Generative AI Cybersecurity Market Size, Share, Trends, Industry Analysis Report

By Type (Threat Detection & Analysis, Adversarial Defense), By Technology, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6413

- Base Year: 2024

- Historical Data: 2020-2023

Overview

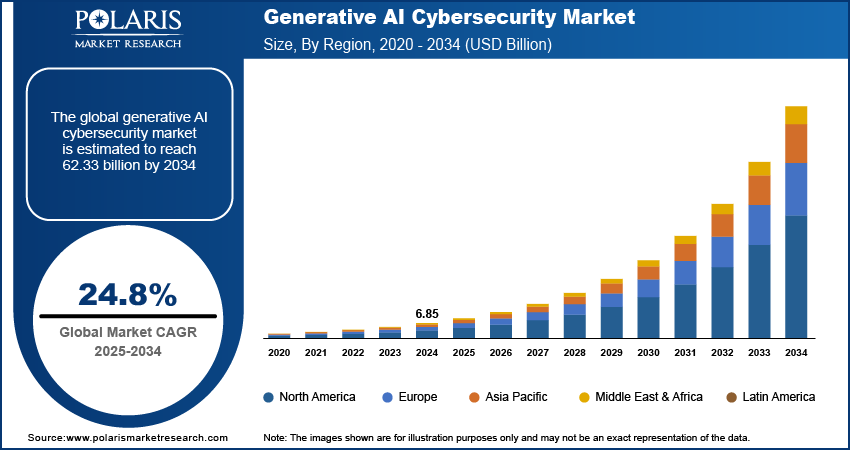

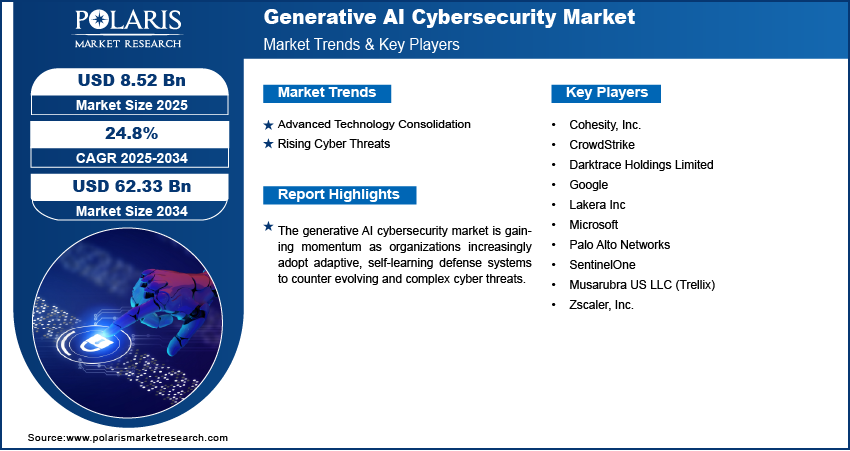

The global generative AI cybersecurity market size was valued at USD 6.85 billion in 2024, growing at a CAGR of 24.8% from 2025 to 2034. Key factors driving demand include adoption of AI across industries, regulatory & compliance pressures, advanced technology consolidation, and rising cyber threats.

Key Insights

- The threat detection & analysis segment led the market in 2024, as its proactive role in identifying zero-day threats and sophisticated attacks is indispensable for modern security operations.

- The reinforcement learning segment is anticipated to grow the fastest, fueled by its unique ability to autonomously adapt to constantly evolving cyberattack strategies.

- The BFSI sector dominated in 2024, due to its critical requirement for advanced security to combat escalating financial fraud and stringent data protection demands.

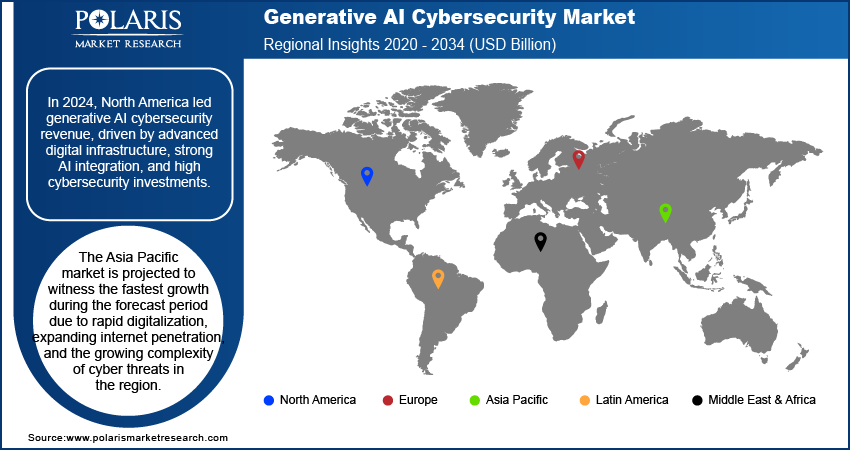

- North America held the largest share in 2024, due to its mature digital infrastructure, early AI adoption, and enterprise cybersecurity spending.

- The U.S. led the North American market in 2024, fueled by robust technological infrastructure, high AI adoption rates, and substantial investments in cybersecurity solutions.

- The Asia Pacific market is expected to grow the fastest during the forecast period, driven by rapid digital transformation, increasing internet access, and a surge in cyber threats.

- China's market is growing rapidly due to accelerated digital transformation and increasing demand for advanced security across cloud, e-commerce, and financial sectors.

- Europe is expected to maintain a substantial share during 2025–2034, supported by its strict regulatory environment and strong corporate emphasis on data privacy and compliance.

Industry Dynamics

- Advanced technology consolidation unifies security tools into integrated platforms, closing gaps that fragmented systems create and reducing organizational vulnerability.

- Rising cyber threats, fueled by AI and automation, drive organizations to adopt equally sophisticated generative AI defenses to counter evolving attacks.

- A primary challenge is the risk of model hallucinations and data poisoning, which lead to false positives, flawed responses, and critical security gaps.

- Generative AI offers the opportunity to automate threat detection and response at unprecedented speed, dramatically reducing operational costs and analyst workload.

Market Statistics

- 2024 Market Size: USD 6.85 billion

- 2034 Projected Market Size: USD 62.33 billion

- CAGR (2025–2034): 24.8%

- North America: Largest market in 2024

Generative AI cybersecurity refers to the application of generative artificial intelligence models to proactively identify, predict, and counter evolving cyber threats through adaptive and intelligent defense mechanisms. The increasing adoption of AI across industries has led organizations to adopt advanced cybersecurity measures capable of handling refined attacks. The attack surface expands, making traditional security methods insufficient as enterprises integrate AI into their operations. According to an FBI March 2024 report, complaints to the Internet Crime Complaint Center reached a record 880,418 in 2023, with potential losses reaching USD 12.5 billion, marking a 10% rise in reports and a 22% surge in financial damages. Generative AI provides an adaptive layer of protection against potential threats, generating countermeasures, and enabling automated response systems. This capability allows businesses across sectors such as finance, healthcare, retail, and manufacturing to maintain resilience against rapidly evolving cyber risks, reinforcing the importance of generative AI in enterprise defense strategies.

The growing regulatory and compliance pressures faced by organizations across different regions boost the demand for refined generative AI for cybersecurity. Companies are made to adopt advanced security frameworks to ensure compliance with stricter data protection laws, industry-specific regulations, and international standards being enforced. Generative AI cybersecurity solutions align with these requirements by offering automated compliance monitoring, risk detection, and incident reporting, reducing the burden on security teams. Moreover, by generating real-time insights and adaptive defense protocols, these solutions enable firms to demonstrate proactive adherence to regulatory expectations. This integration of compliance-driven needs with AI-powered cybersecurity highlights the strategic role generative AI plays in bridging operational security and regulatory accountability.

Drivers & Opportunities

Advanced Technology Consolidation: Advanced technology consolidation is driving the generative AI cybersecurity market as organizations aim for integrated, unified platforms to manage increasingly complex security environments. Fragmented security solutions often create gaps that attackers exploit, with enterprises deploying multiple digital tools, cloud services, and connected devices. Generative AI enables the consolidation of advanced technologies such as machine learning, automation, and predictive analytics into cohesive cybersecurity frameworks. In April 2023, SentinelOne launched a new threat-hunting platform that uses generative AI and deep learning to help organizations defend against AI-powered cyberattacks. The system offers real-time, autonomous response capabilities across enterprise networks. This integration streamlines operations, enhances visibility across networks, and ensures faster, more accurate threat detection and response. Thus, by reducing redundancies and improving interoperability, technology consolidation strengthens overall resilience while optimizing resource utilization, making it a critical factor fueling the adoption of generative AI in cybersecurity strategies.

Rising Cyber Threats: Rising cyber threats also strongly drive the adoption of these cybersecurity solutions, as the scale, frequency, and complexity of attacks continue to intensify across industries. Cybercriminals increasingly leverage automation, AI, and sophisticated attack vectors, making it imperative for organizations to deploy equally advanced defense systems. According to a CSIS report, in April 2025, hackers breached a U.S. banking regulator, spying on over 150,000 emails from 103 staff members for more than a year. The intrusion, via a compromised admin account, exposed highly sensitive financial data, highlighting the rising demand for generative AI for cybersecurity. Generative AI addresses this challenge by detecting and generating potential attack scenarios to test system resilience, thus staying one step ahead of hackers. Its capability to continuously learn from emerging threats ensures that defense strategies evolve alongside attack methodologies. This adaptability provides enterprises with a vital safeguard in an era of expanding digital ecosystems, reinforcing the role of rising cyber threats as an important factor fueling the demand for generative AI-powered cybersecurity frameworks.

Segmental Insights

Type Analysis

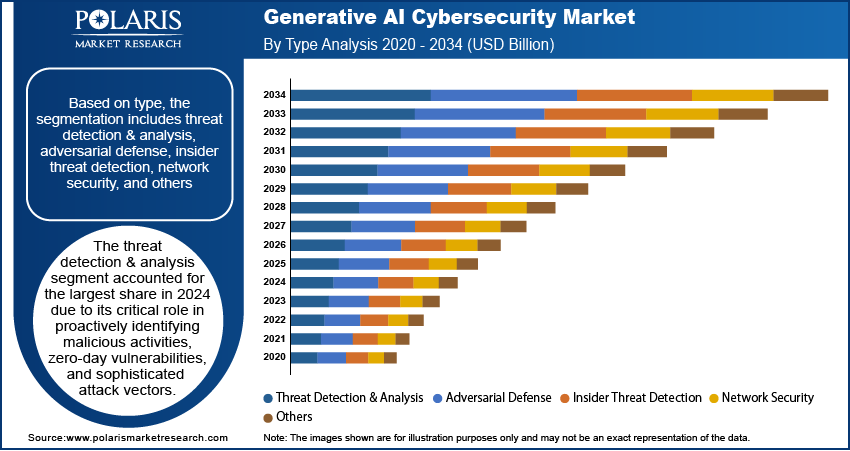

Based on type, the segmentation includes threat detection & analysis, adversarial defense, insider threat detection, network security, and others. The threat detection & analysis segment accounted for the largest share in 2024 due to its critical role in proactively identifying malicious activities, zero-day vulnerabilities, and sophisticated attack vectors. Organizations increasingly rely on generative AI-powered solutions to simulate potential threats and generate adaptive responses as cybercriminals adopt advanced techniques to evade conventional defenses. These tools enhance visibility across complex IT infrastructures, enabling faster detection and automated mitigation of risks. Moreover, the ability of threat detection & analysis solutions to integrate predictive analytics and real-time monitoring establishes them as the foundation of AI-driven cybersecurity frameworks, reinforcing their dominance in the market.

Technology Analysis

In terms of technology, the segmentation includes generative adversarial networks (GANs), variational auto encoders (VAEs), reinforcement learning (RL), deep neural networks (DNNs), natural language processing (NLP), and others. The reinforcement learning (RL) segment is expected to witness the fastest growth during the forecast period, driven by its capability to learn and adapt to dynamic cyberattack scenarios continuously. RL models enable systems to make real-time decisions, optimize defense strategies, and autonomously respond to intrusions without human intervention. Reinforcement learning enhances resilience and supports proactive protection by identifying and countering numerous potential attack strategies. Its growing application in areas such as autonomous intrusion detection and adaptive access control highlights its transformative role in the evolution of generative AI cybersecurity solutions.

End Use Analysis

The segmentation, based on end use, includes banking, financial services, and insurance (BFSI), healthcare & life sciences, government & defense, retail and e-commerce, manufacturing & industrial, IT & telecommunications, energy & utilities, and others. The banking, financial services, and insurance (BFSI) segment dominated the market in 2024 due to its increasing need for advanced protection against fraud, identity theft, and data breaches. Financial institutions manage vast volumes of sensitive transactions and personal data, making them prime targets for cybercriminals. Generative AI empowers the BFSI sector by enabling real-time fraud detection, anomaly recognition, and adaptive risk modeling to safeguard assets and ensure regulatory compliance. The ability to maintain secure digital transactions while minimizing operational risks highlights BFSI as a leading adopter of generative AI cybersecurity technologies.

Regional Analysis

The North America generative AI cybersecurity market accounted for the largest global market share in 2024. This dominance is attributed to the region’s advanced digital ecosystem, strong integration of AI technologies, and extensive cybersecurity investments across industries. In August 2025, CISA and FEMA announced the availability of more than USD 100 million in grant funding to strengthen cybersecurity defenses for communities across the U.S. Enterprises in North America are early adopters of emerging technologies, leveraging generative AI to address evolving threats, protect critical infrastructure, and meet strict compliance frameworks. The presence of well-established technology providers and cybersecurity innovators further accelerates adoption, creating a mature market landscape. This combination of technological readiness and industry-wide adoption positions North America as the leading hub for these cybersecurity solutions.

U.S. Generative AI Cybersecurity Market Insights

The U.S. dominated the market share in North America generative AI cybersecurity landscape in 2024 due to its strong technological infrastructure, widespread adoption of AI, and investments in advanced cybersecurity solutions. Organizations across critical sectors such as finance, defense, and healthcare are early adopters of generative AI to counter sophisticated cyberattacks. The presence of leading technology providers and a mature regulatory framework further enhances the U.S. position for innovation and adoption in this market.

Asia Pacific Generative AI Cybersecurity Market Trends

The market in Asia Pacific is projected to witness fastest growth during the forecast period due to rapid digitalization, expanding internet penetration, and the growing complexity of cyber threats in the region. According to a June 2025 Stimson report, India had 970 million internet subscribers as of December 2024, with annual data consumption growing at a compounded rate of 54%. Enterprises across sectors such as e-commerce, financial services, and telecommunications are increasingly vulnerable to large-scale cyberattacks, creating a strong demand for adaptive AI-powered defenses. Generative AI solutions provide predictive modeling and advanced threat detection capabilities tailored to the region’s evolving digital infrastructure. The combination of rising enterprise security awareness and the need for scalable protection is expected to fuel market growth in Asia Pacific during the forecast period.

China Generative AI Cybersecurity Market Overview

The market in China is expanding due to the rapid digitalization of its economy and the rising demand for advanced security in cloud-based services, e-commerce, and financial platforms. The country’s large-scale deployment of AI technologies across industries has increased the need for intelligent, adaptive defenses against evolving cyber threats. Generative AI solutions provide the capability to simulate, predict, and mitigate threats in real time, aligning with China’s growing focus on securing its digital ecosystem.

Europe Generative AI Cybersecurity Market Outlook

The generative AI cybersecurity industry in Europe is projected to hold a substantial share by 2034 due to the region’s strong focus on regulatory compliance, data privacy, and adoption of advanced security technologies. Organizations are compelled to integrate AI-driven cybersecurity solutions that ensure continuous monitoring, compliance reporting, and proactive risk mitigation, with strict frameworks such as GDPR shaping corporate practices. According to a January 2025 EU report, 41.17% of large enterprises within the European Union utilized AI technologies in 2024. European industries are increasingly investing in generative AI to secure critical infrastructure, financial transactions, and digital services against advanced cyber threats. This alignment of strict data governance with AI-enabled cybersecurity innovation strengthens Europe’s position as a prominent market for these AI solutions in the long term.

Germany Generative AI Cybersecurity Market Overview

The growth of Germany’s generative AI cybersecurity market is driven by the country’s strong focus on industrial digitalization and protection of critical infrastructure. The need for adaptive cybersecurity solutions has increased as advanced manufacturing and Industry 4.0 systems become more interconnected. Generative AI technologies provide Germany with the ability to secure smart factories, supply chains, and sensitive industrial networks against complex threats. The focus on compliance with strict European data protection laws further accelerates the adoption of these solutions in the German market.

Key Players & Competitive Analysis

The generative AI cybersecurity landscape is characterized by intense competition, with established tech giants and specialized vendors leveraging competitive intelligence and strategy to capture revenue opportunities. Strategic investments are heavily focused on technological advancement, particularly in autonomous response and AI-powered threat hunting, which represent major disruptions and trends in the sector. These innovations are becoming critical differentiators for small and medium-sized businesses. Vendor strategies increasingly prioritize region-wise market size and emerging market segments to drive revenue growth. Expert's insight suggests that success hinges on navigating economic and geopolitical shifts and building sustainable value chains. Future development strategies must account for supply chain disruptions and align with macroeconomic trends to capitalize on latent demand and opportunities across both developed markets and emerging markets.

A few major companies operating in the generative AI cybersecurity industry include Cohesity, Inc.; CrowdStrike; Darktrace Holdings Limited; Google; IBM; Lakera Inc; Microsoft; Palo Alto Networks; SentinelOne; Musarubra US LLC (Trellix); and Zscaler, Inc.

Key Players

- Cohesity, Inc.

- CrowdStrike

- Darktrace Holdings Limited

- IBM

- Lakera Inc

- Microsoft

- Palo Alto Networks

- SentinelOne

- Musarubra US LLC (Trellix)

- Zscaler, Inc.

Generative AI Cybersecurity Industry Developments

- July 2025: Accenture and Microsoft collaborated to co-invest in generative AI for cybersecurity. The collaboration focuses on SOC modernization, automated AI security, cyber migration, and enhanced IAM to help organizations better mitigate advanced threats and optimize costs.

- August 2024: IBM integrated generative AI into its managed threat detection services. The new Cybersecurity Assistant, built on watsonx, aims to accelerate the identification, investigation, and response to critical security threats for clients.

Generative AI Cybersecurity Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Threat Detection & Analysis

- Adversarial Defense

- Insider Threat Detection

- Network Security

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Generative Adversarial Networks (GANs)

- Variational Auto encoders (VAEs)

- Reinforcement Learning (RL)

- Deep Neural Networks (DNNs)

- Natural Language Processing (NLP)

- Others

By End Use (Revenue, USD Billion, 2020–2034)

- Banking, Financial Services, And Insurance (BFSI)

- Healthcare & Life Sciences

- Government & Defense

- Retail and E-Commerce

- Manufacturing & Industrial

- IT & Telecommunications

- Energy & Utilities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Generative AI Cybersecurity Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.85 Billion |

|

Market Size in 2025 |

USD 8.52 Billion |

|

Revenue Forecast by 2034 |

USD 62.33 Billion |

|

CAGR |

24.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.85 billion in 2024 and is projected to grow to USD 62.33 billion by 2034.

The global market is projected to register a CAGR of 24.8% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Cohesity, Inc.; CrowdStrike; Darktrace Holdings Limited; Google; IBM; Lakera Inc; Microsoft; Palo Alto Networks; SentinelOne; Musarubra US LLC (Trellix); and Zscaler, Inc.

The threat detection & analysis segment accounted for the largest share in 2024.

The reinforcement learning (RL) segment is expected to witness the fastest growth during the forecast period.