, refrigerated freight, cross-border freight brokerage, and others. The full-truckload (FTL) brokerage segment dominated the market share in 2024 due to high demand from industries such as retail, manufacturing, and automotive, which regularly ship large volumes of goods. Shippers increasingly preferred FTL services for their speed, reduced risk of damage, and lower per-unit transportation costs. Digital platforms significantly improved the efficiency of FTL operations by offering real-time freight matching, dynamic pricing, and automated load booking, which minimized manual intervention and reduced idle time for carriers. The FTL segment also benefited from the rapid expansion of e-commerce and just-in-time inventory strategies, both of which required consistent and timely movement of high-volume shipments across regional and national routes.

The cross-border freight brokerage segment is expected to grow at a robust pace in the coming years, owing to the rising international trade and the growing complexity of global supply chains. Businesses increasingly seek streamlined logistics solutions to navigate customs regulations, varying documentation standards, and fluctuating transit times across borders. Digitally enabled cross-border services address these challenges by offering end-to-end visibility, automated compliance checks, and integration with customs clearance systems. The adoption of trade agreements, particularly in North America and Europe, has encouraged companies to move goods more freely across regions, further boosting the need for efficient cross-border solutions.

Regional Analysis

By region, the digital freight brokerage market report provides insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America held the largest digital freight brokerage market share in 2024 due to established logistics infrastructure, high penetration of digital technologies, and strong presence of tech-enabled freight startups. Shippers and carriers across the US increasingly adopted digital platforms to optimize route planning, improve load matching, and gain real-time shipment visibility. The country's expansive highway network and substantial volume of freight movement, driven by thriving sectors such as retail, manufacturing, and e-commerce, further contributed to digital freight brokerage market growth. Additionally, regulatory support for freight innovation and growing investment in supply chain management in the region encouraged widespread digital transformation among logistics providers and fleet operators.

The market in Asia Pacific is expected to grow at a robust pace in the coming years, owing to rapid industrialization, rising cross-border trade, and increasing demand for streamlined logistics across densely populated countries. China plays a crucial role in this regional expansion due to its massive manufacturing base, government-backed infrastructure development, and aggressive digitalization strategies in transportation and supply chain management. The region's growing e-commerce industry, particularly in Southeast Asia and India, continues to drive demand for faster, more reliable digital freight solutions.

Digital Freight Brokerage Key Market Players & Competitive Analysis Report

The digital freight brokerage market is characterized by intense competition, driven by strategic mergers, acquisitions, partnerships, and collaborations that aim to enhance service offerings and expand market reach. Companies such as Uber Freight and Convoy are leveraging these strategies to build their positions in the rapidly evolving logistics industry. Strategic mergers and acquisitions have become crucial, enabling firms to integrate advanced technologies such as AI and machine learning, thus optimizing freight matching and route planning. The integration of blockchain technology for transparent transactions and IoT for enhanced asset tracking further highlights the market shift towards a more interconnected and efficient ecosystem.

The digital freight brokerage market is fragmented, with the presence of numerous global and regional market players. Major players in the market are C.H. Robinson Worldwide, Inc.; Convoy; Echo Global Logistics, Inc.; J.B. Hunt Transport Services, Inc.; Landstar System Holdings, Inc.; Mode Global; Schneider National, Inc.; RXO, Inc.; Total Quality Logistics, LLC; Uber Freight; and WWEX Group.

RXO, Inc., founded in 2022 and headquartered in Charlotte, North Carolina, is a major provider of asset-light transportation solutions specializing in digital freight brokerage. The company operates across the United States, Canada, Mexico, Asia, and Europe, offering truckload freight brokering services alongside managed transportation, last-mile delivery, and freight forwarding solutions. RXO’s focus on technology-driven logistics is accelerated by its proprietary RXO Connect platform, which integrates features like Freight Optimizer, mobile apps, API integrations, and self-service dashboards. This platform enables real-time visibility and functionality for transacting and tracking shipments efficiently.

Uber Freight, launched in 2017 and headquartered in San Francisco, California, is a major digital freight brokerage that leverages technology to streamline logistics and supply chain operations. The company applies Uber’s ridesharing expertise to freight transportation, offering an innovative platform that connects shippers with truck drivers through its mobile app. This user-friendly system allows shippers to list freight details, including cargo type, weight, pickup and delivery locations, and equipment requirements. Uber Freight simplifies the freight booking process and enhances transparency for both shippers and carriers. Uber Freight provides a comprehensive suite of services, including managed transportation, logistics applications, capacity planning, consulting solutions, and carrier services. Its proprietary AI-Optimized Network delivers deep insights to optimize supply chain operations across various modes and industries.

List of Key Companies

- C.H. Robinson Worldwide, Inc.

- Convoy

- Echo Global Logistics, Inc.

- J.B. Hunt Transport Services, Inc.

- Landstar System Holdings, Inc.

- Mode Global

- RXO, Inc

- Schneider National, Inc.

- Total Quality Logistics, LLC

- Uber Freight

- WWEX Group

Digital Freight Brokerage Industry Developments

November 2024: Uber Freight announced the launch of Broker Access, a new program that enables brokers to book and execute loads digitally on Uber Freight’s carrier network.

June 2022: Convoy, one of the largest digital freight networks in the US, announced a partnership with MercuryGate International, Inc., the largest independent Transportation Management System (TMS) provider, to help freight brokers automate the brokerage process and control costs.

November 2021: Convoy rolled out a new program that provides freight brokers with direct access to Convoy’s digital freight network.

Digital Freight Brokerage Market Segmentation

By Transportation Mode Outlook (Revenue, USD Billion, 2020-2034)

- Road Freight

- Rail Freight

- Air Freight

- Ocean Freight

By Service Type Outlook (Revenue, USD Billion, 2020-2034)

- Full-Truckload (FTL) Brokerage

- Less-Than-Truckload (LTL) Brokerage

- Intermodal Brokerage

- Expedited Freight

- Refrigerated Freight

- Cross-Border Freight Brokerage

- Others

By Customer Type Outlook (Revenue, USD Billion, 2020-2034)

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

By Industry Vertical Outlook (Revenue, USD Billion, 2020-2034)

- Retail & E-commerce

- Manufacturing

- Automotive

- Food & Beverages

- Healthcare & Pharmaceuticals

- Oil & Gas

- Other

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Digital Freight Brokerage Market Value in 2024 |

USD 5.79 Billion |

|

AI-Powered Enterprise Automation Forecast in 2025 |

USD 7.12 Billion |

|

Revenue Forecast in 2034 |

USD 46.15 Billion |

|

CAGR |

23.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global digital freight brokerage market size was valued at USD 5.79 billion in 2024 and is projected to grow to USD 46.15 billion by 2034.

The global market is projected to grow at a CAGR of 23.1% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are C.H. Robinson Worldwide, Inc.; Convoy; Echo Global Logistics, Inc.; J.B. Hunt Transport Services, Inc.; Landstar System Holdings, Inc.; Mode Global; Schneider National, Inc.; RXO, Inc.; Total Quality Logistics, LLC; Uber Freight; and WWEX Group.

The road freight segment dominated the digital freight brokerage market revenue in 2024.

The cross-border freight brokerage segment is expected to grow at the fastest pace in the coming years.