Paraffin Wax Market Size, Share, Trends, Industry Analysis Report

By Product Type (Fully Refined, Semi Refined, Others), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM6205

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

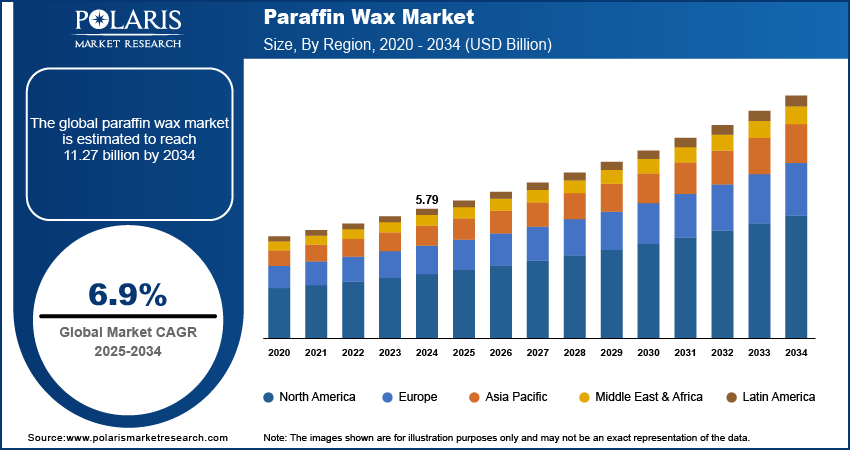

The global paraffin wax market size was valued at USD 5.79 billion in 2024 and is anticipated to register a CAGR of 6.9% from 2025 to 2034. A few growth factors propelling the market growth are the increasing demand from the candle and packaging sectors. The rise in popularity of scented candles for home decor and the need for water-resistant food packaging are key contributors.

Key Insights

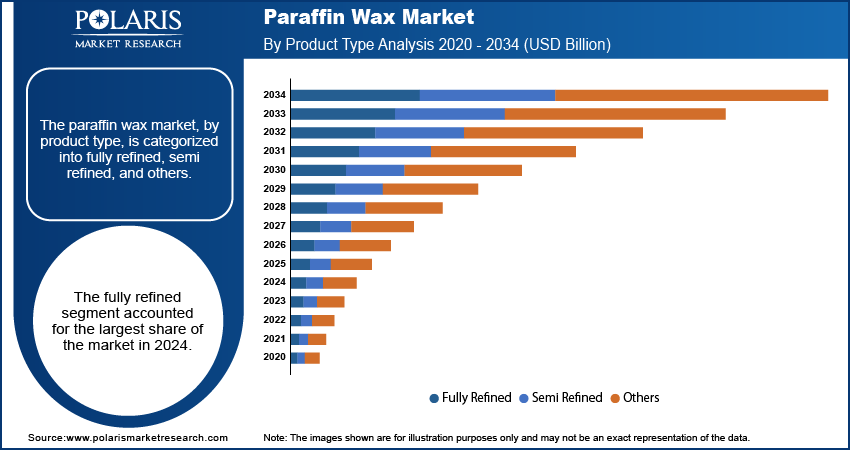

- By product type, the fully refined segment held the largest share in 2024. This is due to its high level of purity, making it ideal for applications that require superior quality and a clean, odorless product.

- By application, the candles application segment held the largest share in 2024. The widespread use of paraffin wax as the main raw material for candle production, combined with the rising consumer demand for decorative and scented candles for home ambiance and relaxation, makes it a key segment.

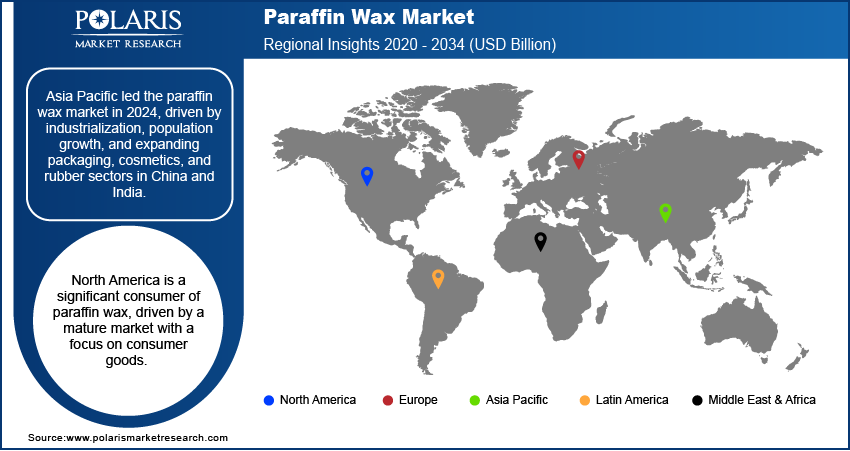

- By region, Asia Pacific dominated the global market for paraffin wax in 2024. This is driven by rapid industrialization, a growing population, and the expansion of key end-user industries such as packaging, cosmetics, and rubber manufacturing, particularly in countries such as China and India.

Industry Dynamics

- The growing demand for candles, especially scented and decorative candles in home décor, is a major factor driving the growth. Consumers are increasingly using candles for a relaxing atmosphere and for aromatherapy, which boosts sales.

- The demand for paraffin wax in food and beverage packaging also fuels the market expansion. Paraffin wax is widely used as a protective coating on paper and cardboard to provide a moisture barrier, extending the shelf life of food products and protecting them during transport.

- Another significant driver is the expanding use in personal care and cosmetic products. Paraffin wax is a common ingredient in many lotions, creams, and lip balms because of its ability to moisturize and soften skin, appealing to consumers seeking these benefits.

Market Statistics

- 2024 Market Size: USD 5.79 billion

- 2034 Projected Market Size: USD 11.27 billion

- CAGR (2025–2034): 6.9%

- Asia Pacific: Largest market in 2024

AI Impact on Paraffin Wax Market

- Artificial intelligence (AI) help manufacturers optimize energy use and reduce waste in the refining and production of paraffin wax.

- AI tools support product development by analyzing emerging market trends and customer preferences.

- The integration of AI and machine learning (ML) in paraffin wax production machines enables predictive maintenance, which helps reduce downtime and increases production capacity.

- Various players operating across the coatings, candles, and personal care industries use AI platforms to analyze consumer purchasing patterns to tailor their product offerings.

- The technology helps measure carbon footprint and guides eco-friendly formulation strategies.

- AI enhances logistic operations as it can predict delays and optimize delivery routes for raw materials and finished goods.

Paraffin wax is a soft, colorless solid derived from petroleum, coal, or oil shale. It is primarily composed of hydrocarbon molecules and is known for its odorless and tasteless properties, which make it useful in a wide range of products. The wax is insoluble in water and is often used as a coating or a key ingredient in many industrial and consumer applications.

Rising use of paraffin wax in the investment casting process. Paraffin wax is used to create the detailed molds for a variety of products, especially for intricate metal parts. This process is important in manufacturing for industries such as aerospace and medical devices, which need precise and complex components.

Drivers and Trends

Rising Demand from Candle Industry: Consumers are using candles, especially scented and decorative ones, for home decor, creating a relaxing atmosphere, and for aromatherapy, which drives up demand for the primary raw material, paraffin wax. This trend is prominent in developed economies and is gaining traction globally. The affordability and versatility of paraffin wax make it an ideal choice for candle manufacturers. It holds fragrances and dyes well, providing a clean and long-lasting burn that meets consumer preferences for quality products.

The National Center for Biotechnology Information (NCBI) published a study in 2024 titled "Assessment of Beeswax Adulteration by Paraffin and Stearic Acid Using ATR-IR Spectroscopy and Multivariate Statistics—An Analytical Method to Detect Fraud," which highlighted that paraffin is the more common material used in candle production compared to beeswax. The study's findings on the prevalence of paraffin in commercial products confirm its widespread use and importance in the candle industry. The growing demand for candles as a lifestyle product, combined with the material's cost-effectiveness and performance, is boosting the demand for paraffin wax.

Growing Use in Packaging Sector: The wax is used in the packaging sector as a coating for paper and cardboard products to give them a moisture and grease barrier. This application is vital for preserving the freshness of food items and extending their shelf life. The demand for convenient and safe packaged foods has been rising steadily, especially with the growth of e-commerce and a shift in consumer habits toward processed foods. Paraffin wax helps ensure products are protected during transport and storage, which is a key requirement for modern supply chains.

The National Library of Medicine (NLM) published an article titled "Effects of Waxes and Wax Blends on the Physical Properties and the Sensory Quality of Paperboard" in 2024 that talks about how paraffin wax is used in packaging materials. The article shows that wax coatings are essential for improving the properties of paperboard, such as its ability to resist water and vapor. This growing need for high-performance packaging materials that protect goods and keep them fresh is a major factor pushing the demand for paraffin wax.

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes fully refined, semi refined, and others. The fully refined segment held the largest share in 2024. This type of wax undergoes extensive processing to remove impurities, giving it a high level of purity, a clean white appearance, and no smell. Its superior qualities make it a preferred material for high-end applications where quality and safety are important. Key uses include cosmetics and personal care products, such as lotions and creams, as well as in the pharmaceutical industry for pill coatings and ointments. It is also the go-to choice for high-quality food packaging, where it acts as a protective, food-grade barrier to moisture. The demand from these specific industries, where high purity is a non-negotiable standard, largely contributes to this segment's dominant position. Its consistent performance and ability to meet strict regulatory requirements across different sectors ensure its leading status. The wide range of premium applications, coupled with its reliable properties, solidify its position as the largest segment in the paraffin wax industry.

The semi refined paraffin wax is anticipated to register at the highest growth rate during the forecast period. This product type is less pure than its fully refined counterpart and contains a slightly higher oil content. This makes it more versatile, cost-effective, and suitable for a broad array of industrial uses where a very high degree of purity is not necessary. Semi refined paraffin wax is widely used in candle manufacturing, especially for budget-friendly and mass-produced candles. It is also a key component in the production of rubber and tires, where it acts as an anti-ozonant agent to protect the rubber from cracking. The strong growth in the construction and packaging sectors further boosts its demand, as it is used for waterproofing materials and in industrial coatings. The increasing industrial activity in emerging economies, combined with the product's balance of quality and cost, makes it the most dynamic and fastest-growing segment.

Application Analysis

Based on application, the segmentation includes candles, packaging, cosmetics, hot melts, board sizing, rubber, and others. The candles segment held the largest share in 2024. This is because paraffin wax is the primary raw material for manufacturing candles due to its low cost and excellent burning characteristics. The rise in consumer spending on home decor and lifestyle products, along with the growing popularity of scented and decorative candles, continues to drive demand. Paraffin wax is highly effective at holding fragrances and colors, which is a crucial quality for manufacturers to create a wide variety of products to meet consumer preferences. Its consistent quality and widespread availability also make it the preferred choice for both small-scale craft candle makers and large industrial producers, solidifying its dominant position.

The cosmetics segment is anticipated to register at the highest growth rate during the forecast period. This is mainly due to the increasing use of paraffin wax in a variety of personal care products, such as lotions, creams, and face masks. The wax is known for its moisturizing properties, as it creates a barrier on the skin that helps retain moisture and soften the skin. With a growing focus on beauty and wellness, consumers are increasingly seeking products with these benefits. Additionally, paraffin wax is used in therapeutic treatments, like paraffin baths for hands and feet, which are popular in spas and salons. The expansion of the personal care industry, especially in emerging areas, and the development of new cosmetic formulations are key factors driving the rapid growth of this segment.

Regional Analysis

The Asia Pacific paraffin wax market accounted for the largest share in 2024, driven by rapid industrialization and a large population. The region's growth is fueled by a high demand from a wide range of industries. The candle segment is growing quickly, particularly in countries with increasing disposable income and urbanization. The packaging industry is also a major driver, as the demand for processed and packaged food is rising across the region. The expanding construction and automotive industries further contribute to the demand for paraffin wax, which is used in waterproofing materials and in tire manufacturing.

China Paraffin Wax Market Assessment

Within the Asia Pacific region, China is a dominant force in the paraffin wax market for paraffin wax. It is both a major producer and consumer of the product. The country's strong industrial base and vast manufacturing capabilities make it a hub for paraffin wax production, which is used in its massive domestic market and also exported globally. The demand for paraffin wax in China is driven by a booming packaging industry, which serves its large and growing consumer base. The country's rapid development and a large number of manufacturing facilities in sectors such as rubber, tires, and cosmetics ensure a continuous high demand for paraffin wax.

North America Paraffin Wax Market Insights

North America is a significant consumer of paraffin wax, driven by a mature segment with a focus on consumer goods. The demand for candles is a major factor, as consumers in this region frequently use candles for home decoration, aromatherapy, and special events. The presence of a strong manufacturing base for personal care and cosmetics also contributes to steady consumption. Additionally, the packaging and hot melt adhesives sectors are key areas of application, where paraffin wax is valued for its barrier properties and cost-effectiveness. The sector is supported by a well-established supply chain and a strong industrial base, ensuring a consistent availability of the product.

U.S. Paraffin Wax Market Insights

In North America, the U.S. is a leading region, with a large and diverse consumer base. The country has a high demand for a variety of products that use paraffin wax, especially in the packaging industry, where it is used to coat paper and cardboard for food items. This is also driven by strict regulations for food safety and a growing consumer preference for packaged goods. The U.S. is also a major market for candles, with a high per capita consumption for both home use and gifts. The country's strong manufacturing and industrial sectors further support the demand for paraffin wax in various applications, including rubber and tire production.

Europe Paraffin Wax Market Trends

Europe is a key region for the global paraffin wax market, characterized by a high demand for consumer products and a strong manufacturing sector. The region is largely influenced by the candles industry, where there is a strong cultural tradition of using candles for both practical and decorative purposes. This is especially true during holiday seasons and for creating a certain mood. Additionally, the cosmetics and personal care industries in Europe are major consumers of paraffin wax, using it as a key ingredient in many formulations. The region’s focus on high-quality and premium products means there is a consistent demand for fully refined grades of paraffin wax.

The Germany paraffin wax market holds a major share in Europe. It has a robust manufacturing sector that relies on paraffin wax for industrial applications such as rubber production and as an additive in coatings and inks. The country is also a significant player in the European candle landscape, with both a strong domestic production and a high consumer demand for candles. In Germany, the market for cosmetics is also large, with consumers showing a willingness to spend on personal care products. The country's strong economy and established industrial base make it a major hub for production and consumption of paraffin wax in Europe.

Key Players and Competitive Insights

The paraffin wax market has a competitive landscape with several key players. These companies often operate on a global scale, producing and supplying various grades of paraffin wax to different industries. The sector is moderately fragmented, with a mix of large multinational corporations and smaller, specialized manufacturers. These players compete on factors such as product quality, price, reliability of supply, and the ability to meet the specific needs of diverse applications, from high-purity cosmetics to industrial uses.

A few prominent companies in the industry include China Petrochemical Corporation (SINOPEC); Exxon Mobil Corporation; Sasol Limited; Shell PLC; PetroChina Company Limited (China National Petroleum Corporation); The International Group, Inc.; and Repsol S.A. Other key companies are HollyFrontier Corporation; NIPPON SEIRO CO., LTD.; Honeywell International Inc.; and Petrobras.

Key Players

- China Petrochemical Corporation (SINOPEC)

- Exxon Mobil Corporation

- HollyFrontier Corporation

- Honeywell International Inc.

- NIPPON SEIRO CO.,LTD.

- Petrobras

- PetroChina Company Limited (China National Petroleum Corporation)

- Repsol S.A.

- Sasol Limited

- Shell PLC

- The International Group, Inc.

Paraffin Wax Industry Developments

June 2025: Lords Chloro Alkali Ltd. Announced its plans to increase the capacity of its Chlorinated Paraffin Wax plant in Rajasthan, India. The company will double its production from 50 to 100 tonnes per day by the 2025-26 fiscal year.

Paraffin Wax Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Fully Refined

- Semi Refined

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Candles

- Packaging

- Cosmetics

- Hot melts

- Board Sizing

- Rubber

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Paraffin Wax Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.79 billion |

|

Market Size in 2025 |

USD 6.18 billion |

|

Revenue Forecast by 2034 |

USD 11.27 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.79 billion in 2024 and is projected to grow to USD 11.27 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

Asia Pacific dominated the share in 2024.

A few key players include China Petrochemical Corporation (SINOPEC); Exxon Mobil Corporation; Sasol Limited; Shell PLC; PetroChina Company Limited (China National Petroleum Corporation); The International Group, Inc.; and Repsol S.A. Other key companies are HollyFrontier Corporation; NIPPON SEIRO CO., LTD.; Honeywell International Inc.; and Petrobras.

The fully refined segment accounted for the largest share of the market in 2024.

The cosmetics segment is expected to witness the fastest growth during the forecast period.